Now Explains Why Convertibles Require Active Management

Convertibles are in a portfolio because, Calamos Convertible Fund (CICVX) Co-Portfolio Manager Jon Vacko commented in January, “No one really knows what’s going to happen in the stock market.” (See Positive about 2020? Even More Reason to Hedge Equity Risk with Calamos Convertible Fund.)

Their function—because they’ve historically provided comparable equity returns with less volatility—is to help keep clients invested and moving forward.

It was two years ago, on the 10th anniversary of the Great Financial crisis, when Joe Wysocki, Co-Portfolio Manager, reminisced about how convertibles provided downside risk mitigation for clients in 2008-2009 (see The Complexities of Investing in Convertibles: What Every Advisor Should Know).

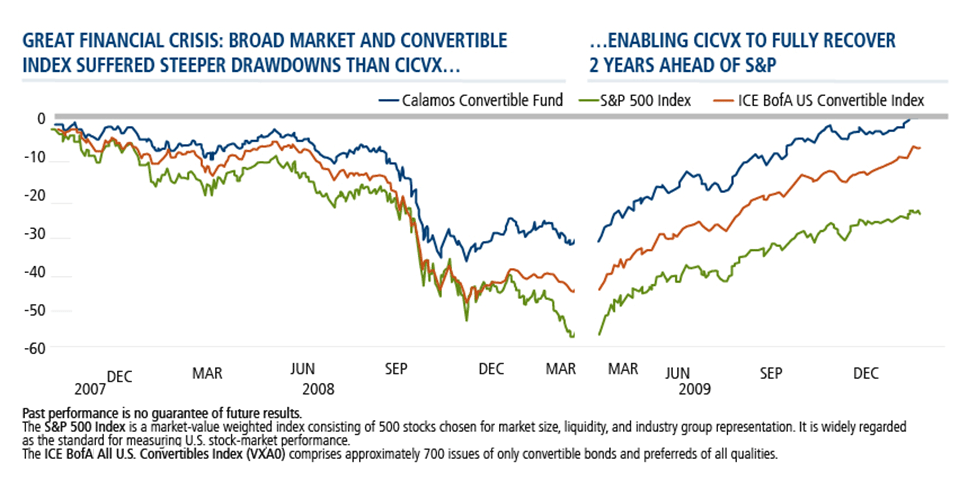

As shown below, the S&P 500 declined -55% peak to trough. The ICE BofA All U.S. Convertibles Index (VXA0) fell -42%. And, as you can see, CICVX fell -30%.

This muted drop, as Wysocki said, was a direct result of the active management of the portfolio. By holding up better and rebalancing risk, the fund was able to fully recover by early 2010—that was two years ahead of the broader equity market.

But in the fall of 2018, Wysocki expressed concern that investors turning to broad use of convertibles were inadvertently taking on more risk.

In a passive strategy, “What happens when equities’ market value increases?” Wysocki asked. “The convertible equity sensitivity increases and equity-sensitive convertibles would potentially be larger positions...In the absence of rebalancing, investors could be holding an equity portfolio (such as in 2000) or, conversely, could be holding a straight bond portfolio (as in 2008) at the exact wrong time.”

Memories may have dimmed the value of an actively managed strategy, Wysocki worried at the time.

