CGIIX Positioned for Less Robust But Still Positive Growth—and More Volatility: Hillenbrand

While the positive impacts of COVID-related fiscal and monetary policies and the initial vaccination rollout have begun to wane, they’re being replaced by more traditional, sustainable but less robust growth drivers.

“Economic growth is going to be driven by higher consumer spending levels, supported by strong balance sheets, improving employment and wages, as well as higher corporate capex spending and inventory—which is supported by increased productivity and profitability,” said John Hillenbrand, CPA, Co-CIO, Head of Multi-Asset Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager, on the Aug. 11 CIO Conference Call. (To listen to the call, go to www.calamos.com/CIOequities-8-11.)

“Corporations are in very strong shape, with ample liquidity and more streamlined cost structures to appropriately address the increased demand, related input inflation, as well as the near-term supply shortages,” he said. “We also see some increased levels of mergers and acquisitions, which should help provide opportunities for revenue and cost synergies.”

Volatility to be Expected

The transition from a higher growth period to a more moderate growth period will be characterized by volatility, according to Hillenbrand.

“But we’re going to end up with a more sustainable equilibrium as we find labor and goods markets settle down. That should result in more realistic and sustainable inflation and interest rates,” he said.

The recent COVID resurgence and slowing pace of vaccinations also will be a source of economic and equity market volatility in the short term, Hillenbrand said.

“Many had thought that there was going to be a straight-line improvement in COVID cases once vaccinations were prevalent here in the U.S. It turns out the mutated virus is proving a little bit more difficult to mitigate, especially among the unvaccinated. Over the intermediate term, which we think is post-fall, post-winter, things look a lot better.”

An increased number of cases and hospitalizations should have a minor to moderate impact on economic activity, he said.

“Those areas where we see potential weakness are going to be focused on the usual suspects—travel, some level of consumer services, some businesses that are tied to people returning to work in the fall. Those are smaller parts of the economy but they can be impacted a little bit more significantly. It won’t derail this economic growth engine that we have into 2022,” according to Hillenbrand.

Possible risks to the outlook, he said, include “further slowing in growth, low vaccination in some geographies, slowdown in goods consumption. We still have some sustained supply chain issues and overly aggressive increases in taxation and regulation.” But he called these risks “modest detractors.”

Infrastructure and Budget Reconciliation

Hillenbrand also commented on the potential impact of the Biden administration’s infrastructure legislation—which he considers a “moderate positive”—and the budget reconciliation bill.

“We needed an infrastructure bill. We haven’t done one for the last five to 10 years. It’s important to spend on those for the long term…,” he said. “I think that bill’s pretty straightforward, pretty decent policy.”

Hillenbrand is less positive on the reconciliation bill, which he referred to as a mixed bag that comes with “some positives and some negatives.”

“Many of the social programs that they look to implement seem like generally reasonable things to do. But they’re not going to have a significant payoff. Yes, having free community college, that’s great. But it’s going to take time for those people to go through, get better skills, come out into the economy, be more productive in the economy. There’s a multi-year payoff to that.

“We’ll see how it plays out,” continued Hillenbrand. “But I think the view would be that much of that spending is going to be offset by a higher tax rate on corporations and higher income people.”

The impacts of the tax rate increases happen immediately, he noted, as opposed to the delay in the payoffs that result from the spending.

CGIIX Positioning

Hillenbrand, whose responsibilities include Calamos Growth and Income Fund (CGIIX), said he isn’t looking for equity returns in the next 12 months to match the previous 12 months. Further, he expects the transition from early to mid-cycle to usher in an investment regime change.

Calamos Growth and Income Fund (CGIIX)

Morningstar Overall RatingTM Among 302 Moderately Aggressive Allocation funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 4 stars for 3 years, 5 stars for 5 years and 5 stars for 10 years out of 302, 277 and 228 Moderately Aggressive Allocation Funds, respectively, for the period ended 6/30/2024.

“We should see market leadership transition away from some higher risk areas—both on the cyclical side and some of the high growth areas—and more toward a focus on companies that have high returns on capital, improving margins, and less volatile cash flows. That kind of quality bias should play out generally better when you see growth that’s still positive but decelerating,” he said.

Hillenbrand continues to be positive on Consumer Discretionary, Industrials, and Technology sectors, where CGIIX is overweight. However, he said, the composition within those sectors has been adjusted some, now to favor retail and services as improved employment, wages, and strong balance sheets should still favor consumer spending.

Allocations to travel and leisure holdings continue despite their underperformance recently. “There’s still a case to be made with a little bit longer term investment horizon. Those are areas that have a lot of pent-up demand and a supply constraint. That should be a good dynamic once we get past this Delta variant issue.”

Hillenbrand and the CGIIX team see plenty of opportunities in Industrials and Materials, especially with the infrastructure bill, “whether that’s rebuilding inventory or spending on capex to ramp up some capacity constraints within the supply chain.”

Technology, and specifically productivity-enhancers, is another focus and overweight for the fund. “If we have supply chain issues, and we get back to closer to full employment, with demand being stronger, and wages being stronger, there’s definitely a need for productivity-enhancers both at consumer companies, as well as industrial and materials companies. We’re looking for companies that can provide technology and improve productivity at a lower cost. We find plenty of areas to be able to do that,” said Hillenbrand.

Recent portfolio adjustments have been aimed at upgrading in terms of quality and higher returns on capital.

While the multi-asset class fund currently favors equities, Hillenbrand also commented on fixed income opportunities.

