Convertible Issuance, Performance, Rising Rates and the Risk of the Passive Approach: CICVX PMs on 2021

“Nothing was normal about 2020,” according to Jon Vacko, Calamos Senior Co-Portfolio Manager, “from the cause, global size, and stimulatory response (monetary and fiscal) of last year’s recession to the speed and depth of the market correction and recovery, with record-low bond yields, negative oil at one point, unemployment that went from a 50-year low to a Depression high, and an election that thrilled us all.”

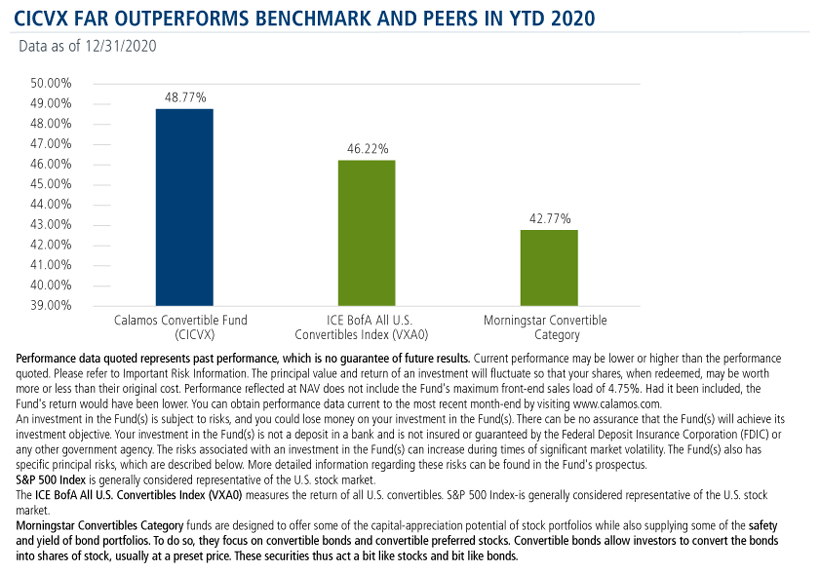

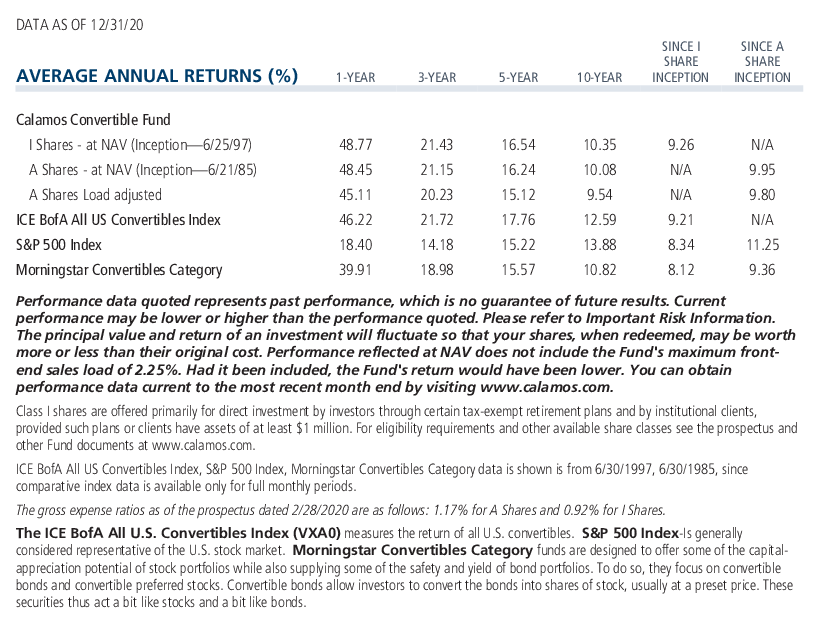

It was a time when the $550 billion convertible bond market played a vital role in providing access to capital to a broadening range of companies—and a year that Calamos Convertible Fund (CICVX) navigated to shield investors on the downside while participating on the upside, thereby producing the best return in its 35-year history.

