Today’s Pullback in Convertibles? For CICVX, It Can Be Time to Go Shopping for the Market Leaders of Tomorrow

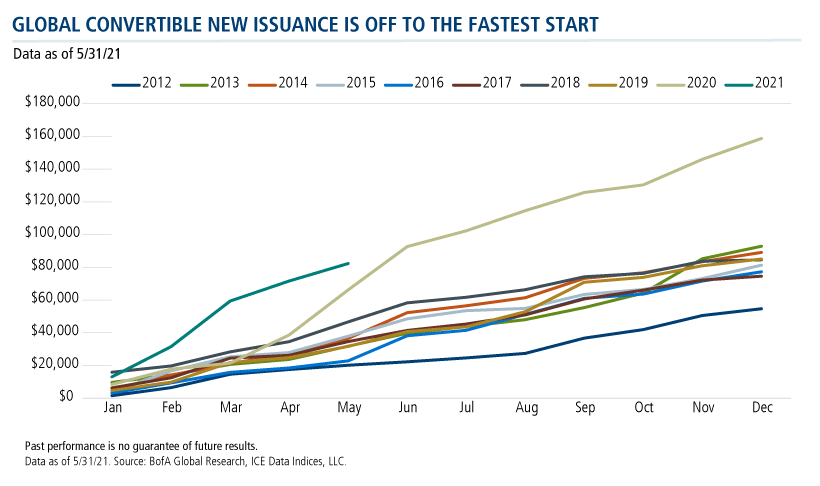

- Global convertible new issuance is off to its strongest start to the year, $82.3 billion through the end of May.

- March’s 43 deals totaling $25 billion was the strongest month ever.

- 60% of the volume of the issuers are younger than three years old.

- More than half of issuers don’t have existing converts, representing a broadening the market.

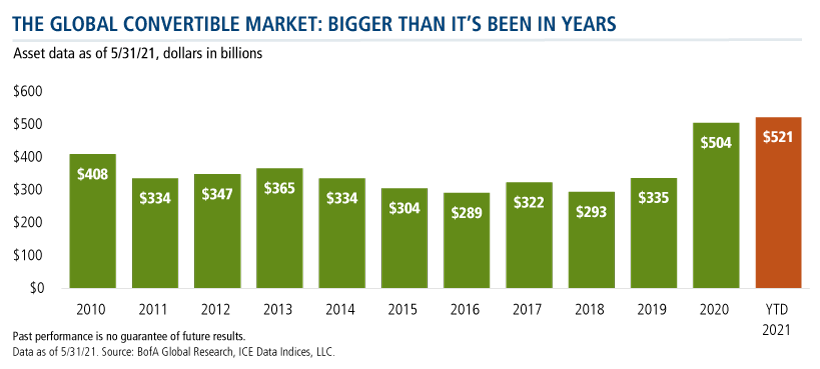

- Assets in the U.S. and global markets are touching all-time highs, at $521 billion as of May 31.

You’d be hard pressed to find two convertible bond investors more enthusiastic than Jon Vacko, CFA, and Joe Wysocki, CFA, Calamos Senior Co-Portfolio Managers, who reviewed the above stats at a recent meeting of investment professionals.

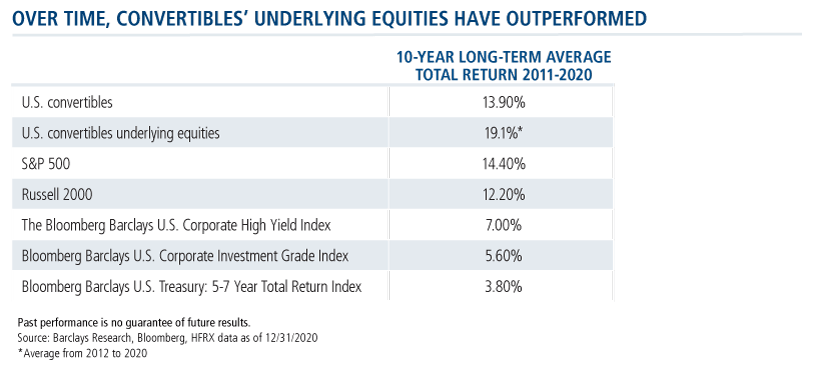

While acknowledging the market’s underperformance against the S&P 500 year to date, they offered the benefit of their experience as long-term investors in a niche space that’s higher growth, smaller cap—and this is important: capable of volatility that produces opportunities during market pullbacks.

