With CICVX There’s No Need to Make a Market Call

On August 4, Calamos hosted a Convertible Bond Market Review and Outlook with Joe Wysocki, CFA, Senior Vice President, Co-Portfolio Manager of the Calamos Convertible Fund (CICVX). To listen to the call in its entirety, go to www.calamos.com/CIOconvertibles-8-4.

Here’s what Calamos Co-Portfolio Manager Joe Wysocki considers one of the most compelling advantages of convertible bonds, especially at this time.

“How do you want to be invested in the winners at this point in the cycle? And how do you want to be positioned for the eventual recovery? With convertibles, it’s not an either/or question,” Wysocki told investment professionals on last week’s call.

Wysocki went on to elaborate on the differentiated value that convertibles have contributed so far this year—and why he’s enthusiastic about the opportunities ahead.

FAANG stocks have driven the bulk of the returns of the U.S. equity indexes, offsetting weakness in many other areas. While many companies have improved their conditions at the margin since March, much of the market is still below where the stocks started the year.

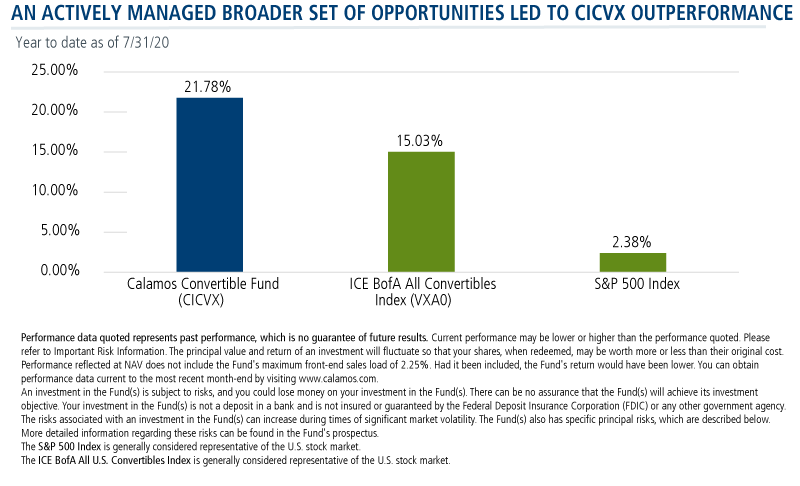

By contrast, there’s no FAANG component to the convertible market. The strong year-to-date performance of convertibles—and more specifically, Calamos Convertible Fund (CICVX)—was a result of several market dynamics as described by Wysocki below.

Growth Companies Seeking Growth Capital

This year’s performance has been led by mid-cap companies, which over time have demonstrated their capability to produce strong returns as they mature.

“Many growth companies,” Wysocki noted, “have come through the convertible market over the years, whether that's Tesla today or Nvidia five years ago, Salesforce.com a decade ago, or even Amazon 20 years ago.

“We think,” he continued, “there's a very good chance that tomorrow's market leaders are in the convertible market today. And there’s the potential for tremendous returns if we can identify them and stick with them over the longer term."

The risk, of course, is that not all of these companies will be winners. And, the volatility that comes with investing in higher growth companies can be unnerving. Converts are a unique way to stay exposed to these growth trends and help manage that near-term volatility.

And this, Wysocki said, is what’s different about owning convertibles. "When owning equities, you'll always have 100% of the upside, and you'll always have 100% of the downside.”

Cyclical Stocks Broadening the Opportunity Set

Names in industries such as airlines, cruise ships, even retail have been “not only a good near-term opportunity to play the recovery, but they can provide a good balance of opportunities for years to come, even if the market changes.”

And here’s another difference between converts and straight equities: turnover. “The news cycle tends to get caught up about whether or not a single name is going to be added to the S&P, but we've had 50 added to the convertible market already this year,” Wysocki said. One-third of the CICVX portfolio is comprised of convertibles that didn't exist prior to the start of the year.

“How do you want to be invested in the winners at this point in the cycle? And how do you want to be positioned for the eventual recovery? With convertibles, it’s not an either/or question.”

The CICVX team is pleased to see issuance reaching multi-decade highs (see this post). But what’s more important, Wysocki said, is that the demand is meeting the supply. “Whether it's credit investors who are seeking more equity upside or equity investors seeking a better downside mitigation, that underlying structural demand for convertibles to get equity risk in a risk-managed exposure is what’s appealing,” he said.

Issuing convertibles, Wysocki added, can be a financing option that's less expensive than offering high yield bonds. The high yield market “wants high cash flows. They want hard assets.” For many growth companies, “coming to the convertible market makes a lot of sense because they're able to issue [bonds] with lower coupons.”

