Investment Team Voices Home Page

Investment Team Voices Home Page

A Market Focused on Growth Fundamentals: Early Innings for Our Investment Style

Brandon Nelson, CFA

- We expect start-stop and rotational market conditions over the near term but believe we are in the early innings of an upcycle for our investment style.

- The Calamos Timpani funds are tilted toward stocks that we believe offer above-average growth prospects and very visible fundamental strength—and we are encouraged these characteristics are gaining traction in the market.

- Small caps are relatively inexpensive, have tended to do well in periods after bear market bottoms and are entering what historically has been a seasonally strong period running from October through April.

The third quarter saw overall weakness in equity markets, led lower by mid and small cap stocks. The smallest of the small were especially weak this quarter, as seen in the performance of the Russell Microcap Index, down -7.9%, and in the Russell Microcap Growth Index, down -12.0%

The market was in “risk-off” mode for most of the quarter, especially in August and September, two months that have tended to be seasonally difficult for equity markets. The underlying weakness in equity prices was at least partially caused by rising oil prices and rising 10-year US Treasury bond yields. Both rose each month of the quarter and caused investors to question the overall outlooks for earnings estimates and the valuation multiples paid on those estimates.

In addition to increasing oil prices and Treasury yields, another theme that gained traction during the quarter related to health care and a specific group of weight loss drugs known as GLP-1s (short for glucagon-like peptide 1 agonists). Clinical data continues to be released, but investors are encouraged by the potential for these drugs to improve not only patient aesthetics but also overall patient health. This excitement does have a downside for other industries, however, as some investors suspect a healthier society may result in lower demand for certain medical devices and medical procedures. We won’t know the true implications for some time, but stocks are moving in the meantime.

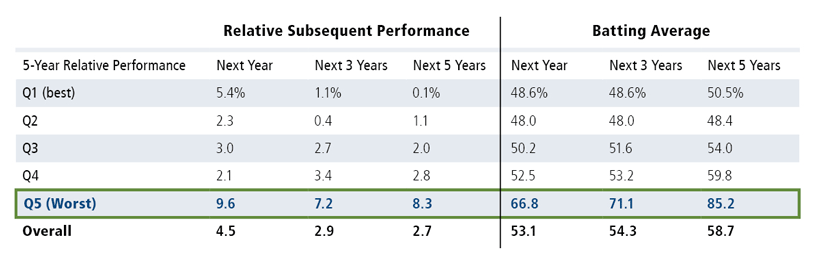

Although small caps have underperformed during the quarter and year to date, the outlook for them looks compelling. Small caps are relatively inexpensive and have tended to do well in periods after bear market bottoms (see our post “5 Reasons for Small Caps and Calamos Timpani Small Cap Growth Fund”). Small caps are also entering what historically has been a seasonally strong period running from October through April. Regarding valuation, small caps look extremely stretched to the downside relative to large caps. Looking back at more than 90 years of data, research by Jefferies shows that the most significant dislocations have historically tended to be a positive indicator for future small cap performance. The table below shows the historically strong relative performance for small caps versus large caps over the next one, three, and five years, with high probabilities of confidence (“Batting Average”).

When performance has been this bad, small caps have historically enjoyed long bounce backs

Past performance is no guarantee of future results.

Note: performance is annualized. Batting average is the % of time that small beats large. Source: Center for Research in Security Prices (CRSP®), the University of Chicago Booth School of Business, Jefferies. Large and small are defined by CRSP based on placing market caps into deciles. Deciles 1 and 2 are large and 6 through 8 are small.

We believe Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX) are well positioned. Both funds are tilted toward stocks that we believe offer above-average growth prospects and very visible fundamental strength. Stocks with those characteristics were out of favor for most of 2022 as valuation multiples compressed, but since early February 2023, many of these stocks are back on track with the market.

In other words, we believe we are in the early stages of a new upcycle for our particular investment style. That, combined with the potential to see a recovery in the overall small cap asset class, has us feeling upbeat on an intermediate-to-long-term basis. Admittedly, the short-term is murky, with many macro sources of concern. This murkiness is causing performance to have many stops, starts, and rotations. We’re focused on finding stocks that have company-specific secular growth, and thus are theoretically less vulnerable to some of that macro murkiness. We believe this approach makes the most sense, especially in this environment.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund and Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of the potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

Foreign security risk: As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Past performance is no guarantee of future results. The S&P 500 Index is a measure of large-cap US stocks and the Russell 2000 Index is a measure of small cap US stocks. Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The Russell Microcap® Index measures the performance of the microcap segment of the US equity market. Microcap stocks make up less than 2% of the US equity market (by market cap, as of the most recent reconstitution) and consist of the smallest 1,000 securities in the small-cap Russell 2000 Index, plus the next 1,000 smallest eligible securities by market cap. The Russell Microcap® Growth Index measures the performance of the microcap growth segment of the US equity market. It includes Russell Microcap companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years).

822203 1023

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.