Investment Team Voices Home Page

Investment Team Voices Home Page

Headwinds to Tailwinds: An Improved Horizon for Overseas Markets

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA, and Kyle Ruge, CFA

Summary Points:

- We continue to see the balance of headwinds versus tailwinds shifting toward a weak-dollar bias.

- On a relative basis, overseas economies are offering more attractive growth prospects than the United States.

- We are optimistic about the investment environments in many developing economies, where we see attractive valuations, improving economic backdrops and domestic economic policy environments that encourage capital to go where it will be treated well.

Currency Headwinds Become Tailwinds for Overseas Markets

The opportunities for non-US equities are growing. Our constructive case reflects a variety of factors, including abating currency headwinds. Overseas markets have typically experienced their strongest relative performance during periods of US dollar weakness (for example in late 2022), more mixed performance during periods of consolidation (as in 2023), and underperformance during periods of dollar strength.

We continue to believe we are in the early innings of a multi-year weak dollar cycle. Valuations continue to favor foreign currencies on the basis of purchasing power parity and real effective interest rates, and the dollar remains one of the most expensive currencies on the planet.

Of course, valuation is just one component of an investment thesis and things can remain expensive for a prolonged period. Relative real yields have supported the US dollar as global investors have favored the higher relative returns and perceived safety of US Treasuries. But this may be changing. Over the past year, several Asian countries have reduced US Treasury purchases, and there are reports that at least one European central bank has diversified its balance sheet into US equities in recent years. As it becomes clearer that the US dollar is entering a weakening cycle, its perceived status as a preeminent safe haven will likely be increasingly questioned.

One of the more significant factors influencing the near-term dollar outlook is the relative economic growth prospects for the US versus overseas markets. Although the US consumer remains resilient, the fiscal support provided during the Covid crisis is waning, inflation remains sticky, interest-rate costs have increased, and year-over-year growth comparables for companies have become more challenging.

In contrast, many overseas economies are still in the earlier stages of their reopening cycles. Friendshoring initiatives support new capital expenditure cycles, and local housing markets benefit from increased demand driven by changing consumer preferences, supply deficits, and improving living standards.

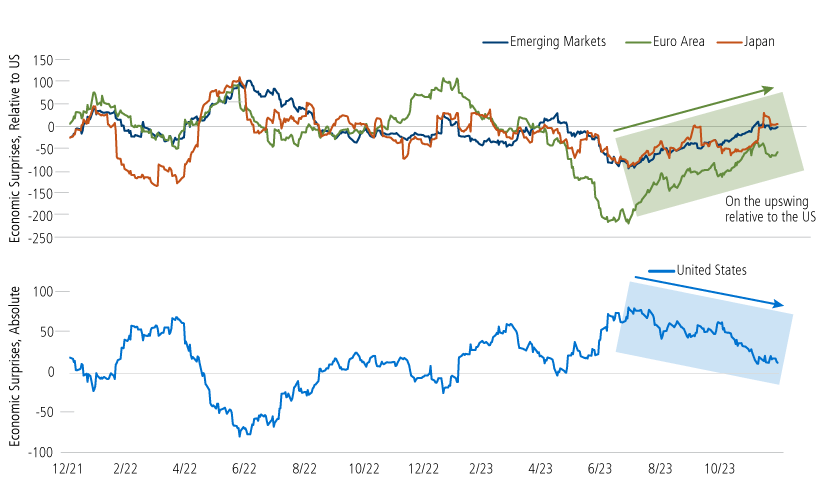

The chart below illustrates how relative growth indicators are beginning to inflect in favor of overseas markets. As growth differentials tip in favor of overseas markets, we anticipate improved capital flows into these markets and a natural bid for their currencies.

US Versus Overseas Markets: Signs of an Inflection in Economic Growth

Source: Macrobond.

Additionally, different monetary policy stances may contribute to a weakening dollar. The Federal Reserve has a dual mandate of price stability and maximum sustainable employment, and it may have most recently signaled that the risks between price stability and employment are now more balanced, increasing the probability of rate cuts on any signs of weakening growth. In contrast, the European Central Bank’s mandate is solely price stability, so it may have more flexibility to hold rates and watch for inflation to recede while Europe’s growth picture gets less bad. Meanwhile, the Bank of Japan may be on the verge of abandoning the negative interest rate policies in place since 2016.