The Value Provided by Active Management

The CICVX team’s continuous focus on balancing risk and reward is designed to mitigate the downside—including establishing floors in the event of unforeseen pullbacks—while pursuing the potential for upside capture by remaining exposed to positive trends and well-executing companies.

“If you manage this on an issuer level, a sector level, and a portfolio level, it can help you compound wealth over market cycles,” Wysocki said.

He acknowledged today’s challenge: “What's the bigger risk at this point, that the market continues to run higher, or that the market corrects?” The team advantage is that they don’t need to make a market call.

“COVID-19 is still the number one variable right now in any investor's mind. And the outcome still remains highly uncertain.” That said, “[the market’s] fundamental momentum, coupled with very accommodative monetary policy that will keep liquidity high, interest rates low, and basically a promise to do more if needed, this environment is really quite appealing,” said Wysocki.

Investment professionals, for more information on diversifying your clients’ portfolios with CICVX, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Convertible Securities Risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also, may have an effect on the convertible security’s investment value.

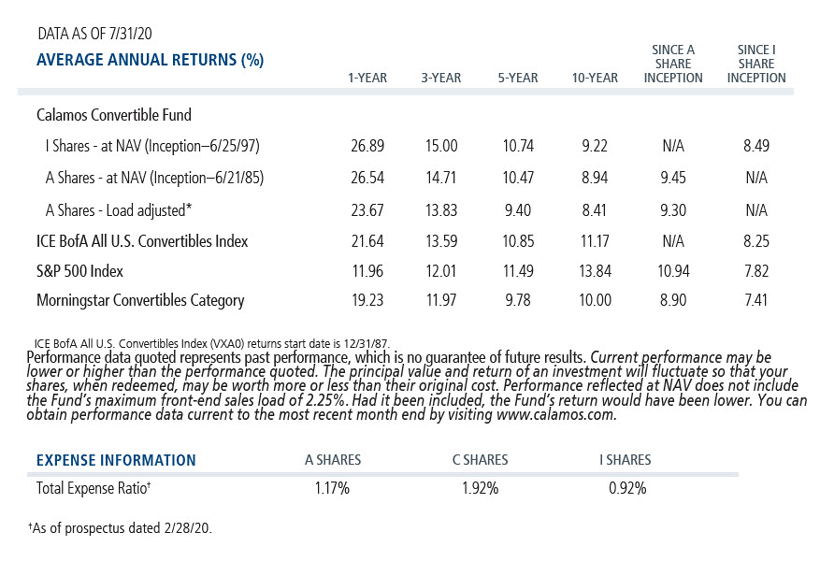

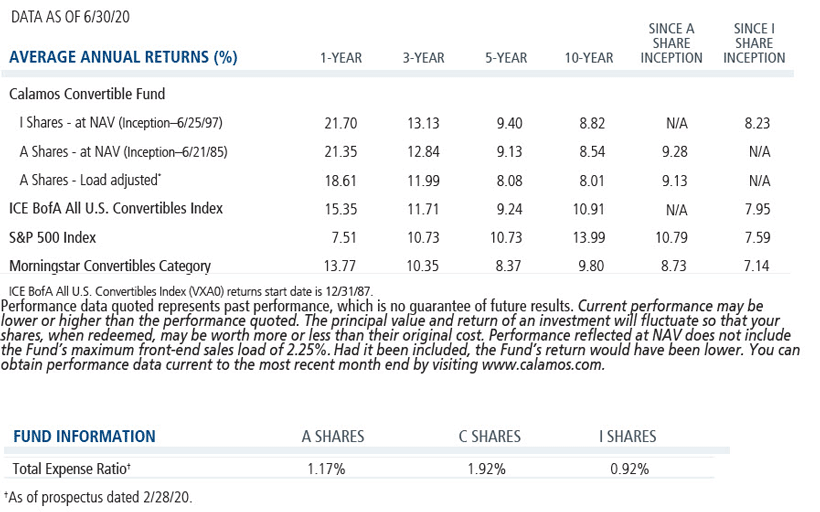

The S&P 500 Index is generally considered representative of the U.S. stock market.

The ICE BofA All U.S. Convertibles Index measures the return of all U.S. convertibles.

Morningstar Convertibles Category funds are designed to offer some of the capital appreciation potential of stock portfolios while also supplying some of the safety and yield of bond portfolios. To do so, they focus on convertible bonds and convertible preferred stocks. Convertible bonds allow investors to convert the bonds into shares of stock, usually at a preset price. These securities thus act a bit like stocks and a bit like bonds.

802106 820

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on August 13, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.