Investment Team Voices Home Page

Investment Team Voices Home Page

Global Investment Themes Spotlight, 3Q 2023

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA, and Kyle Ruge, CFA

The following is an adaptation of our recent commentary, “3Q 2023 Global Investment Theme Spotlight: India, obesity treatments, Chinese electrical vehicles and energy” (Read the commentary in its entirety here).

Our investment process marries bottom-up fundamental analysis with the identification of top-down considerations. Here, we highlight four themes represented in our portfolios:

- In India, pro-growth policies are bearing fruit on the vine of the country’s long-term growth story, with stocks across sectors benefitting.

- Demand for obesity treatments creates growth opportunities not only for biopharmaceuticals but also for companies solving supply chain challenges.

- Supported by policy tailwinds, China continues to extend its global leadership in electric vehicles.

- In the energy sector, favorable supply/demand trends support our positive but selective outlook.

Theme 1: India’s Pro-Growth Policies

We believe India’s growth story has plenty of runway ahead. Many reforms have taken root and are bearing fruit, and the execution of additional pro-growth policies pushes on. All of this comes as India establishes itself as a regional manufacturing hub through its “Make in India” program, Production Linked Incentive scheme, and friendshoring, while leveraging its massive lower-cost workforce and strengthening its consumer base. These forces are coming together to drive capex and housing upcycles. Job and wage growth remain robust across the country, consumer balance sheets have been bolstered post-Covid, and corporate balance sheets are in stronger shape after a multiyear deleveraging cycle.

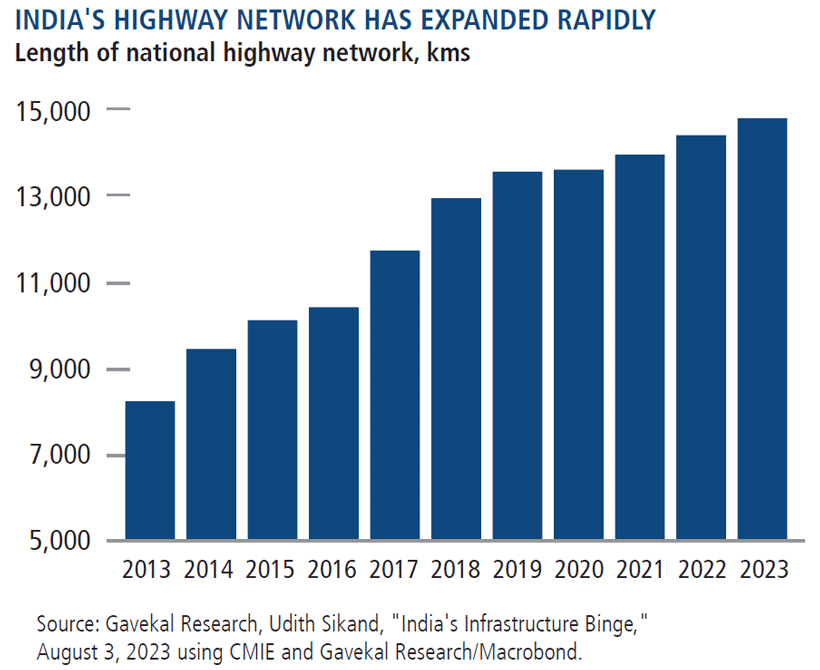

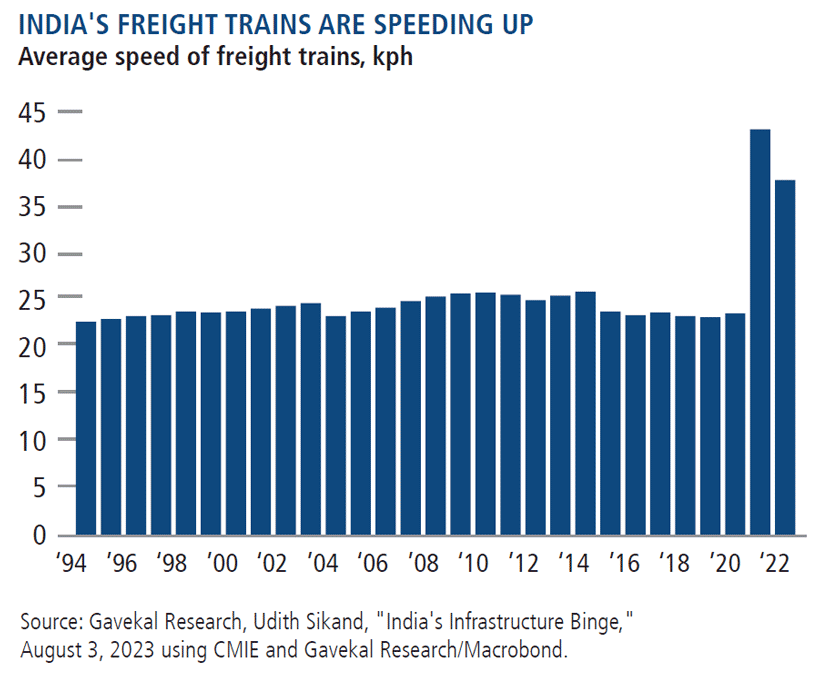

The Indian government has implemented a range of strategies to enhance the country’s logistics capabilities (including the expansion of highways and faster freight trains), thereby raising overall economic productivity and expanding India’s importance in global trade. Pro-growth policies are taking hold in private markets as well, with the size of total private project announcements reaching a new decade high.

