Investment Team Voices Home Page

Investment Team Voices Home Page

Perspectives on Innovation: Ingredient Companies Provide Appetizing Growth Potential

- We believe companies that are aligned with sustainability themes have a competitive advantage and are better positioned to outperform.

- Packaged food companies face many risks, including fast-changing consumer preferences, intense competition, displacement by private labels, food safety, and increased retail consolidation.

- By investing in ingredient companies instead of packaged food companies, we believe we can mitigate key risks while also gaining exposure to long-term secular growth trends, including those related to consumers’ increased focus on health and sustainability.

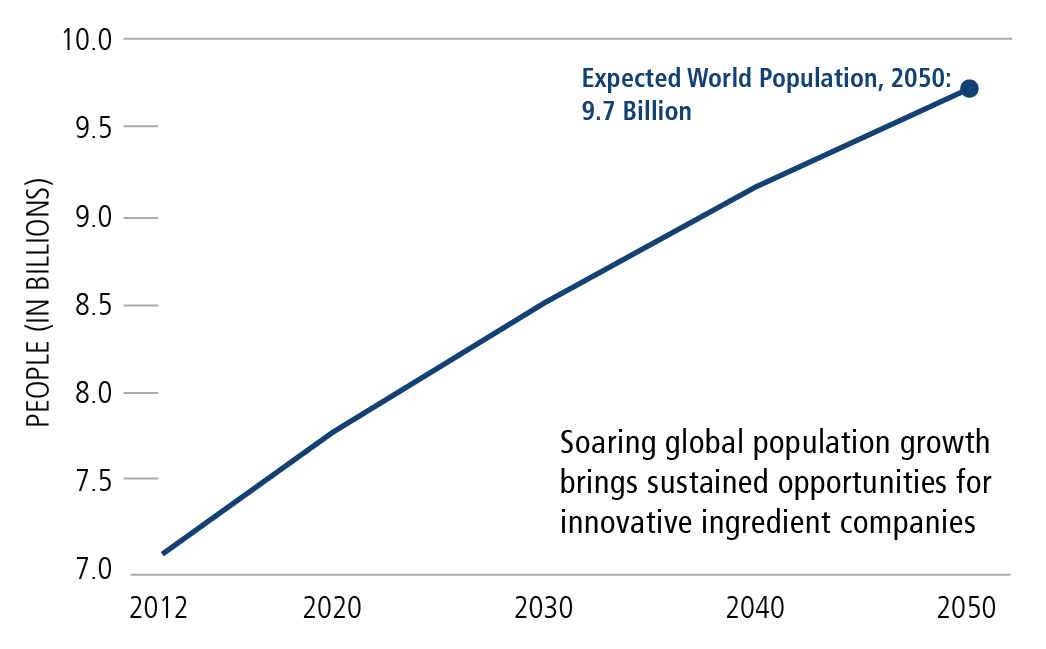

The global population is expected to reach 9.7 billion by 2050, and with it, the demand for food and beverage products will grow. This creates opportunities for ingredient makers to provide the value-added inputs needed to meet demand. For example, ingredients are used to improve the taste, texture, and shelf life of food products. They are also used to make bread rise, to curdle milk, and to break down starches in fruits and vegetables. Ingredients can enhance product quality, reduce environmental impacts, improve safety, and lead to significant cost savings.

Global Population Growth Sets the Table for Ingredient Innovators

Source: FAO. 2018. The future of food and agriculture – Alternative pathways to 2050. Rome.

Three Reasons Why Ingredient Companies are Well Positioned for Future Growth:

- Ingredient companies can help food and beverage companies stay ahead of the curve. The food and beverage industry is constantly evolving, creating opportunities for ingredient producers. Innovative foods can be derived from plants, animals, or microorganisms and are replacing traditional ingredients that are perceived as unhealthy or unsustainable.

- Ingredient companies can help enhance and improve the nutritional value of foods. Consumers are increasingly concerned about health and wellness. As such, demand for foods that are high in nutrients and low in unhealthy ingredients will likely grow at a faster pace than the overall packaged foods industry. Novel ingredients enable food products to retain desired characteristics but with less sugar, salt, and fat. They can also help to boost the immune system, improve gut health, or reduce the risk of chronic diseases.

- Ingredient companies can reduce contamination risk for food manufacturers. Even a small outbreak of food poisoning can have a devastating impact on brand reputation and sales. Ingredients can improve the safety of food products by reducing the risk of foodborne illness. For example, probiotics can be used to improve the gut health of animals, which can reduce the risk of contamination.

Our investment process emphasizes high-quality companies with track records of profitability and continued growth potential. Ingredient companies have tended to have strong financial performance, with high profit margins and stable revenue streams—providing an attractive hunting ground for our approach.

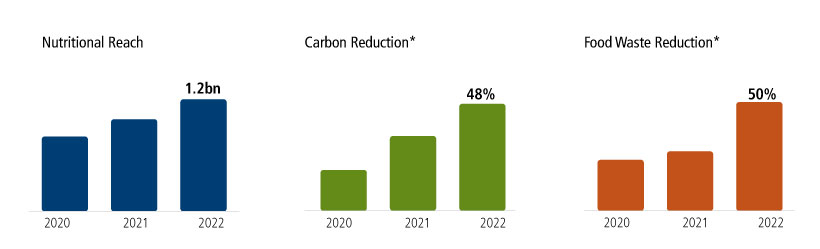

Case Studies in Innovation: Kerry Group

Headquartered in Ireland, Kerry Group develops ingredients that food companies need to be competitive and mitigate risk. Kerry stands out as a global leader in the ingredients space because of its unparalleled breadth of technologies and its holistic approach to innovation. Kerry has led the industry transformation into a total solutions supplier. The company now provides ingredients for the entire product spectrum and its collaborative partner model cultivates a customer ecosystem that gives Kerry a head start on the competition and locks in long-term demand. Also, the company has a large group of scientists targeting changing consumer behavior. As a result, Kerry is at the forefront of secular growth trends, including sustainable and plant-based foods, local food production, food waste reduction initiatives, and healthy living.

Kerry Group: Business Strategy Aligns with a Global Focus on Sustainability and Human Development

Source: Kerry Group, www.kerry.com, “CAGNY 2023 Conference, Inspiring Food, Nourishing Life.” Nutritional reach by consumer. * Reduction versus 2017 baseline (Scope 1 and 2 carbon reduction).

About the authors

Jim Madden, CFA; Tony Tursich, CFA; and Beth Williamson manage the Calamos sustainable equities suite, including Calamos Antetokounmpo Global Sustainable Equities ETF (SROI) and Calamos Antetokounmpo Sustainable Equities Fund (SROIX), as well as separately managed portfolios. Our team has been at the forefront of sustainable investing since 1997 and launched one of the first fossil-fuel-free funds in the United States. Prior to Calamos Investments, Jim, Tony, and Beth were portfolio managers for the Trillium ESG Global Equity Fund Retail (PORTX).

More Perspectives on Innovation

- Sustainable Building Trends Drive Investment Opportunity

- Biodiversity is Abuzz

- Stock Exchanges, A Catalyst for Improved Transparency

- Sustainable Commodities

- The China Conundrum

- We are Bullish on Energy

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

19116 0823

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.