What’s ahead? That was the theme of questions posed by investment professionals joining Thursday’s CIO call (listen to replay here).

Vacko and Joe Wysocki, Co-Portfolio Manager, forecasted a year with continued market volatility, continued strong issuance and a continued breadth of opportunity in the convertible market.

Favorable Supply and Demand

Last year’s U.S. convertible issuance of $105 billion fell just short of the 2007 record of $106 billion. That's compared to the average annual U.S. issuance of less than $40 billion over the last 10 years.

Vacko offered several reasons issuance should continue to be strong this year, if not quite at the same lofty level:

-

To issuers, convertibles offer attractive pricing. “Even with low interest rates, volatility is relatively higher and companies can monetize that volatility in the convertible market,” he said.

Last year saw 100 new issuers. They included growth companies such as Square, Etsy, Snapshot, Uber, Shopify and Wayfair, which is consistent with the convertible market’s tradition of financing “tomorrow’s leaders today.” But Vacko noted that converts last year also appealed to cyclical firms both for the pricing and the speed with which capital could be accessed.

As in previous years, Technology and Healthcare names led the issuance in 2020. The biggest change was the increase in Consumer Discretionary companies, the third most active issuing sector representing 20% of all issuance. Companies impacted by the COVID-19 global quarantine, such as those in cruise lines, restaurants, retail, live events, leisure (skiing, movie theaters, etc.), needed liquidity, refinancing and a shoring-up of their balance sheets in general. Airlines in Industrials and device manufacturers in Healthcare also were among 2020 issuers.

Even as liquidity funding and refinancing issues are likely to slow in 2021, supply can be expected to be lifted this year by more traditional sources of issuance (e.g., mergers and acquisitions, R&D and capital spending), Vacko said. - There’s more demand. The investor base is broader now as the CICVX team sees crossover equity and crossover bond buyers participate in the convertible market for its attractive attributes.

- The economy is improving and earnings are expected to rebound across many sectors, given the very accommodative Fed, the recent and likely additional stimulus checks, the vaccine roll-out and significant pent-up consumer demand.

- A new administration with new priorities, resulting in the favoring of certain industries with stimulus or subsidies. Examples: renewable energy or “green-focused” firms, infrastructure build-out firms and healthcare.

The Upside Needn’t Be Limited

People who see CICVX’s 48.77% 2020 return and ask, “Did we miss it?” aren’t considering what’s unique about investing in convertibles, according to the portfolio managers.

“It’s a question that tends to come from people thinking there has to be a limited upside, like you might have in traditional fixed income, or maybe a mean reversion in other parts of the equity market,” Wysocki said.

The beauty of converts, he said, is that they are hybrid securities that have both bond and equity characteristics. One of their key benefits is that they can be actively managed to rebalance risk/reward and maintain an asymmetric profile.

The balanced part of the market—what the team considers the sweet spot—is a “healthy 40%,” as elaborated on in this recent post. The team has plenty to work with, thanks to the strong issuance of the last few years.

To illustrate, Wysocki offered this hypothetical:

An active manager buys a convertible bond at par, with a typical five-year maturity.

As the equity moves up substantially over those five years, that convert can participate in the upside. Theoretically, it has unlimited upside, just like a stock does.

The active manager can maintain a positive risk/reward profile by rebalancing over the convert’s life. Let’s say, hypothetically, the convert doubles or triples and is now well above its bond floor. If it’s bought at par and it’s trading well above 200 or 300 because the equity has appreciated, that downside protection in the form of the bond component is far out of the money. It has diminished ability to mitigate risk.

The manager can sell the convert and buy a different one back at par. The convertible can be replaced with a bond from the same issuer—many companies can have multiple converts issued at different times with different terms—or from a different company within the sector or even different sectors overall.