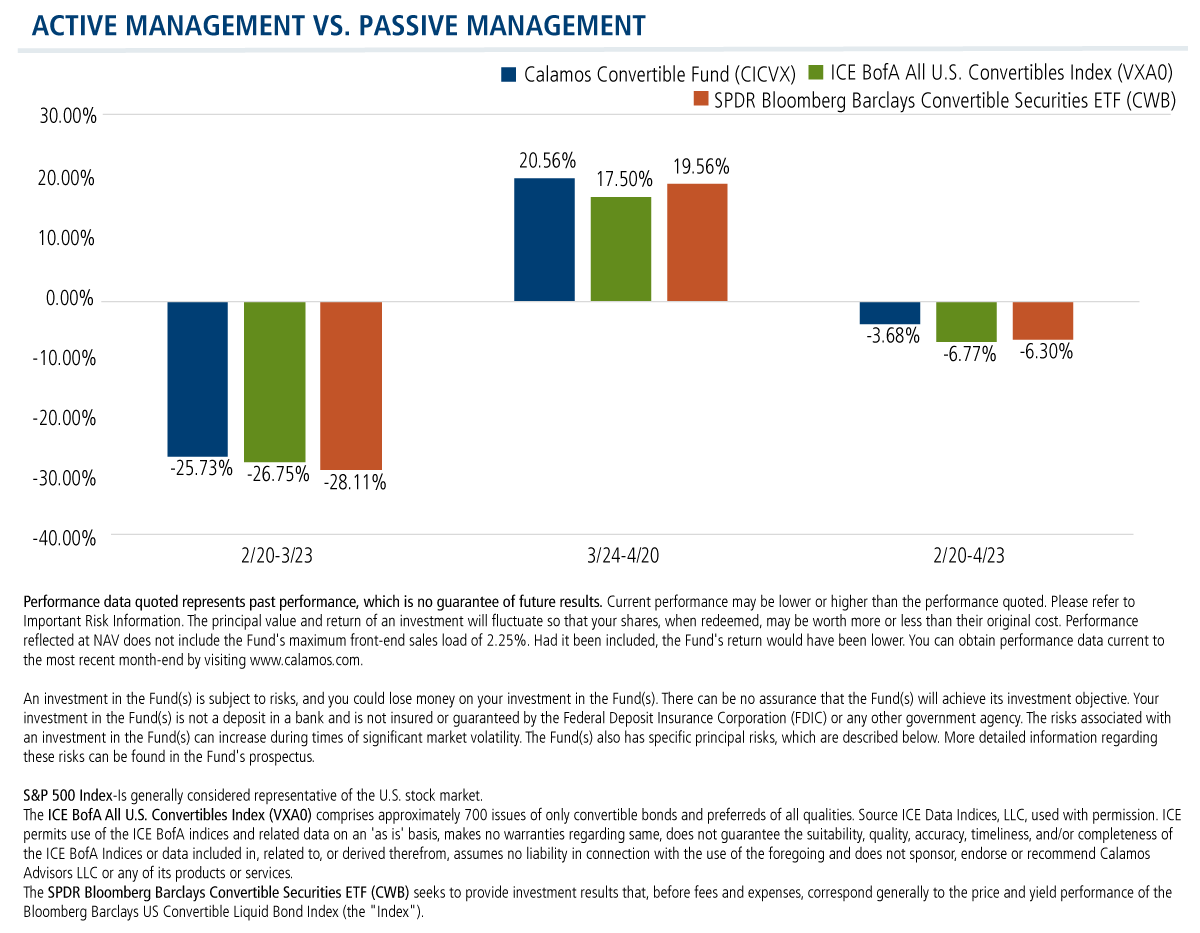

But now here we are, fresh off a -34% decline in the S&P 500, and CICVX is once again pulling away. The fund has outperformed the VXAO on the downside (during the market’s swoon between February 20 and March 23) and on the upside (during its snapback through yesterday).

Obviously, convertibles weren’t exempt from the sell-off. Underlying equities were pressured while credit spreads widened simultaneously.

But, as Wysocki wrote in this month’s U.S. Convertible Market Snapshot, “The flipside is that such volatility can create opportunities. The seemingly indiscriminate selling has pushed convertible theoretical valuations to discounts that we have rarely seen over the past few decades.”

With cheap converts and a reset of equity valuations and credit spreads, a “trifecta” could be setting up, resulting in compelling returns as fear subsides, he wrote.

“Being able to actively capitalize on opportunities such as these when they present themselves serves as a reminder that it is not simply the convertibles that make a strategy work,” Wysocki says, “rather how convertibles are managed to achieve a particular investment objective.”

For more on the trifecta, read Tactical Opportunity in the Convertible Market: Convertible Trifecta.

Investment professionals, to learn more about actively managed convertibles now, register for our May 7 Adding Convertibles to Your Playbook webcast. You’ll hear from Wysocki along with the recognized pioneer in convertible investing, Founder, Chairman and Global Chief Investment Officer John P. Calamos, Sr., and Eli Pars, CFA, Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager.

For more information at any time, reach out to a Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

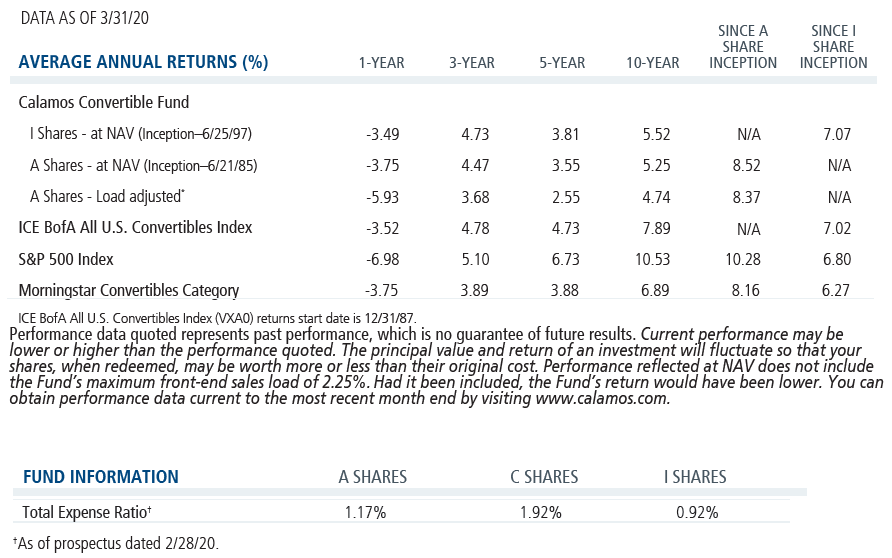

S&P 500 Index-Is generally considered representative of the U.S. stock market.

The ICE BofA All U.S. Convertibles Index (VXA0) comprises approximately 700 issues of only convertible bonds and preferreds of all qualities. Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an 'as is' basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

802005 420

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on April 24, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.