Investment Team Voices Home Page

Investment Team Voices Home Page

As the Global Recovery Takes Hold, the Dollar Resumes a Downtrend

Todd Speed, CFA

In the first quarter, we saw U.S. equities lead and the dollar rise in an environment the Calamos Global Team has come to think of as the “U.S. Trifecta.” More specifically, the United States’ standout experience on three fronts—the Covid-19 vaccine rollout, fiscal stimulus, and an acceleration in economic activity—drove significant outperformance in U.S. equities and the dollar.

During this period, markets reacted swiftly to a higher dollar and rising bond yields, which contributed to near-term weakness in overseas risk assets, most notably in the emerging markets. However, we believed these conditions would be temporary. As we discussed in our second quarter outlook, “Synchronized Global Recovery on the Horizon,” although the U.S. Trifecta and its boost to the dollar and rates might be driving volatility, repricing and rotation, it did not change our team’s medium-term fundamental view on the global recovery and opportunities in risk assets.

We expected this pivot …

We also noted our confidence that the global recovery was delayed, not derailed. As the global recovery began to re-synchronize, we anticipated the dollar would resume a stable-to-weakening bias, providing additional support to overseas risk assets and diversification opportunities.

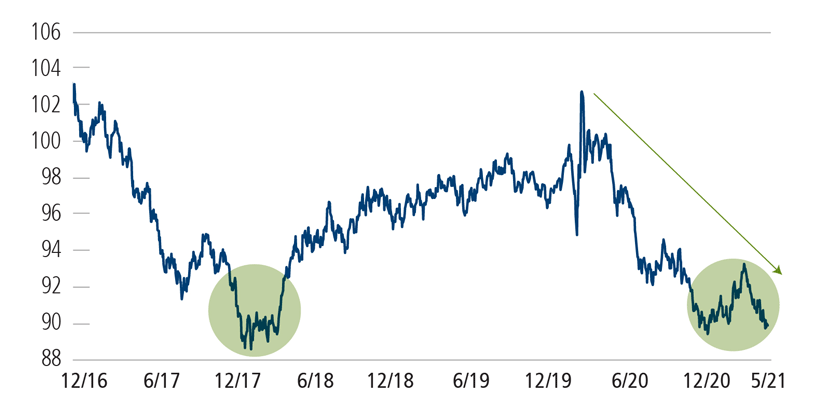

In the most concise terms, this is happening. The dollar resumed a downtrend over the past several weeks and is testing key support levels (see Figure 1).

U.S. Dollar Index

Past performance is no guarantee of future results. Source: Bloomberg. The U.S. Dollar Index measures the value of the U.S. dollar relative to a basket of foreign currencies, including Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden.

A Weak Dollar Regime Supports the Case for non-U.S. Markets

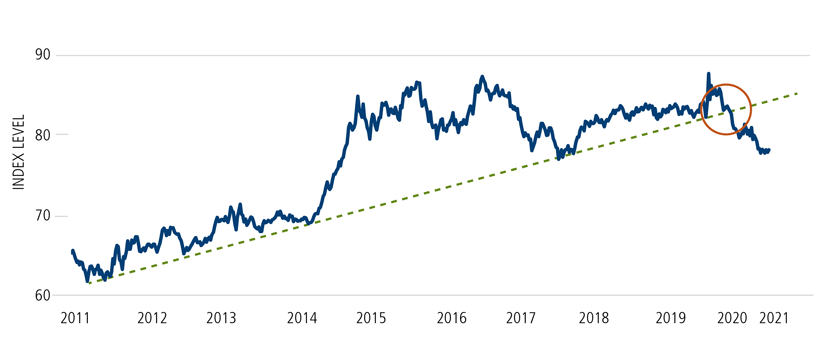

The past decade saw sustained outperformance in U.S. equities and the dollar, reflecting economic leadership and favorable rate and growth differentials. We believe conditions have changed, and the duration and magnitude of these potential shifts should not be underestimated (Figure 2). (For more on this, see “How Long Could Emerging Markets Lead? See These 2 Charts” and “Niziolek Talks Emerging Markets and the CNWIX Book on Animal Spirits Podcast.”) We reiterate our view that the world has entered a weaker dollar regime, with critical implications for international return and diversification opportunities.

Deutsche Bank USD Trade-Weighted Index

Source: Bloomberg, Deutsche Bank. The trade-weighted dollar index is a measurement of the foreign exchange value of the U.S. dollar compared to the euro, Canadian dollar, Japanese yen, British pound sterling and Swiss franc.

