How to Keep Your Clients From Calling the Market Top

The S&P 500 had its best first half of the year in 22 years and its best June since 1955. And yet, many investors have been calling the end of the bull market for months.

Flows out of equities and into bonds are now at extreme levels. As reported in the June 17 issue of the Calamos Weekly Alternatives Snapshot, the divergence between the two asset classes is the largest it’s been in more than 15 years.

Financial advisors’ client conversations at this point cover the gamut. At one extreme are the talks with those who have been invested but now want out of the market, believing a correction is overdue. And then there are the communications with clients in cash, wondering if they should plunge back in.

Here’s how you can add value right now: Introduce Calamos Hedged Equity Fund (CIHEX), a fund whose experienced portfolio management doesn’t try to call the market.

The fund has two distinct parts—equities and options. While the equity investment represents a portfolio closely based on the S&P 500, the potential alpha generation comes mainly from trading options and constructing what the team believes is the best possible hedge for the specific market environment.

“The goal is to construct the best hedge based on what the market is giving us,” explains Eli Pars, CFA, Co-CIO, Head of Alternative Strategies & Co-Head of Convertible Strategies and Senior Co-Portfolio Manager.

“We don’t have much of an opinion about the market, but we do have an idea where volatility normally trades. We don’t make big bets on the direction. Our strategy is more about the best trade we can get based on the volatility regime that we are in.”

CIHEX continuously searches for a hedge that provides as much potential downside protection as possible, while giving up as little participation as possible in a market rally.

CIHEX Can Help Avoid Missed Opportunities

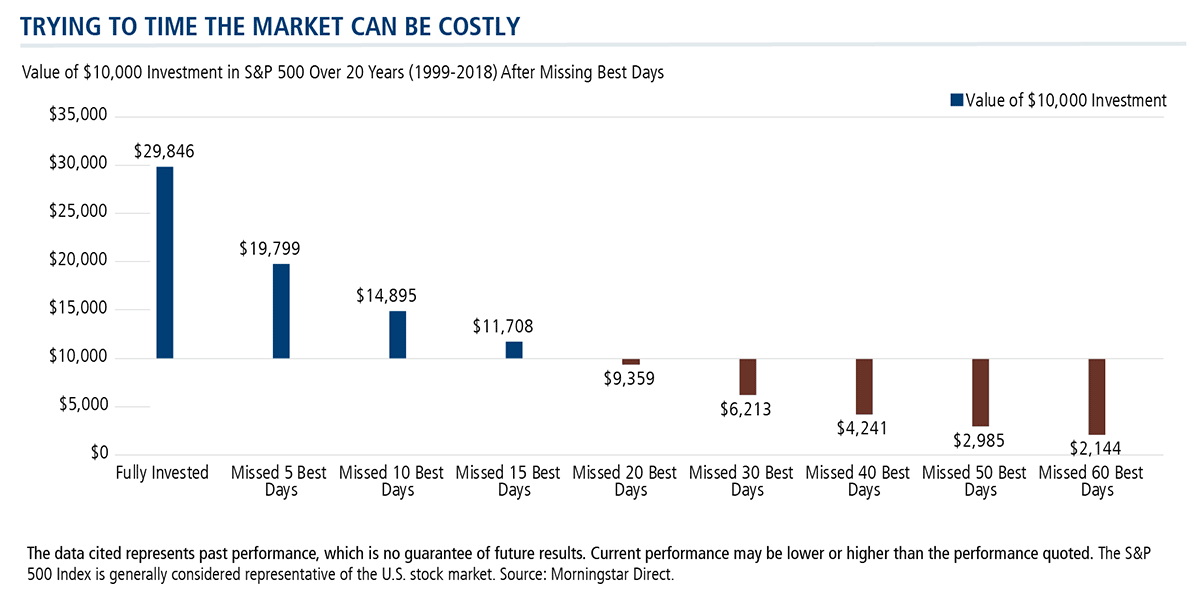

With its focus on aiming to dampen volatility, CIHEX can help ease your clients’ urge to market-time. It’s no secret that timing the market is a risky strategy because market-timers often miss the market’s best days. And even a handful of days can make a sharp difference in investment returns.

