Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Investment Team Outlooks, October 2023

Introduction from John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

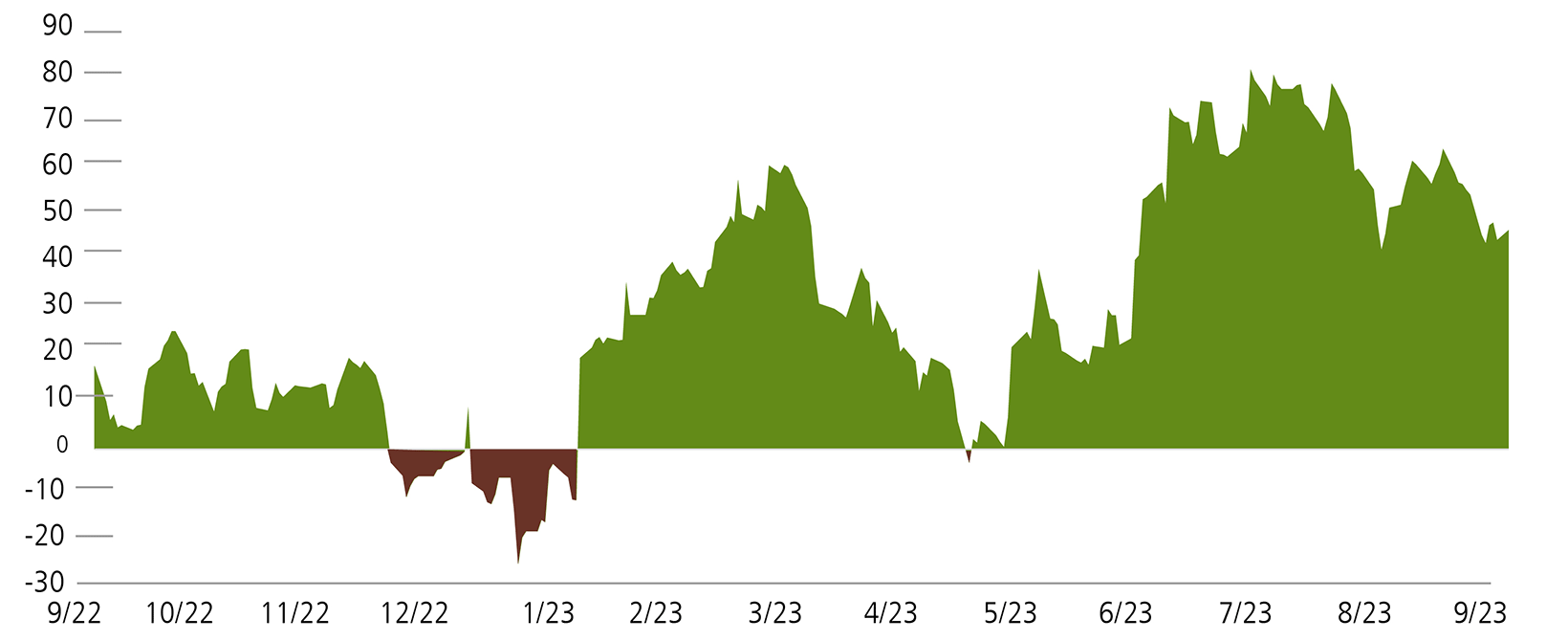

As the third quarter began, markets reflected investors’ upbeat mood, but this positive sentiment fizzled as the quarter wore on. Despite a steady stream of economic data continuing to surprise on the upside (Figure 1), investors became increasingly unsettled as they looked forward. Rising energy prices and rekindled inflation fears led to a ramp up in 10-year Treasury yields and deepened concerns about the sustainability of corporate earnings, the health of the consumer and economic growth overall. And although the Federal Reserve paused its rate tightening in September, the decision provided little comfort to markets as the central bank dashed hopes of imminent rate cuts by reinforcing prior guidance that rates would be higher for longer.

Figure 1. US economic data continued to surprise to the upside

Past performance is no guarantee of future results. Source: Bloomberg.

