How Fixed Income Alt CMNIX Is Pursuing 3%, 4%, 5% in a Zero-rate World: Pars on CIO Call

Asked for a client-ready explanation of Calamos Market Neutral Income Fund (CMNIX), PM Eli Pars offers this: “I say we’re a trading strategy trying to take advantage of opportunities in the markets with experienced traders who have been trading those strategies for a while…

“And then,” the Calamos Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager continues, “I say look at the fund’s return profile and the outcome. Focus on the result.”

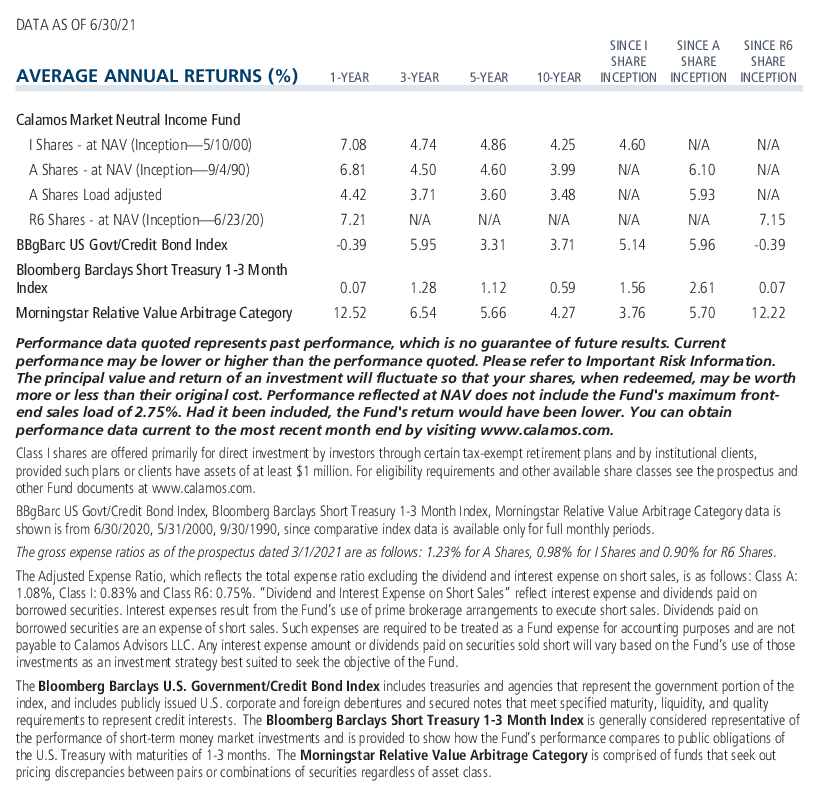

Over the long term, according to Pars, CMNIX “fits really well as a fixed income substitute or replacement to what people used to get from intermediate fixed income in terms of risk and return. The challenge is how to earn 3%, 4%, 5% in a zero-rate world without a lot of rate sensitivity. We’ve generally been able to deliver that most of the time.”

The fund ended July with a 3.00% return year to date. This compared to the -0.67% YTD return of the Barclays U.S. Government/Credit Index and the 1.75% return of its peers in the Morningstar Relative Value Arbitrage Category.

On Tuesday’s kickoff of the Calamos’ CIO Conference Call series for investment professionals (call schedule here), Pars elaborated on the multiple ways his team has found to be opportunistic this year. (To listen to the August 10 call, go to www.calamos.com/CIOmarketneutral-8-10.)

Pleased with the year so far, Pars reported that the fund's core strategies—convertible arbitrage and hedged equity—have been profitable. In a flip from 2020, hedged equity has been the greater contributor to return. He also provided some detail on a new strategy, which is a limited investment in Special Purpose Acquisition Corporations (SPACs).

Convertible Arbitrage Update

Pars characterized the fund’s convertible arb approach as a long volatility strategy. “We run the convertibles unlevered, which has historically made for a very steady, albeit somewhat low return. We’re not saying it’s up every month, but most days, most months we made a little money. It has some nice convexity—bigger moves in the market enabled us to make a little more money.”

Pars said he was surprised by the continued “torrid” pace of the convertible market, with issuance in the first half of the year exceeding 2020 (for more on issuance and performance trends, see the Calamos U.S. Convertible Snapshot). As in last year, many of the issuers were new names.

A healthy calendar is positive for a few reasons, he explained.

“New deals tend to come cheap, providing an attractive valuation arbitrage. But they also tend to stir the pot. Issuance of a convertible bond at par may trigger a long-only investor to rotate out of an in-the-money convertible in the same industry that doesn’t have the convexity profile that they want. That may cheapen up that old convertible to the point where we want to buy that,” he said.

Pars also commented on the fund’s international diversification, representing no more than 15% of the portfolio, in issues from Japan, Europe and southeast Asia (mostly China). Some are ADRs while some trade overnight.

“Europe tends to be a higher credit quality market on average, and there are some quirky structural things in Japan that create lower risk opportunities on the convert arb side,” he said. “It’s a nice part of our book that we hope to grow over time, although it will never be 50% of our book.”

Hedged Equity Update

“In a decent vol environment, we’ve been able to run a conservative, pretty well hedged book,” said Pars.

Pars reviewed the controls with the options trading strategy: “We have guardrails in place to make sure that we don’t overwrite. We don’t want to sell more than 100% notional on the options side. We’re always going to have at least 40% downside put options and we’re always going to have at least a 40 delta theoretical sensitivity to the downside.”

