Investment Team Voices Home Page

Investment Team Voices Home Page

The Sweet Spot of Disinflationary Growth

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA, and Kyle Ruge, CFA

Summary Points:

- A global macro backdrop of falling inflation and improving economic fundamentals provides strong tailwinds for our growth approach.

- Our approach to AI focuses on the entire ecosystem, including growth-oriented industrials as well as technology companies.

- Economic reform sets the stage for investment opportunity—through this lens, South Korea is a market that has our attention.

Our team’s investment framework incorporates top-down elements to help guide our bottom-up research and portfolio construction. Identifying and investing alongside global secular themes is a pillar of this top-down framework (for more, see our paper “Identifying Global Growth Opportunities Through a Thematic Lens”). We also pay close attention to more cyclical macroeconomic conditions to understand the environment we’re in and to identify potential inflection points.

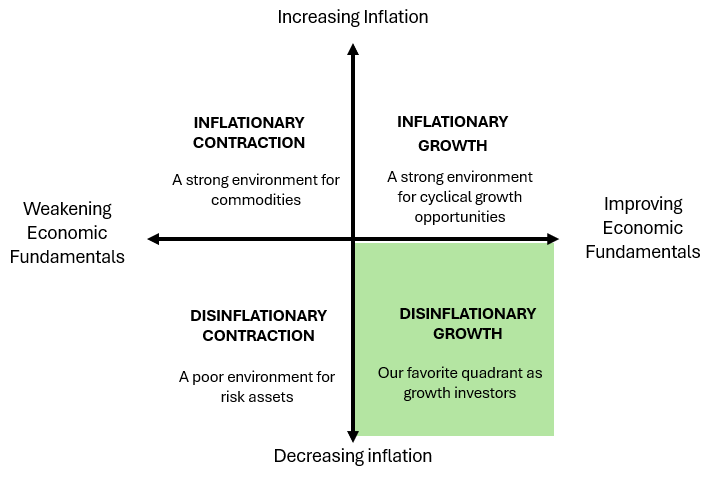

Economic growth and inflation levels and their rates of change are the primary high-level determinants of the investing environment. Within each environment, there are historical patterns of how asset classes, sectors, industries, and factors have tended to perform. Since mid-2023 and led by the United States, we’ve been in a global environment of falling inflation while growth has been resilient. Even in Europe and Japan, where conditions have been more challenging, nominal growth remains positive.

Market cycle regimes: We see macro tailwinds for global growth

Historically, this has been the best environment for risk assets and for growth stocks in particular. Capitalist systems thrive on innovation, productivity enhancements, and creative destruction. Fundamentally we believe investing in companies driving such progress is akin to following a healthy diet and exercising regularly.

Market participants seem to value these characteristics most when they are not worried about the prospect of a significant change in the growth outlook or inflationary backdrop. In an environment of reasonable albeit slowing economic expansion, still elevated but falling inflation, and ubiquitous innovation, it is not surprising that the equity returns of companies with strong growth fundamentals have outperformed the broader market.

We do not see a material shift in the growth or inflation dynamic on the horizon. As such, we see a long runway of opportunity for the quality growth companies our approach favors. In addition to the top-down tailwinds, many of these companies are seeing significant fundamental improvements in their businesses that support valuations that we believe are still reasonable.

Korea: Next Up with Value Up?

Our thematic framework favors countries embracing economic freedoms and reforms. In 2023, we wrote about the opportunities we saw in Japan as reforms promoted by the Tokyo Stock Exchange fueled a rerating in Japanese Equities (the Yamaji Rally). This year, Korea looks to be following Japan’s blueprint by promoting reforms to unlock value in its equity market, one of the cheapest on the planet.

