Investment Team Voices Home Page

Investment Team Voices Home Page

Higher-Quality Companies for a “Higher-for-Longer” Rate Environment

Jim Madden, CFA, Tony Tursich, CFA, and Beth Williamson

- SROIX’s positioning reflects our belief that a well-diversified portfolio of high-quality companies is advantageously positioned to produce long-term returns.

- We seek high-quality companies that effectively manage nonfinancial and financial risks.

- In an environment of higher interest rates, companies with high debt levels may face added pressure.

After a torrid first half of 2023, stocks took a breather in the third quarter. The large-cap tech-stock domination that propelled the market higher during the first half of the year waned, and the tech sector underperformed the market (as measured by the S&P 500 Index) for the quarter. Energy and communication services were the only sectors within the index that posted positive quarterly returns.

From a capitalization perspective, mega caps continue to dominate the S&P 500 Index, with the market caps of the largest 31 companies in the S&P 500 Index about equal to the combined market caps of the other 469. How fast companies this big can continue to grow is a fair question.

The Calamos Sustainable Equities team has always focused on the advantages of diversification. We believe that holding a well-diversified basket of high-quality stocks for the long term enhances our ability to produce superior returns. Heavy reliance on a small number of stocks or a single sector may produce outsized returns in the short term, but the downside risk, often ignored by investors, is equally large.

While SROIX is well-diversified across industries and sectors, its holdings share important characteristics. Across the portfolio, we have sought high-quality companies that have strong financial metrics and are addressing nonfinancial risks related to governance, ecological impact and human development.

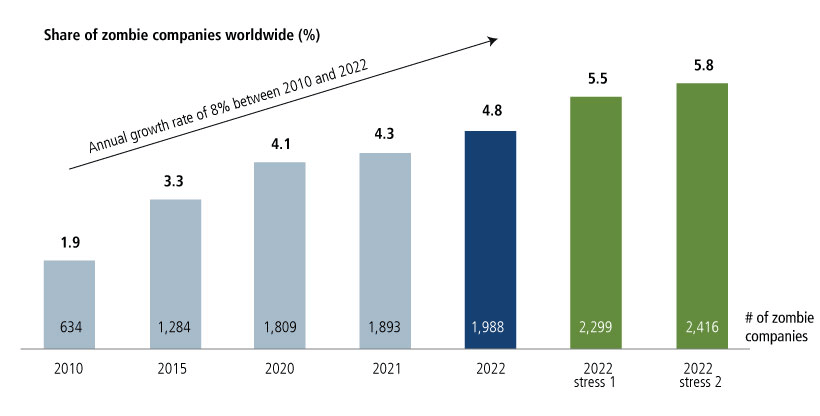

In an environment of higher interest rates, we maintain a focus on identifying and investing in high-quality companies with lower levels of debt than their peers. Although the Fed paused interest rate hikes in September, its language was cautious regarding the timing of future rate cuts. Following more than a decade of essentially free money, it’s important to keep an eye on the effects of higher rates as the “higher for longer” scenario becomes more possible. The graph below shows the increase in “zombie companies” (i.e., companies with operating profits that fall short of their interest expenses).

Avoiding a zombie company apocalypse: SROIX invests in companies with lower debt

Source: Kerney.com, “Dawn of the debt,” September 14, 2023. Stress test 1 represents a 1.5-fold interest rate increase. Stress test 2 represents a 2-fold increase. Increases are applied to individual companies’ existing interest payments.

These “zombies” could soon experience further difficulties. Historically, the economy starts to feel the effect of interest rate increases 18 to 24 months after the date of the first hike. We are now about 18 months out from the first hike in this latest cycle. Against this backdrop, we believe our focus on quality fundamentals will be especially important—both for pursuing returns and managing risks.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations.

Environmental, social and governance (ESG) is based on the premise of investing in companies that have good environmental records, are ethically run and have a positive social impact.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s)will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Antetokounmpo Sustainable Equities Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, large-capitalization stocks as a group could fall out of favor with the market, small and mid-sized company risk, sector risk, portfolio turnover risk, and portfolio selection risk.

The Fund's ESG policy could cause it to perform differently compared to similar funds that do not have such a policy. The application of the social and environmental standards of Calamos Advisors may affect the Fund's exposure to certain issuers, industries, sectors, and factors that may impact the relative financial performance of the Fund-positively or negatively-depending on whether such investments are in or out of favor.

Calamos Antetokounmpo Asset Management LLC (“CGAM”), an investment adviser registered with the SEC under the Investment Advisers Act of 1940, serves as the Fund’s adviser (“Adviser”). CGAM is jointly owned by Calamos Advisors LLC and Original C Fund, LLC, an entity whose voting rights are wholly owned by Original PE, LLC which, in turn, is wholly owned by Giannis Sina Ugo Antetokounmpo. Giannis Sina Ugo Antetokounmpo is the majority shareholder of Original C, with a 68% ownership interest.

Mr. Antetokounmpo serves on the Adviser’s Board of Directors and has indirect control of half of the Adviser’s Board.

Mr. Antetokounmpo is not a portfolio manager of the Fund and will not be involved in the day-to-day management of the Fund’s investments, and neither Original C nor Mr. Antetokounmpo shall provide any “investment advice” to the Fund. Mr. Antetokounmpo provided input in selecting the initial strategy for the Fund.

Mr. Antetokounmpo will be involved with marketing efforts on behalf of the Adviser.

If Mr. Antetokounmpo is no longer involved with the Fund or the Adviser then “Antetokounmpo” will be removed from the name of the Fund and the Adviser. Further, shareholders would be notified of any change in the name of the Fund or its strategy.

The Adviser is jointly owned and controlled by Calamos Advisors LLC and, indirectly, by Mr. Antetokounmpo, a well-known professional athlete. Unanticipated events, including, without limitation, death, adverse reputational events or business disputes, could result in Mr. Antetokounmpo no longer being associated or involved with the Adviser. Any such event could adversely impact the Fund and result in shareholders experiencing substantial losses.

822205 1023

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.