That said, he noted that the team takes a different approach from others. “Unlike some of our peers that are very mechanical and methodical to the point where sometimes you can predict where their next trade is going to be, we like to be more opportunistic and work within those guardrails to take advantage of what the market’s giving us.

“Over the years we think that’s served us well,” Pars continued. “It allows us to take advantage of what’s cheap in the options market at any given time. Just like any other markets, values shift…We come in every day and look at the options book and think about what’s different in the market today and how can we trade it around to optimize performance for our investors.”

SPACs Diversification

Call moderator Robert F. Behan, CFA, Calamos Executive Vice President and Chief Distribution Officer, introduced the diversification into SPACs as the latest example of how the fund has used opportunistic buckets to potentially generate returns over the years.

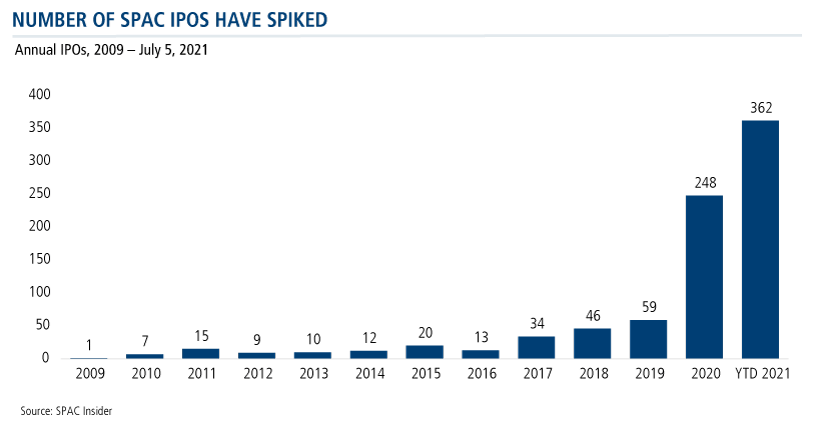

Pars said he and another team member had experience with a previous generation of SPACs 15 years ago. In the last two years, SPAC IPOs have spiked, providing an interesting opportunity for the fund starting in January because they “look a lot like a convert” and share some characteristics, he said.

Here’s how Pars describes the opportunity:

“A typical SPAC goes public with the intent of making an acquisition. They typically come for $10 and that $10 goes into a trust to pay for the acquisition, but the acquisition has to be approved by shareholders and at the time of the acquisition the shareholders have the right to redeem.

“So, I get a free look at whether the market thinks the acquisition is attractive. If there’s no deal at the end of two years, I get the $10 back. What’s interesting is that you also get some fraction—a quarter, a third or a half—of a warrant stapled to it that makes that theoretical value at issuance worth $10.25, $10.50, $10.75, depending on the structure of it. So, we’re buying it at a theoretical discount…

According to Pars, the biggest downside of SPACs to CMNIX is “dead money.” That’s true because of how the team trades them.

“We want to buy at the $10 issue price or less, if we can pick them up at a discount —$9.90 or $9.95, that’s meaningful,” he said. “We’re not the guy holding on for a double or a triple. If they’re up 5% or 10% from where we bought them, we’re trading out of them and trying to trade the book around to generate some profits.”

SPACs are the kind of trade whose risk/return profile fits the fund, Pars said. While it remains to be seen whether they’re a long-term opportunity, they currently represent 4% of the portfolio.

Rising Rates and Morningstar Rating

The call concluded with a Q&A that sought Pars’ view on inflation and rising rates.

The hedged equity strategy doesn’t have much rate exposure, he said, but elaborated on why the convert arb book is also less affected when rates rise.

“The typical convert is issued for a five-year term but because of the embedded equity option it has the rate sensitivity of a three-year bond and, as converts get in the money, the rate sensitivity goes down,” explained Pars. “When you have a book like ours, that’s seasoned, that skews in the money, your rate sensitivity gets low. Our theoretical rate sensitivity is around 1.”

He continued, “The end result of that, when you look at the history and what the fund has done in a rising rate environment, you don’t see a lot of rate sensitivity there. As I like to say, we don’t have a lot of rate risk and we don’t have a lot of rate opportunity. But where the Treasury curve is, I’m not sure anyone has a lot of rate opportunity left.”

The conversation also touched on Morningstar’s reassignment of the fund in April to the new, unrated Relative Value Arbitrage category. The category reassignment followed a 10-year period when CMNIX consistently earned five and four stars while in the now defunct Market Neutral category (see this post).

“Nothing’s changed,” said Behan and Pars. CMNIX “is the same fund, following the same approach.”

“Can’t get too hung up on what the sportswriters are writing about the team,” Pars added.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The S&P 500 Index is generally considered representative of the U.S. stock market.

In the money. A call option’s strike price is below the market price of the underlying asset or that the strike price of a put option is above the market price of the underlying asset. Being in the money does not mean you will profit, it just means the option is worth exercising. This is because the option costs money to buy.

The Bloomberg Barclays U.S. Government/Credit Index comprises long-term government and investment grade corporate debt securities and is generally considered representative of the performance of the broad U.S. bond market. Unlike convertible bonds, U.S. Treasury bills are backed by the full faith and credit of the U.S. government and offer a guarantee as to the timely repayment of principal and interest.

The Morningstar Relative Value Arbitrage Category is comprised of funds that seek out pricing discrepancies between pairs or combinations of securities regardless of asset class.

802475 0821

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on August 11, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.