The Calamos Convertible Fund (CICVX) portfolio, said Wysocki, includes “companies that we think are really unique. They’re growing their intrinsic value, they’re tomorrow’s market leaders in many cases. That tends to lead to higher returns, more volatile--but in a convertible structure, we’re able to mitigate that downside and still retain a call option on the upside.”

“Whether it’s software as a service or electric vehicles or semiconductors,” continued Wysocki, “over the years, companies come to the convert market for growth capital. Having the freshest companies in the market keeps it exciting, keeps it innovating. If they come with higher volatility, it’s because they’re earlier in their profit cycle.”

Issuance Trends

Wysocki commented on a few current trends in issuance terms. At any given time, he said, pricing is either investor-friendly or issuer-friendly. Zero coupon convertibles, firmly in the issuer-friendly category, have been part of this year’s market.

Even with the lower coupon trend, Wysocki said he was encouraged: “If you get a lot of supply in a relatively niche asset class and there isn’t a demand, the market will cheapen up. But we didn’t see that...To me, it signifies that there is still a very strong demand for convertibles.”

The pendulum has since swung back toward higher coupons, which Wysocki considers the result of the array of options available to investors. As an example, he said, Priceline, Airbnb, Trip Advisor and Expedia convertibles all are available for those looking to invest in the reopening trade.

“In the past, there might have been one. Now we have four, and so you’re able to be a little bit more selective,” he said.

Wysocki also elaborated on the near-record size of the global convertible market even as Tesla—a prominent name over the last few years—has become a smaller part of the market. Representing 10% of convertibles outstanding at the end of 2020, Tesla has shrunk to 2% as one of its convertibles matured, and several other convertibles converted.

“If you have 10% of the market evaporate in a short period of time, you might expect that the convert market has shrunk, but that’s actually not the fact at all. The market’s grown,” said Wysocki. And, he added “I would actually argue it reduced some of the concentration risk, because now that we don’t have that single name comprising 10% of the market, being so deep in the money and very equity-sensitive.”

This year’s issuers have covered the gamut from Ford Motor Company, an old line company tapping the convertible market to roll out their EV projects, to companies like Airbnb and DraftKings.

Throwing the Baby Out with the Bathwater

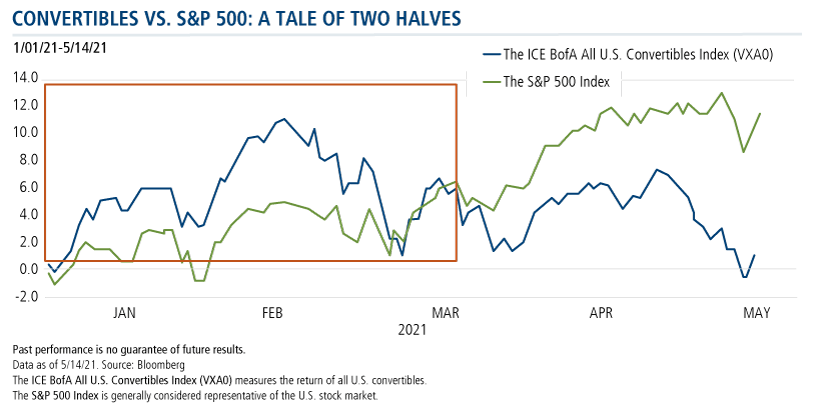

As structurally solid as the convertible market is, a significant rotational selloff undid converts’ strong start to the year, and the 3.74% return of the ICE BofA All U.S. Convertibles Index (VXA0) trailed the S&P 500’s 12.62% as of May’s end.

For an explanation, Wysocki said, look no further than at the stocks underlying convertibles, some of which have declined from 30% to 40%.

