Are Your Clients Positioned to Participate As the Rest of the World Recovers?

While the United States’ COVID-19 recovery has been underway for months there’s still time for investors to take part in what the Calamos Global Equity Team believes will be a global rebound.

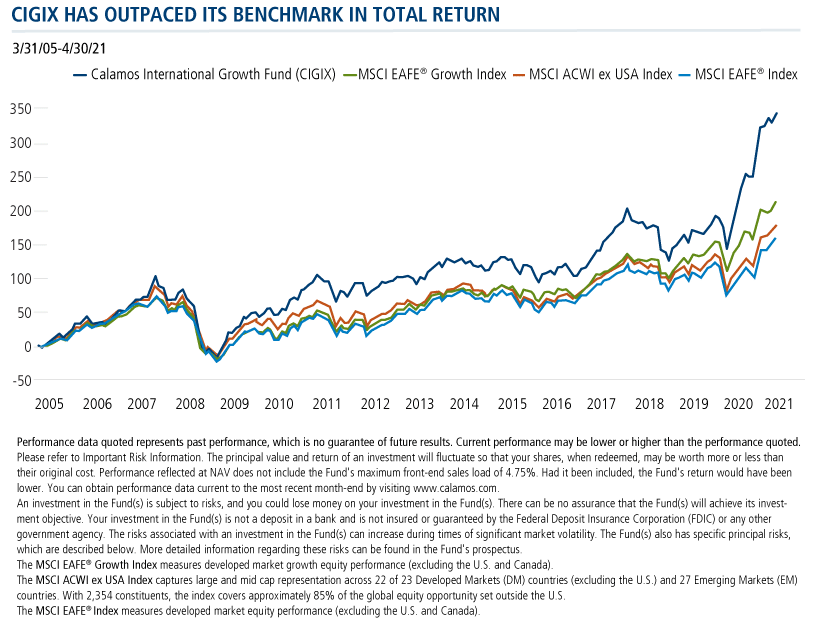

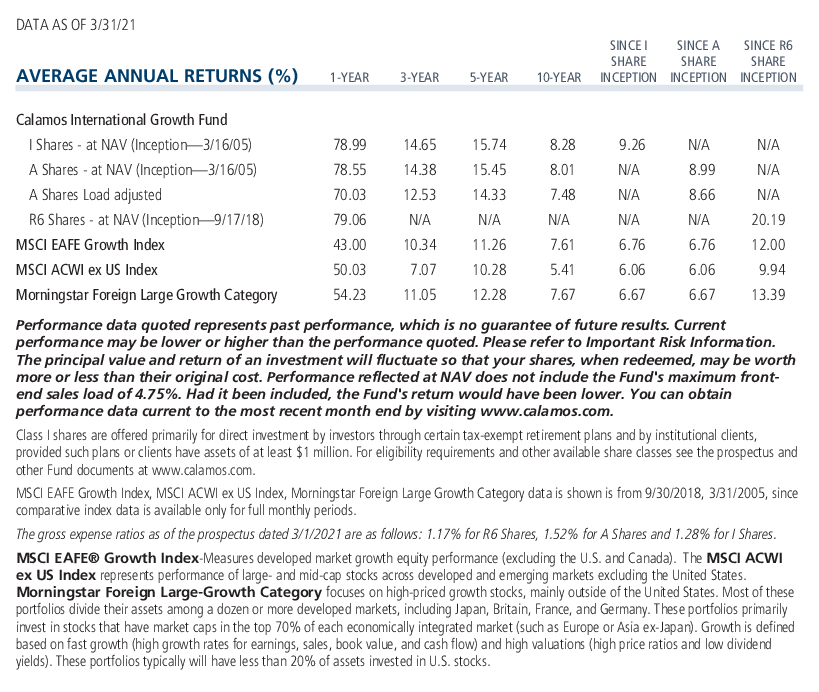

Calamos International Growth Fund (CIGIX)

Morningstar Overall RatingTM Among 383 Foreign Large Growth funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 3 stars for 3 years, 5 stars for 5 years and 4 stars for 10 years out of 383, 331 and 221 Foreign Large Growth Funds, respectively, for the period ended 6/30/2024.

- Experienced team with time-tested process that is highly adaptable and repeatable with a combination of fundamental, quantitative and thematic insights

- Process marries fundamental research with a top-down framework and identification of long-term secular themes

- Invests across a wide spectrum of opportunities—by geography and market cap

- Focus on cash flows returns on invested capital ultimately seeking businesses capable of compounding intrinsic value over time

- Analysis of source of revenues, profits and capital base versus focus on country of domicile

- Actively incorporates ESG considerations into our research process and an emphasis on countries enacting structural reforms and improving economic freedoms

Let’s take a quick tour of what the management of Calamos International Growth Fund (CIGIX), specifically, is looking for in non-U.S. markets.

