The Market Turned, and Our Alts Worked: CMNIX, CIHEX and CPLIX in January

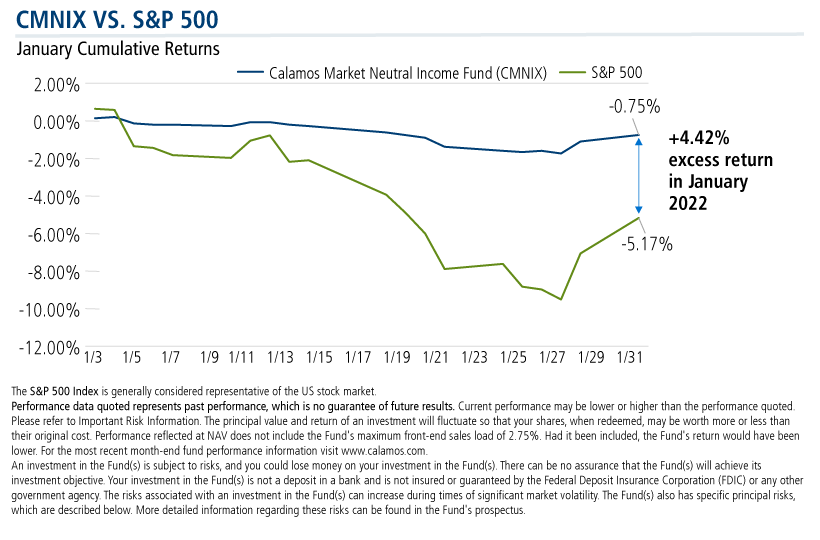

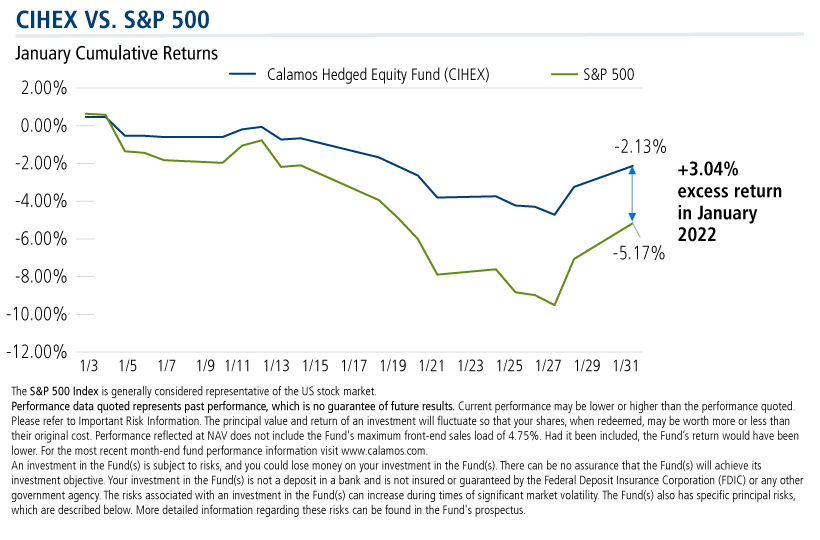

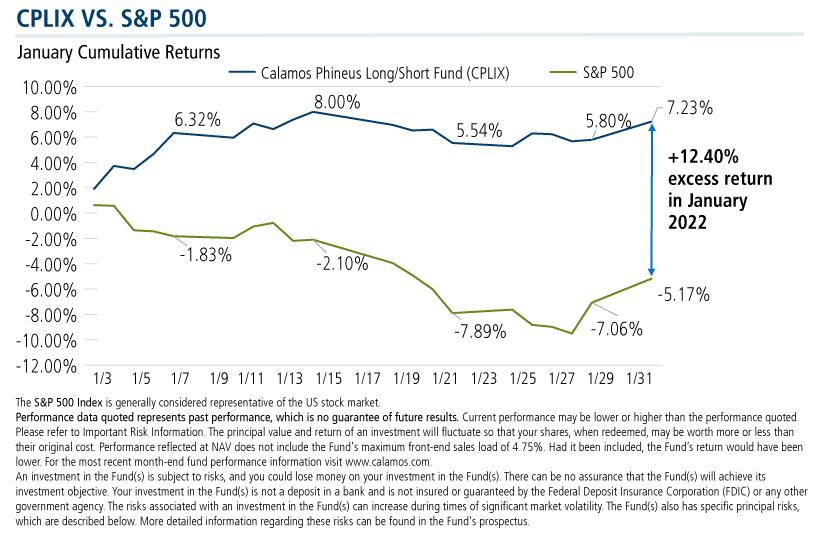

After avoiding a 5% pullback for most of 2021, the S&P 500 was down a full 4% intraday on January 25. The overall volatile start to 2022—which included touching -10% at one point in the month—sent a strong signal that this year may be nothing like last.