The rebalancing can reset the possibility for participation in the upside, while re-establishing the downside risk mitigation.

This strategy does have a cost, Wysocki noted. A balanced convert might get 60%-70% of the upside versus a deep in-the-money issue that may get 100% of the upside. If that stock continues to appreciate and the manager is in a balanced convert, they may be leaving some money on the table—but they’re doing it to mitigate the downside risk.

This is how returns are compounded through the ups and downs of a company and the market. For example, Wysocki explained, this is how the CICVX team has managed the risk of equity valuations in technology. They use balanced converts to gain exposure while seeking to limit the risk of downside.

Wysocki was asked to comment on the risk of a passive approach of investing in convertibles. First, he said, remember that the convert market is still a niche market—“plenty big to find opportunities but much smaller on a relative basis than global equity markets.” A single name or single industry can have an outsize effect, leading to the risk of a less diversified approach.

Also remember that, as a hybrid, a convertible can act like a bond or it can act like equity at any point in time. In the event of an outsize move on an underlying equity, that convertible will participate in the upside and drive the market value higher.

“For example,” Wysocki continued, “we have a number of bonds in our market right now that were issued at par and are currently trading at over 1000—so a 10x return on that convertible because the underlying equity has appreciated 10x. But if you think about it from the context of an ETF that’s simply market-weighting those securities, the ETF can become top-heavy or at times concentrated in certain issuers or certain segments of the market.”

He encouraged investment professionals to consider what they’re intending to accomplish with converts. “The core approach with converts is to have that risk/reward profile, to have that upside participation but also that ability to mitigate the downside,” he said.

Wysocki offered a contrast: The buyer of a credit ETF knows what they’re getting—they’re choosing a credit profile, whether investment grade, high yield or any segment. The same is true if buying a piece of the equity market. “You’re choosing equity risk and you’re getting equity risk,” he said.

“The risk in a passive convertible approach is that when you think you’re getting that upside/downside risk/reward, you may in effect be getting a closet equity portfolio or a busted bond portfolio,” according to Wysocki.

Finally, he acknowledged, it can be challenging at times to understand what’s driving returns in the convertible market. A convertible has a life of five years so 20% of the market is new every year. Last year, thanks to the new issuers, the constitution of the market completely changed. Outsize moves can heighten the risk of concentration.

Convertibles and Rising Rates

As we begin 2021, there’s a new consideration weighing on investors that also adds to the appeal of convertibles. While a 100-basis point rate rise can be a headwind for traditional fixed income, converts often have a different response because of the embedded optionality within convertibles.

At separate times in the call, Wysocki and Vacko made the point that convertibles belong in a portfolio because of the risk of the unknown.

“The risk of rising rates may not be top of mind for everyone yet,” said Wysocki. “The Fed has been pretty clear that they are keeping the short end of the curve on the low end, but what often happens in financial markets is that when things adjust, they adjust fast.”

While still historically low, the rate on the 10-year has doubled since August, he noted. “During that time, investment grade has had negative returns, high yield returned about 5% and converts are up about 25%.”

“Converts can provide a different outcome when rates rise,” he concluded, pointing to CICVX’s long record of outperformance when interest rates have risen by 100 basis points (see this PDF).

Beyond the prospect of a climb in rates, though, Wysocki noted the risks that continue for investors today. As optimistic as the team is about the economy in 2021, they see the potential for uncertainty and volatility in the transition to re-open the economy, a changed fiscal policy, how or whether the Fed begins to unwind the massive liquidity in the system. These help make the argument to use converts to pursue further equity upside while minimizing the risk of downside, Wysocki said.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The ICE BofA All U.S. Convertibles Index (VXA0) comprises approximately 700 issues of only convertible bonds and preferreds of all qualities.

The S&P 500 Index is generally considered representative of the U.S. stock market.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

802277 0121

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on January 15, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.