As of March 1, Calamos Hedged Equity Income Fund’s name has been changed to Calamos Hedged Equity Fund.

We’re happy any time the media recognizes the advantages of active management, and there’s more of that kind of commentary appearing in the wake of 2018’s volatility and multiple drawdowns. But we need to push back on one suggestion published last week:

“One of the best ways active managers can earn their money in a down market is by holding cash, which is something index funds are not able to do…cash management is the secret weapon for most active managers.”

Financial advisors, understand that holding cash is the very least that Calamos alternative active management does during volatility.

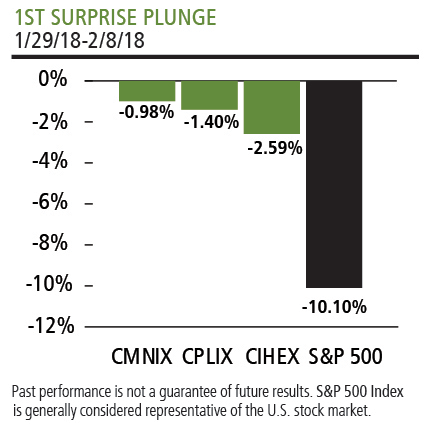

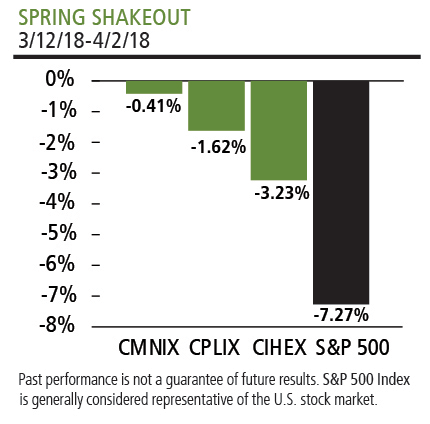

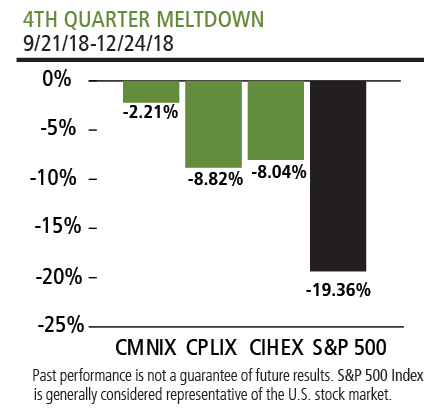

Calamos alternatives’ performance in 2018 benefited from a portfolio management toolbox that includes short-term fixed income, short-selling, derivatives (i.e., options strategies, futures contracts, etc.) and convertible arbitrage.

Together these are what enabled our alternatives portfolio managers to preserve capital by minimizing the effect of the year’s repeated drawdowns.

Our alternatives worked in 2018 because of the effectiveness of the full range and dynamism of our active strategies.

Also see:

CIHEX Beats Back 3 Equity Market Drawdowns to Finish 2018 Positive

1000 Basis Points: CPLIX’s Q4 Difference

Advisors, for additional information about Calamos’ hard-working alternative funds, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Calamos is the fourth largest alternatives manager by assets under management and #1 in alternative flows for 2018 (Morningstar data, 12/31/18).

Click here to view CMNIX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Alternative investments may not be suitable for all investors.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Covered Call Writing: As the writer of a covered call option on a security, the fund foregoes, during the option’s life, the opportunity to profit from increases in the market value of the security, covering the call option above the sum of the premium and the exercise price of the call.

Convertible Securities Risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also, may have an effect on the convertible security’s investment value.

Convertible Arbitrage Risk: If the market price of the underlying common stock increases above the conversion price on a convertible security, the price of the convertible security will increase. The fund’s increased liability on any outstanding short position would, in whole or in part, reduce this gain.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk.

The principal risks of investing in the Calamos Hedged Equity Income Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

S&P 500 Index is generally considered representative of the U.S. stock market.

MSCI World Index is a market capitalization weighted index composed of companies representative of the market structure of 21 developed market countries in North America, Europe, and the Asia/Pacific region.

Unmanaged index returns assume reinvestment of any and all distributions and do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

Citigroup 30-Day T-Bill Index is generally considered representative of the performance of short-term money market instruments.

Bloomberg Barclays U.S. Government/Credit Index comprises long-term government and investment grade corporate debt securities and is generally considered representative of the performance of the broad U.S. bond market. Unlike convertible bonds, U.S. Treasury bills are backed by the full faith and credit of the U.S. government and offer a guarantee as to the timely repayment of principal and interest.

Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

Morningstar Market Neutral Category represent funds that attempt to eliminate the risks of the market by holding 50% of assets in long positions in stocks and 50% of assets in short positions.Morningstar Long/Short Equity Category funds take a net long stock position, meaning the total market risk from the long positions is not completely offset by the market risk of the short positions. Total return, therefore, is a combination of the return from market exposure (beta) plus any value-added from stock-picking or market-timing (alpha).

Morningstar Options-based Category funds use options as a significant and consistent part of their overall investment strategy. Trading options may introduce asymmetric return properties to an equity investment portfolio. These investments may use a variety of strategies, including but not limited to: put writing, covered call writing, option spread, options-based hedged equity, and collar strategies. In addition, option writing funds may seek to generate a portion of their returns, either indirectly or directly, from the volatility risk premium associated with options trading strategies.

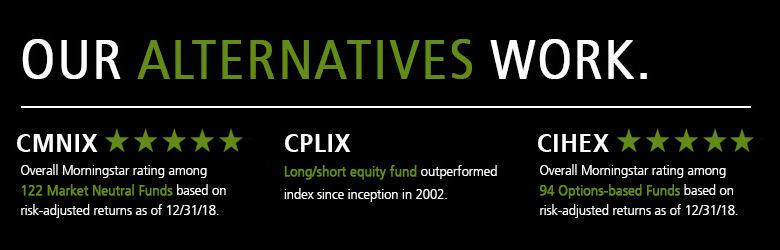

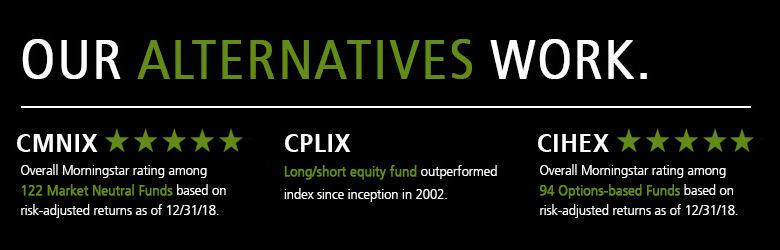

Calamos Market Neutral Income Fund’s load-waived Class I shares received 4 stars for 3 years, 4 stars for 5 years, and 5 stars for 10 years out of 122, 98 and 31 Market Neutral funds, respectively, for the period ended 12/31/18.

Calamos Hedged Equity Income Fund’s load-waived Class I shares received 5 stars for 3 years out of 94 Options-based funds for the period ended 12/31/18.

Morningstar Ratings™ are based on risk-adjusted returns and are through 12/31/18 for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2019 Morningstar, Inc.