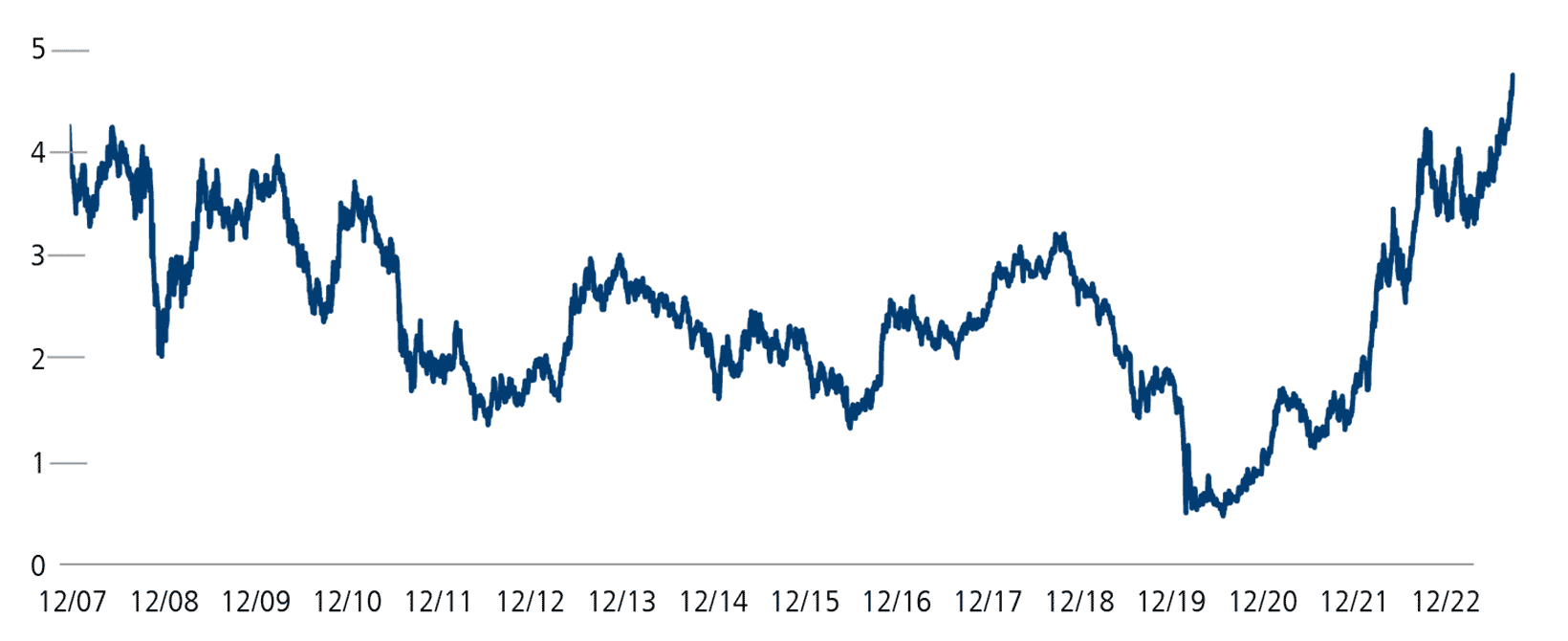

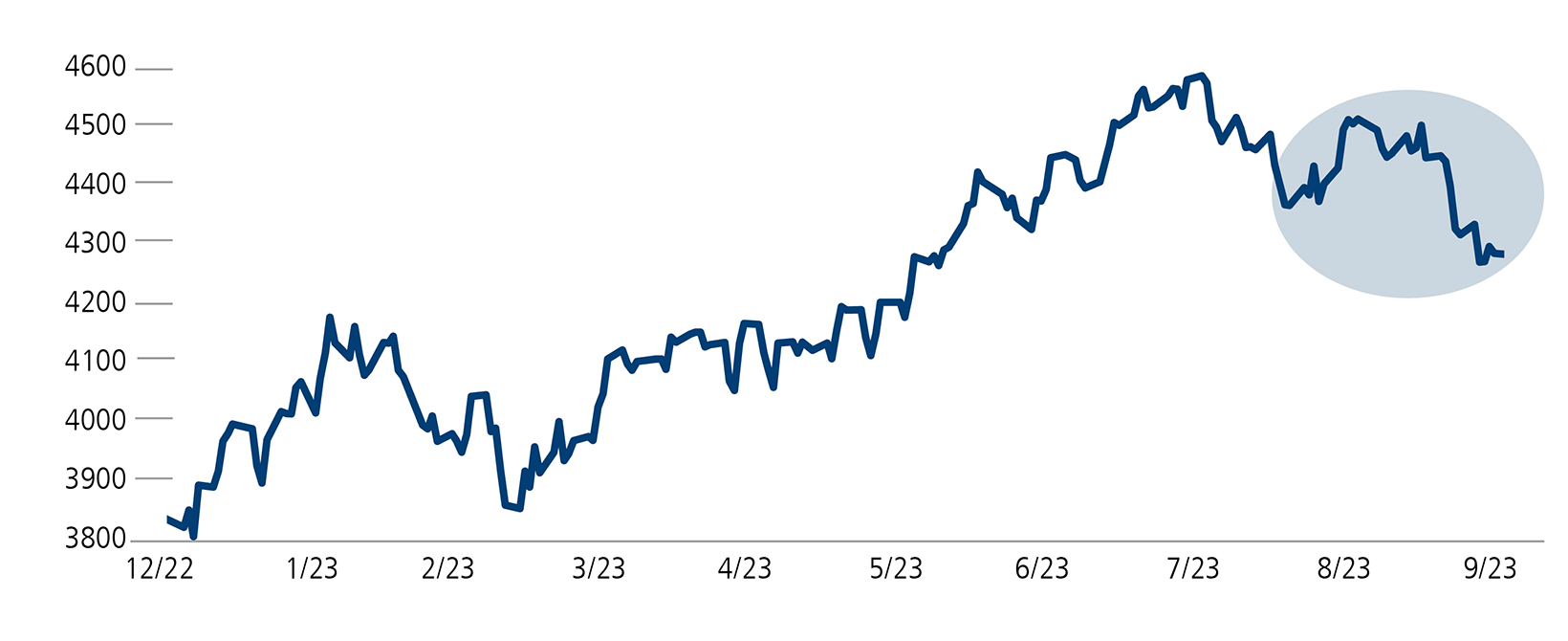

Higher interest rates are problematic for equities for a variety of reasons—higher rates ultimately lead to increased borrowing costs for companies and individual borrowers alike, which may create economic headwinds and crimp overall consumer and business spending. We have seen that equity valuations are also intricately linked to the long end of the yield curve and will, over long periods of time, generally fall as rates rise, and vice versa. Accordingly, as long-term Treasury yields have spiked to levels that we haven’t seen since before the Great Financial Crisis of 2008 (Figure 2), equities have come under renewed pressure (Figure 3).

Figure 2: Long-term yields have spiked to levels not seen in years

Past performance is no guarantee of future results. Source: Bloomberg.

Figure 3. Stocks have fallen as investors digest the impact of a higher interest-rate environment

Past performance is no guarantee of future results. Source: Bloomberg.

