No Recession and the Value of a Long/Short Model: Grant Talks the CPLIX Book on Animal Spirits Podcast

Calamos Co-CIO and Head of Long/Short Strategies Michael Grant sees two possible paths forward:

-

No recession this year, which is what he expects.

To listen to the full interview, you’ll find the podcast on the major podcast platforms, including Apple Podcasts, Android, Spotify and Stitcher.

To listen to the full interview, you’ll find the podcast on the major podcast platforms, including Apple Podcasts, Android, Spotify and Stitcher.“The pullback in financial asset prices has been so extreme over the past six months that it has generated the kind of trauma for investors that they normally associate with economic recession,” Grant, also Senior Co-Portfolio Manager of Calamos Phineus Long/Short Fund (CPLIX), said in a 32-minute interview this week on the Animal Spirits Talk Your Book podcast with hosts Michael Batnick and Ben Carlson.

But, he said, available data suggests the economy is simply moving from above-trend growth to below-trend growth, not heading into a recession.

“If a recession was about to happen, we should be seeing it in indicators of credit stress. We are not,” according to Grant. “Every recession in history was preceded by the three-month to two-year or three-month to 10-year curve inverted. Every single one. We're nowhere near that point.” Consumer finances, job markets and the private sector all are in good and even remarkable condition, he added. -

Recession, which may be what some in the investment community expect but is not priced into stock prices today. If the economy were to experience actual recession with a 25% downturn in earnings, the S&P 500 would decline to 3,500 or below, Grant predicted.

Grant believes there will be no recession until 2024 or 2025. “Between where we are today and then, there is a lot of wood to chop,” he said. “If we can get to the point where it looks like inflation is taming down and the Fed feels more comfortable with its policy and says, 'You know what, we're done for now,’ and there are two more years left on the expansion, I think stocks can go higher.”

General lack of clarity about the direction of the economy has to do with uncertainty surrounding inflation, what Grant called “the paramount question of the moment,” and investors “being held hostage to the US 10-year yield.”

“I think the Fed's first priority is to provide cover for its late intervention. It needs to get rates to 2.5%, which will happen in September,” said Grant. “At that point, I think the Fed will be able to pause. Politically, this will enable the Fed to be perceived as less hawkish, especially if it can start to see the inflation numbers in different parts of the economy improving. I think that's likely at that point.”

Without a pause, “if the Fed follows market expectations and continues to tighten into spring of next year, then I think we're probably in recession by late 2023.”

However, he continued, “if the Fed pauses this autumn, I think the soft landing is still the best bet.”

Leaning In and Out of Equity Risk

Carlson introduced the discussion by commenting on the challenge of a long/short strategy.

“One of the hard things that I learned from tracking hedge funds back in the day,” Carlson said, “is that long/short funds have a lot of ways to be wrong, because it's not only about picking the right sectors and the right stocks and then which ones to go long and which ones to go short, but it's how much do you short, how much do you go long? What's your net and your gross exposure? Do you have leverage on? How do you balance out your longs and shorts?”