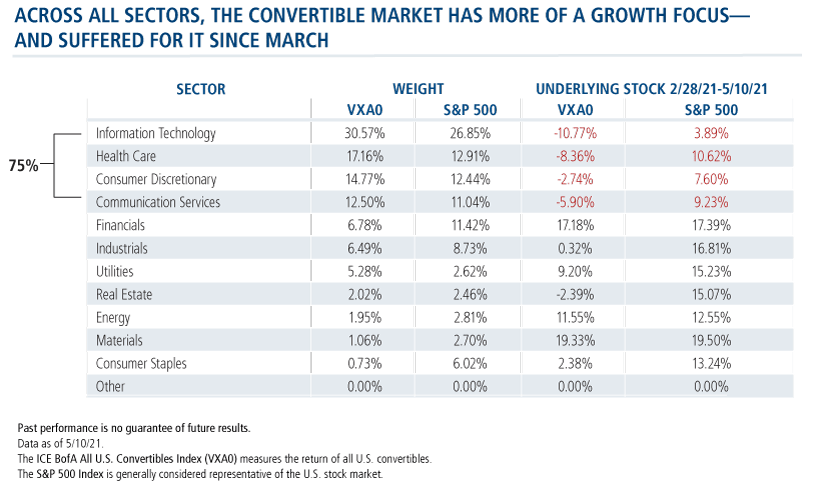

More of the U.S convertible market is in growth sectors, and in those growth sectors are higher growth smaller to mid-cap companies. “So, more software within tech, higher growth software, earlier profit cycles. Within healthcare, it’s more biotech and pharma in its earlier cycle. We could go up and down the entire spectrum of all the sectors. They all have more of a growth focus.”

While tech, healthcare, consumer, and communications services have been negative for the convert market, they have been positive for the broader S&P 500.

“The baby is being thrown out with the bathwater in some cases…,” Wysocki said. “Here we’ve seen good results, with good indicators, and good forecasts from companies that we own. We think the intrinsic value is growing over time. But importantly, it’s not a credit event.”

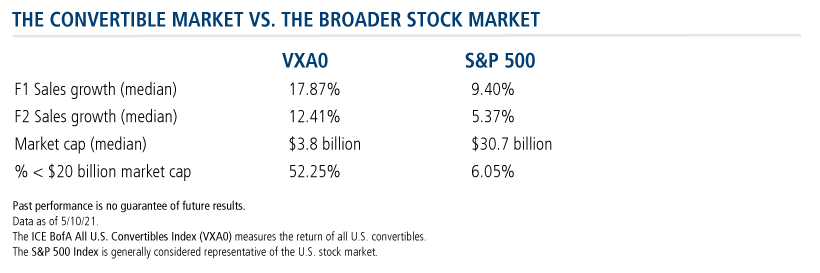

Below see the table showing a comparison of Sales growth (next year’s sales) and Forecasted sales (two years out) for the convertibles index and the S&P 500.

“We think that’s important because growing the intrinsic value of the business can come from revenue. It can also come from cost-cutting and margin expansion. But you can’t really cut costs or cut expand margins into infinity. It’s really harder to manufacture that growth. You need a strong product and a strong service to be able to sell.”

Given that most companies’ earnings are easily beating comparisons to last year, “It’s not going to be a question of who grew the most in 2021,” said Wysocki. “It will be who is going to grow in 2022. And you can see that on that basis, the convert market outperforms or looks favorable to the S&P 500.”

Why You Own Convertibles

“Growth companies,” Vacko said, “love the convert market because of the lower interest costs, and they’d rather spend their capital on growing the business rather than actually paying for the capital in cash. So that’s why they love the lower cost interest.”

“But,” he continued, “it’s not uncommon for more volatility with these. And we’ll quite often see these smaller companies have one quarter when they’re investing for growth, so their earnings might be a little short of what the expectations are, and so you’ll have a pullback.”

Also, Vacko acknowledged, “Not all names work out, but then again, that’s why you own converts, right? You own them for the short-term pullbacks and sometimes, some of the names, just don’t work. But you have these higher potential valuations, and you have the ability to mitigate against the downside."

Last year, many issuers benefitted largely from convertibles providing liquidity, refinancing and shoring up the balance sheets, according to Vacko. Today the capital is being used for more growth, expansion, and mergers and acquisitions.

“This reflects companies’ managements’ being more willing to accept risk, that they’re less risk averse,” he said.

The selloff in growth has been indiscriminate. Even so, the team is being selective in rebalancing the portfolio, according to Vacko.

“We’re lining up our shopping list,” he said. “We’re looking at names that have pulled back, names that still have fundamentally strong performance, but are effectively cheaper and quite often better structures. We’re rebalancing within the capital structure.”

It’s work that Vacko describes as requiring discipline. “This is very bottom-up focused, very company-specific, and we can’t time the market, so we don’t do this all at once. We don’t on one day decide that we’re going to change 10%, 15% or 20% of the portfolio today. It’s over time that we’ll continue to change and make these moves.”

On the cyclical side, the team is looking for companies that will be stronger on the other side of COVID. “We talk about names that are focused on permanently lowering their costs, improving their margins, and driving higher or sustainably higher returns. So, when they return to pre-COVID levels in terms of performance, their valuations are higher.”

Investment professionals, for more about CICVX, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

For monthly updates on the U.S. convertible market, subscribe here. We also publish a quarterly snapshot of the global convertible market, subscribe here to receive that via email.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

802411 621

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on June 08, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.