Investment Team Voices Home Page

Investment Team Voices Home Page

The Case for Emerging Markets Is Strong

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA, and Kyle Ruge, CFA

- We remain optimistic about global risk assets in 2023 and maintain our preference for non-US exposure.

- We see growth opportunities for emerging markets (EMs) supported by a reopening of ASEAN1 economies, and a reorientation of global supply chains (nearshoring and friendshoring).

- There is a fundamental case for relative stability in many high-quality EM banks in countries such as India, Indonesia, Mexico and the Philippines.

The following is an adaptation of our recent commentary, “Global Opportunities: The Case for Emerging Markets is Strong.” (Read the commentary in its entirety here.)

Although unpleasant, the rolling shocks and volatility we are seeing now in global markets are normal at this stage of the cycle, as the excesses that built up when monetary conditions were very easy are now being worked out of the system. Typically, these excesses are within the emerging markets. However, during this tightening cycle, most emerging markets are in a much better position. Below, we highlight three key themes supporting global opportunities, especially in emerging markets.

ASEAN Reopening

In the ASEAN region, we are extremely optimistic about the pent-up demand being released and the economic health of countries that faced years of Covid lockdowns. Still, our analysis (including recent research trips to the region) indicates reopening and revenge spending may be much slower than what occurred in the United States and Europe. Also, there’s a bifurcation of demand in EMs similar to what we saw in developed markets. High-end hotels, shops, and restaurants are full, and company managements are reporting a sharp recovery and steady demand. The rebound has been considerably more muted within segments that rely more on middle-class spending, including air travel. We believe these challenges will be resolved and have invested selectively in the domestic mass-travel recovery. However, we are focusing our near-term efforts on beneficiaries of a high-end outbound travel recovery.

Nearshoring and Friendshoring Provide Growth Tailwinds

We are identifying companies in the manufacturing, capital goods, engineering and construction, transportation, semiconductor, and real estate industries that are positioned to benefit from nearshoring and friendshoring.2

Although both trends were in place before 2020, global supply chain disruptions caused by Covid and the war in Ukraine have materially accelerated these trends across regions and industries. In North America, the United States is aggressively building semiconductor capacity and multiple auto companies are establishing or expanding capacity in Mexico, providing tailwinds for many capital goods and technology companies and economic support for Mexico overall. In Asia, India’s Make in India initiative continues to drive increased local manufacturing of products consumed in India while positioning India to become a larger manufacturing hub for Asia. Other ASEAN countries, such as Vietnam, should benefit as companies diversify manufacturing capacity.

Emerging Market Bank Stocks Have Demonstrated Resilience

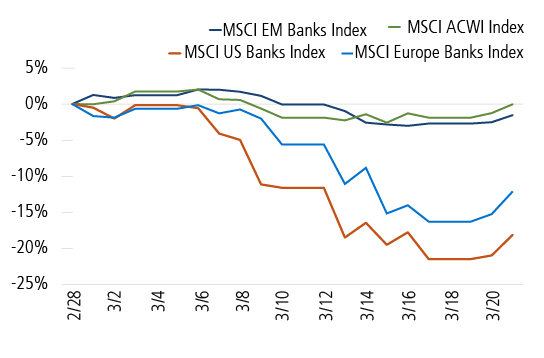

What’s interesting about the recent spate of banking failures is the extent to which US banks have been disproportionately hurt. The conventional perception post-GFC has been that US banks were the safest globally, but year-to-date share price performance conflicts with this view. Indeed, the EM banks have held up best globally, and this is not entirely surprising on a fundamental level.

EM bank stocks have held up better than those in Europe and the United States

Increasing consumer wealth and access to financial services and products are powerful—but relatively early-stage—growth themes across many emerging economies. Consequently, local savers have fewer alternatives for deploying and redeploying savings. On the liability side, term deposits (e.g., certificates of deposit) tend to represent a much higher percentage of funding for banks in developing economies. As a result, the deposit betas in emerging markets are comparatively lower than in developed markets. On the asset side, EM banks tend to be more “vanilla.” Loans as a percentage of deposits tend to be much higher than for developed market banks, so mark-to-market losses and resulting capital adequacy issues may be less of an issue.

Of course, underwriting standards and loan quality matter, but the highest quality banks in countries such as India, Indonesia, Mexico and the Philippines have demonstrated strength in this regard. Put it together, and there is a fundamental case for relative stability in many of these EM banks. Clearly, these banks are in economies that are still vulnerable to global shocks and would not be immune to severe recessions in the United States or Europe. However, we believe there is good reason to be more optimistic about EMs. If we look back at financial crises across EMs over the past 30 years, three important points emerge:

- EM financial crises tend to be preceded by periods of large capital inflows, and particularly portfolio inflows, into EMs. We have not seen such inflows over the past several years.

- A US dollar liquidity squeeze has been the catalyst for capital flight. We have seen the US dollar weaken since the third quarter of 2022.

- China, a significant end market for many of these emerging economies, is in the process of reopening after years of zero-Covid-policy lockdowns and is easing monetary conditions.

Conditions can change, and the US dollar will be a critical signpost to monitor, but at this point we aren’t seeing the types of conditions that preceded previous periods of economic and financial weakness in EMs. Against this backdrop, EM banks versus developed market banks look like a microcosm of the broader positive case for higher exposure to EMs.

1ASEAN: Association of Southeast Asian Nations, including Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

2Nearshoring refers to the reorientation of supply chains by companies seeking to move production closer to the customer and diversify their dependence on concentrated regions of production. Although there is often overlap with nearshoring, friendshoring refers to moving production to a country with a favorable relationship to diversify production. This new location may not be geographically close to the customer as it is with nearshoring.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk: As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing in the Calamos International Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

Unmanaged index returns assume reinvestment of any and all distributions and do not reflect any fees, expenses or sales charges. Investors cannot invest directly in an index.

MSCI Emerging Markets Index is a free float adjusted market capitalization index. It includes market indexes of Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. The MSCI ACWI Index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets and emerging markets. The MSCI EM Banks, MSCI Europe Banks Index, and MSCI US Banks Index measure the performance of banking stocks within emerging markets, Europe and the United States, respectively.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.