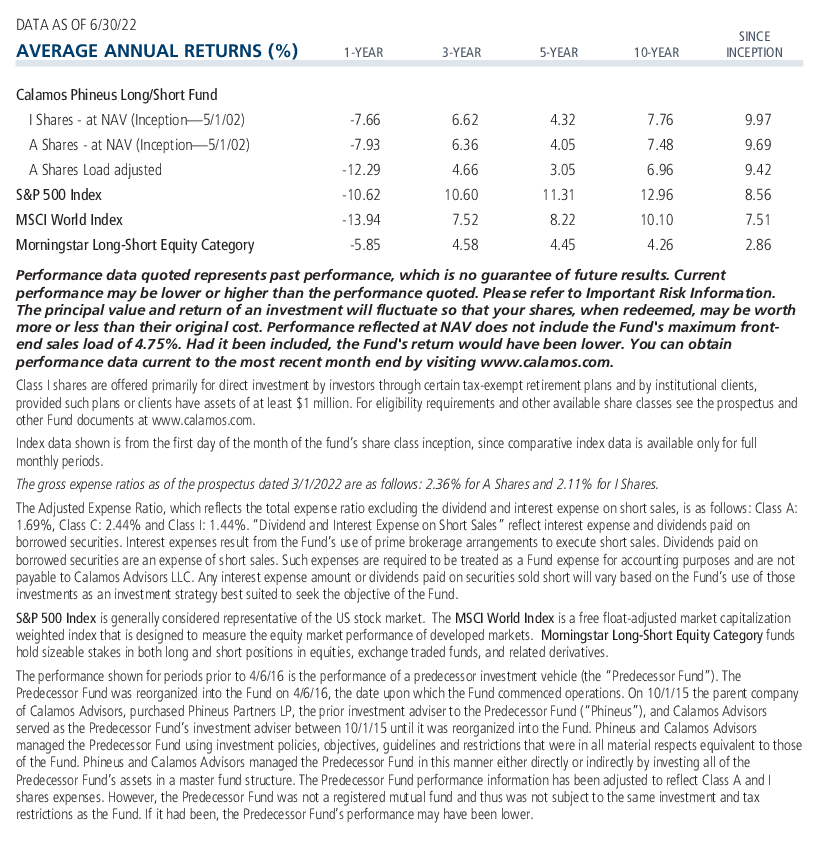

Asked to explain CPLIX’s outperformance year-to-date against its benchmark and peers in the Morningstar Long-Short Equity Category (see post), Grant said, “As usual, there are several themes. One of the big themes, of course, is that we stepped away from the long duration parts of the equity world, the growth technology concept names that could be dramatically repriced if interest rates went higher, because the truth is we had a bull market in stupidity because of all this free money [historically low interest rates facilitating unjustifiable equity valuations].

"When people think about alternatives, they think, oh good, they're avoiding risk. No, no, no, no, no. If you avoid risk, you avoid return. The key is to understand when you are paid properly for taking that unit of risk, because if I'm paid properly, I should be leaning aggressively into it."

“Being underweight in that part of the market meant that if we got something wrong, the stock was down 20%, not 70%. We know the damage that's happened in that part of the market.”

Grant went on to comment on “the real value of a long/short model. Unfortunately, many long/short funds are what I call ‘long light’. They promise you 70% of the upside for 60% of the downside, and they don't try and actively manage their equity risk.”

By contrast, he continued, “I think that deciding whether we're properly paid to engage equity risk is the core of anything that calls itself an alternative. For example, we can be 80% net long, or we can be 20% net short. In other words, we can be outright short. So, our willingness to lean into equity risk or lean out of equity risk as we did late last year and the early part of this year was a key reason we were able to protect capital.”

The conversation included a back and forth between Grant and the hosts on allocation decisions related to regime shifts, bottom-up portfolio construction, value versus growth stocks, and the difficulty of shorting stocks.

“There are a few moments in financial history where the alpha opportunity on the short side is broad—2000, 2008 and 15 months ago. But outside of those windows of time, shorting over the long term is for losers,” Grant said.

“The real money in the US economy is always on the long side of some economic value equation. The short book can be important at times to reduce risk or to reduce beta and to control the volatility tails in the financial cycle. That’s absolutely true. But the real money is still made in the long book.”

“Therefore,” Grant continued, “what you want to do when we enter these periods of financial asset repricing, which is what we've gone through in the last six months, is we want to behave like a market neutral fund. We want to use the short book to cut off that volatility tail.

“But after that storm has passed, after the ferocity of it is largely done, it's far better for us to ask where can we really make money on the long side at this point, because everything's been taken down.”

Carlson followed up by asking, “So you guys have obviously done really well this year by going to a more defensive posture. How do you get over the psychological hurdle of wanting to stay there because it feels more comfortable than going out and taking some more risk again?”

Grant’s response: “I would flip it around and say that I feel far more comfortable taking risk than sitting in cash. What I have to do is fight the temptation to buy into the decline too early. The reason is that at the end of the day, in the long-term we believe in equities, and we tell our clients to believe in equities. Therefore, in the middle of the storm, we have to have the courage to embrace that and start leaning into risk again.

“When people think about alternatives, they think, oh good, they're avoiding risk. No, no, no, no, no. If you avoid risk, you avoid return. The key is to understand when you are paid properly for taking that unit of risk, because if I'm paid properly, I should be leaning aggressively into it.”

CPLIX has had above average net exposure, compared to its historical levels, throughout 2022.

To listen to the full interview, you’ll find the podcast on the major podcast platforms, including Apple Podcasts, Android, Spotify and Stitcher.

Investment professionals, for more about Grant’s outlook or CPLIX, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

810182 0622

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on July 05, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.