Calamos Fixed Income Team Pursues a Bond-by-Bond Approach to ‘Getting Well Paid for Risk in All Circumstances’

The pandemic came on like a bolt out of the blue and has dramatically affected us all. We had a demand and supply shock. We were in a liquidity crisis, though the Fed did an amazing job of resolving it. Investors are still struggling with solvency issues in the market, and the dust has yet to settle on valuations.

As part of our CIO Call series underway, Co-CIO and Head of Fixed Income Strategies Matt Freund Tuesday tackled the topics above and discussed where his team is discovering value in the fixed income and credit markets. (Listen to the call replay here.)

Making Sense of Credit Markets in Unprecedented Times

When Freund discusses the fixed income or the credit markets, his traditional framework is to describe the markets in terms of what’s going on with the economy, fiscal policy and monetary policy. “But before we can talk about that framework, we need to discuss the COVID-19 crisis and the market repercussions that we’ve been dealing with this year,” said Freund, also Senior Portfolio Manager of Calamos Total Return Bond Fund (CTRIX), Calamos High Income Opportunities Fund (CIHYX) and Calamos Short-Term Bond Fund (CSTIX).

He acknowledged that his team has no unique insight on the virus per se, “but we do have a lot of insight regarding how crises evolve. Typically, a crisis starts with some kind of shock, such as an oil shock, an interest rate shock, or a demand or supply shock of some kind.” The shock then reverberates into financial markets in multiple phases.

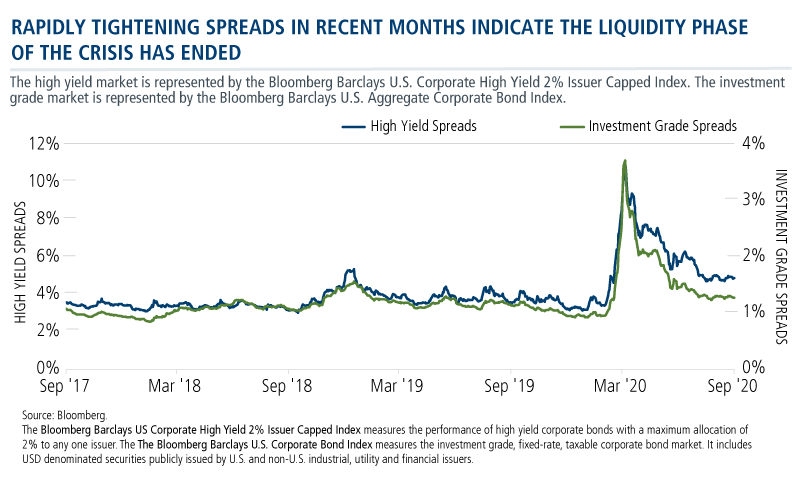

Phase 1: The Liquidity Crunch. That’s what happened in March. A massive deleveraging occurred. “The good news is the Federal Reserve is powerful and effective at handling liquidity problems. Thanks to the Fed’s support of vulnerable markets and resumption of massive quantitative easing among other measures, we are through that phase of the crisis,” Freund said.

Phase 2: The Solvency Crisis. A company or entity may not have liquidity issues, but it might not be solvent; it might not be profitable; and its cost structure might not work in the new post-COVID environment.

Phase 3: The New Reality. The last stage of the crisis has a much longer tail. This phase is the most fun to talk about, said Freund, but it is also the least discernible for investors in the near term. Freund reflected, “How has COVID-19 changed the world going forward, and what new pitfalls and opportunities exist in the marketplace?”

Squaring the Economy, Monetary Policy and Fiscal Policy

Monetary Policy. Is the Fed out of options? The answer is “no,” according to Freund, though he admitted, “They may be out of good options. Even so, they have affirmed that they are not raising rates and are injecting a lot of liquidity—they’re all in.”

Fiscal Policy. Freund conceded that fiscal policy is much less clear. “I was in the camp that politicians would not pass up the opportunity to spend money. But so far they can’t agree on another fiscal aid package. With the upcoming election, it’s unclear whether anything will happen in the next month, but we have a high degree of certainty that an agreement will be struck post-election.”,

The economy. Freund pointed out that a new term had to be coined to describe the economy of late. “It wasn’t a depression; we didn’t have a recession; we had an ‘enforced moratorium’ on economic activity. Many individuals had to endure severe economic pain for the collective good. This moratorium was lifted several months ago, and we have bounced significantly. In fact, GDP for the third quarter is tracking over 30%. This is phenomenal news. The only bad news is that the recovery is slowing,” Freund said.

So, the economy has bounced back; the Fed is really all in; and the team believes fiscal support might be delayed but not denied.

Finding Relative Value in the Marketplace

Given the recent sea change where the Fed is at zero and they are actively waiting for inflation, the team believes that inflation expectations will be priced into the curve. “We will see a steeper curve, so the long end of the market with maturities out past 20 years will be a challenging place to be.”

Freund on the Fed’s Sea Change on Inflation

“There has been a monumental shift in Fed policy; really we’re following the rest of the world. I don’t know how many of you remember Fed Chair Paul Volcker’s epic battle with inflation in the 1970s and 1980s. He ratcheted up interest rates and was willing to tolerate enormous disruption to get things under control. [Volcker successor] Alan Greenspan was the direct beneficiary of that effort.”