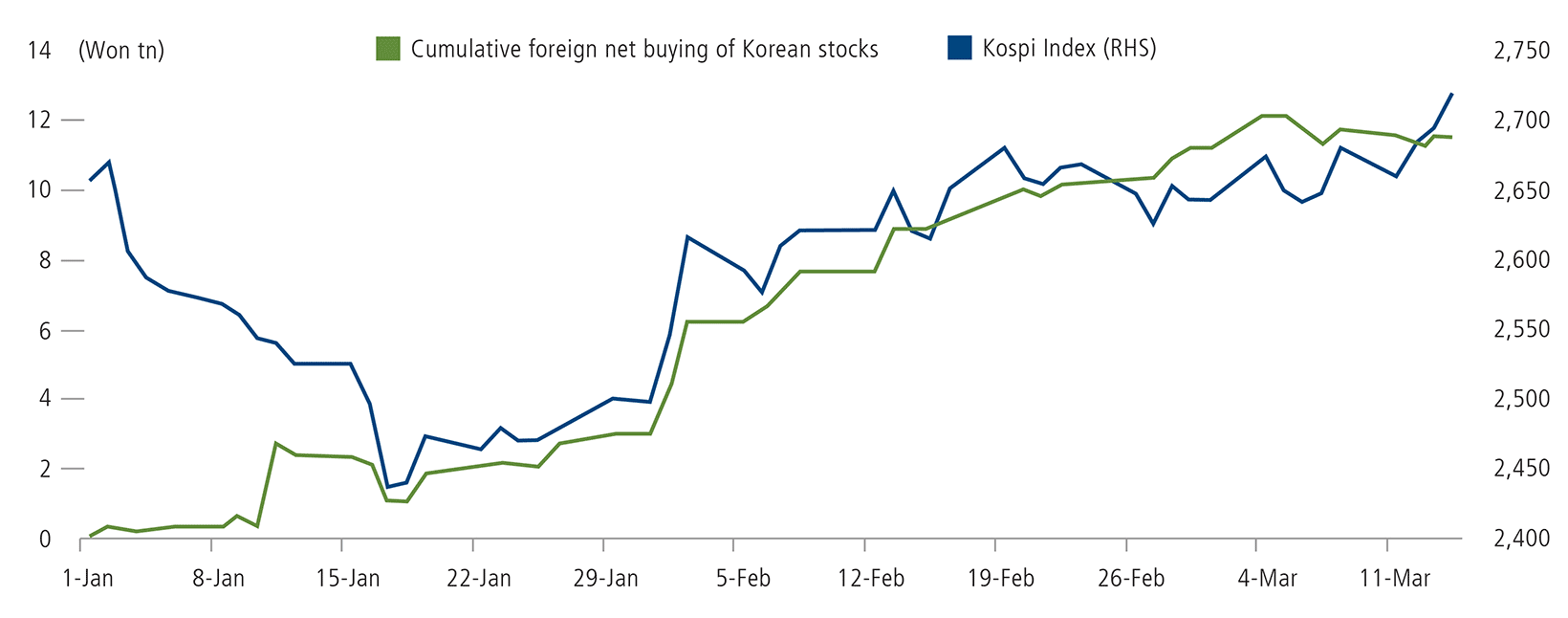

Korea’s “Corporate Value-Up Program” includes efforts to bring attention to companies’ progress in improving price-to-book, return-on-equity, and dividend ratios. There are plans to launch indices of companies making positive progress on these factors, create exchange traded funds that allow investors to directly invest in these companies, and establish a department within the Korean Exchange to provide advisory support to help companies become more shareholder-friendly. As the graph below shows, Korea’s equity market has ramped up quickly since the announcement of the Value-Up program.

Although foreign investors have been net-buyers of the Korean equity market for most of 2024, local investors have remained more skeptical. Tax considerations have historically incentivized companies to leave dividend-payout ratios low and maintain complicated shareholding structures. For the Value-Up program to be truly successful, a re-writing of Korea’s tax code will likely be required.

Foreign interest and Value Up are giving a boost to Korea’s equity market

Past performance is no guarantee of future results. Source: Jefferies, “Value Up in Korea,” March 14, 2024 using Bloomberg, Korea Stock Exchange. The Kospi is a measure of Korean equity performance.

Parliamentary elections on April 10 have the potential to give Value-Up a real boost and catalyze a period of significant outperformance for Korean equities. If the ruling People Power Party (PPP) gains control of Korea’s legislature. President Yoon Suk Yeol will be in a strong position to implement many of the pro-business reforms he supports.

Our international and emerging market offerings are already overweight Korea and we are actively seeking opportunities to build exposure across our portfolios. We’re positioned in companies that are already implementing reforms and that offer quality fundamentals and the ability to perform regardless of election outcomes.

