Day by Day: How CPLIX Has Bested the Market YTD

In this market, every day is a battle—a fight to end the day positive or, if not positive, less negative than others.

Here’s how Calamos Phineus Long/Short Fund (CPLIX) has performed on that score this year:

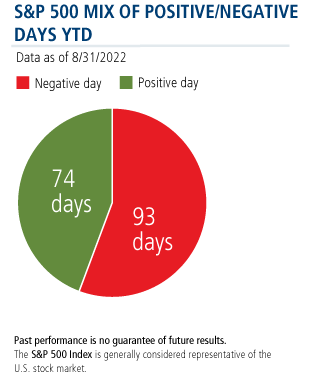

- The S&P 500 ended the day in the red 93 of 167 trading days as of August 31, or 56% of the time.

- On those down days in the market, CPLIX finished in the green 24% of the time (22 days).

- On 58 of those down days, almost two-thirds of the time (62%), the fund outperformed—i.e., finished positive or finished negative but not as negative relative to the S&P 500.

How do you help your clients remain invested and committed to the long term during volatile markets such as what’s been experienced this year? Many investment professionals have turned to CPLIX for the fund’s stated objective of pursuing equity-like returns with a superior risk profile over full market cycles.

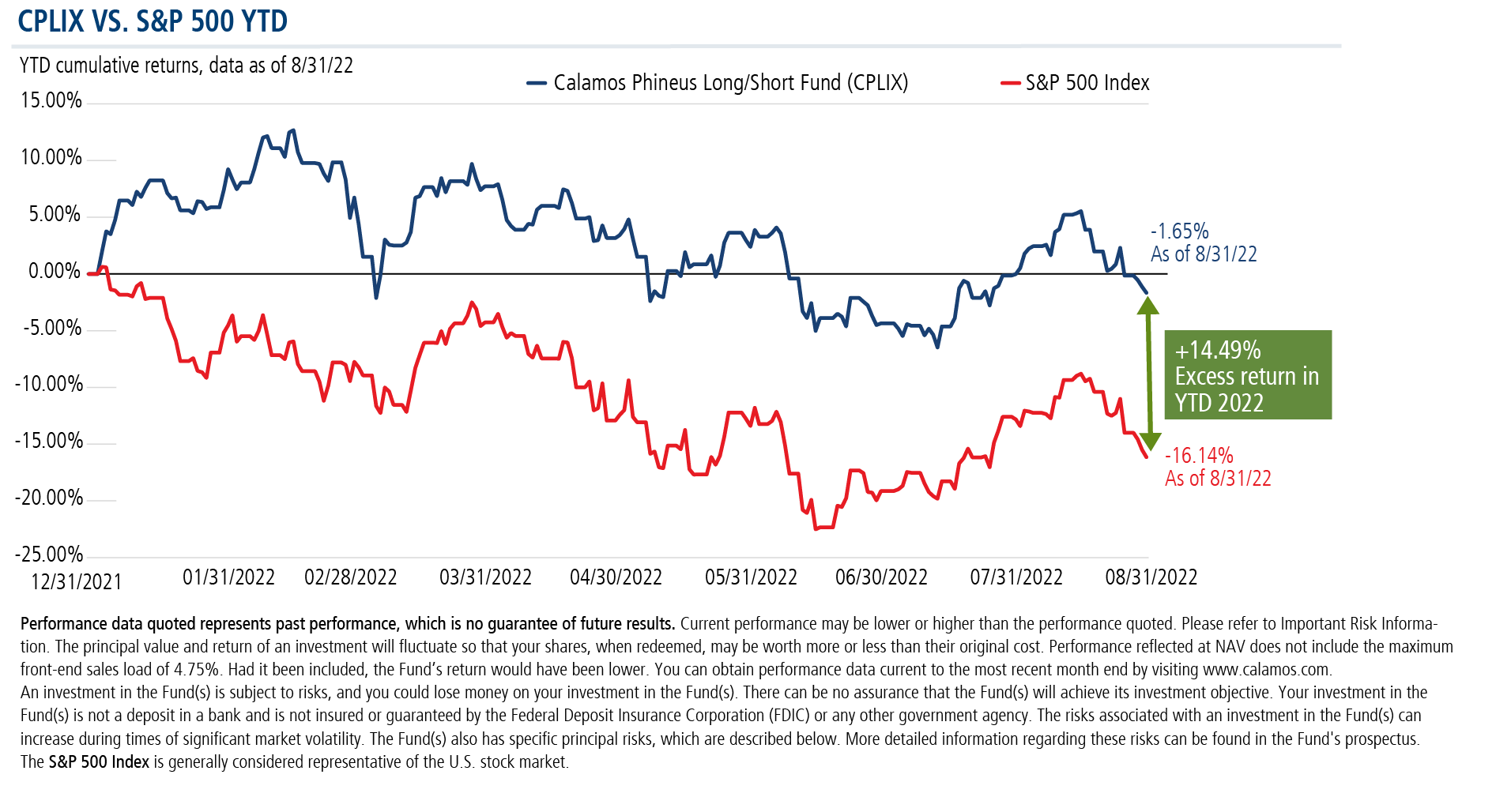

