CMNIX + CICVX: Adjust the Dials for the ‘Right’ Blend of Market Risk, Volatility, Return Profile

First published: June 18, 2021

Today’s post draws its inspiration from the fine work by the people behind Reese’s peanut butter cups. Their first move was to combine two premium ingredients—chocolate and peanut butter—into an iconic cup. Then they followed one genius decision with another: to adjust the amount of chocolate and peanut butter used in a series of successive sweet products designed to appeal to individual tastes.

We can apply the same thinking to two of our storied funds.

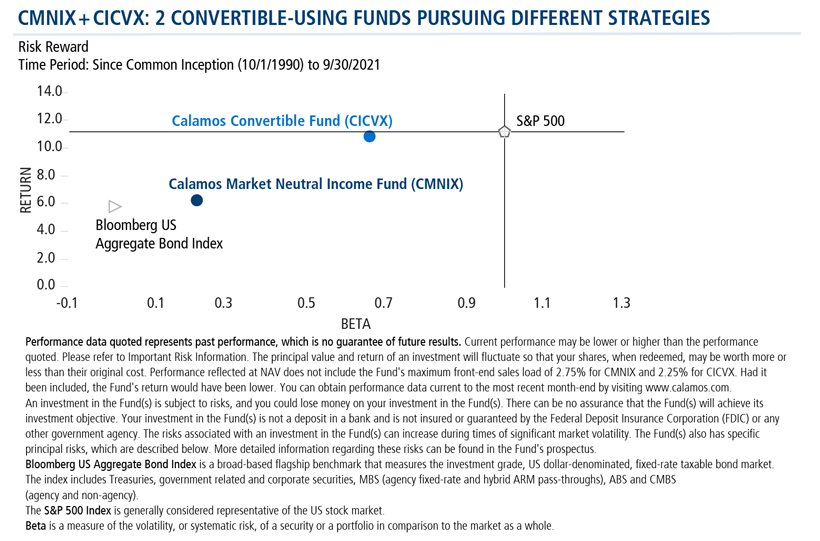

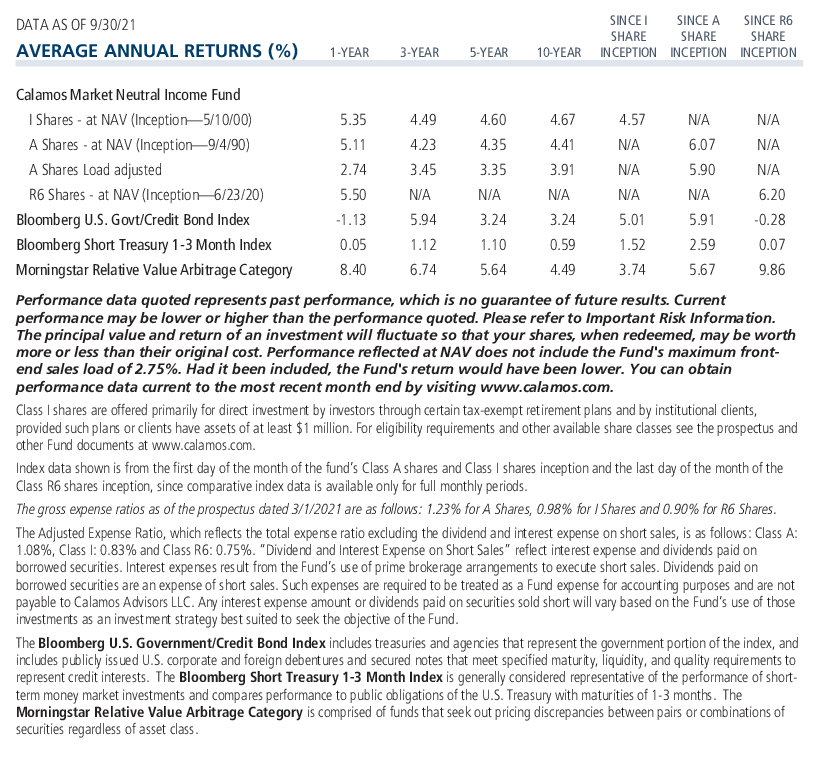

Calamos Market Neutral Income Fund (CMNIX) and Calamos Convertible Fund (CICVX) have been standalone allocations in clients’ portfolios for 30 and 36 years, respectively. Both strategies use convertible securities, but to different ends.