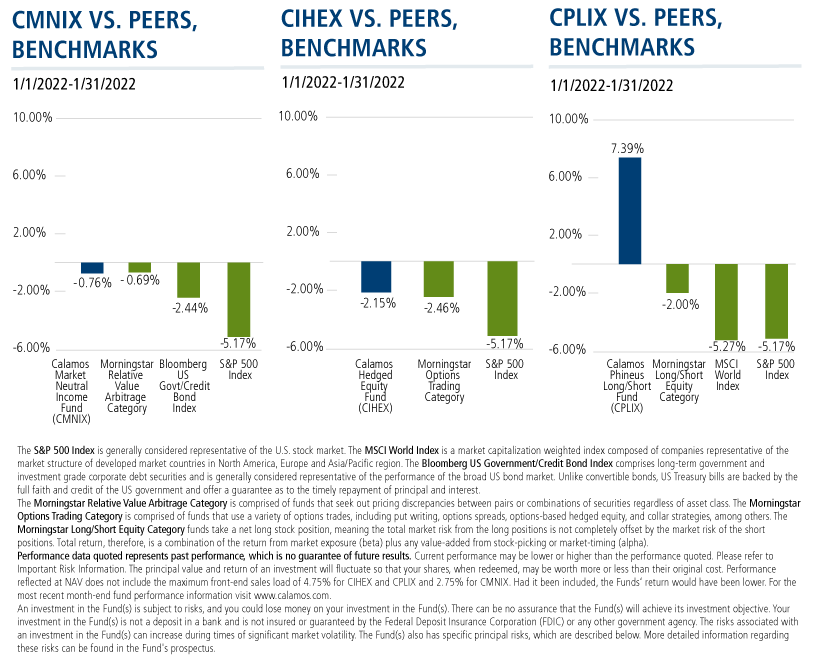

The traditional investor was shut out in the first month of the year. Stocks were down, bonds were down. But here’s what worked: the Calamos suite of alternatives. Added to clients’ portfolios expressly to diversify risk, our alts performed as advertised.

The charts below review how the funds progressed through every day of January as the S&P 500 rose to set an all-time high, fell and then climbed back into positive territory to end the month. Also, see the bottom of the page for their long-term performance records.

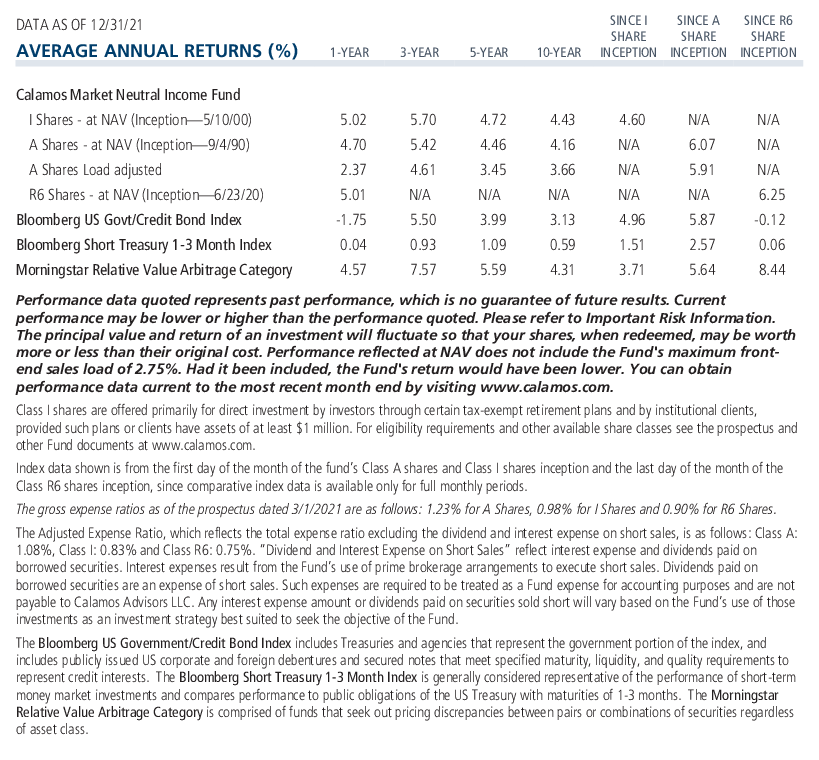

CMNIX

Fixed income alternative Calamos Market Neutral Income Fund (CMNIX) in January extended its 31-year-old history of providing stability to a portfolio during times of market shocks.

