Investment Team Voices Home Page

Investment Team Voices Home Page

Perspectives on Innovation: Biodiversity is Abuzz

- Many businesses depend on natural capital, which means threats to biodiversity (the variation of life in an ecosystem) can give rise to economic and business risks.

- The Calamos Sustainable Equities Team has long understood that nature-related risks can impact business strategies.

- Companies in diverse industries are working to reduce biodiversity loss, including agricultural equipment leader Deere & Co.

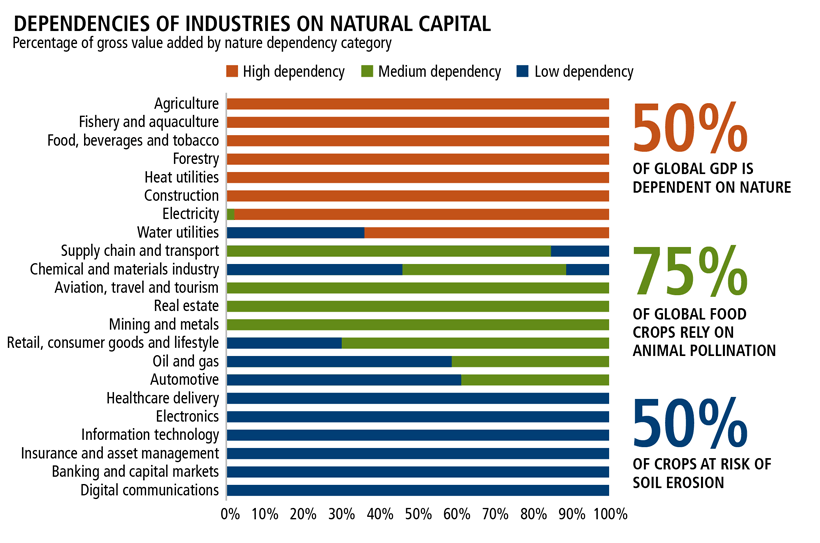

There’s growing buzz around biodiversity as a new environmental metric—and for good reason. According to the World Economic Forum, more than half of the world’s total GDP ($44 trillion of economic value generation) is moderately or highly dependent on nature and its services. As a result, exposed risks from nature loss are material risks to companies and investment portfolios.1

Source: MSCI ESG Research, World Economic Forum and PwC, 2020. “Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy,” Intergovernmental Science Policy Platform on Biodiversity and Ecosystem Services (IPBES), 2020. “The Global Assessment Report on Biodiversity and Ecosystem Services.”

New measures provide increased clarity around companies’ biodiversity risks

In December 2022, representatives from 188 governments gathered in Montreal for COP15 and agreed to ambitious goals and 23 targets under the Global Biodiversity Framework (GBF), including a commitment to conserve and manage 30% of the world’s lands, inland waters, coastal areas and oceans by the end of the decade.

According to the World Wildlife Fund’s “Living Planet Report 2022,”3 there has been an average 69% decline in the relative abundance of monitored wildlife populations around the world between 1970 and 2018. These drastic declines demonstrate that biodiversity, defined as the variety of life (plants, bacteria, animals, and humans) in a specified ecosystem, is in dire jeopardy.

Biodiversity loss and climate change are inextricably intertwined. Both are driven by human economic activities and mutually reinforce each other. Neither can be resolved unless both are confronted concurrently.

Notable to the investment community is Target 15, which states that businesses must assess and disclose biodiversity dependencies, impacts and risks and reduce negative impacts. Target 15 advances the mission of the Taskforce on Nature-related Financial Disclosures (TNFD). TNFD is comprised of 40 individuals from across the finance sector, businesses, and market service providers, representing $20.6 trillion in assets under management and 70% of the globally systemic banks (G-SIB). Their mission is to develop and deliver a risk-management and disclosure framework for organizations to report and act on biodiversity-related risks, “with the ultimate aim of supporting a shift in global financial flows away from nature-negative outcomes and toward nature-positive outcomes.”2 The TNFD framework will be published in September 2023 and will include recommended disclosures aligned with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

Greater transparency around nonfinancial risks benefits all investors. The Calamos Sustainable Equities Team applauds the work and recognizes the myriad roles organizations have taken on to bring nonfinancial disclosures to the forefront. We strongly believe that the TNFD framework will improve companies’ transparency and disclosures surrounding their nature-related risks and opportunities. Moreover, we believe a brighter spotlight on nature-related risks will ultimately assist companies in optimizing their business strategies while reducing their ecological impacts and risks.

Although more disclosures are always welcomed, natural capital is not a new concept to us. In fact, in a recent piece written by our team, entitled Perspectives on Innovation: Sustainable Commodities, we note that “we are focused on sustainable commodities sourced from natural capital-rich regions with proficient production and processing techniques that add value and mitigate negative impacts on local ecosystems.”

As we seek out high-quality growth opportunities, our investment process considers both traditional financial risks and the nonfinancial risks many investors may overlook. Since our earliest days managing sustainable strategies in the 1990s, we have considered “nature-related” risks and opportunities across potential investment candidates. Our investment approach utilizes our proprietary framework, co-created with the Global Footprint Network, to identify investment opportunities that can operate and create shareholder value in an increasingly environmentally constrained future.

Case Study: Deere & Co.

One example of a non-commodity-based company working to reduce biodiversity loss is Deere & Co.

Food production is the most significant driver of terrestrial biodiversity loss. As the global population grows, the enormous problem of producing sufficient food in a sustainable manner will only intensify. Technological innovations and sustainable food production systems, such as those offered by Deere can decrease the sector’s contribution to biodiversity loss while potentially providing a positive economic impact.

Specifically, Deere’s ST Series strip-till product line reduces soil disruption improving a farmer’s soil health and reducing biodiversity loss. The company’s See & Spray Select reduces the volume of chemicals applied, creating an overall positive outcome for the farmer’s economics as well as the health of the soil, waterways, and biodiversity.

About the authors

Jim Madden, CFA; Tony Tursich, CFA; and Beth Williamson manage the Calamos sustainable equities suite, including Calamos Antetokounmpo Global Sustainable Equities ETF (SROI) and Calamos Antetokounmpo Sustainable Equities Fund (SROIX), as well as separately managed portfolios. Our team has been at the forefront of sustainable investing since 1997 and launched one of the first fossil-fuel-free funds in the United States.

More Perspectives on Innovation

- Sustainable Building Trends Drive Investment Opportunity

- Stock Exchanges, A Catalyst for Improved Transparency

- Sustainable Commodities

- The China Conundrum

- We are Bullish on Energy

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

1World Economic Forum, “Nature Risk Rising, Why the Crisis Engulfing Nature Matters for Business and the Economy.” 2020, www.weforum.org.

2Environmental Finance, “Biodiversity Insight 2023,” www.environmental-finance.com.

3World Wildlife Fund, “Living Planet Report 2022, Building a Nature-Positive Society,” wwf.panda.org.

4Global Footprint Network, “One Planet Prosperity,” www.footprintnetwork.org.

19107 0623

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.