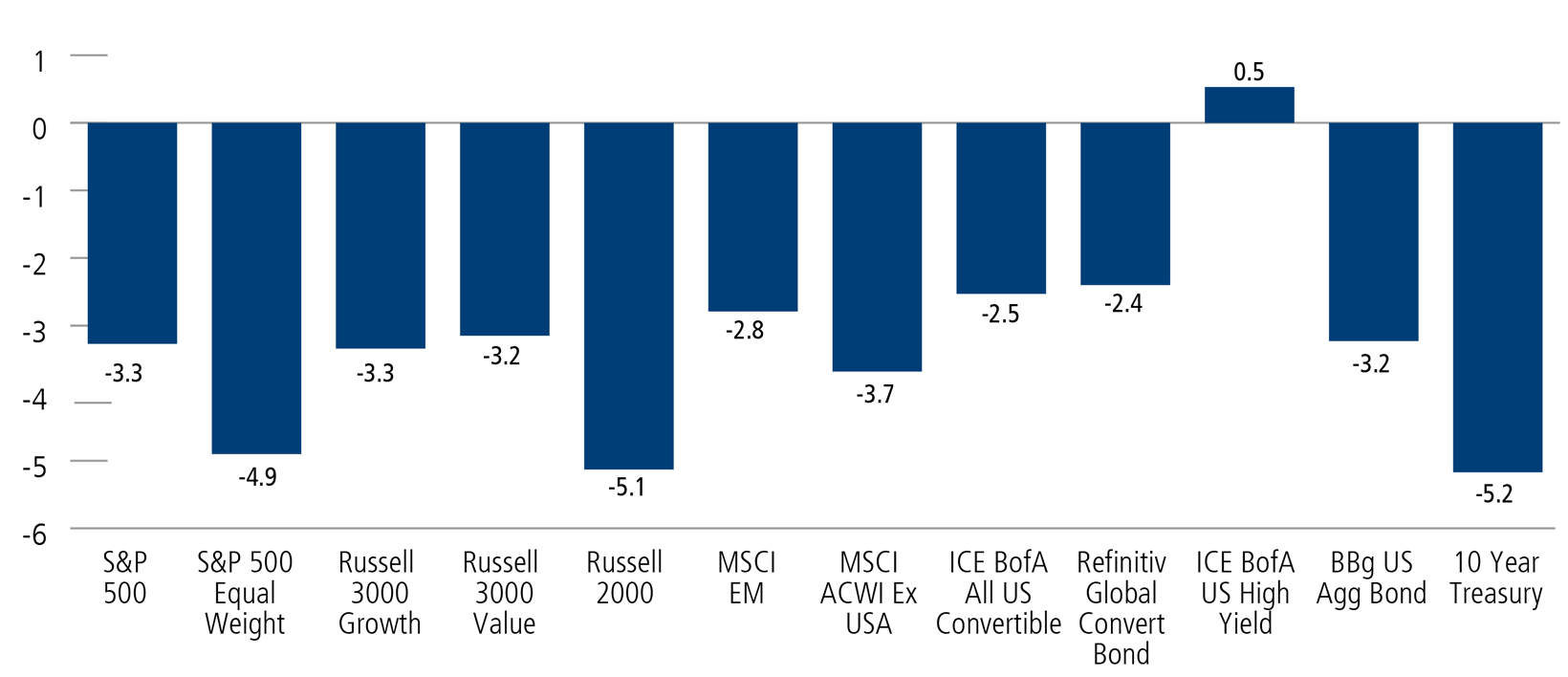

Reflecting this deteriorating sentiment, stocks and traditional bonds ended up in the red for the quarter, and to a remarkably similar degree (Figure 4). The high yield was the only major asset class to inch into positive territory, and small caps fared worse. In recent commentaries, we’ve discussed the wide performance differential between the market-cap weighted S&P 500 Index, which was propelled by the performance of a narrow pool of mega-cap technology-oriented names, and the S&P 500 Equal Weighted Index, which fared much worse. During the third quarter, the gap between the two narrowed and both fell into negative territory as investors worried about the impact of higher rates on growth-oriented companies, including technology.

Figure 4. For the quarter, global asset class performance was consistently lackluster

Past performance is no guarantee of future results. Source: Morningstar. Data as of 9/30/23.

Perspectives on Asset Allocation

When global financial markets decline broadly as they did in the third quarter, investors may be tempted to retreat to the sidelines. However, jumping in and out of the market is a dangerous strategy—investors tend to capture the downturns and miss the upturns. Instead, a far better course is to focus on establishing a well-diversified asset allocation that aligns with your needs and risk tolerance. Your asset allocation should be determined by your holding period—for example, the considerations are different if your holding period is six months or six years, and investors make a mistake just focusing on returns. Rather, we believe investors should seek to be well compensated for the risks they undertake.

In many cases, alternative investments can help investors optimize their asset allocations and provide an additional ballast during volatile markets. Calamos Phineus Long/Short Fund and Calamos Hedged Equity Fund, for example, are designed to complement traditional stock funds. Calamos Market Neutral Income Fund, our flagship alternative, and Calamos Aksia Alternative Credit and Income Fund, our private credit offering, provide ways to enhance a fixed income allocation, including in environments such as these when traditional bonds come under pressure. Finally, many investors may be well served by expanding their portfolios to include active ETFs.

There are Opportunities in Every Environment—Even Challenging Ones

Markets are forward looking, as are our teams. We see many signs pointing to slower growth and increasing risks across sectors. Global manufacturing data is trending down, and rising fuel prices are putting significant pressure on a wide variety of companies and many households. Meanwhile, retailers will likely struggle as the nest eggs that consumers amassed during the pandemic dwindle and student loan repayments start again. Fiscal policy uncertainty, already elevated (as we saw once again with this latest round of debt ceiling negotiations), will no doubt intensify as the US presidential election approaches. Against this backdrop, we expect sideways moving markets, rotation, and short-term volatility to continue.

Nevertheless, there are opportunities in all markets. We continue to see companies innovate and disrupt the status quo, creating entire new ecosystems of opportunity, from AI to biotech. It’s important to not get caught up in the emotion—either to the upside or the downside—because ultimately, we believe fundamentals will win out. Against this backdrop, our teams continue to focus on individual security selection, the identification of key growth themes, rigorous research, and multi-faceted risk management.

As you’ll read in the posts below, our teams are finding a breadth of investment potential across the global markets. They share their outlooks on the economy and markets, where they are finding opportunities, and how they are managing risks for the benefit of our shareholders.

