CPLIX’s Grant on the ‘Dangerous Bridges to Cross’

Unlike at the start of the year when risks were skewed negatively, the opportunity/risk trade-off is more balanced today—depending on the bridges to cross. However, the opportunities are much more nuanced in a market environment that is challenged by the repricing of financial assets in the wake of rising interest rates.

“The macro backdrop feels threatening and confusing,” acknowledges Michael Grant, Co-CIO and Senior Co-Portfolio Manager of Calamos Phineus Long/Short Fund (CPLIX). “And yet the threats are possibilities. They’re not certainties, and therefore I’m thinking of them as dangerous bridges to cross.”

Grant expands on this view in his recently published 45-page Dangerous Bridges to Cross commentary, including narrative and charts. Dangerous Bridges is an Investment Professionals-only piece, available to be downloaded here.

Grant comments on:

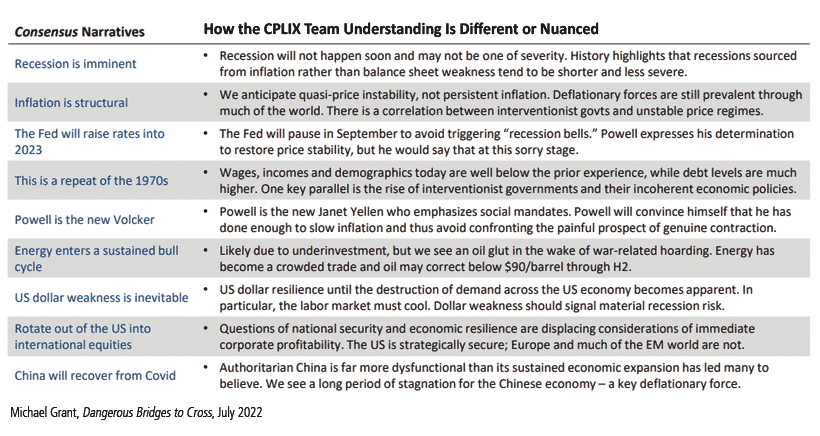

- Comet tails of confusion. “The mood is black as 2022 has been the worst start for the S&P 500 Index since 1970 and the worst for bonds on record as investors fear a recession is imminent. However,” Grant believes, “traditional analysis or logic may not necessarily apply to the unique features of the fallout of the pandemic.” Indeed, as shown above, Grant and team part ways or have a more nuanced take on some of the consensus themes.

- Economic slowdown, not recession. Investor trauma is translating into a fear of recession, he writes. However, financial and economic data is consistent with below trend growth rather than a full-blown recession. While real GDP growth at near 0% may fit the technical definition, economic characteristics normally associated with a recession are not currently present.

- Not the 1970s. Financial markets are struggling with the repricing of financial assets in an inflationary environment. The Fed “put” of maintaining interest rates at 0% is no longer available, notes Grant. While quasi-price instability may be more the norm, the comparison of today’s economic dynamics vs. that of the 1970s is a false equivalency, he says.

- Corporate profitability: Cracks in the wall. The true enemy of equities is not inflation, but rather deflation, according to Grant. Equity markets are repriced for slower growth. However, a nominal GDP (6%-8% in 2022) implies corporate profitability can be sustained into 2023 as consumers still evoke pent-up demand into services in the wake of the pandemic.

- Places to hide: CPLIX. Today's setting remains radically different from that seen in the aftermath of the Financial Crisis. Without inflation, things happen slowly. With inflation, things happen more quickly and asset allocation and risk mitigation matter. Clients should consider how to hedge themselves as the investment landscape is being reconstituted for the decade ahead, Grant recommends.

Dangerous Bridges is a companion to the fund’s commentary, available here. Investment professionals, also see this recently published analysis of CPLIX’s performance over the last 20 years. For information about Grant’s perspective or CPLIX, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

810231 822

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on August 17, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.