Well Ahead of Index and Peers YTD, Here’s How CGIIX Is Pursuing Growth While the World Waits for a Vaccine

The U.S. economy in September 2020 is in a transitional phase. Having sharply rebounded from the onset of the COVID-19 crisis and the resulting shutdown, from here the economy will grow at a modest pace until there’s widespread distribution of a vaccine, likely in the second half of next year.

Economies in the U.S. and globally have re-opened to the “living without a vaccine stage,” Calamos Co-CIO John Hillenbrand told investment professionals on Tuesday’s CIO conference call. (Listen to replay here.)

“In this stage, we can expect slower growth, uneven improvement in economic activity shaped by the variable path of the virus’s spread, a slowing in physical location openings, a winding down of fiscal stimulus programs that have not been renewed, and a higher level of unemployment, bankruptcies and restructurings,” said Hillenbrand, Head of Multi-Asset Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager.

Equity-Like Returns with Lower Volatility

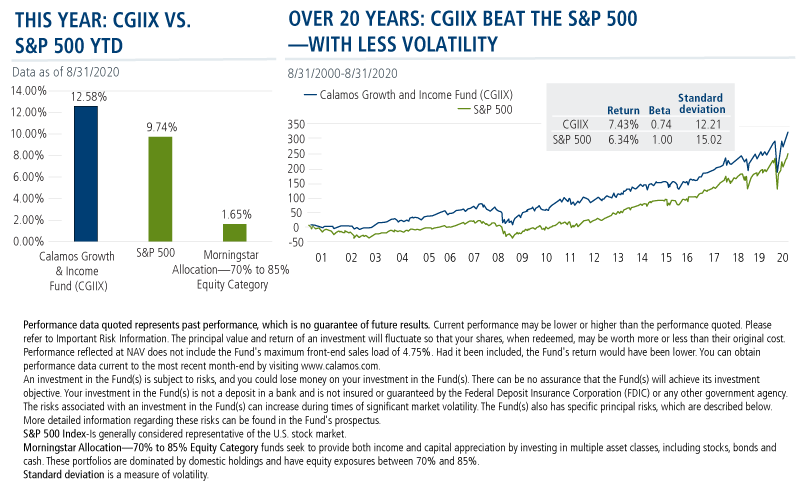

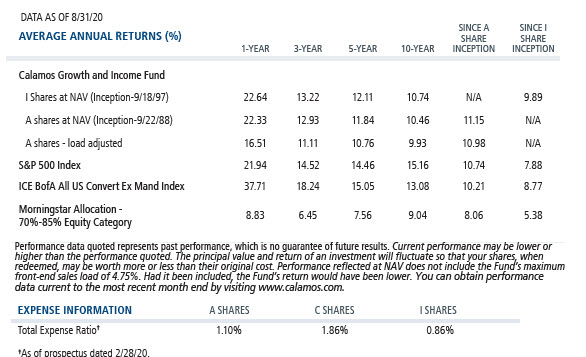

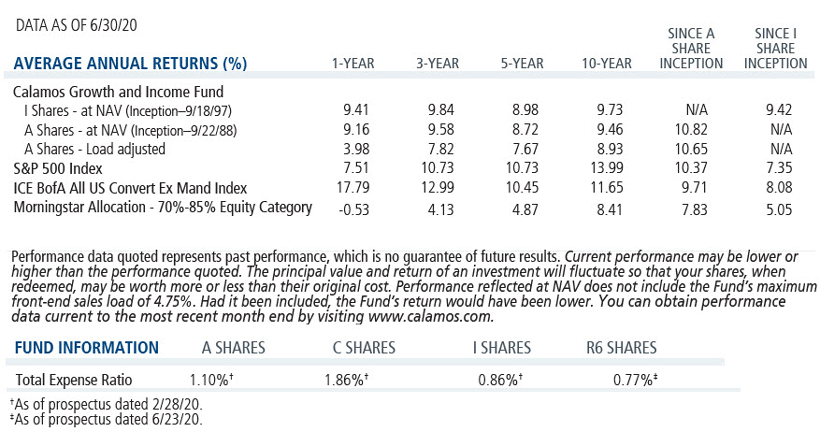

With that as a backdrop, Hillenbrand reviewed how he’s positioned Calamos Growth and Income Fund (CGIIX), an equity-oriented multi-asset class strategy whose goal is to generate equity-like returns with a lower volatility profile than the S&P 500. The fund has easily outperformed the S&P and its peers in Morningstar’s Allocation—70% to 85% Equity category through August 31, and has a long-term record of matching or beating the S&P with less volatility while providing attractive income.