CMNIX offers an alternative to traditional bond strategies. Convertible arbitrage is one of two complementary strategies (hedged equity being the other) used to generate returns not dependent on interest rates. In contrast, the objective of CICVX is upside participation in equity markets with less exposure to downside than an equity-only portfolio, over a full market cycle. While CICVX seeks to profit from individual convertible security selection, CMNIX doesn’t.

CMNIX and CICVX can work together in a blend, depending on the problem you’re trying to solve for. Lately, we’ve been talking to investment professionals about using these two in combination as a way to play defense and as a hedge against inflation (see related post).

The following ideas are provided by our in-house mixologist Elise Pondel, CFA, Calamos AVP, Product Management & Analytics.

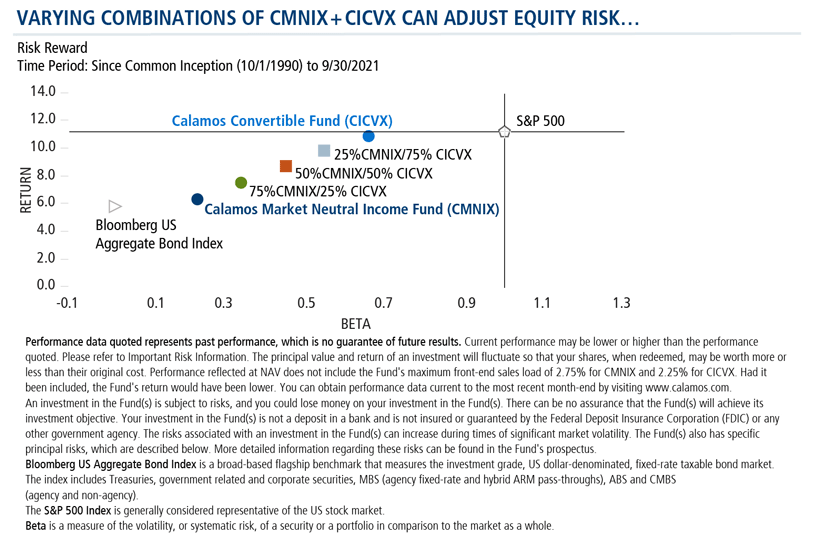

The investment professional who’s 100% in CICVX, for example, might halve the allocation in favor of an allocation to CMNIX. Use this blend to:

- Aim to significantly reduce volatility and equity market risk for a more risk averse investor

- Seek to create an absolute return stream and/or pursue a more fixed income-like risk/return profile

- Seek to provide consistent return streams during rising interest rate and rising inflation periods

Alternatively, Pondel says, dial a 100% CMNIX allocation down to 50% and a CICVX allocation up to 50% to:

- Increase convertible exposure but not at the expense of continuing to manage equity volatility and market risk

- Pursue more of an asymmetric up/downside capture relative to the S&P 500 than CMNIX alone

- Pursue equity-like performance during periods of rising rates and rising inflation

For even more variety, her analysis also includes 75%/25% blends.

