Having Turned the Page on a 54% 2020, CNWIX’s Niziolek Sees a Continued Bright Future for Emerging Markets

Calamos Evolving World Growth Fund (CNWIX) is positioned for the next leg of the market, which the Global team expects to be pro-growth and reflationary (see this just-published outlook).

Then again, Co-CIO, Head of International and Global Strategies and Senior Co-Portfolio Manager Nick Niziolek acknowledges, the team settled on its outlook last year at this time and it was “quickly thrown out the window.”

Calamos Evolving World Growth Fund (CNWIX)

Morningstar Overall RatingTM Among 718 Diversified Emerging Mkts funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 3 stars for 3 years, 5 stars for 5 years and 4 stars for 10 years out of 718, 646 and 423 Diversified Emerging Mkts Funds, respectively, for the period ended 6/30/2024.

Such is the advantage of the flexibility of active management. “We didn’t stand still with the prepared outlook,” Niziolek says. “We adapted to new information as it was available and re-positioned our portfolios multiple times throughout the year.”

On Wednesday’s CIO call (listen to replay here), Niziolek looked back on a 2020 that seemed like a full economic cycle in 12 months, including: pro-growth positioning heading into the new year, a defensive tilt mid-February through late March, consolidation around core secular winners for most of the middle part of 2020, and ultimately rotation into its current positioning.

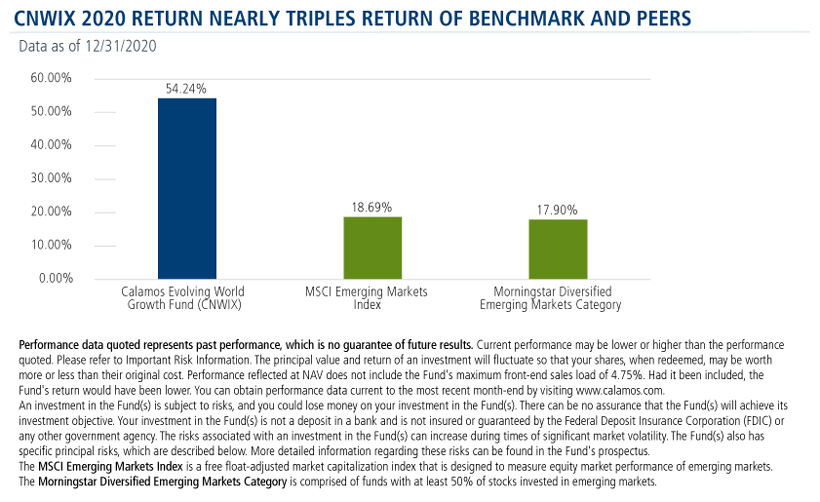

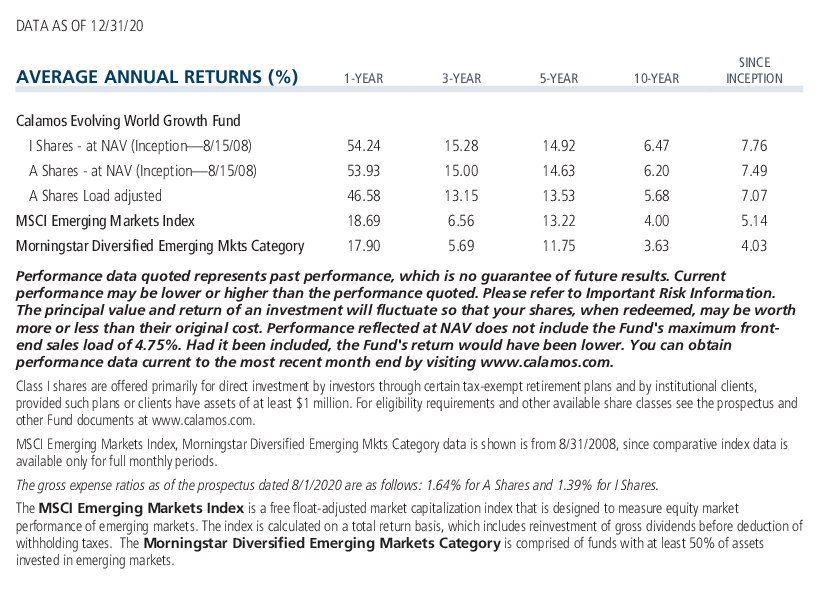

The continuous adaptation worked as Calamos’ four global portfolios all rank in the top quartile of their Morningstar categories as of 2020’s year-end. CNWIX, specifically, returned 54.24% for the year—almost three times the return of its MSCI Emerging Markets benchmark or Morningstar Diversified Emerging Markets Category peers.