Europe: Delayed But Similar Trajectory to the U.S.

While the COVID rebound was delayed in Europe, the team believes the region has “catch-up” potential to reach the same trajectory that U.S. and UK re-opening stocks achieved. In addition to liking companies that stand to benefit from COVID recovery and re-opening, the team also favors more cyclical recovery/interest rate driven names that could take part in a continued global recovery.

Europe is home to a high proportion of cyclicals and financials relative to the U.S. and many regions globally, notes Calamos Portfolio Specialist and Senior Vice President Todd Speed, CFA.

“Our outlook for Europe remains constructive,” explained the team in its 2Q 2021 Global Outlook, “supported by the region’s fundamental leverage to the continuing global growth rebound we expect, the encouraging resilience of the European markets during recent months of negative news flow, as well as our views on global currencies. More specifically, while vaccine rollouts have had a near-term impact, we believe the longer-term fundamentals are more conducive to resumed euro stability.”

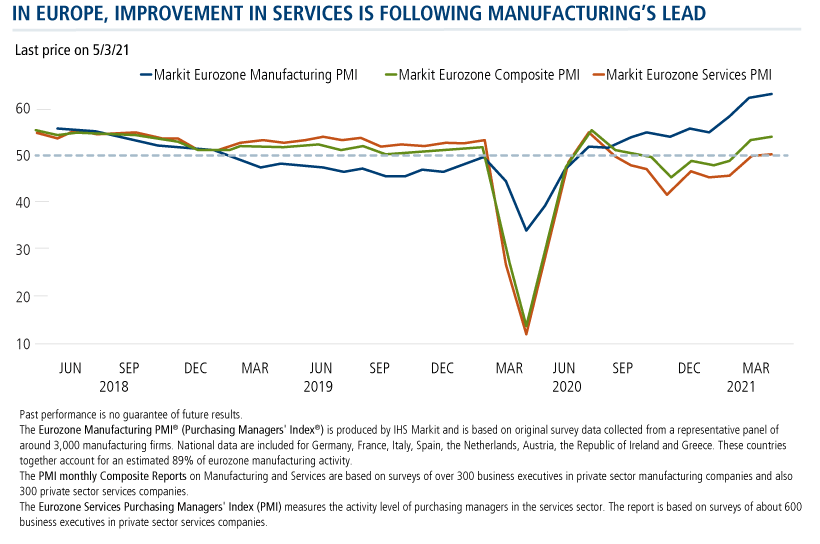

EU economic data is encouraging. That includes both manufacturing, which is tied more to global recovery trends, and services. Household balance sheets remain very strong and the labor market has been resilient. A pickup in the vaccination trend could allow the consumer/household sector to provide additional support to the economy fairly quickly, according to the team.

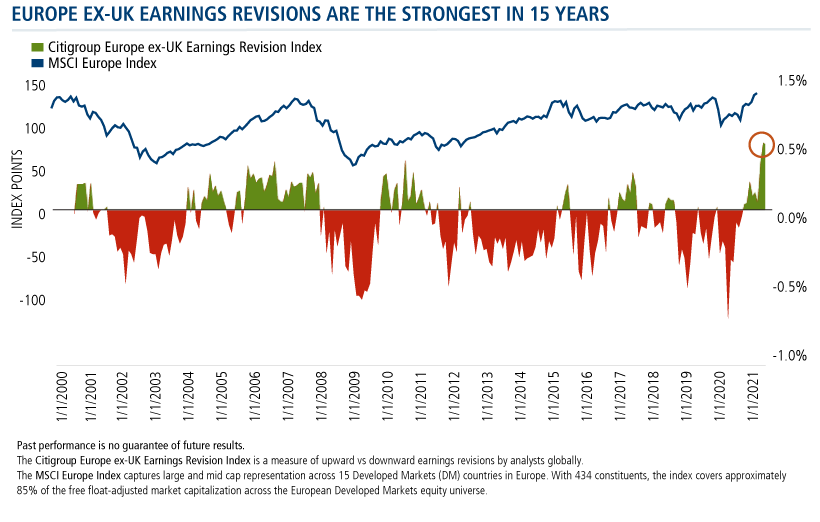

Europe ex-UK earnings revisions are the strongest they’ve been in 15 years. And, Speed adds, CIGIX’s holdings are projected to grow earnings above the benchmark level in the next year.

