The Right Way to Think About Convertibles—And What They Can Do for Clients in 2021

Convertible securities (as represented by the ICE BofA All U.S. Convertibles Index or VXA0) were up 46.22% in 2020 and outperformed every other major asset class. At this point, the natural inclination might be to wait for a pullback before investing. But, says Calamos Co-Portfolio Manager Joe Wysocki, “We think that's just, structurally, the wrong way to think about convertibles.”

Calamos believes the right way to think about convertibles, he says, is to focus on their strategic benefit as a core allocation: “Through full market cycles, the ups and the downs, you have the opportunity to compound wealth over time, compound those returns, and you can get equity-like returns or better through many of those cycles.”

Convertibles provide the opportunity to participate in equities’ upside, coupled with the ability to mitigate the risk of equities’ downside.

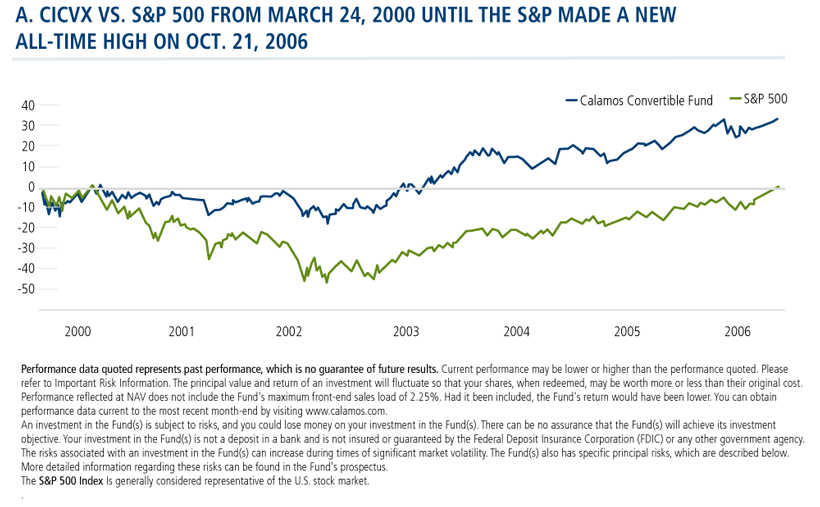

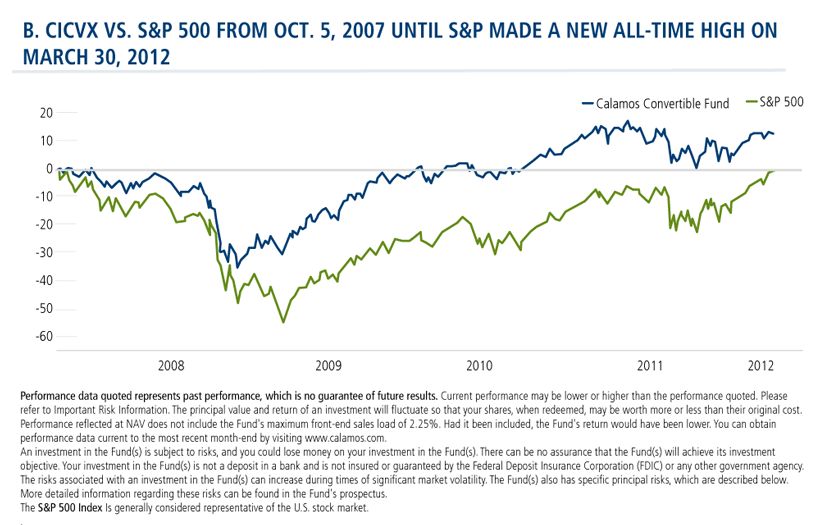

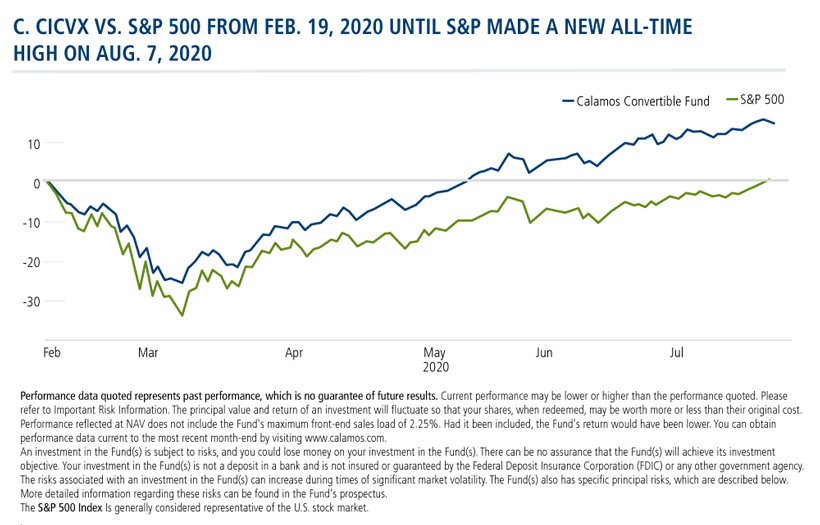

CICVX Recovered Quicker

Below Wysocki looks at 2020 and two other market corrections—the S&P 500 after the tech bubble burst in 2000 and after the 2008-2009 financial crisis. The speed and magnitude of what happened in 2020 was unlike what happened previously as both earlier crises took years to recover. But in each occasion, he notes that the Calamos Convertible Fund (CICVX) had recovered—and with double-digit returns—well before the S&P 500 went on to make new highs.

Now What?

As they have historically, convertibles in 2020 proved themselves to be a valuable asset class during and after a market correction. But as we start the new year, equity markets are at all-time highs and the underlying equities of some convertible issuers have doubled and tripled.

Here, too, Wysocki acknowledges that some investors may mistakenly believe this heightens the risk of an especially equity-sensitive convertible market. “Just remember that converts are an actively managed asset class,” he stresses.