The team maintains a positive view on equities—although, Hillenbrand qualified, “Equities and convertibles can do well, but the winners going forward might be different over the next six to 12 months than the winners of the last six to 12 months.”

Calamos Growth and Income Fund (CGIIX)

Morningstar Overall RatingTM Among 302 Moderately Aggressive Allocation funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 4 stars for 3 years, 5 stars for 5 years and 5 stars for 10 years out of 302, 277 and 228 Moderately Aggressive Allocation Funds, respectively, for the period ended 6/30/2024.

Included in the stock portfolio are growth companies the team believes to have sustainable growth prospects.

“We have become more selective in part because of valuations and in part because of the potential for decelerating growth in 2021. Growth equities perform better in an accelerating growth environment than in a decelerating environment,” he said.

CGIIX also has its share of cyclical exposure. “It’s easy to say that that cyclicals are the place to be,” Hillenbrand said, but here too expressed the need to be selective. “You could look at some of the travel names but those really rely on having a vaccine, or you could can look at energy names but they require everyone to start traveling again.”

The team’s approach has been to ladder cyclicals, starting with those that are starting to rebound today, those that expected to improve in the next three months to six months and those expected to perform post-vaccine.

Turning to more secular growth stories, CGIIX bottom-up analysts are focused on distinguishing between companies whose growth is sustainably accelerating and those whose demand has just been pulled forward.

Hillenbrand included ecommerce and payments innovations as examples of accelerating trends that are enabling consumers and businesses. On the other hand, demand for home office-related or home entertainment purchases may have just been pulled forward.

Managing the Volatility

With convertibles, an important instrument in the fund, Hillenbrand values the fixed income base and the optionality. Convertibles are used both to access growth companies that are higher volatility than he likes to have in the portfolio and cyclical companies, as well. Convertibles in the travel and leisure industry, for example, offer an asymmetrical risk/reward and a considerable coupon that pays while an investor waits until the economy improves post-vaccine.

With volatility declining, Hillenbrand said, the team also has been selectively using calls and puts to create synthetic convertibles, as a means of further managing the downside while providing opportunities for upside.

The portfolio includes very little traditional fixed income, a marked change from a year ago. “We just don't see the value there,” he said, “and would rather use either converts or an option strategy or high quality companies with free cash flow margins to bring down the volatility of the portfolio.”

3 Risks

Hillenbrand named three risks to investors:

- Vaccine availability and effectiveness: This outlook is predicated on a vaccine, he said. “The big risk is that the vaccines don’t turn out the way we want them to. A relatively low risk is that we don’t get any vaccine but that’s something to look out for.”

- Election outcome: “Our view is still a divided government,” said Hillenbrand, “but it’s a little close to call depending on where the economy is in the next six weeks and depending on views on the economy.”

- China: The U.S. and China are at odds on technology and militarization. “On a lot of fronts China is moving to exercise their view of the world, with the U.S. and other countries pushing back,” noted Hillenbrand.

Investment professionals, for more information on our equity perspective or CGIIX, please talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Growth and Income Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, equity securities risk, growth stock risk, small and mid-sized company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk and portfolio selection risk.

The S&P 500 Index is generally considered representative of the U.S. stock market.

The ICE BofA All U.S. Convertibles ex Mandatory Index (VOAO) represents the U.S. convertible market excluding

mandatory convertibles. Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and

related data on an ‘as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy,

timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no

liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any

of its products or services.

Morningstar Allocation—70% to 85% Equity Category funds seek to provide both income and capital appreciation by investing in multiple asset classes, including stocks, bonds and cash. These portfolios are dominated by domestic holdings and have equity exposures between 70% and 85%.

Morningstar RatingsTM are based on Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/ or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2019 Morningstar, Inc. All rights reserved.

802149 920

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on September 18, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.