CPLIX: Hedged Against a Near-term Downturn While Expecting a Late Summer Bounce Back

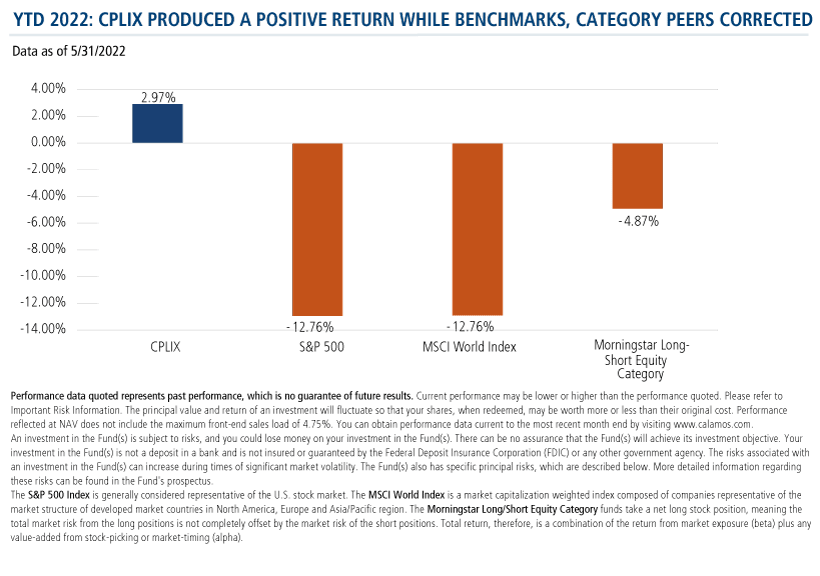

Calamos Co-CIO, Senior Co-Portfolio Manager and Head of Long/Short Strategies Michael Grant’s read on the economy has served him and the Calamos Phineus Long/Short Fund well this year. CPLIX closed the five months ended May 31 with a 2.97% return vs. the -12.76% and -4.87% declines of the S&P 500 and Morningstar Long-Short Category, respectively.

And, Grant told a group of investment professionals last week, his views have not been altered by May’s recent market tumult. He believes the Fed has a “sporting chance” of achieving a soft landing as the economy slows but avoids recession until 2024 or 2025.

Grant cited several factors to support his view. He remains positive on the consumer, noting income growth at a 30-year high. In addition, in spite of rising interest rates, the real estate market continues to remain strong with housing supply at 30-year lows. Household balance sheets are healthy, as many have deleveraged over the past several years. Corporate earnings, in several sectors, remain healthy as pent-up demand in the services area post-Covid are being met. Supply chain delivery issues will continue to abate.

“Current market volatility,” he emphasized, “is predicated on the repricing of financial assets in an inflationary environment, rather than a corporate earnings crisis.”

Grant can see a scenario where the market begins to understand that inflation is moderating and when core inflation itself shrinks to 3% by spring 2023. Starting in late summer, he said, there could be a three- to six-month move where the S&P could effectively retrace two-thirds of what’s been lost, getting back to 4500.

As the Fed continues to ramp up rates, the next four to eight weeks will be what Grant calls “a window of vulnerability. The key question is whether the next 400 points on the S&P are up or down. I can see both.”

All eyes are focused on inflation and interest rates, he acknowledged. “The Fed has a real problem today. The problem is that it looks negligent for having stuck near zero range-bound for far too long. They need to get those short-term rates somewhere in the neutral ballpark for credibility. And I would define that rate at 2%, which should be achieved over that four- to eight-week period.”

Once short rates are at 2%, Grant reasons, the Fed can pull back on its professed “hawkishness.”

“[Federal Reserve Chairman Jerome] Powell has to talk tough because he doesn’t want to lose control of the bond market or long-term inflationary pressures. But the idea that he genuinely wants to push demand into any kind of contractionary state is ludicrous,” according to Grant.

“If we can get to July, the Fed will acknowledge the tightening of financial conditions that has taken place. I equally think the worse part of the inflation scare will start to ease,” he believes.

But he makes room for the possibility that things don’t proceed smoothly. “Could we get a bit of a panic, a de-risking cycle or a forced liquidation because there’s still mispositioning in the market? Yes, we can. We don’t want to be Pollyannaish and ignore the possibility.”

Given that, the CPLIX team is using SPY hedges to defend the portfolio between here and 3500. “I would be surprised if we get anywhere near there but let’s face it, financial asset repricing could take us there.”

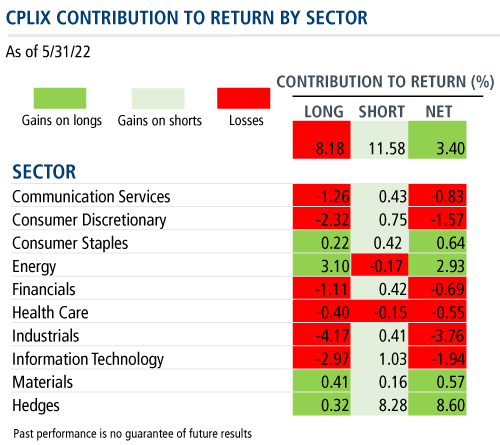

Specific sector hedges—in consumer staples, energy and semi-conductors—are also part of the fund’s strategy. At right is the latest estimated attribution data available to be published.