2023: Now For the Harder Part

Calamos Phineus Long/Short Fund (CPLIX)

Michael Grant

CMNIX: Continued Strength as Bonds Tumble

Calamos Market Neutral Income Fund (CMNIX)

Eli Pars, CFA

When Textbook Asset Allocation Falls Short, CIHEX Uses Higher Rates to Earn Extra Credit

Calamos Hedged Equity Fund (CIHEX)

Eli Pars, CFA

Harnessing Convertible Opportunity: Bottom-Up Selection and Growth Themes Guide the Way

Calamos Convertible Fund (CICVX)

Jon Vacko, CFA and Joe Wysocki, CFA

Ready for Market Upticks and Potential Pullbacks

Calamos Global Convertible Fund (CXGCX)

Eli Pars, CFA

Finding Opportunities in a More Muted Growth Environment

Calamos Growth and Income Fund (CGIIX)

John Hillenbrand, CPA

Quality Growth Holds Its Appeal as Economic Pressures Mount

Calamos Growth Fund (CGRIX)

Matt Freud, CFA, and Michael Kassab, CFA

A Market Focused on Growth Fundamentals: Early Innings for Our Investment Style

Calamos Timpani Small Cap Growth Fund (CTSIX), Calamos Timpani SMID Growth Fund (CTIGX)

Brandon Nelson, CFA

Global Investment Themes Spotlight, 3Q 2023

Calamos Global and International Suite (CNWIX, CGCIX, CIGEX, CIGIX, CSGIX)

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA and Kyle Ruge, CFA

Higher-Quality Companies for a “Higher-for-Longer” Rate Environment

Calamos Antetokounmpo Sustainable Equities Fund (SROIX)

Jim Madden, CFA, Tony Tursich, CFA and Beth Williamson

Braking (and Not Breaking) the Economy

Fixed Income Suite (CIHYX, CTRIX, CSTIX)

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk (all funds excluding Calamos Hedged Equity Fund, Calamos Total Return Bond Fund, and Calamos Growth and Income Fund): As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk—the Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment advisor to predict pertinent market movements, which cannot be assured.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

The principal risks of investing in the Calamos Convertible Fund include a potential decline in the value of convertible securities during periods of rising interest rates and the possibility of the borrower missing payments. The credit standing of the issuer and other factors may also affect a convertible security’s investment value. Synthetic convertible instruments may fluctuate and perform inconsistently with an actual convertible security, and components of a synthetic convertible can expire worthless. The Fund may also be subject to foreign securities risk, equity securities risk, credit risk, high yield risk, portfolio selection risk and liquidity risk.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

The principal risks of investing in the- Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small and mid capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, mid-sized company risk, foreign securities risk and portfolio selection risk.

The principal risks of investing in the Calamos Growth and Income Fund include the potential for convertible securities to decline in value during periods of rising interest rates and the possibility of the borrower missing payments; synthetic convertible instruments risks include fluctuations inconsistent with a convertible security and components expiring worthless. Others include equity securities risk, growth stock risk, small and midsize company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk, and portfolio selection risk.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing in the Calamos International Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, US Government security risk, foreign securities risk, non-US Government obligation risk and portfolio selection risk.

The principal risks of investing in the Calamos Antetokounmpo Sustainable Equities Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, large-capitalization stocks as a group could fall out of favor with the market, small and mid-sized company risk, sector risk, portfolio turnover risk, and portfolio selection risk.

The Fund’s ESG policy could cause it to perform differently compared to similar funds that do not have such a policy. The application of the social and environmental standards of Calamos Advisors may affect the Fund’s exposure to certain issuers, industries, sectors, and factors that may impact the relative financial performance of the Fund-positively or negatively-depending on whether such investments are in or out of favor.

Calamos Antetokounmpo Asset Management LLC (“CGAM”), an investment adviser registered with the SEC under the Investment Advisers Act of 1940, serves as the Fund’s adviser (“Adviser”). CGAM is jointly owned by Calamos Advisors LLC and Original C Fund, LLC, an entity whose voting rights are wholly owned by Original PE, LLC which, in turn, is wholly owned by Giannis Sina Ugo Antetokounmpo.

Mr. Antetokounmpo serves on the Adviser’s Board of Directors and has indirect control of half of the Adviser’s Board.

Mr. Antetokounmpo is not a portfolio manager of the Fund and will not be involved in the day-to-day management of the Fund’s investments, and neither Original C nor Mr. Antetokounmpo shall provide any “investment advice” to the Fund. Mr. Antetokounmpo provided input in selecting the initial strategy for the Fund.