Historically, the fund relied on fixed income because of Treasuries’ negative correlation to equities. “Because yields are so low, we don’t really expect that negative correlation to be very strong,” he said.

He expects the 10-year Treasury to climb to 1.4% or even 1.6%. “Treasuries might be a good place to go if you’re worried about return of capital, but you’re going to get low return at best from a total return standpoint,” he noted.

On the team’s use of convertible bonds this year, Hillenbrand said, “We’ve been a little bit more selective, in part because many of the converts (businesses) were a little bit higher risk with more variable cash flows.” The preference has been for those with more attractive underlying businesses and more favorable structures.

Regarding other available options on the credit side “where we’re going to get paid to take on risk,” Hillenbrand mentioned bank loans and selected parts of high yield “where we think that they can take a bit of a rate increase and still benefit with a bit of spread contraction.”

Investment professionals, for more information on perspective or CGIIX, please talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

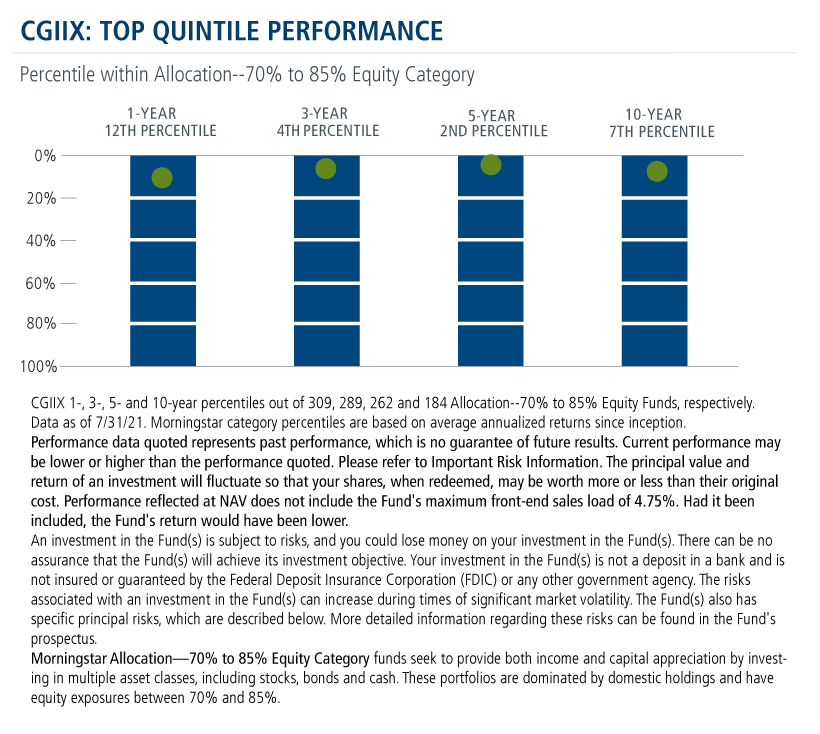

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Growth and Income Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, equity securities risk, growth stock risk, small and mid-sized company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk and portfolio selection risk.

The S&P 500 Index is generally considered representative of the U.S. stock market.

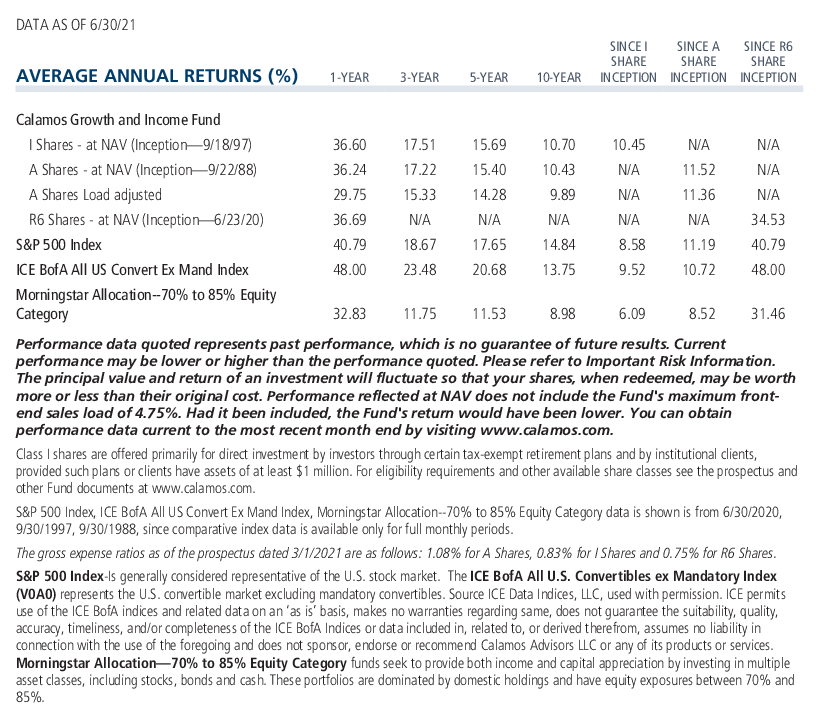

Morningstar Allocation—70% to 85% Equity Category funds seek to provide both income and capital appreciation by investing in multiple asset classes, including stocks, bonds and cash. These portfolios are dominated by domestic holdings and have equity exposures between 70% and 85%.

Morningstar RatingsTM are based on Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/ or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2021 Morningstar, Inc. All rights reserved.

802470 0821

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on August 23, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.