May 2022: Mayhem and Then a Flat Finish

The S&P 500 in May ended at 4132 or right about where the month began—a performance that belied the intra-month volatility that included a 7.8% drop.

- CPLIX was one of just 402—or 6%—of actively managed funds that generated a positive return YTD through May.

- Of those funds with positive YTD performance, about one-third are alternative strategies.

- Within Morningstar’s Long-Short Equity category, CPLIX is one of only 19 funds with positive YTD returns.

Three Cautions

For those charged with navigating these markets, Grant offered three cautions:

- We are shifting to a world of “quasi-price instability, and that creates different winners and losers.” When prices are stable, as they were for the last 30 years, explained Grant, “you didn’t have to worry about your cost of goods sold. You knew your labor costs would be stable. You knew your interest costs would be stable. And that led to corporations to focus entirely on their top line, sales growth, and the markets followed that focus.” Longer duration assets, whose valuations are based on longer term results, are more vulnerable to this dynamic.

-

Technology is confronting a range of problems, and that’s a big issue because “40% of the market is technology.”

Earnings and cash flow matter, said Grant, cautioning against long duration assets. “Technology became the longest duration asset in equities, with everyone focused purely on sales at the expense of more traditional measures. The market, even when it bottoms, is not going to go back to those technology or concept stories that were all about growth and not about the urgency of cash flow.” - What’s going on in China is also unnerving investors, Grant said. The economic impact of the government’s zero-Covid policy may be a four-, five- or six-quarter problem affecting the supply chain, he said. But beyond that, China has multiple other issues, including its debt, real estate, demographic and long-term growth model challenges. “I don’t want to be exposed to companies who rely too heavily on China,” he said.

Looking ahead, Grant sees investors on a “journey from inflation anxiety to inevitable recession. It will be a prolonged one, including many notable stages including some windows where equities will do quite well.” That being the case, he argued against an outright defensive posture in favor of “tactical risk management nuance. Certain sectors may do well, others likely not.”

Investment professionals, reach out to your Calamos Investment Consultant to learn more about how Grant is managing CPLIX to pursue the opportunities ahead. You can reach him or her at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

810157 0622

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

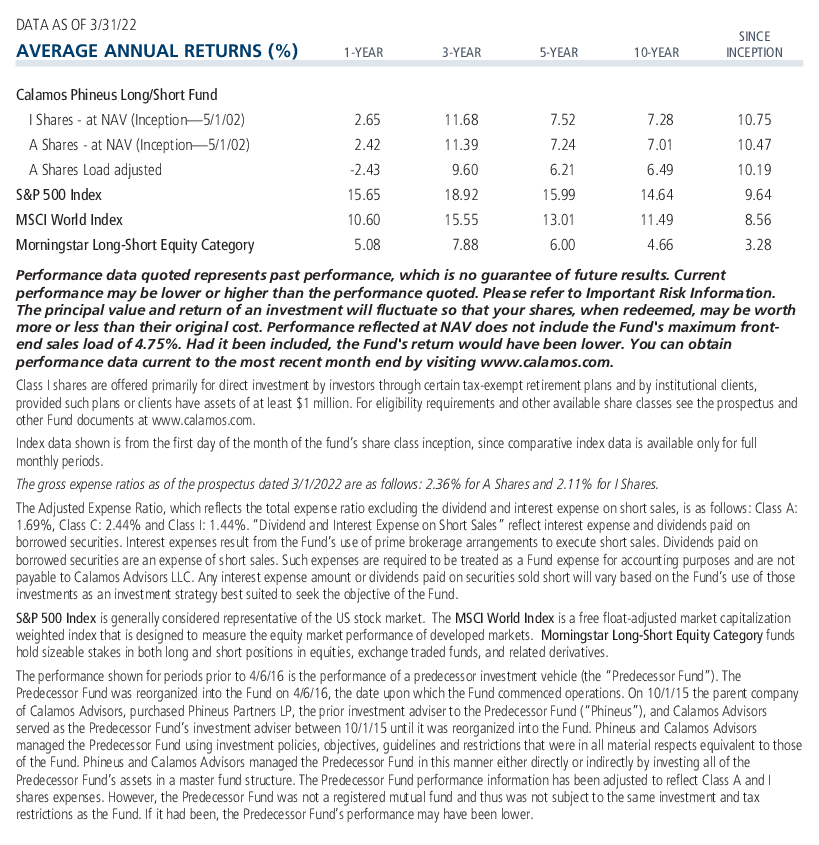

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on June 06, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.