Investment Team Voices Home Page

Investment Team Voices Home Page

Ready for Market Upticks and Potential Pullbacks

Eli Pars, CFA

- Oil prices, Fed policy, and political uncertainty contribute to a questionable growth outlook for 2024.

- Given these crosscurrents, our focus remains on achieving the best risk/reward profile through bottom-up security selection.

- Convertible issuance remains strong year-to-date, and we expect healthy issuance in 2024 as companies seek to refinance maturing debt across the credit markets.

During the third quarter, stock and bond markets fell into the red by about the same degree. Global convertibles, which blend equity and fixed income characteristics were not immune to these pressures, but provided a degree of resilience, with the Refinitiv Global Convertible Bond Index losing less ground.* In a post-zero interest rate world, we don’t believe we’ve seen the last of simultaneous declines in stocks and bonds. We believe that global convertibles can continue to provide benefits, with active management enhancing the potential of the asset class.

The Fed seems (mostly) done with raising rates, but the market’s obsession with the Fed continues, with investors now fixated on when the Fed will start cutting rates again. But with the economy holding up quite well, it’s hard to see why the central bank would cut rates unless inflation falls below its 2% goal. With oil prices flirting with triple digits, that final drop in inflation may also be pushed out further on the horizon. And that’s before we consider that we have a big election next year. It’s hard to see the Fed wanting to get in the middle of that mess.

All of this combines for a questionable outlook for growth in 2024. This is the point where we remind our readers that we’re not macro traders, just convertible managers. We will stick to our fundamental process and work to get the best risk/reward profile possible. We continue to position Calamos Global Convertible Fund to participate in upside equity rallies while also seeking to manage the downside if the market pulls back. The Fund remains overweight to the US and the technology sector and underweight Europe.

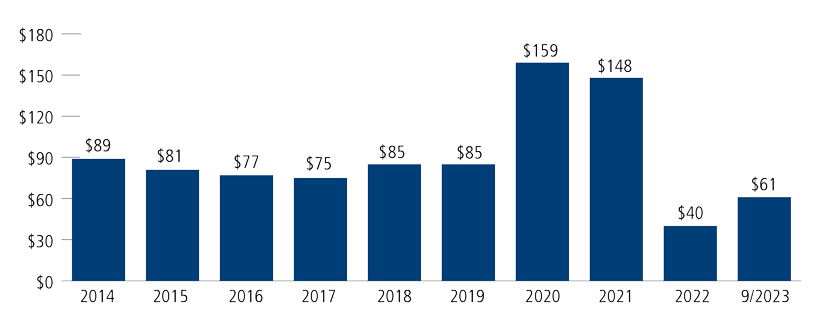

The global convertible market continued to see healthy issuance in the third quarter, and we remain active in the new issuance market. Global issuance totaled $20.5 billion for the third quarter and $60.9 billion year to date, which compares favorably with $39.5 billion in issuance for all of 2022.

Figure 1. 2023 global convertible issuance has proceeded at a healthy pace

Data as of 9/30/23. Past performance is no guarantee of future results. Source: BofA Global Research, ICE Data Indices, LLC.

In prior commentaries, we have discussed the potential for a large uptick in investment grade issuance. During the third quarter, we saw signs that this trend is taking hold, including a large investment-grade oil company domiciled in Italy. According to Bank of America Global Research, 30% of year-to-date issuance has been investment grade, up from 7% in 2022.

Across the credit markets, a large maturity wall is on the horizon, beginning in 2025. As companies begin to address their refinancing needs, we maintain our belief that convertibles will be a popular choice for issuers. We just don’t know whether that will be this year or next. With most potential issuers in quiet periods during the first month of every quarter because of pending earnings releases, we expect October issuance to be low. In November and early December, we’ll see just how motivated companies are to raise capital, but the next leg up in convertible issuance looks more likely to be a 2024 story.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

*Stocks are represented by the S&P 500 Index, a measure of large-cap US stock performance and by the MSCI World Index, a measure of developed equity markets. The S&P 500 Index declined 3.27% for the quarter and the MSCI World Index declined 3.36%. Bonds are represented by the Bloomberg US Aggregate Index, a measure of investment grade bonds, which declined 3.23%. Global convertibles are measured by the Refinitiv Global Convertible Index, which declined 2.40%.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

Foreign security risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

822199 1023

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.