Investment Team Voices Home Page

Investment Team Voices Home Page

CMNIX: Continued Strength as Bonds Tumble

Eli Pars, CFA

Summary

- During the quarter, rising interest rates delivered a blow to traditional bonds, with the Bloomberg US Aggregate Bond Index declining -3.2%.

- CMNIX posted a gain for the quarter, demonstrating the benefits of not being at the mercy of interest rate moves.

- We see an attractive opportunity set for convertible arbitrage continuing, supported by rising overnight interest rates and increased convertible issuance, while the Fund’s hedged equity component continued to benefit from higher interest rates.

- CMNIX maintains a 40% notional value of net long puts, which we believe will provide ample income opportunities without taking on an undue amount of residual equity risk—consistent with the fund’s investment mandate.

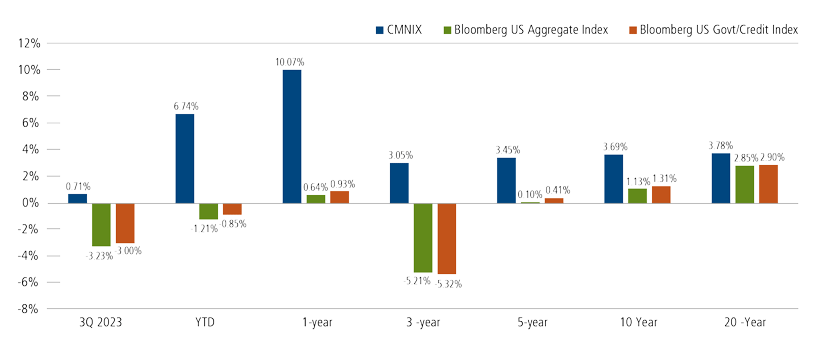

A History of Outperformance Versus Traditional Fixed Income

Calamos Market Neutral Income Fund (CMNIX) is designed to enhance a traditional fixed income allocation. The fund combines two complementary strategies—arbitrage and hedged equity—to pursue absolute returns and income that is not dependent on the level of interest rates. This approach has proven effective over the long term (as seen in Figure 1 below) but also through periods of extreme change in the markets (For more, see our post “Consistency Through Uncharted Waters.”)

Figure 1. CMNIX has outperformed bonds over the short term and long term

Source: Morningstar

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Please refer to Important Risk Information. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund's maximum front-end sales load of 2.75%. Had it been included, the Fund's return would have been lower. All performance shown assumes reinvestment of dividends and capital gains distributions. The fund’s gross expense ratio as of the prospectus dated 3/1/2023 is 0.88% for Class I shares.

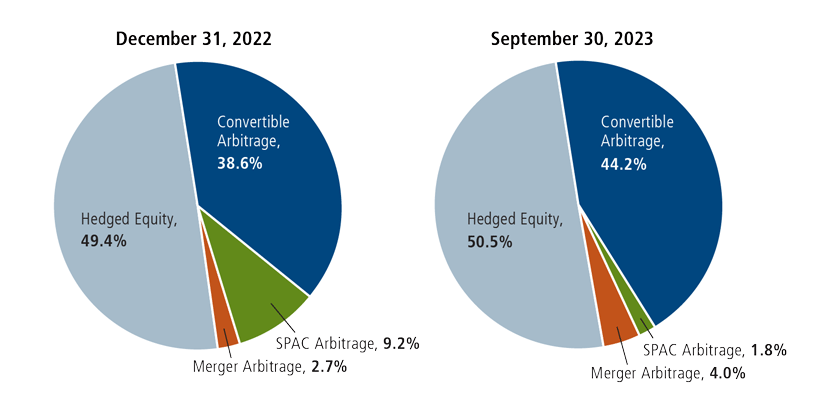

We monitor and manage the fund’s allocation between arbitrage and hedged equity and have maintained a roughly equal balance in recent months based on our view of strong relative opportunities in each.

The Arbitrage Strategy Reflects Our Optimism on Convertible Arbitrage

Within the arbitrage strategy, we have the flexibility to diversify among different sub-strategies, including convertible arbitrage, merger arbitrage and special purpose acquisition company (SPAC) arbitrage. During the third quarter, each of the arbitrage sub-strategies was up.

We continue to like the opportunity in convertible arbitrage most, and the fund’s allocation to convertible arbitrage has grown from 39% at the start of the year to 44% on September 30 (Figure 2). We expect to continue adding to convertible arbitrage, particularly if we see the attractive new convertible issuance that we anticipate.