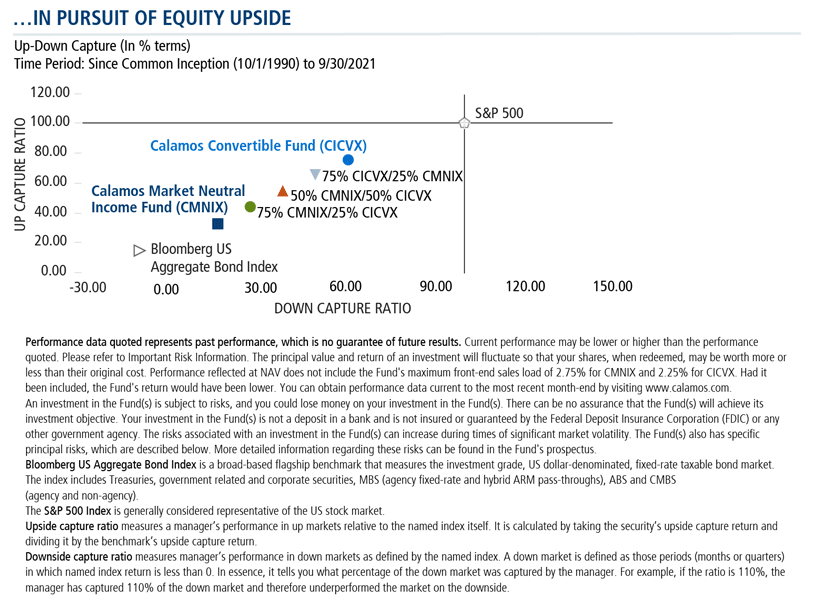

Below you’ll see the historical upside/downside capture results of using CMNIX and CICVX in combination. The blend you choose will be influenced both by your perspective on the economy and on your client’s risk profile.

Does any of the above appeal to your taste? Please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The performance shown in this post is hypothetical in nature and does not represent the performance and/or investment risk characteristics of any specific client. While the performance listed for each respective Investment Professional is based on actual performance, the aggregate portfolio performance, allocations listed and account comparisons shown are hypothetical in nature, as no actual clients are invested in these blended strategies. Hypothetical performance results have many inherent limitations, including those described below:

- Hypothetical performance results are generally prepared with the benefit of hindsight.

- There are limitations inherent in model results, such results do not represent actual trading and that they may not reflect the impact that material economic and market factors might have had on the advisor's decision making if the advisor were actually managing clients' money. In the hypothetical accounts shown actual 3rd party advisor performance has been blended in various allocations.

- The hypothetical performance shown does not involve financial risk, and no hypothetical performance calculation can completely account for the impact of financial risk on an actual investment strategy.

- The ability to withstand actual losses or to adhere to a particular investment strategy in spite of losses are material points which can adversely affect actual performance results.

There are distinct differences between hypothetical performance results and the actual results subsequently achieved by a particular investment portfolio. No representation is being made that an account will or is likely to achieve profits or losses similar to those shown, and any investment may result in loss of principal.

As with any hypothetical illustration there can be additional unforeseen factors that cannot be accounted for within the illustrations included herein.

Hypothetical performance and index returns presented assume reinvestment of any and all earnings/distributions.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

The S&P 500 Index is generally considered representative of the US stock market.

802422 1221

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

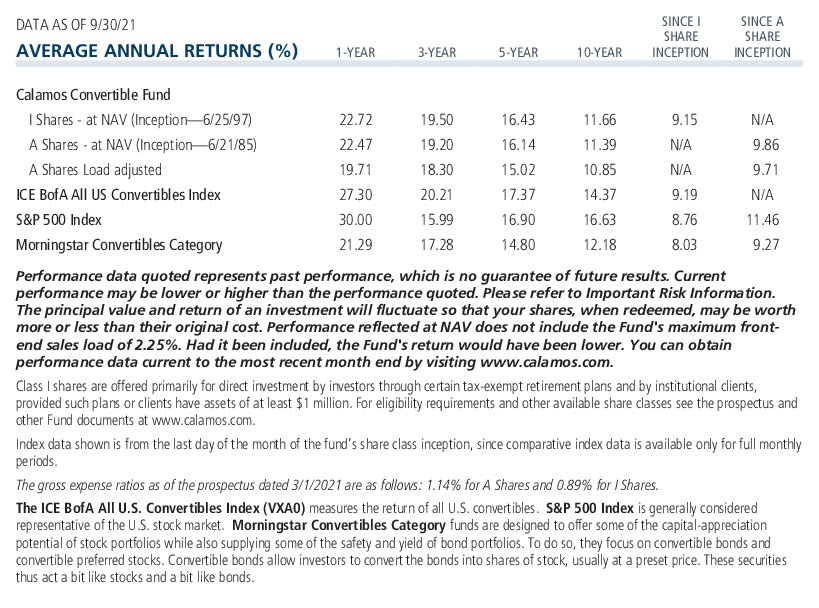

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on December 02, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.