Economic Reforms Provide Another Pillar to Support Emerging Market Opportunity

We’ve often cited valuations and improving macroeconomic backdrops as factors supporting the case for emerging markets, but they certainly aren’t the only ones. We’re also optimistic about the domestic economic policy environments in several countries, which we believe set the stage for healthy growth and development. The adage that “capital goes to where it is treated best” can provide a north star for us as we consider which countries offer the best investment conditions. Some of the most important determinants of where capital goes include ease of doing business and attracting foreign direct investment (FDI), deep or deepening financial services industries and capital markets, low taxes, fiscal soundness, monetary discipline, and strong private property rights.

Some of the most developed markets forget these guiding principles from time to time. In fact, we believe that several developing economies are among those setting the best examples, including the following:

- India. India’s favorable demographics and highly educated population are key drivers for achieving world-leading economic growth. Also important are economic policies introduced over the past decade, including tax simplification, bankruptcy code reforms, improved access to banking and other financial services, and FDI liberalization.

-

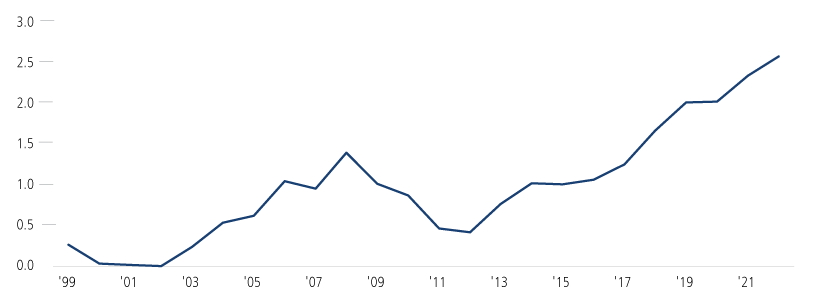

Greece. A poster child for economic policy dysfunction in the 2000s, Greece has restored fiscal and financial stability and improved competitiveness through tax and pension reforms, bank recapitalizations, and key labor market and product market reforms that have eased business conditions. As a result, the country has made great progress toward restoring economic health, which has been rewarded with higher FDI.

Greece: Foreign Direct Investment Is on the Rise in the Wake of Economic Reforms

World Bank Greece FDI inflows as a % of GDP, 3-year moving average

Source: Macrobond.

- Indonesia Like India, Indonesia has attractive demographics and some of the strongest economic growth globally. Encouraging economic reforms of the past decade include tax simplification, compliance incentives, and policies to ease business conditions, promote trade, and protect property rights.

- Argentina. Argentina and the policy proposals of newly elected President Javier Milei offer the most recent case study in reforming a broken economy. His “radical” ideas to restore economic stability and prosperity include fiscal discipline, monetary policy stability, deregulation, privatization of state-run industries, and reduced trade barriers. Milton Friedman would have been hard pressed to prescribe more capital-friendly policy objectives. Argentina has a long way to go, but the policy direction can help unlock this country’s tremendous potential.

Emerging Markets Opportunity Spotlight: Real Estate

This past year, we identified investment opportunities in India and Mexico real estate that benefited from underlying secular and cyclical tailwinds. We see continued upside as the global rate environment should be more hospitable, and secular and cyclical tailwinds persist.

India. India’s residential real estate market benefits from strong underlying secular tailwinds and economic growth trends. Rising incomes, increased urbanization and declining household sizes are all fueling increased demand. The cycle bottomed out over the past few years with the lowest inventories in over a decade and the greatest affordability in two decades. As in other markets around the world, Covid was a catalyst that sparked what we believe will be a multiyear upcycle in the residential real estate market. In addition to the strong underlying tailwinds, policy and regulatory reforms and tighter financing conditions are driving a consolidation wave that is boosting the large, listed developers whose share of the organized residential development market has increased significantly over the past five years.

Mexico. Given its proximity to the US, competitive labor costs and specialized manufacturing, Mexico has been a clear beneficiary of a nearshoring trend that has been supercharged in recent years by increased tensions between China and the West. The ramp-up in nearshoring has created new opportunities for the real estate market, with occupancy and rent levels rising to historically high levels near the US border. With China still accounting for approximately 18% of $4 trillion-plus in annual US imports, we believe the secular shift in demand for industrial property in Mexico is still in a relatively early stage. In addition, the larger listed developers are well positioned to gain share in a highly fragmented market where most local and private developers lack the scale, capital or expertise to satisfy the demand ramp-up.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk: As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing in the Calamos International Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

024001l 0124

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.