Convertibles Can Help Mitigate the Biggest Risk in Your Asset Allocation (Fixed Income): CICVX PMs

Convertibles attracted significant attention last year for both the strength of the issuance as well as for their performance as the market fell and then snapped back (see post).

Converts continue to be a good idea this year, too, but for different reasons, according to Joe Wysocki, CFA, Senior Vice President, Senior Co-Portfolio Manager of Calamos Convertible Fund (CICVX) on last week’s CIO Conference Call. (To listen to the August 12 call, go to www.calamos.com/CIOconvertibles-8-12.)

“Equity markets are at all-time highs, there are questions about valuations, which we think are full but fair. There’s some concentration in the broader equity indices with large cap tech, and pockets of volatility and rotational aspects going on.

“In fixed income, the absolute level of interest rates is low and certainly not a very big margin of safety in traditional debt. Where’s the biggest risk in the asset allocation? It may be in the fixed income allocation that's exposed to rising rates.

“I really think investors are seeking ways right now to retain upside potential but to do so in a risk-managed way,” said Wysocki.

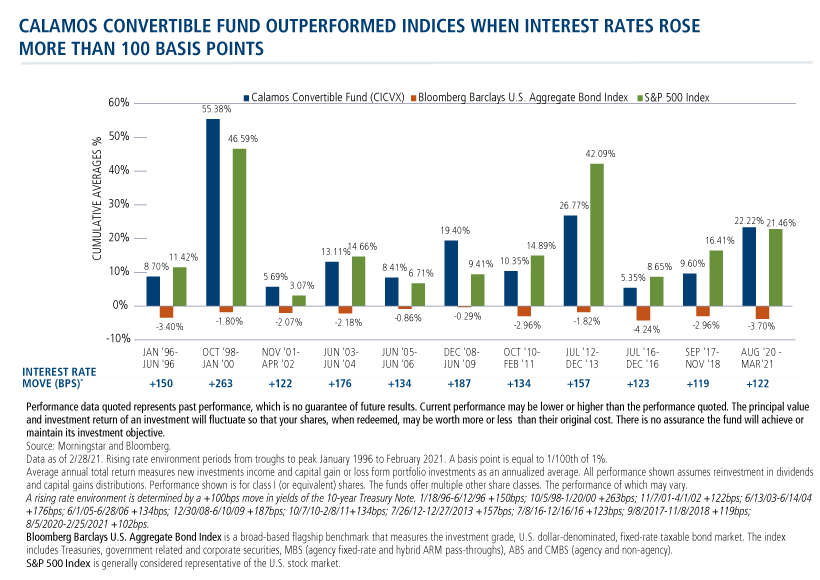

For those looking to diversify their fixed income, Wysocki offered convertibles’ historic outperformance advantage when rates have risen more than 100 basis points, citing the chart below.

“In periods when economic growth is plentiful, when earnings are growing, companies are benefiting from profitability, and can take advantage of inflation to some degree from a pricing power perspective,” said Wysocki. “The optionality embedded within the convertible allows you to have a different return profile because you're able to potentially benefit from that.”

“At the same time,” he continued “the fixed income component [of a convertible] is shorter duration—five years and typically even shorter effective duration when you consider the optionality embedded.”

A More Growth-y Market vs. the S&P 500

For those using convertibles to pursue equity gains, “the convert market looks more growth-y from a sales perspective versus the broader market than it has in the past 20 years,” said co-presenter Jon Vacko, CFA, Senior Vice President, Senior Co-Portfolio Manager.

2021 Convertible Market vs. 2020

Global new issuance of convertible bonds totaled just under $100 billion as of June 30 and marked an all-time high for the first half of a year. It’s been a year when the convert market returned to the more traditional type of issuer—mid cap and smaller cap companies that identify niche growth areas and are seeking capital to exploit those opportunities.

Some more characteristics of this year’s market versus last, as identified by Wysocki:

- More companies. At the start of last year, there were 300 different companies that were in the U.S. convertible market, today there are 400.

- New companies. More than half of those coming to the market didn’t have an existing convertible prior to this year.

- Younger companies. More than 60% of the issuance volume is coming from companies who have been public for less than three years. “Often they are on the foremost front of the emerging growth trends in all the capital markets,” said Wysocki. “Having them in our market really creates a good niche opportunity to have access to that exciting growth potential, but do so in a risk-managed way, using converts to mitigate the downside risk.”

- A higher mix of global versus U.S. While as much as 70% of last year’s issuance came from the U.S., this year it's split about 45% non-U.S. and 55% U.S.

For more on market trends, subscribe to the U.S. Convertible Market Snapshot or the Global Convertible Market Snapshot.

“Right now we're seeing virtually every company report very strong year-over-year growth because of the base effects…the growth that we've seen will naturally fade, and that's normal, that's not unexpected and it doesn't necessarily derail the market.

“But,” Vacko continued, “there's a difference between companies that can grow profits by temporarily cutting costs versus those that can actually grow revenue.”

Given its predominance of mid and small caps, “the convertible issuer base is different than what you would see in the S&P 500,” as Wysocki explained. “Historically, this has been a very good way to invest in companies growing from $5 billion market cap to $10 billion on their way up to $100 billion.”

Second quarter earnings reports were strong, according to Vacko. “However, we’ve seen that growth versus value rotational aspect overwhelm some of the positives we see. But for those who have the ability to look out more than one quarter in terms of performance, there is a great opportunity to invest in some innovative growth companies,” he said.