Asia

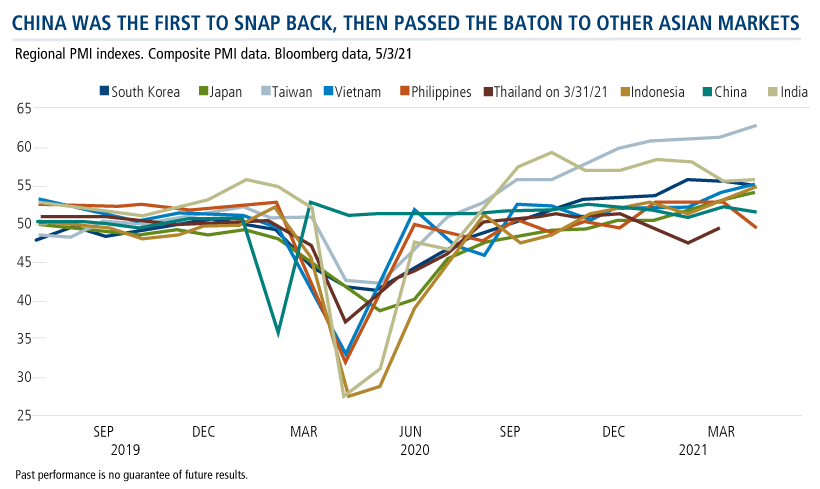

The chart below shows how manufacturing in Asian markets has bounced off last spring’s bottom, with many markets taking the baton from China, which had been the first to snap back.

The team is selective in Asia, and investment decisions in China and India in particular are driven by bottom-up analysis, according to Speed.

CIGIX’s exposure to China is below the benchmark weight, although still significant at almost 8% at the end of the first quarter. The team is balancing secular names in e-commerce, payments and online services with cyclical exposure poised to benefit from improving global growth conditions.

The team continues to see opportunities in India. Even while the country is suffering a severe COVID-related crisis with tragic consequences for hundreds of thousands, Indian markets are demonstrating an impressive resilience. The government’s pro-growth stimulus and reform measures should aid in a post-COVID recovery, benefitting financials, real estate, industrials, and consumer sectors in particular.

“India also provides opportunities to invest in technology, manufacturing, and health care companies that benefit from the developed market recovery,” according to the team.

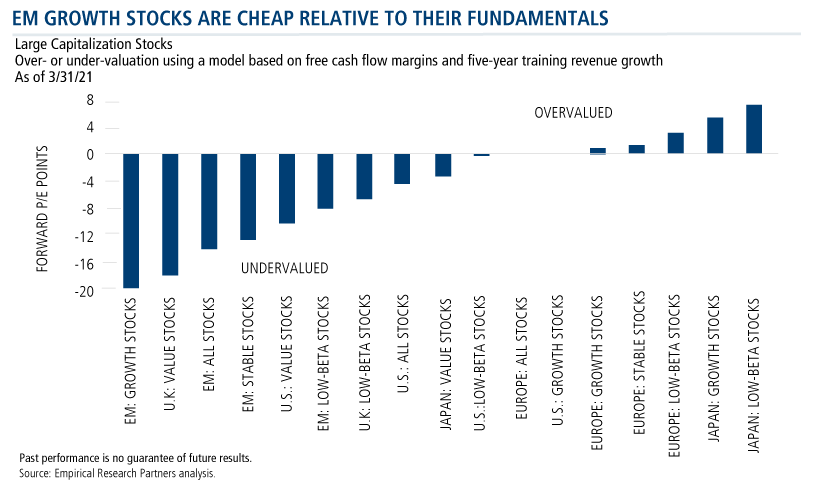

There are no cheaper large cap stocks than emerging markets businesses, Speed notes. “Taken altogether, this could be a loaded spring-type scenario,” he says.

Non-U.S. economies are on course to recover and grow even as the global landscape has grown more complex and competitive. That’s at the heart of Calamos’ argument for strategic allocations to global and international strategies, including emerging markets. Notwithstanding the short-term disruptions of the first quarter—primarily due to differing paces of vaccinations, rising U.S. long-term rates and a strengthening of the dollar—the team believes non-U.S. assets, including select emerging markets, are positioned to deliver strong returns as the recovery progresses.

Ahead of us, the Global Equity team believes, are opportunities that can make a difference in your clients’ portfolios.

Investment professionals, to learn more about our views and CIGIX in particular, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Morningstar Foreign Large-Growth Category focuses on high-priced growth stocks, mainly outside of the United States. Most of these portfolios divide their assets among a dozen or more developed markets, including Japan, Britain, France, and Germany. These portfolios primarily invest in stocks that have market caps in the top 70% of each economically integrated market (such as Europe or Asia ex-Japan). Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). These portfolios typically will have less than 20% of assets invested in U.S. stocks.

Morningstar RatingsTM are based on risk-adjusted returns and are through 4/30/21 for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2021 Morningstar, Inc.

802405 521

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on May 25, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.