Although energy prices and equity valuations both add some risk of near-term volatility to India’s equity market, we believe there is abundant opportunity that will only increase in the medium and long term, supported by a confluence of growth in the manufacturing and consumer sides of the economy. Over the past quarter, we’ve increased positions in India’s electronics manufacturing, railways, transport, autos, online travel, food delivery, and jewelry industries.

Theme 2: Obesity Treatments

Over the past three years, a key biopharmaceutical breakthrough has paved the way for safe, convenient, and effective treatments for obesity. The potential benefits of these drugs may be far broader than weight loss. This summer, a leading biopharmaceutical company reported that its top weight loss drug also reduces major adverse cardiovascular events, such as heart attack, stroke, and cardiovascular death by 20%. Although yet unproven, there also are hopes that these drugs could also treat other diseases, such as Alzheimer’s disease.

Disruption on this scale creates both opportunities and risks, and we are vigilant to both. One way we are participating in the opportunity is through investments in leading biotechnical firms. But we’re also looking into other niches. Demand has been so strong for these drugs that manufacturers have been unable to keep up, leading to significant shortages. Businesses that are alleviating these pressures have a real edge. We maintain positions in companies addressing supply chain bottlenecks, such as those making vials and autoinjectors that contain and deliver weight loss medicine.

Theme 3: China’s Electric Vehicle Ecosystem

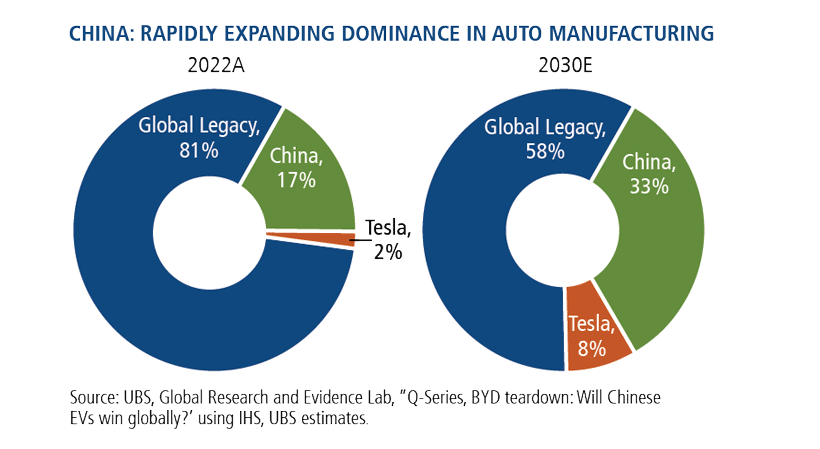

Chinese auto manufacturers are becoming more competitive not only in China but also globally. China already leads the world in electric vehicle (EV) adoption. Chinese companies are at the forefront of EV innovation, with the lowest-cost battery production at the largest scale and are also making significant strides in areas such as autonomous driving, rapid charging, and battery swapping.

We see continued growth potential in China’s electric vehicle ecosystem, with domestic demand supported by tax incentives and China’s slow economic recovery. Chinese EV manufacturers are enjoying tailwinds as local consumers increasingly favor domestic vehicles. Our portfolios have exposure to China EV manufacturers we believe can not only be successful in China but in other parts of the world.

Theme 4: Energy

Global oil demand is likely to remain resilient, with a variety of factors keeping prices high. When energy prices spiked in 2022, the US government released excess inventory from the Strategic Petroleum Reserve (SPR) to help balance the market. The SPR is now at its lowest level since the mid-1980s, so a move by the US to release more oil to offset the recent price spike wouldn’t have the same impact. Additionally, in response to the weaker oil prices seen in the first half of 2023, OPEC+ has reduced its oil output in recent months, causing upward pressure on prices as demand has outpaced supply. Looking further out to the medium term, we are unlikely to see a major rush of new supply coming to market to meet future demand, given underinvestment in oil-and-gas capital expenditures over the past decade.

The flipside of this capital discipline is improved balance sheet health and shareholder returns. We continue to view the sector positively and favor exposure to integrated oil and gas and exploration-and-production companies with direct exposure to underlying commodity price strength. Our portfolios also own equipment and service contractors that stand to benefit from strong activity growth in international and offshore markets.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk: As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing in the Calamos International Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The MSCI India Index is designed to measure the performance of the large and mid-cap segments of the Indian market. The index covers approximately 85% of the Indian equity universe.

Unmanaged index returns assume reinvestment of any and all distributions and do not reflect any fees, expenses or sales charges. Investors cannot invest directly in an index.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

822200 1023

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.