Weaker Dollar and the Return of Inflation

Much of the team’s optimism for 2021 is rooted in its conviction that we’ve entered a new multi-year cycle where the U.S. dollar will weaken against most global currencies.

“There’s a very high correlation between overseas equity market outperformance relative to U.S. markets. It’s not just the translation benefit of the stronger currencies overseas. It’s the fact that the fundamentals of those economies also benefit.” Asian currencies, especially, benefit from stronger pick-up in economic growth and export demand, Niziolek said.

Reflationary prospects also are expected to lift emerging markets this year. Demographic and technological influences on sustained inflation continue, he said. But the scope of monetary and fiscal stimulus, wide availability of loan guarantees, and a trend underway to bring the supply chain home all could provide inflationary pressures near-term. Inflation has been beneficial to the fund’s cyclical positioning when certain sectors pick up.

Green Infrastructure Opportunities

Niziolek singled out one secular theme that the team has done some work on, and which Barron’s Tuesday based an article on. As explained in this December post, the global move to renewable energy and related green infrastructure is creating commodity demand that has thus far been underappreciated. The Calamos team is positioned for heightened demand for copper, cement and steel as facilities are built and opportunities present themselves. This could turn out to be as significant as the China infrastructure build-out of the early 2000s, Niziolek believes.

Global Tailwinds Strengthen

The Calamos Global Equity Team maintains a favorable outlook on global equity markets based on a backdrop of tremendous monetary and fiscal support, U.S. dollar weakness, and an expectation that the health crisis is nearing an end.

With the green infrastructure direction, opportunities arise up and down the supply chain. “When you think green, you think solar plants, wind farms, etc. and there may be opportunities there, as well,” he said, “but with our team it’s not just the first derivative.”

For example, the team’s work has led it to battery technology, which is enabling the move into electrical vehicles and electrical vehicle manufacturers in Korea and China. And, Niziolek added, “there’s value to be had in cement and iron ore manufacturers, and copper producers as well.”

Niziolek acknowledged China as an emerging markets performance leader in 2020, and a likely significant contributor this year. But, he said, “to look where the puck is going,” the team now is drawn to opportunities in countries hit hard by COVID-19 and are early in their recovery.

In the last few months, the team has been adding to financials, consumer and industrial sectors in India, industrials and consumers in Brazil, and consumers in Mexico and the Philippines. “There’s an export story going on in these markets, and there’s a consumer story, and we want to be exposed to both sides of that,” he said. The populations of these countries are much younger, and the team is tracking a significant snapback in activity and a broadening out of returns.

In response to a question about China, Niziolek commented that the change in U.S. leadership could have a positive effect on relations. While unlikely to alter the course of China pursuing its own trade agenda and elevation of its national brand, the Biden administration is likely to be more communicative and less volatile, and China “will appreciate that,” said Niziolek.

Investment professionals, your Calamos Investment Consultant can share much more with you about CNWIX. For more information, reach out at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Evolving World Growth Fund include: the risk the equity market will decline in general, the risks associated with growth securities which tend to trade at higher multiples and be more volatile, the risks associated with foreign securities including currency exchange rate risk, the risks associated with emerging markets which may have less stable governments and greater sensitivity to economic conditions, and the risks associated with convertible securities, which may decline in value during periods of rising interest rates.

Convertible Securities Risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also, may have an effect on the convertible security’s investment value.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries. Total return assumes reinvestment of dividends and capital gains distributions and reflects the deduction of any sales charges, where applicable. Performance may reflect the waiver of a portion of the Fund’s advisory or administrative fees for certain periods since the inception date. If fees had not been waived, performance would have been less favorable.

The S&P 500 Index is generally considered representative of the U.S. stock market.

Morningstar RatingsTM are based on risk-adjusted returns and are through 12/31/20 for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2021 Morningstar, Inc.

802273 0121

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on January 13, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.