Next Year May Be More Nuanced, But CPLIX’s Grant Believes Equity Investors Need to ‘Ride the Tiger’

When introducing Calamos Co-CIO and Head of Long/Short Strategies Michael Grant at a recent meeting of investment professionals, the host recalled three highlights of Grant’s 2021 outlook:

“We need to lean into and stick with this equity risk view.”

- Be bullish on equities.

- Stick with the United States.

- Be bearish on China.

“I was very grateful for that outlook, obviously,” she said.

Next year promises to be more “nuanced,” according to Grant, also Senior Co-Portfolio Manager of Calamos Phineus Long/Short Fund (CPLIX), in the presentation that followed.

Investors have just experienced an earnings cycle when the S&P 500 was trading 10 times forward earnings with a free cash flow yield of greater than 10%, he recalled (and see this post). Just four quarters after the S&P 500 was at 2300 in March 2020, stocks were generating earnings of more than $200 a share.

Grant commented on the bullish posture of the fund since March 2020. “In my 35 years, I've never seen so many bullish factors come together to support equities. I think the reason for [others’] caution, despite the incredible backdrop, is that everyone can look out to next year and understand how the cycle ends.”

Liquidity and interest rates can cause problems at any point in the cycle, he said. “But the backdrop of liquidity today is so historic that we have been reluctant to try to suggest any problems that might immediately impede liquidity. The Fed’s balance sheet is going to continue to rise in the next 12 months, even if it tapers.

“If you follow what the Fed tells us, the Fed is still going to add $700 billion, $800 billion, maybe $1 trillion of liquidity between now and 12 months from now,” he added.

“Our simple view,” Grant said, “is as long as fundamental momentum is above trend, but we don’t have to worry about the liquidity resetting, we need to ride the tiger. We need to lean into and stick with this equity risk view.”

This Is Different From What Followed the GFC

Grant acknowledged a widespread feeling that “there’s something unconventional about this cycle and that we may be shifting to a new kind of regime.”

He listed three significant differences between today and the period following the 2008 Great Financial Crisis. The differences, which he believes are creating demand that’s likely to persist, are:

-

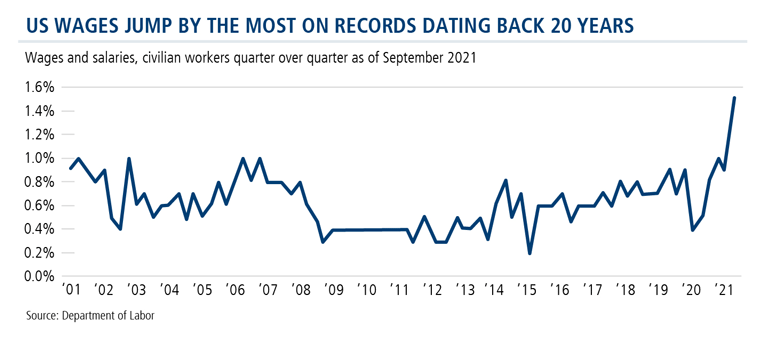

The health of the consumer and private sector. “In a normal recession, wages go down. They didn’t go down in this recession, they’re going up,” Grant noted. Both the consumer and the private are much healthier than after the 2008 crisis.

-

The fiscal and policy mix. “We’ve talked about this many times, so I won’t repeat it (see this post),” said Grant. “But the important point is that there is a sense that we can print money and spend money without consequences. Lacking an intellectual framework, policymakers are doing this because they can, not because they have this deep intellectual underpinning concerning what they’re doing.

“In the absence of any kind of intellectual basis for doing so, the only thing that’s going to pull this dynamic back is higher inflation and higher interest rates. That’s another reason we think this cycle is going to end in overshoot rather than undershoot,” he added.

-

The reversal of globalization, which Grant said is “fracturing the global economy into distinct regions of profitability and corporate governance.”

“This is not a flash-in-the-pan shift,” he said. “And it’s very favorable to US equities, in particular, as the dynamics of globalization fade.”

Further, he made specific comments on several ongoing debates among investors, including:

- Fears of the fiscal cliff, and the drag that’s coming in 2022. Grant contrasted this year’s fiscal stimulus to next year’s fiscal spending on projects, which have a more direct relationship with economic growth. He and the team believe that the health of the private sector and the buildup of private savings is sufficient to overcome any kind of fiscal cliff in 2022.

-

The supply chain. Grant expects the supply chain to normalize between now and the middle of 2022. “The good news,” he said, “is that because of supply chain issues, industrial production has not been as strong as consumer spending. Industrial production going forward to the next 12 months is simply going to be very strong to meet pent-up demand. In a sense, supply chain issues have probably lengthened the current economic cycle because they basically extended unfilled demand into the future.”

