Question Marks on the Horizon but No Worries: Calamos Fixed Income Team Is Positive, Always Selective

Matt Freund, CFA, Co-CIO, Head of Fixed Income Strategies, Senior Co-Portfolio Manager, began Thursday’s call (listen here) with a positive macro view of the “three pillars for risk assets: The Fed is virtually all in, fiscal policy is very supportive, and the economy is re-opening faster than market observers would have thought three or four months ago.”

“There are some question marks on the horizon,” he said, “but they are not going to be a worry for the next several quarters.”

With that framing, Freund and panelists Charles E. Carmody, CFA, Vice President, Co-Portfolio Manager and Senior Fixed Income Trader, and Christian Brobst, Vice President and Associate Portfolio Manager, surveyed how the opportunity set has changed over the last 12 months and highlighted what they believe today offers sufficient compensation for the risk taken.

The team expects long interest rates to drift higher as the economy regains its footing. Freund said new policy direction from the new Biden administration could pressure rates to as high as 1.4%-1.6%— “higher but not dramatically so.”

“Higher interest rates will be a drag on very high quality government or near-government obligations and we don’t think you’re getting paid for the risk,” he said. “Long duration may work out but, again, there’s some significant downside if you’re wrong…It should do well, we’re just not sure you’re being paid for the risk.”

After falling dramatically last year, inflation may trend “a bit higher,” in the second and third quarter, Freund said (and see this post). Beyond that, time will tell once more is known about a few issues such as tax hikes, trade and whether COVID-19 truly is in the rearview mirror.

Finding Value Where Others Don’t Think to Look

The team favors loans, high yield, structured products and preferreds—opportunities surfaced by what Freund described as “old-fashioned credit work.”

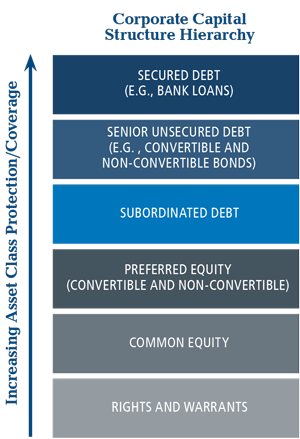

Carmody elaborated in his discussion of Calamos High Income Opportunities Fund (CIHYX). “Our process lends itself to finding value in areas where others wouldn’t even think to look,” he said. “We look at the capital structure up and down, bond by bond. Our bottom-up approach entails looking at high yield, loans, preferreds and sometimes even equities.”

One recent example of finding value using this comprehensive approach: the team swapped out of a bond and into a term loan, producing a 120-basis point advantage.

Freund differentiated the Calamos fixed income process from the risks inherent in other approaches.

With duration in the market about as long as it’s ever been, indexers or closet indexers represent heightened risk. “Being tied to passive benchmarks or blindly following them is not a great idea at this time,” he said.

Freund said he’s been impressed by macro-oriented strategies, “but that’s not what we do. There are some requirements they have. They need to be able to time the market, when to get short, when to get out. And then they have to be able to time the market, when to get back in. What we’ve seen is that liquidity conditions can be fickle and they can change. Not only do the [macro players] have to get the decision right, they have to be able to execute and execute at attractive prices.

“We don’t require liquidity,” Freund continued. "We are comfortable with our holdings. If we have to hold them, we’re happy to do so.”

Ample Liquidity

Last year’s “policy-induced cessation of economic activity in order to facilitate public health” didn’t take the full toll that was feared, according to Freund.

There’s ample liquidity in the marketplace today, he said. “Companies are having no problems bringing issues to market. The equity side gets a lot of headlines but on page 2 of the financial press, it’s a strong issuance market in credit, high yield and converts.”

While last year, airlines, cruise lines and some retailers were willing to pay steep prices to put cash on their balance sheets, Fed support is providing “seemingly endless liquidity,” according to Carmody. “You are not being paid to take that risk as much as you were six to nine months ago,” he said.

At one point last year, the serious concern was that business insolvencies would approach 2008 peaks. But the combination of Fed liquidity, Fed support in the way of direct loans, and fiscal support allayed those concerns. "For the most part, companies that made it to this point will be supported as the economy re-opens,” said Freund.

Carmody provided a few bullet points about the positioning of each fixed income fund:

Calamos Total Return Bond Fund (CTRIX)

- Short duration—roughly a half-year, within that a sizable underweight to the long end of the curve

- Overweight credit but somewhat cautious

- Favoring BB-weighted bonds, high yield and leveraged loans

Calamos Short-Term Bond Fund (CSTIX)

- More neutral duration

- Overweight credit

Calamos High Income Opportunities Fund (CIHYX)

Carmody explained a current bias toward the loan market. “There’s more value there, we’re at the top of the capital structure, and given how tight yields and spreads have gotten over the course of the last year or so, we’re more comfortable being at the top of the structure,” he said, noting that loans provide a hedge against higher rates.

Securitized Products

Brobst commented on the three distinct parts of the securitized products market, noting that the funds were underweight in two.

-

The agency mortgage-backed market is “an area where we have some concern about the potential for widening spreads over the course of this year.”

Mortgage-backed securities have a challenging technical backdrop, given that the Fed is committed to continue to purchase $40 billion of mortgages per month. Net issuance could reach a record high, potentially surpassing $500 billion of paper.

“Couple that with the fact that mortgages are trading 5 bps wide of their all-time tights,” Brobst said, “that’s a concern and leads us to an underweight.” -

The commercial mortgage market, which is also benefiting from Fed-provided excess liquidity. Challenges there relate to changed behavior since the spread of COVID.

“With the re-opening of the economy, the question is how much of a normal do we return to” in office space, leisure and hospitality properties, said Brobst. The team is underweight commercial mortgages compared to benchmarks and peer groups. - Asset-backed securities are enjoying a very favorable environment because they offer relative spreads to like-rated corporates, according to Brobst. He mentioned a student lender that brought a $1 billion deal to the market two weeks ago and attracted more than $16 billion in orders for the AAA tranche. The team is meaningfully overweight in asset-backed securities.

Investment professionals, for more information about Calamos Fixed Income funds (CTRIX, CIHYX, CSTIX) and the opportunities ahead, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, U.S. Government security risk, foreign securities risk, non-U.S. Government obligation risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty.

802271 0121

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on January 29, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.