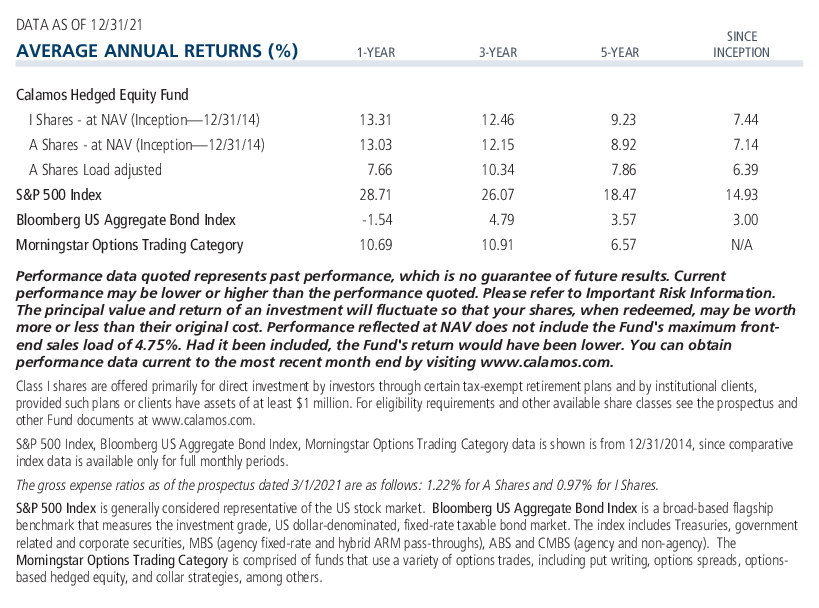

CIHEX

Investment professionals turn to Calamos Hedged Equity Fund (CIHEX) to potentially de-risk an equity portfolio without trading away all of the equity upside potential. By blending a core long-equity portfolio with an actively managed option overlay, the goal is to capture 60% of the S&P’s upside while mitigating 40% of the downside. And, that’s what CIHEX did in January.

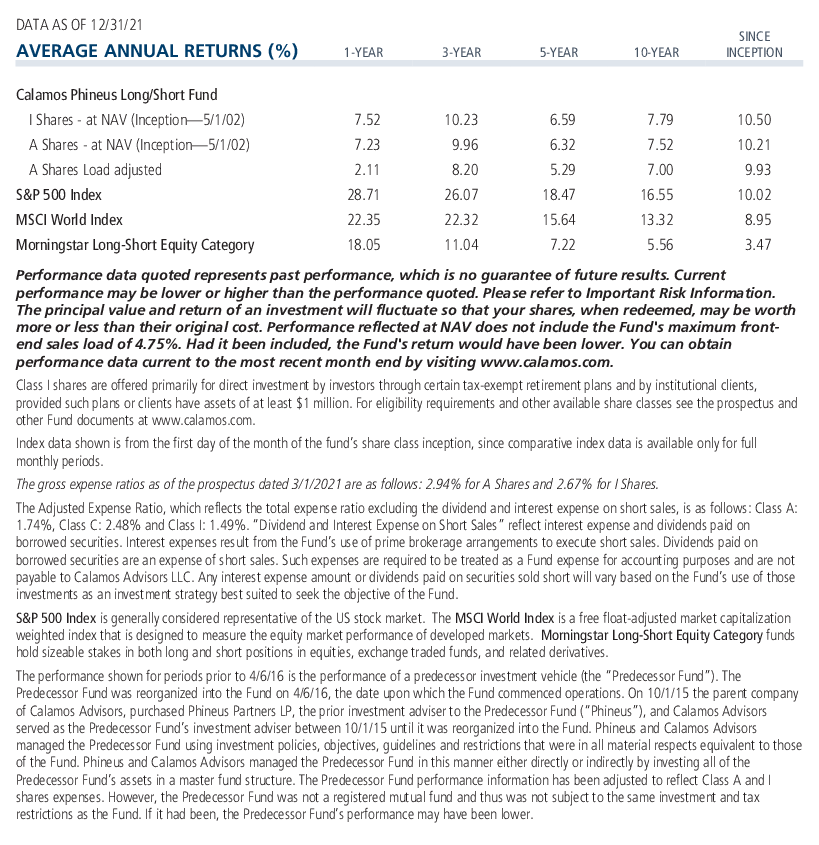

CPLIX

With a 7.39% return in a month when the S&P 500 is down -5.17%, Calamos Phineus Long/Short Fund (CPLIX) in January demonstrated its ability to diversify equity exposure. Co-CIO, Senior Co-Portfolio Manager and Head of Long/Short Strategies Michael Grant has been bullish on what he considered an “extraordinary” earnings recovery since the COVID crisis lows of 2020 (see post). The fund’s net equities exposure was almost 54% at 2021’s year-end.

But, the equities that the CPLIX team has been leaning into have been related to the value/reopen trade (Industrials, Energy) and reflation (Financials). At the same time, CPLIX has leaned away from higher duration growth (Technology). While Grant expects the earnings cycle to remain supportive for risk assets through 2022, “there is discontinuity on the horizon that implies more discrimination across styles and industries: decelerating nominal GDP, rising wage pressures and rising investment needs.”

Investment professionals, January provided another illustration of how risk-managed strategies can contribute to an overall portfolio when equities are under pressure. Please talk to your Calamos Investment Consultant about putting our alternatives to work for your clients’ portfolios in the likely volatile days ahead. You can reach him or her at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing in the Calamos Hedged Equity Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks. As of March 1, Calamos Hedged Equity Income Fund’s name has been changed to Calamos Hedged Equity Fund.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

808646 222

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on February 02, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.