Through the end of August this year, the team managed by Michael Grant, Co-CIO, Head of Long/Short Strategies, and Senior Co-Portfolio Manager, has battled and won more days than the broad market, resulting in CPLIX’s year-to-date return of -1.65% versus the S&P’s loss of -16.14%. That’s a 1449 basis point outperformance.

“I never want [CPLIX] to be the problem fund in a client’s portfolio. I want investment professionals to have three or four or five other funds that they have to explain before they get to our fund,” Grant has said (see post)—and delivered on year to date.

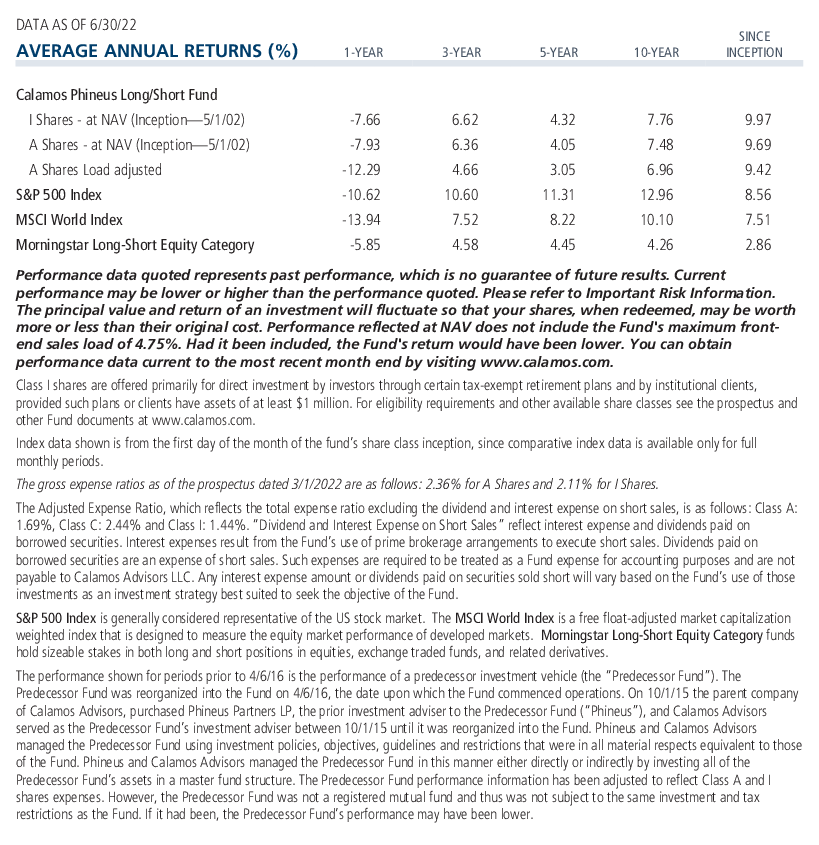

The fund has mitigated market volatility through the use of a 20-year risk managed strategy that’s outperformed both domestic and global equity markets during that time. The intent: to help clients feel comfortable about staying invested over the long haul.

For more information on CPLIX, including Grant’s outlook for the rest of the year and next, contact your Calamos Investment Consultant at 800-582-6959 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

820245 922

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on September 13, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.