Investment Team Voices Home Page

Investment Team Voices Home Page

The Opportunity of Preferred Securities

Fixed Income Perspectives by Matt Freund, CFA and Christian Brobst

At this point of the cycle, investors are confronting many crosscurrents. Volatility in the equity markets is likely to be high due to the U.S. election and global growth concerns—especially in light of the uncertain trajectory of the coronavirus outbreak. The Fed is highly unlikely to hike short-term interest rates in 2020 and odds are increasing that there will be more cuts to come. Credit spreads in traditional fixed income don’t leave much room for error. While the multiples of the U.S. equity market as a whole may be reasonable against a backdrop of continued domestic growth, there are pockets of valuations that warrant caution.

This is an environment where investors are well served by enhanced diversification into asset classes that play at the edges of traditional style boxes. Think hybrids—high yield bonds, convertible securities—as well as a lesser utilized category: the preferred security.*

Calamos has long used hybrids to purse a variety of asset allocation goals. With active management, hybrid securities provide advantages that may be especially differentiated during more challenging economic environments.

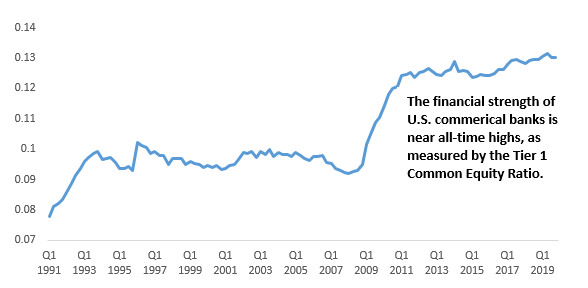

For example, today’s preferred securities market offers many opportunities for risk-conscious investors seeking income and the potential for total return. The preferred universe is dominated by financial companies, which are under higher regulatory scrutiny since the financial crisis. As a result, most of these companies exhibit strong balance sheet fundamentals. In addition to these quality attributes, many preferred securities offer high levels of current income in comparison to traditional fixed income.

Source: S&P Global Market Intelligence. Data above shows Tier 1 Common Equity Ratio, U.S. Commercial Banks. The ratio compares a bank’s common equity capital versus its total risk-weighted assets.

Preferreds offer another potential benefit: Frequently, the income paid on preferred securities is classified as qualified dividend income. Because qualified dividend income receives more favorable tax treatment than ordinary income, the preferred security may offer enhanced after-tax benefits.

Conclusion

Market conditions such as these call for added diversification and a broader view of opportunity. Since our founding in the 1970s, we have used hybrids to help investors capture income and total return. In 2019, the preferred securities market returned 18.39% while providing attractive income. Looking forward, we see further opportunities in preferreds, especially if interest rates decline.

We are using preferred securities in a number of our strategies. From an asset allocation standpoint, preferred securities can be used as a stand-alone allocation. They also lend themselves to opportunistic allocations in multi-asset and core-plus strategies. The combination of quality fundamentals, attractive current income and potential for tax-advantage treatment make preferred securities a compelling choice for many investors.

* Preferred securities are normally viewed as subordinated debt or senior equity instruments, sitting between the senior debt and common equity in a company’s capital structure.

Please remember that past performance may not be indicative of future results. Indexes are unmanaged, do not entail fees or expenses and are not available for direct investment.

The preferred securities market is measured by the ICE BofA US All Capital Securities Index. Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an ‘as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations. Fixed income securities entail interest rate risk and default risk.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice.

18762 0220O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.