Investment Team Voices Home Page

Investment Team Voices Home Page

Perspectives on Innovation: We are Bullish on Energy

We believe:

- Our sustainable approach provides many opportunities to participate in the innovation that is reshaping energy demand and consumption, leading to long-term value creation.

- Our focus on quality businesses with strong financial and nonfinancial characteristics has led us to a breadth of companies at the cutting-edge of secular trends related to energy.

- Many traditional energy companies present an unattractive level of risk, including exposure to long-term secular decline.

Sustainable investment managers are often scrutinized for their supposed lack of investment in the energy sector. We should know—we haven’t invested in the energy sector, as defined by S&P Global and MSCI, since we first began managing dedicated sustainable funds in the 1990s.

But this statement may be somewhat misleading. We do invest in energy innovation, albeit in different ways than the ratings firms define it today. And, in the current environment, we’d go so far to say that we are bullish on energy.

Our views and exposure to energy differ from many investment managers and the broader market. The energy sector, as defined by S&P Global and MSCI’s Global Industry Classification System (GICS), includes oil-and-gas exploration-and-production, downstream processing and distribution, and related services and equipment.

We believe companies in these industries are in long-term secular decline. Oil and gas use is not going away, but we believe demand will fall as governments strive to meet their Paris Climate commitments and corporations endeavor to reach net-zero promises. Increased regulation and demand for cheaper and cleaner renewable sources of energy will only add to the profitability challenges for fossil fuel companies and other traditional energy names.

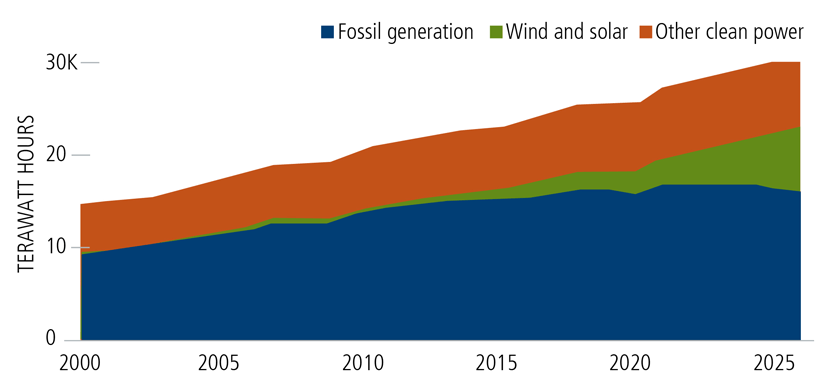

Renewables are starting to push fossil fuels out of the power grid

Source: Bloomberg using Ember.

However, demand for energy, more broadly defined, will continue to grow as standards of living rise in developing countries and digitalization and electrification trends play out around the world. There are many investment opportunities to capitalize on these developments.

So where do we see growth? One area is the global electric grid.

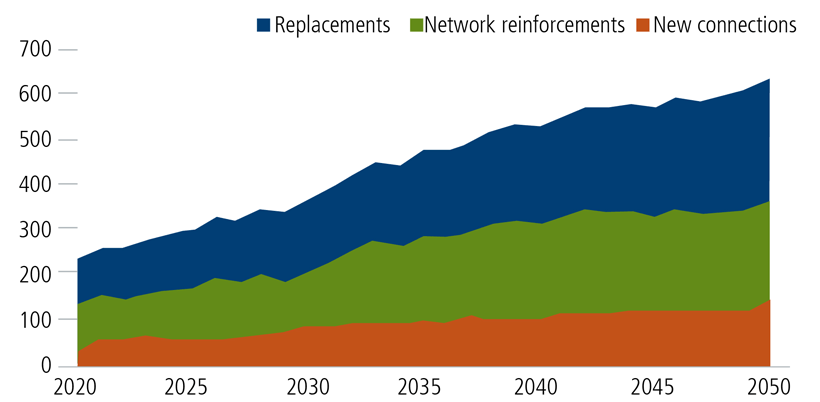

The transmission and distribution of electricity will be key to the coming energy transition. Whether it’s connecting renewables, hardening the grid against severe weather and other external threats, or replacing worn-out components, grid investment is an area we believe is primed for growth in the coming years. The chart below shows an estimate of that growth.

Global Annual Electrical Grid Investment ($ billion)

As of February 21, 2021. Source: Bloomberg NEF

Case Study: Terna Rete Elettrica Nazionale SpA

Our approach focuses on identifying high-quality companies that have strong financial metrics and seek to address nonfinancial risks related to governance, ecological impact and human development. This includes companies that are exposed to positive long-term secular trends and have flexible business models to profit from the energy transition. These companies are exposed to growing energy infrastructure and renewable energy needs. However, you will not find these companies in the energy sector as defined by GICS. They can be found in other economic sectors such as industrials, materials, utilities, information technology, and even the consumer staples and discretionary sectors.

Here are some examples of companies that we believe provide the opportunity for us to participate in energy innovation … without compromising our focus on sustainability.

- Quanta Services: A specialty contractor focused on the design, installation, and maintenance of energy infrastructure solutions.

- Darling Ingredients: Diamond Green Diesel, a joint venture with Valero, is the largest producer of renewable diesel in North America.

- Linde & Air Liquide: Legacy hydrogen providers will be large players in the production and transport of clean hydrogen.

- Orsted: A leading offshore wind energy development company.

- BYD Co: A leading electric vehicle company in China and leader in battery technology.

Conclusion

We don’t see our exclusion of traditional energy companies as a hinderance to performance. Instead, we see our approach to energy opportunity as being guided by sound risk management. It’s important to remember that the potential of an investment is based on a wide array of factors: company-specific fundamentals, valuations, risk exposure, and thematic growth tailwinds—not its sector classification.

More Perspectives on Innovation

- Sustainable Building Trends Drive Investment Opportunity

- Biodiversity is Abuzz

- Stock Exchanges, A Catalyst for Improved Transparency

- Sustainable Commodities

- The China Conundrum

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

19069 0423 O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.