Investment Team Voices Home Page

Investment Team Voices Home Page

When Risk Management Matters Most, Global Convertibles Shine

Global Convertible Perspectives by Eli Pars, CFA

The recent volatility in the stock market has led many investors to rethink their allocation to global equities. We expect volatility to remain a dominant theme this year as market participants confront uncertainties ranging from the global coronavirus outbreak to the U.S. election cycle.

However, looking past the headlines, we see many reasons to maintain exposure to the global equity market. Steady U.S. economic data, many positive earnings announcements, reasonable valuations, and a global environment of fiscal and monetary stimulus can benefit stocks and other equity sensitive securities.

For investors who recognize the importance of global equity market exposure but are concerned about volatility, global convertible securities may be just the ticket. Convertibles may make it easier for investors to take a more patient approach and resist the temptation to make shifts based on fear or greed. Convertible securities can provide upside participation in equity market gains with potentially less exposure to drawdowns. One feature of convertibles that many investors find attractive is that the asset class is dominated by growth oriented companies, including many technology companies. The bond-like characteristics of the convertible can provide a lower-volatility way to achieve exposure to growth names.

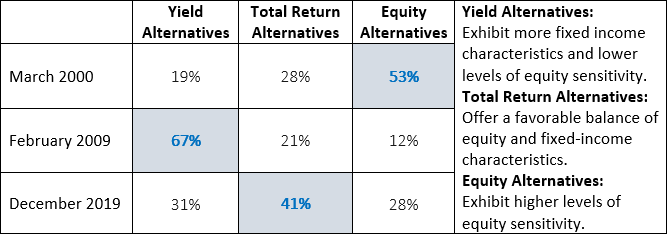

But, you need active management to make the most of the opportunities global convertibles offer. As we’ve explained in the past, convertible securities blend characteristics of stocks and bonds, and a convertible’s level of sensitivity to its underlying equity can change over time. The characteristics of the overall market also shift. Some readers may recognize this next chart—it’s a favorite of ours—which shows how the U.S. convertible market has been more or less equity sensitive at different points in time.

Why Active Management? Convertibles Are Complex and Their Attributes Vary Over Time

A convertible portfolio that has drifted to a high level of equity sensitivity may be unintentionally exposed to a global market drawdown. Alternatively, too much fixed income exposure limits the opportunity to participate in the upward moves in the global equity market.

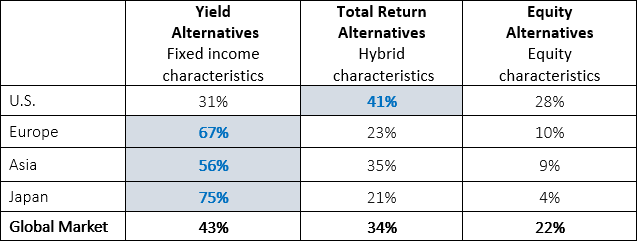

Especially for non-U.S. investors, a global convertible universe provides a real advantage in achieving an appropriate level of exposure to the global equity market. The chart below illustrates the potential limits of home-country bias. For example, an investor who is only investing in European issuers would be sidelined from accessing the breadth of balanced opportunities the U.S. market offers today.

As of December 31, 2019.

Conclusion

Elevated volatility will be par for the course, but there are many reasons to maintain exposure to the global equity market. Global convertible securities make it easier to take equity volatility in stride. Capitalizing on the opportunities in the convertible market requires active management, and a global investment universe provides strategic benefits.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific companies, securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to buy or sell. Investing in non-U.S. markets entails greater investment risk, and these risks are greater for emerging markets. Convertible securities entail interest rate risk and default risk. The above commentary is for informational and educational purposes only and shouldn’t be considered investment advice.

Active management does not guarantee investment returns and does not eliminate the risk of loss. A convertible bond has "fixed income characteristics" when it is valued at about the same level as a similar non-convertible bond and is not as sensitive to the underlying equity. A convertible bond has "hybrid characteristics" when it has fixed income characteristics as previously explained but is becoming increasingly sensitive to changes in the underlying equity price. "Equity characteristics" represents a convertible bond that is highly sensitive to movements in the underlying equity.

Percentages shown represent the proportion of convertible bonds in VXA0 (a measure of the U.S. convertible market), VE00 (a measure of Europe’s convertible market), VASI (a measure of Asia’s convertible market), VJEU (a measure of Japan’s convertible market) and CONV (a measure of the broad global convertible market) that fall into each classification. Source: ICE BofA Global Research, ICE Data Indices, LLC Research, used with permission. ICE permits use of the ICE BofA Indices and related data on an ‘as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment.

18761 0220O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.