Investment Team Voices Home Page

Investment Team Voices Home Page

Japan, Global AI and an Uneven Covid Reopening

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA, and Kyle Ruge, CFA

The following is an adaptation of our recent commentary, “2H 2023 Global Equity Team Outlook: Japan, Global AI and an Uneven Covid Reopening”.

- We remain optimistic about global equities and maintain a preference for non-US exposure, including emerging markets.

- As the breadth of opportunities expands globally, we see encouraging trends in Japanese equities.

- Asia’s post-pandemic reopening is multispeed, with China’s recovery reflecting bifurcation.

- Reflecting our emphasis on secular growth themes, global beneficiaries of the AI value chain are well represented in our portfolios.

Japan’s resurgence: The “Yamaji Rally,” improving fundamentals, or both?

After an extended period of underperformance, the Japanese equity market has quietly emerged as one of the strongest over the past year. Japan has long been viewed as attractive from a valuation perspective, but we haven’t seen the catalysts that could unlock and sustain this valuation opportunity … until recently.

Catalyst 1: The TSE is influencing capital allocation policies in a shareholder-favorable way. We’re seeing new momentum driven by the Tokyo Stock Exchange (TSE) and its CEO Hiromi Yamaji focused on improving governance, transparency, and ultimately the valuation of Japanese equities. The TSE’s efforts carry significantly more weight and would require companies to delist if they fail to achieve or show meaningful progress toward required capital efficiency targets before March 2026. Our conversations with company management teams indicate that they are responding swiftly. We’re encouraged to be hearing about improved corporate governance, transparency and independent oversight, as well as streamlined reporting structures and business segments, rationalized non-core assets, and increased share buy-backs and progress in capital allocation plans.

Catalyst 2: A shift in business and consumer mindsets amid signs of waning deflation. Japan’s economy also benefits from an improving fundamental outlook. While most countries are concerned with elevated levels of inflation post-Covid, Japan is embracing its newfound inflation. And there’s reason to believe that higher inflation may endure: Wages are increasing in Japan at a more significant rate than we’ve seen in recent history, and women’s workforce participation has reached an all-time high, which is bolstering consumption.

Market reform, reflation, and reopening tailwinds should continue to support better Japanese equity performance in the upcoming years. We hold a combination of high-quality multinationals that we believe are some of the better companies globally but have historically traded at a “Japan-market” discount. We also maintain positions in companies more directly exposed to the post-Covid reopening and to companies whose balance sheets and valuations make them more likely to enjoy a boost from market reforms or reflation.

Asia’s Multispeed Reopening

Covid reopening and the different speeds at which it is occurring around the world are important factors in our outlook for the second half of 2023 and beyond. The US was quick to reopen compared to many parts of Asia, including China. This speed, combined with stimulus checks, resulted in a quick V-shaped consumer spending recovery. Many Asian countries that reopened before China have experienced strong recoveries in consumer spending, especially travel and entertainment. In contrast, China was one of the last countries to end lockdowns, which leaves its recovery a few years behind the US and with negative impacts that will likely take longer to unwind.

There are many reasons that China’s recovery has been uneven and slower than in the US or other parts of Asia. Among them, wealthier individuals who were less affected by lockdowns have returned quickly to spending on luxury goods, travel, and gambling, providing a boost to areas like domestic tourism. However, the average Chinese consumer may take longer to recover from the pandemic given there wasn’t stimulus money to spend when the economy reopened. We believe the Chinese recovery will likely remain bifurcated near term, but consumer spending will recover over time.

Secular opportunities in a global AI value chain

A central component of our process is identifying and investing alongside global secular growth themes. Typically, these themes are found in areas undergoing transformative innovation and disruption, and in some instances, can run for decades. Advancements in artificial intelligence (AI) and large language models (LLM) like ChatGPT are a great example of the evolving and durable nature of a growth theme, in this case intersecting themes like increasing mobility and connectivity, mass digitization and data, and artificial intelligence.

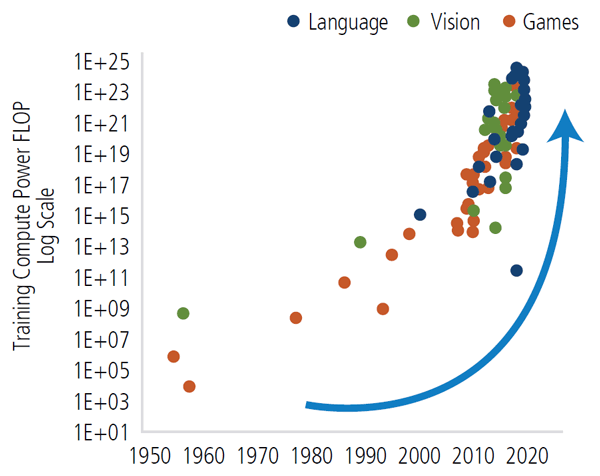

The rise of AI is driving a race to build computing infrastructure to support further advances and mass usage. We are at the early stages of what looks to be a transformational shift, but it stands on the shoulders of advancements in computing power that have been powering a variety of other themes for more than a decade (Figure 1).

Figure 1. AI models require exponentially more computing power

Source: Stanford AI Index, Evercore ISI Research.

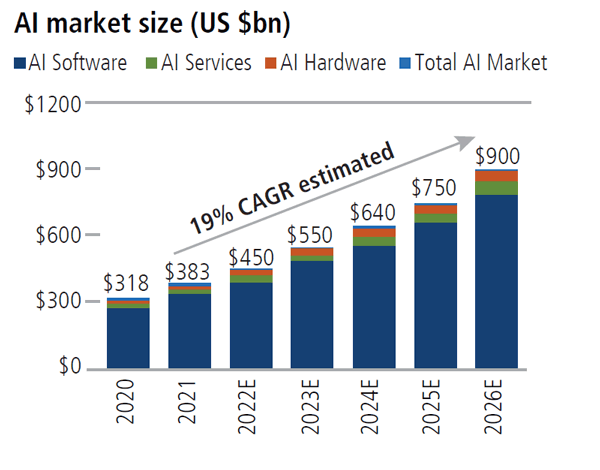

Indeed, the semiconductor industry of the digital age is analogous to the pickaxe and shovel suppliers of the gold rush. And while the world is only beginning to understand the productivity-enhancing potential of generative AI for consumers and businesses, significant capital spending to build the infrastructure to train and use these huge models is already underway (Figure 2).

Figure 2. Global AI market is expected to reach $900 billion by 2026

Source: BofA Global Research, “Me, Myself and AI-Artificial Intelligence Primer,” February 28, 2023

In the near term, we believe the opportunity lies with many of the companies leading computing advancements over the last decade. And that is a truly global group.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk: As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing in the Calamos International Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

Unmanaged index returns assume reinvestment of any and all distributions and do not reflect any fees, expenses or sales charges. Investors cannot invest directly in an index.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

19108 0623

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.