Figure 2. We have increased CMNIX’s convertible arbitrage allocation in 2023

The portfolio is actively managed. Holdings subject to change daily.

Why We’re Bullish on Convertible Arbitrage

A principal driver for our bullishness in convertible arbitrage is our heightened return expectations for the strategy on the back of the rise in overnight interest rates. Convertible arbitrage returns have historically been correlated with overnight rates. This is because of the rebate the fund receives on its short stock positions, which is directly tied to the fed funds rate. Although returns don’t necessarily go up tick-for-tick with rates, we expect a meaningful tailwind in 2023 and beyond. Conditions for convertible arbitrage generally improve as short-term interest rates move higher. One factor, for example, is that rebates on short stock positions are highly correlated with the level of the fed funds rate. Markets continue to price in that the recent tightening by the Federal Reserve will remain for the near term.

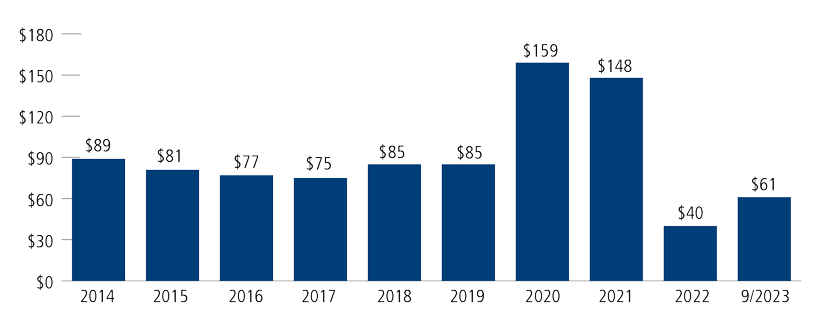

Increased convertible issuance is also favorable. We continue to see the potential for a large uptick in investment-grade issuance. During the third quarter, we saw signs that this trend is taking hold (Figure 3), including a large investment-grade oil company domiciled in Italy. According to Bank of America Global Research, 30% of year-to-date issuance has been investment grade, up from 7% in 2022.

Figure 3. Healthy convertible issuance provides opportunities for convertible arbitrage

Source: BofA Global Research.

Across the credit markets, a large maturity wall is on the horizon, beginning in 2025. As companies begin to address their refinancing needs, we maintain our belief that convertibles will be a popular choice for issuers. We just don’t know whether that will be this year or next. With most potential issuers in quiet periods during the first month of every quarter because of pending earnings releases, we expect October issuance to be low. In November and early December, we’ll see just how motivated companies are to raise capital, but the next leg up in convertible issuance looks more likely to be a 2024 story.

The increase in convertible arbitrage has offset a reduction in the SPAC portion of the portfolio. SPACs are now 2% of CMNIX after peaking at almost 10% of the fund. While we have sold a few SPACs, most of the decrease has resulted from the natural runoff of 2021 issuance with terms of two years or less. Over the last few years, SPACs served the fund well, contributing upside with limited volatility, and we would continue to buy new SPACs on the terms we bought them in 2021. However, the SPAC new issue market has been quiet since late 2021.

Hedged Equity Strategy: Focused on Steady Returns

We position the hedged equity strategy with the goal of providing steady returns whether the stock market is going up or down. In a quarter when both stocks and bonds declined (with the S&P 500 Index and Bloomberg US Aggregate Index both falling more than -3.0%), the hedged equity component of CMNIX was flat.

In a higher interest environment, we can earn more from selling calls, which highlights part of the attraction we see in the hedged equity strategy with overnight interest rates at 5%. We have been more defensively positioned in recent years, which proved advantageous over the quarter.

In Calamos Market Neutral Income Fund, we have consistently maintained a 40% notional value of net long puts. This has served the fund well, and we believe it will continue to do so, based on the parameters of the fund’s mandate. Given that CMNIX is designed to serve as a fixed income alternative, we are especially mindful of taking on too much residual equity risk.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The S&P 500 Index is considered a measure of the US equity market. The Bloomberg US Aggregate Index measures the performance of investment grade bonds. The Bloomberg US Government/Credit Bond Index includes Treasuries and agencies that represent the government portion of the index, and includes publicly issued US corporate and foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements to represent credit interests.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Foreign security risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability in less developed countries.

822207 1023

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.