“In the last 40 years, we’ve had momentum toward falling inflation here in the U.S. There’s a number of reasons for this decline, including demographics and technology among other factors. As of late, however, that all changed. The Fed has made it extremely clear that they will tolerate inflation over their target. The long-term target is a little above 2%. About a month ago, the Fed said it would tolerate inflation up to 2.5%.”

“They haven’t told us how long they are willing to let things ride, but they’ve been clear that rates are going to stay at 0%, and savers are going to have a tough time until we’re back to full employment. This more tolerant/flexible approach is already the rule of the road in Japan and Europe.”Freund reflected, “When you think about markets today, there are individual segments of the market that we think are attractive, but it’s hard to say with a few exceptions that the broad markets are cheap.” Even so, he thinks there are opportunities to generate income and acquire assets that provide stability should the markets become unhinged.

“We generally prefer risk assets, which include credit, structured products and high yield as well as preferreds over Treasuries. We think the additional income these securities provide will be attractive to investors over time,” he said.

“We think TIPS, or I bonds for small investors, make sense over nominals. To put inflation into context, right now the breakeven on long TIPS is about 1.7%. The Fed is willing to tolerate up to 2.5% inflation on average. So,” Freund continued, “we think TIPS and inflation indexed securities will outperform.”

“In the market today, it’s actually more evident where we don’t want to be. When I look at the front end of the curve, there is very little reason to extend beyond a year or two. That’s not to say we’re not looking for unique stories beyond those constraints,” Freund said.

The team’s key philosophy is to be well paid for risk. “We don’t feel that the reward of owning long-dated securities is justified by the risks we’re going to take should our base case occur and inflation gets priced into the long end of the curve. However, we do think the long end of the curve could be an attractive hedge.”

Within the front end of the curve, the team particularly likes credit. “We have been looking for companies that are a little out of favor, are paying well for the risk, and are money good. For example, energy is dramatically out of favor, but there are some very good companies that are clear for the next two or three years at current energy prices. We like airlines that are secured. We’ve been playing in the enhanced equipment trust certificate (EETC) market where there’s a boots-and-suspenders approach. This means the airline is on the hook, and the planes serve as collateral.”

Within the short duration market, Freund said the team is also looking at taxable munis, which can be more attractive than the corporate market.

With regard to bank loans, he said the team is specifically looking at fallen angel names that were investment grade. “Although they’ve tapped the Fed liquidity programs, we’re being paid more to take on that risk. The other thing I would add is we only buy bank loans when they’re cheap.”

Freund observed that high yield has recovered dramatically, with this caveat: “The market is really bifurcated into the ‘haves’ and ‘have nots.’ We are especially wary of companies that are vaccine-dependent for their survival.”

Comparing a Core Plus Strategy to a Straight Core or Multi-Sector Strategy

Freund began by outlining three types of funds:

- Those that are very macro-driven.

- Those that are closet index funds that hug the benchmark within 20 basis points.

- Funds like Calamos Total Return Bond Fund (CTRIX) that focus on individual bonds and actively strive to get well paid for the risk.

Core bond funds are heavily reliant on Treasury securities. “In fact, 70% of the benchmark is government-guaranteed,” according to Freund. “However, Treasuries are not something that we currently favor, and that’s what you’re mostly getting in a core bond fund.”

Core plus funds, such as CTRIX, allow for more latitude in asset classes. “We have more leeway to diverge from the Bloomberg Barclays Aggregate Bond Index, and the duration targets are still similar. So I think in this market, there are especially good reasons to consider core plus,” Freund said.

Multi-sector funds are loosely defined and can shape shift. “I think they need to be aptly renamed ‘go anywhere’ funds. The thing about them is they can generate attractive returns, but in the context of income or hedging, they don’t work as well. They may zig when you want them to zag.

“I think if you find a multi-sector fund that fits your need or the client’s need, you should consider it, keeping in mind that it may not look the same in the future because they’re much more variable in their approach,” said Freund.

Taking a Different Tack with High Yield

How is Calamos High Income Opportunities Fund (CIHYX) different from other funds in the asset class? Freund summarized: “If you are being well paid for the risk, if you are patient, and if you know your securities including your indentures better than anyone else, you should be able to hold those securities through whatever the market dishes out.”

He continued, “We take a bond-by-bond approach, making sure we are well paid on our investors’ behalf. We are not tied to any given benchmark. Instead, we really focus on our analysts’ highest conviction names. We don’t make huge macro bets, which often leads to throwing the baby out with the bath water.”

“I’ve found that approach over time will generate more income with less turnover and less trading costs than peers. We understand why we like a security,” said Freund. “We understand why the market doesn’t; and we capitalize on this discrepancy.”

Investment professionals, for more information about Calamos Fixed Income funds (CTRIX, CIHYX and Calamos Short-term Bond Fund [CSTIX]) and the opportunities ahead, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, U.S. Government security risk, foreign securities risk, non-U.S. Government obligation risk and portfolio selection risk.

The principal risks of investing Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market of SEC-registered securities. The index includes bonds from the Treasure, Government-Related, Corporate, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS sectors.

Morningstar Intermediate Core-Plus Bond portfolios invest primarily in investment-grade U.S. fixed income issues, including government, corporate, and securitized debt, but generally have greater flexibility than core offerings to hold noncore sectors such as corporate high yield, bank loan, emerging-markets debt, and non-U.S. currency exposures.

Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index measures the performance of high yield corporate bonds with a maximum allocation of 2% to any one issuer.

Morningstar High Yield Bond Category represents funds with at least 65% of assets in bonds rated below BBB.

Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges.

802163 0920

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on September 24, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.