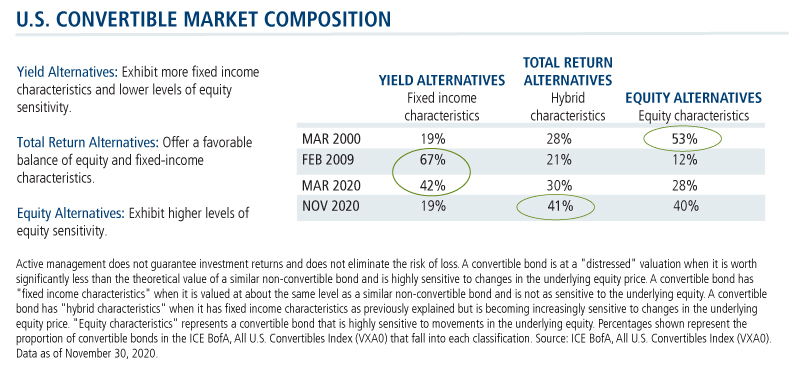

As active managers, the Calamos team thinks about the convert market in different buckets:

- The yield alternative or busted-type convertibles

- Total return alternatives, which Calamos considers the sweet spot

- Equity alternatives, where the equities have appreciated, converts have participated, but there’s little downside protection.

The table below shows a few snapshots of the composition of the convertible market as a whole. “Things can move fast,” comments Wysocki, noting that 40% of the market was in busted converts last March, reduced to 19% by November. “Taking advantage of volatility and rebalancing between convertible structures can be a useful tool to maintain a consistent risk/reward profile.”

With 41% of the market in the total return segment, the team sees ample opportunity for balanced convertibles in today’s market. Last year’s strong new issuance—including from about 100 new issuers—has provided broader opportunities in areas the team likes. Converts can be an effective way to diversify growth, Wysocki adds. More than half of issuers are below $20 billion in market cap, and convertibles have a reputation for supporting tomorrow's market leaders.

While issuance overall may decelerate from 2020’s record-setting pace, demand is expected to continue as companies prefer convertibles as a financing vehicle. Finally, Wysocki looks ahead to the return of rising rates. That’s another environment when convertibles have performed well.

Investment professionals, for more on CICVX, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Click here to view CICVX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The ICE BofA All U.S. Convertibles Index (VXA0) comprises approximately 700 issues of only convertible bonds and preferreds of all qualities.

The S&P 500 Index is generally considered representative of the U.S. stock market.

802261 121

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on January 04, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.