Mr. Antetokounmpo will be involved with marketing efforts on behalf of the Adviser.

If Mr. Antetokounmpo is no longer involved with the Fund or the Adviser then “Antetokounmpo” will be removed from the name of the Fund and the Adviser. Further, shareholders would be notified of any change in the name of the Fund or its strategy.

Important Information: Calamos Aksia Alternative Credit and Income Fund

The Fund has been organized as a closed-end management investment company. Closed-end funds differ from open-end management investment companies (commonly known as mutual funds) because investors in a closed-end fund do not have the right to redeem their shares on a daily basis. Unlike most closed-end funds, which typically list their shares on a securities exchange, the Fund does not currently intend to list the shares for trading on any securities exchange, and the Fund does not expect any secondary market to develop for the shares in the foreseeable future. Therefore, an investment in the Fund, unlike an investment in a typical closed-end fund, is not a liquid investment.

Risk Factors: General Economic Conditions and Recent Events. Difficult global credit market conditions may adversely affected the market values of equity, fixed-income, hard assets, and other securities and these circumstances may continue or even deteriorate further. Investments made by the Fund are expected to be sensitive to the performance of the overall economy.

Lending. The value of the Fund's assets is volatile and may fluctuate due to a variety of factors that are inherently difficult to predict and a re outside the control of the Advisor and Sub-Advisors, including prevailing credit spreads, general economic conditions, financial market conditions, domestic or international economic or political events, developments or trends in any particular industry, changes in interest rates, or the financial condition of the obligors of the Fund's assets.

Direct Origination. A significant portion of the Fund's investments may be originated. The results of the Fund's operations depend on several factors, including the availability of opportunities for the origination or acquisition of target investments, the level and volatility of interest rates, the availability of adequate short and long-term financing, conditions in the financial markets and economic conditions.

Loans. Loan interests generally are subject to restrictions on transfer, and the Fund may be unable to sell loan interests at a time when it may otherwise be desirable to do so or may be able to sell them only at prices that are less than what the Fund regards as their fair market value.

Secured Debt. Secured debt in most circumstances is fully collateralized by assets of the borrower. However, there is a risk that the collateral securing the Fund's loans may decrease in value over time, may be difficult to sell in a timely manner, may be difficult to appraise, and may fluctuate in value based upon the success of the business and market conditions, including as a result of the inability of the borrower to raise additional capital.

High Yield, Low-Rated or Unrated Securities. Debt securities (including bonds) and preferred stock in which the Fund invests may or may not be rated by credit rating agencies. The values of lower-rated securities (including unrated securities of comparable quality) fluctuate more than those of higher-rated securities because investors generally believe that there are greater risks associated with them.

Unsecured Loans. The Fund may make unsecured loans to borrowers, meaning that such loans will not benefit from any interest in collateral of such borrowers. Liens on such a borrower's collateral, if any, will secure the borrower's obligations under its outstanding secured debt and may secure certain future debt that is permitted to be incurred by the borrower under its secured loan agreements. The holders of obligations secured by such liens will generally control the liquidation of, and be entitled to receive proceeds from, any realization of such collateral to repay their obligations in full before the Fund.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The US Dollar Index measures the value of the US dollar relative to a basket of foreign currencies, including Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden. The S&P 500 Index is considered generally representative of the US equity market and is market cap weighted. The MSCI All Country World Index represents the performance of global equities. The MSCI All Country World ex USA Index represents the performance of global equities, excluding the US. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA US High Yield Index is an unmanaged index of US high yield debt securities. The ICE BofA All US Convertible Index (VXA0) is a measure of the US convertible market. The Refinitiv Global Convertible Bond Index measures the performance of the global convertible market. Oil is represented by current pipeline export quality Brent blend. The Bloomberg US Aggregate Bond Index is a broad based benchmarks of the US investment grade and global investment grade bond market, respectively. They include Treasury, government related, corporate and securitized fixed-rate bonds. The Russell 2000 Index is a measure of US small cap performance. The Russell 1000 Index is a measure of US large cap performance. The Russell 3000 Index measures the performance of 3,000 publicly held US companies based on total market capitalization, which represents approximately 98% of the investable US equity market. The Russell 3000 Growth Index is representative of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Value Index is representative of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. The MSCI Japan Index is designed to measure the performance of the large and mid cap segments of the Japanese market. The Citigroup Economic Surprise Index measures economic data versus expectations.

ICE Data: Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an `as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.