To Go Where the Market Goes—Don’t Underestimate the Advantage of Being Opportunistic When Hedging Equities

First published: July 19, 2021

It’s days like last Monday—when the S&P 500 plunged 4% before closing up 0.28%—when our hedging equities conversations take on added urgency. Specifically, we’re talking to investment professionals about the value of flexibility when hedging stocks. Only an actively managed fund with a flexible options strategy can move and ideally capitalize on markets when they move.

Compare Calamos Hedged Equity Fund (CIHEX)—which has the flexibility to go where the market goes—to funds that follow a systematic strategy with known ranges and resets. These are in place for a reason, but it’s important to understand the implications of such a passive strategy.

CIHEX is a dynamic, opportunistic strategy. Conversely, mechanistic strategies are static, they’ll set their option hedges once a quarter and that will be that. There’s a cap on the downside but know, too, that the upside is also capped—which makes the timing of a new investment into the strategy tricky.

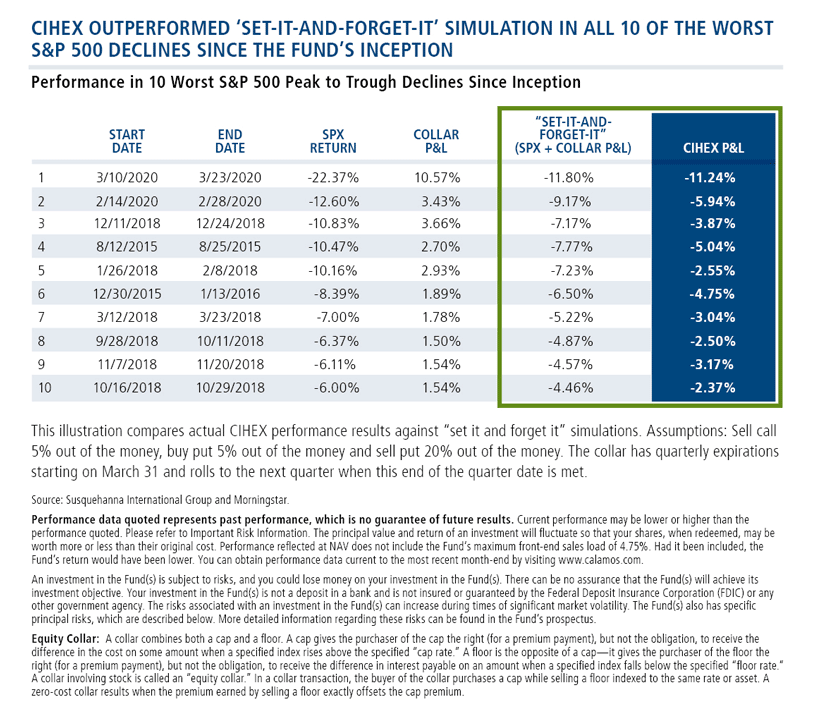

Below we show the potential performance advantage of CIHEX over a simulated static “set and forget” strategy in the 10 worst S&P 500 peak to trough declines since the fund’s inception. CIHEX outperformed in all.

Your takeaway: CIHEX’s active management has positioned the fund opportunistically for multiple outcomes, with the goal of mitigating the downside effectively and extending upside capture without additional capital risk.

CIHEX can help address several distinct equity investment needs:

- To keep or build equity exposure with historically less volatility and beta

- To keep clients invested and mitigate market timing concerns

The fund isn’t about market timing or making factor or sector bets. The dynamically managed equity option strategies are used to defend against declines.

For more information about CIHEX, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in the Calamos Hedged Equity Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Covered Call Writing Risk—As the writer of a covered call option on a security, the Fund foregoes, during the option’s life, the opportunity to profit from increases in the market value of the security, covering the call option above the sum of the premium and the exercise price of the call.

Options Risk—The Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment adviser to predict pertinent market movements, which cannot be assured. The Fund may also purchase or write over-the-counter put or call options, which involves risks different from, and possibly greater than, the risks associated with exchange-listed put or call options. In some instances, over-the-counter put or call options may expose the Fund to the risk that a counterparty may be unable or unwilling to perform according to a contract, and that any deterioration in a counterparty’s creditworthiness could adversely affect the instrument. In addition, the Fund may be exposed to a risk that losses may exceed the amount originally invested.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

802432 122

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

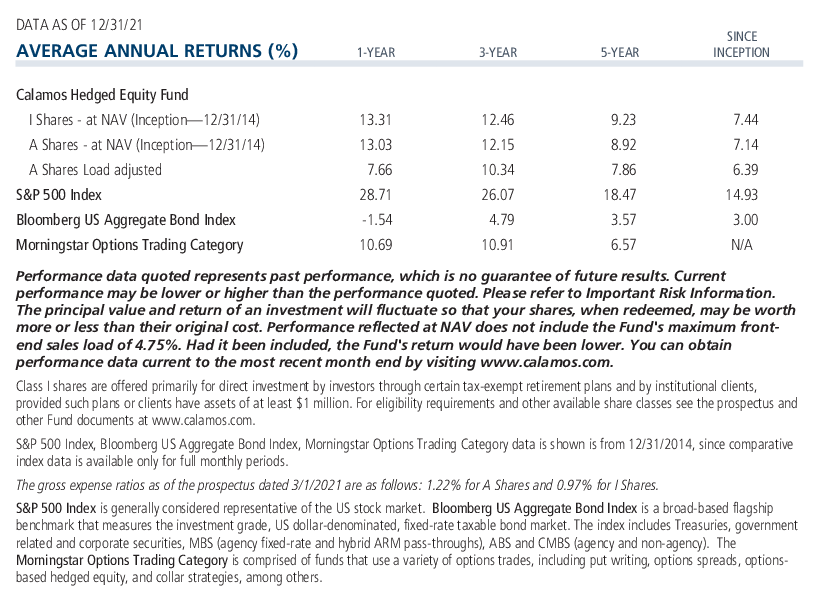

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on January 31, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.