As a consequence, in the second half of next year, inventories may build faster than demand, which Grant expects to change the psychology of the market. -

China. Grant remains negative on China. “The real estate bubble in China is about three times the size of the US real estate bubble in 2007,” he said. Other material challenges for the country’s economic growth include demographic challenges from population declines and politics that Grant believes are “very dangerous” for China.

“President Xi is centralizing power, and the problem is that President Xi doesn’t understand the difference between equity and bonds,” he said. Specifically, Grant thinks Chinese leadership doesn’t fully understand how incentives or disincentives of government intervention play out—"which creates great risk for policy for a very long time.”

According to Grant, "there are only two decisions that investment professionals need to get right. One is China, the other is the US. Everything else falls in the bucket of less than 10%. Given its challenges, I believe that China is something you don't have to pay attention to for the rest of your professional careers.” -

COVID. Grant acknowledged that he previously may have been “too glib and too dismissive of COVID,” which is a crisis he believes will be over between now and next summer. But, he said, “it's very frustrating when you see this back and forth, this fear and that fear, based on the headlines. It's led to a range of rotations in different parts of markets.”

Grant and team believe that the S&P could get to 5000 over the next six months. Between now and late March, he said, “if we get more of a top in US equities, that could last for a while.”

Even apart from the recent reaction to the news of the omicron variant, Grant said, investors are nervous because they understand that inflation and interest rates will have to go higher at some point.

“I've been surprised,” he said, “that 10-year yields are still below 2%. But the government can probably keep them there for an extended, multi-year period of time.”

Inflation, Labor Issues and, Ultimately, Recession

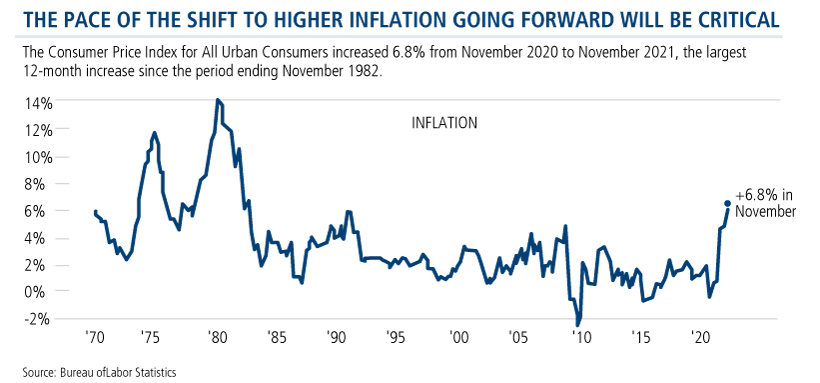

“If you just read the tea leaves, you’d see that the market expects higher inflation next year but even stronger economic growth. That’s a very favorable trade-off for all risk assets. That, for now, is still the key fundamental support for everything that’s going on, and our advocacy for ownership of risk assets,” said Grant.

What will be critical, he said, is the pace of the shift to higher inflation. Inflation at a glacial speed is positive for a range of industries, including financials and cyclicals. “I think it will be glacial through the first half of next year, because supply chains will improve, and goods prices will start to ease. Some of this is just the math of how inflation works.”

But labor is the eventual challenge, Grant said. Labor price increases will stick and there will be a range of shortages in several industries through most of next year, he believes. Ultimately, these factors will combine to result in a squeeze in corporate profitability.

How long can the current favorable environment continue? “People ask, ‘Where are we in the cycle? What analogy can I use to help me understand what I should be doing today?’ What's striking to me is that I don't think this has happened before,” Grant said.

“My guess is that equities will be in more of a trading range next year. I think if equities are up, and they can probably be up, it’s going to be single digits, and not double digits. I think there's a window where the risk gets so extreme, that one has to simply step back. And my view is that probably happens in the first half of next year.

“It doesn't necessarily mean that the market simply collapses,” Grant continued. “A lot of major troughs in equities take time. In the late 1960s, the S&P 500 and the Dow Jones Industrial Average got stuck at 1000 for five years. So, there's a pretty good chance that maybe the market gets stuck at 5000 for 12 to 18 months. After that, you could get a bad bear market because the Fed is reducing liquidity in a more obvious way.”

After this year, equity investing is “no longer a one-way bet,” he said. “A lot of products in our industry—including both active managers who actually are benchmarkers and passive money—work as long as there's momentum. The moment there isn't momentum, that requires strategies that are truly active.”

Investment professionals, for more on Grant’s outlook or CPLIX, please reach out to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

808593 1221

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on December 10, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.