AI, more than meets the I

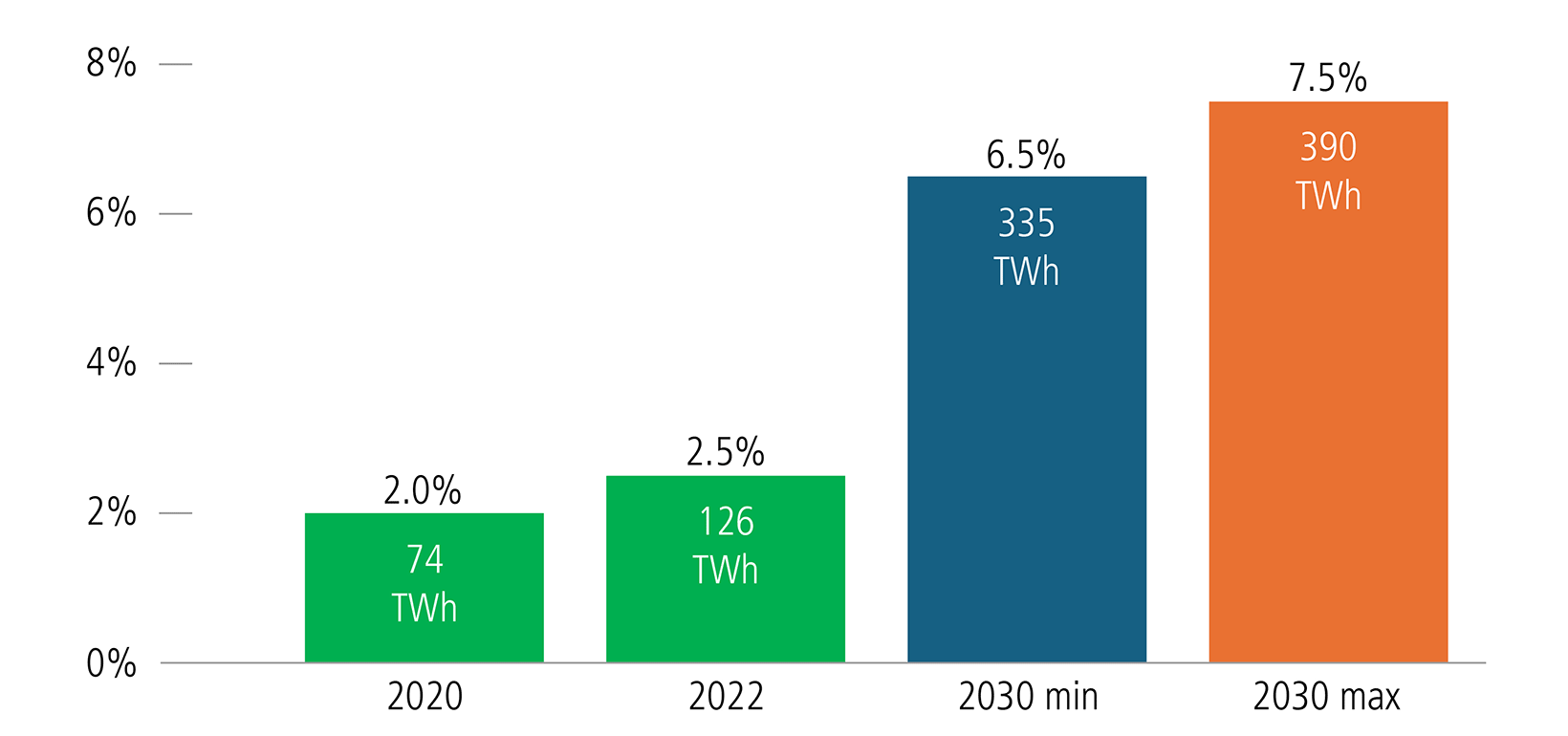

AI is one of the most powerful secular growth themes in the world today. As we noted in our recent post “Investing for Growth: Understanding the Value of Disruption,” our thematic approach also delves into niches. For AI, that means we’re finding opportunities not only in chips and software, but also in less glamorous places, like the global industrial companies that keep the massive data centers housing the AI ecosystem running, but not running too hot.

There are already about $1 trillion worth of data centers installed, but over the next four or five years, another $1 trillion of data center infrastructure and hardware will be required to power software around the world, according to Nvidia CEO Jensen Huang. The proliferation of next-generation AI chips will require additional power and thermal management equipment throughout the data centers to mitigate the uptick in heat generation.

AI creates new demands for electricity usage—and opportunities for industrial innovation

Source: Barron’s, using Boston Consulting Group. 2030 estimate represents a range depending on future use of generative AI.

As AI-related capex increases, the infrastructure to support it will need to change as well. As cooling needs rise, we see ramped-up growth potential for established data center equipment providers and new entrants with expertise in thermal management for adjacent industries. Our portfolios include companies driving optimal performance in AI applications by controlling humidity and power to the data centers and by providing global electrical equipment projects for data center management.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk: As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing in the Calamos International Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

024014f

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.