At July’s end, CICVX’s largest sector exposures included:

- Technology, including secular opportunities in cloud computing, internet security, epayments, ecommerce, and other at-home trends that accelerated during the pandemic.

- Healthcare, including companies that can focus on better treatment, reducing the cost of health care, and improving the effectiveness and speed of healthcare delivery.

- Consumer discretionary, including some companies benefiting from the release of pent-up demand in travel and entertainment and also some cyclical opportunities.

The issuance calendar should finish the year strong, although likely not at the blistering pace of the first half of 2020, according to Vacko. He mentioned the recently passed infrastructure bill as a possible driver of heightened capital-raising.

“It's not just roads and bridges, internet connectivity is in the bill, which impacts communication equipment. Green energy transmission and electrification of vehicles, those are in the bill too,” he said. “It's not just an infrastructure/industrial sector bonanza, it's going to impact multiple areas, multiple sectors, which I think can drive growth,” he said, adding that further legislation was likely.

Focusing on the Risk/Reward

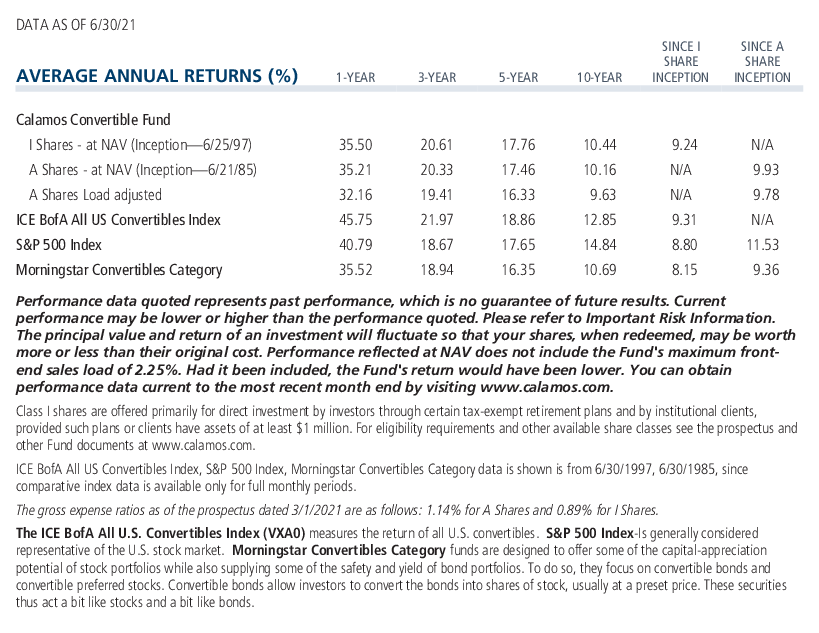

Vacko addressed CICVX trailing the ICE BofA All Convertibles Index (VXA0) year to date (3.83% vs. 6.22% as of July 31).

“We’ve gotten questions and have been asked whether the risk profile has changed. Not at all,” he said.

“If you look at the benchmark, there's much more exposure to the equity-sensitive portion of the universe as well as more exposure to busted converts. As always, we try to maintain exposure to the balanced part of the converts and really take advantage of one of the benefits that the convert provides relative to straight equity or straight fixed income,” Vacko said.

As positive as the team is about risk assets, the PMs mentioned the daily COVID headlines, monetary policy changes and fiscal policy changes all as contributing to investor uncertainty, which can create volatility.

“Uncertainty creates volatility,” said Vacko. “That’s never going to change. And volatility creates opportunity. The market climbs the wall of worry, but not in a straight line.

“We're focused on the risk/reward, focused on taking advantage of this volatility, and continuing to actively rebalance the abundance of new and existing converts, and remaining disciplined where we take the risk,” he said.

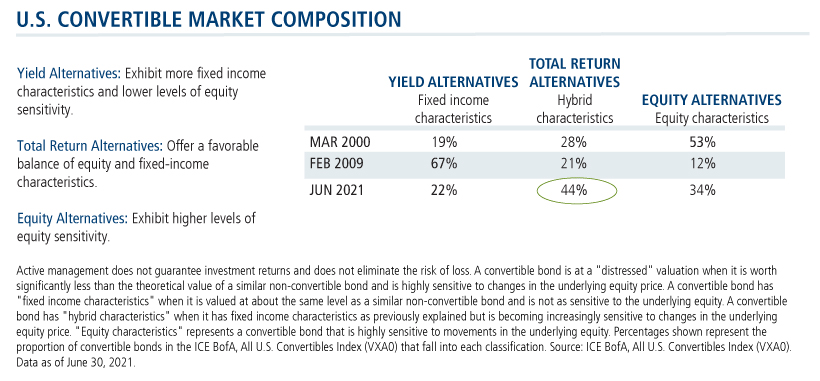

The good news about today’s convert market, according to Wysocki: 44% of the market is within the core balanced portion—what the team considers the sweet spot. “That's where you have the asymmetric profile, a positive risk reward, where we're getting more of the equity upside and less of the downside. That's a structural skew that's embedded within these convertibles when they come to market.

“That’s really key,” he added, “because there can be times when strong equity prices lead to more equity-sensitive converts. That can be a little bit more challenging” from the perspective of building and managing a portfolio.

Investment professionals, for more information about convertibles or CICVX, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The ICE BofA All U.S. Convertibles Index (VXA0) comprises approximately 700 issues of only convertible bonds and preferreds of all qualities.

The S&P 500 Index is generally considered representative of the U.S. stock market.

802471 0821

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on August 18, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.