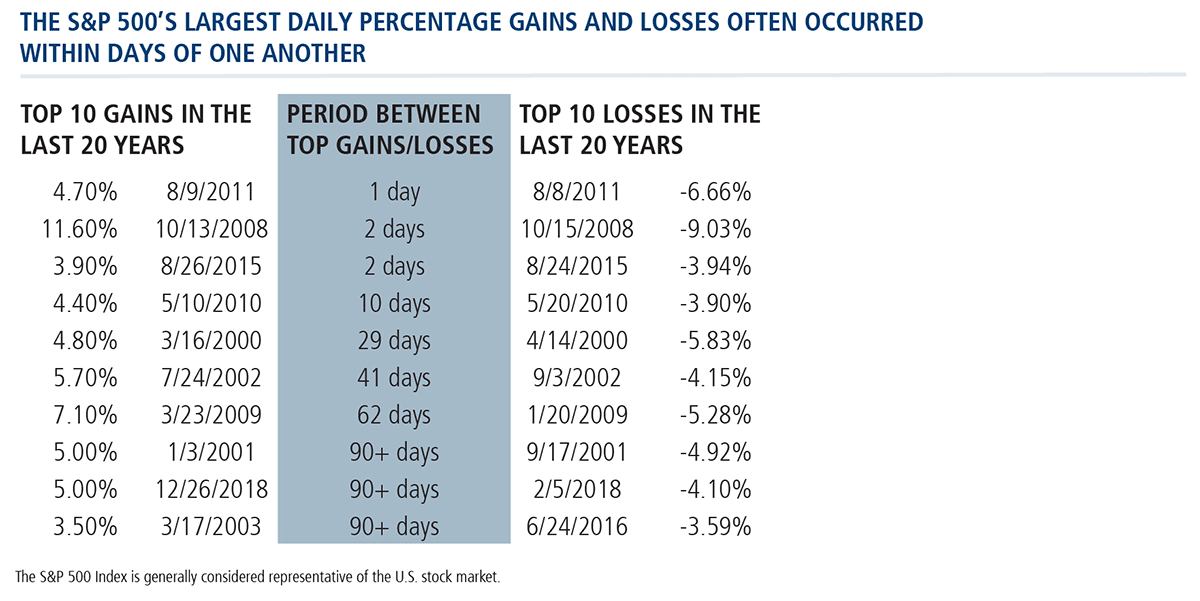

To complicate matters, it’s not unusual for a year's best gains to occur right before or right after the year's worst losses—sometimes it’s just a matter of days. The table below makes the point, showing that seven of the S&P 500’s 10 largest daily percentage gains over the last 20 years took place within days or weeks of the deepest drawdowns.

Adding to the potential risk of market timing, there is little evidence that retail investors can time or hold unhedged equities across full market cycles. If they try to leave the market and jump back in at just the right time, chances are high that they’ll fail. And the opportunity cost is high:

The client who stayed fully vested over the last 20 years would have almost tripled his or her initial investment. But, by missing the best 60 days, the client's initial investment would have shrunk to just $2,144.

The hedged equity approach of CIHEX is designed to help your clients remain invested across full market cycles.

Advisors, to learn more about CIHEX, talk with your Calamos Investment Consultant, who can be reached at 888-571-2567 or caminfo@calamos.com.

Calamos was #1 in flows to funds in the Morningstar Alternatives Category in 2018, and ranks fourth on the list of alternative fund managers by assets under management as of 5/31/19.

Click here to view CIHEX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk—the Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put of call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment advisor to predict pertinent market movements, which cannot be assured.

Alternative investments are not suitable for all investors.

The S&P 500 Index is generally considered representative of the U.S. stock market.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market of SEC-registered securities. The index includes bonds from the Treasury, Government-Related, Corporate, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS sectors.

©2019 Calamos Investments LLC. All Rights Reserved. Calamos® and Calamos Investments® are registered trademarks of Calamos Investments LLC.

801640 0719

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on July 01, 2020Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.