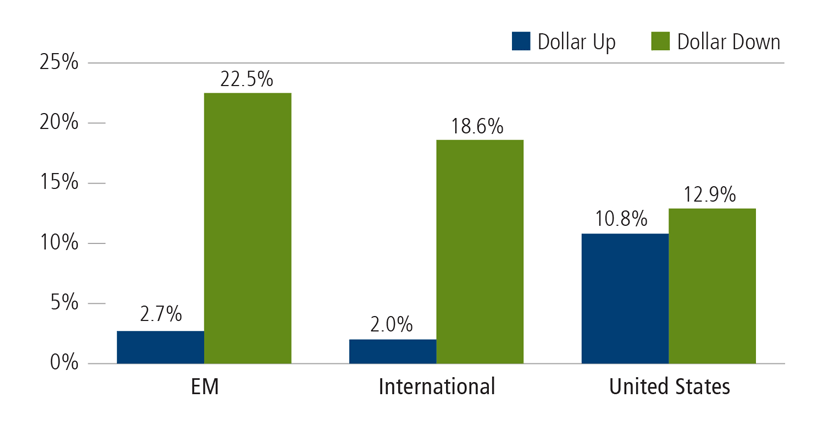

U.S. Dollar and Equity Returns, Yearly, 1974-2019

Past performance is no guarantee of future results. Source: Ben Carlson, Fortune.com, August 2020. Emerging markets equities are represented by the MSCI Emerging Markets Index; international equities are represented by the MSCI EAFE Index, which includes equities from developed markets, excluding the U.S. and Canada; and U.S. equities are represented by the S&P 500 Index. Indexes are unmanaged, do not include fees and expenses, and are not available for direct investment.

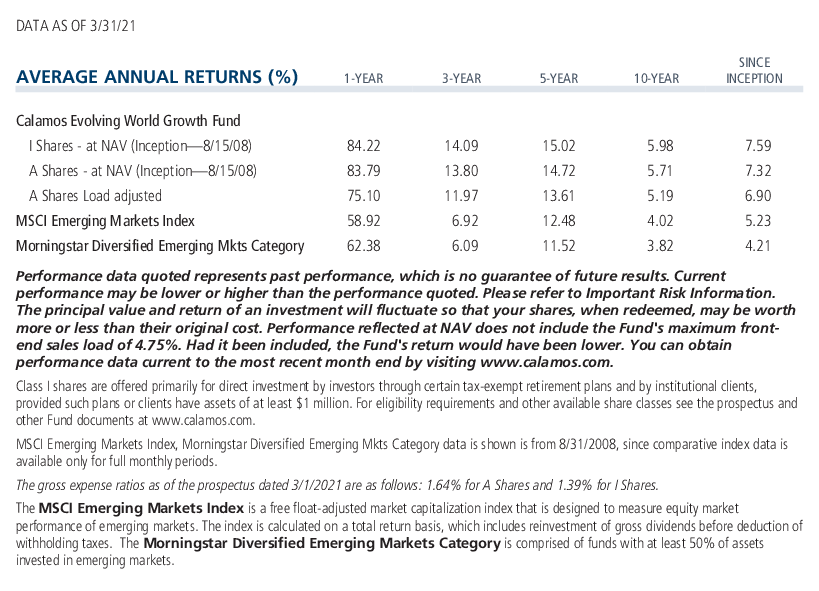

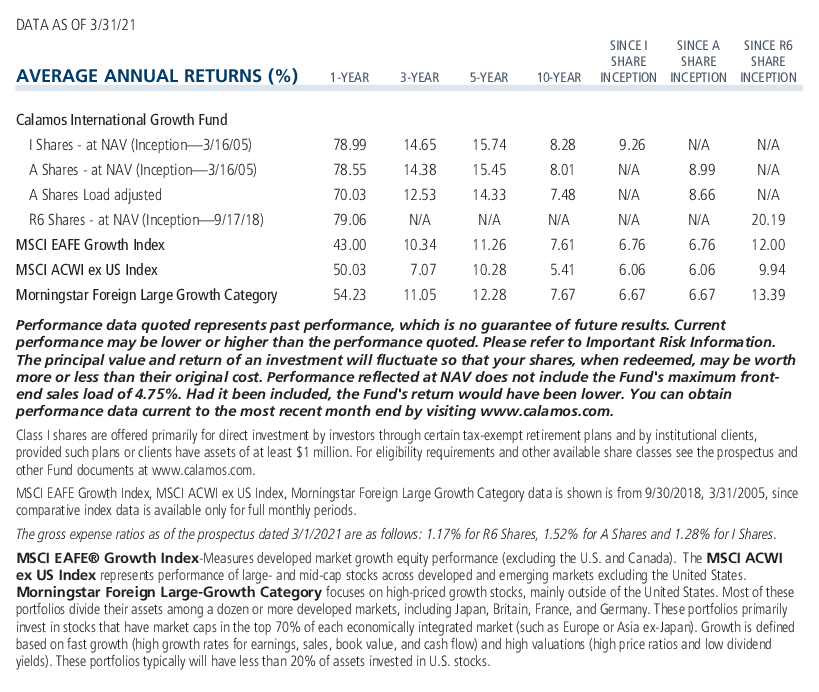

Of course, the case for international equity allocation is predicated on far more than dollar strength alone—there is significant potential in non-U.S. markets aside from the dollar. That said, now may be an especially opportune time to increase allocations to international funds, including emerging market offerings. As the global recovery synchronizes and the dollar resumes its downward trend, we believe Calamos International Growth Fund (CIGIX) and Calamos Evolving World Growth Fund (CNWIX) are well positioned. Each offers a compelling history of outperformance versus peers and benchmarks over both short and longer periods.

For more on our team’s perspectives on the dollar, the global economy and where we see investment opportunities, visit our blog and Global Funds Insights.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

18886 0521 R

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.