Investment Team Voices Home Page

Investment Team Voices Home Page

Perspectives on Innovation: The China Conundrum

As global investors, we are often asked about our strategy for investing in China. Clearly, there are many red flags for foreign investors seeking access to the world’s second largest economy. But there are also opportunities.

Our approach reflects caution. In our global and international portfolios, we have been consistently below benchmark weight in Chinese equities. The main reason for this underweight is a lack of what we consider to be quality companies. Another reason is the extreme influence the Chinese Communist Party (CCP) has in domestic equity markets.

However, this government influence can also create tailwinds. We firmly believe that understanding government policies and looking for companies and sectors that will benefit from those policies improves the probability of successfully investing in Chinese equities.

A prime example is the CCP’s environmental approach. China’s 14th five-year plan (for 2021‒2025) calls for reduced CO2 emissions, lower energy consumption, and increased use of renewables and electric vehicles (EVs). This strengthens the investment case for a select group of innovative companies, including Sungrow Power (solar), China Water Affairs (clean water) and BYD (EVs).

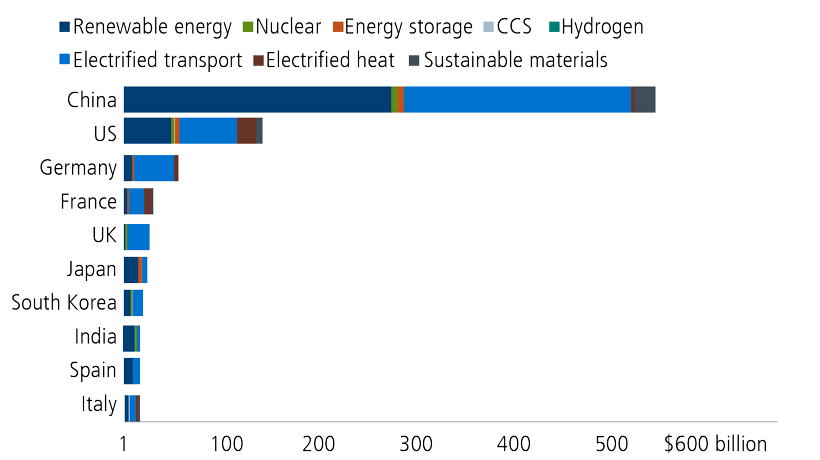

But even with government backing for these specific environmental initiatives, China’s impact on the world’s environment is not by any means universally positive. On one hand, it is the largest cleantech investor in the world by a wide margin (Figure 1).

Figure 1. China spends half of the world’s total in energy transition

Source: Bloomberg NEF.

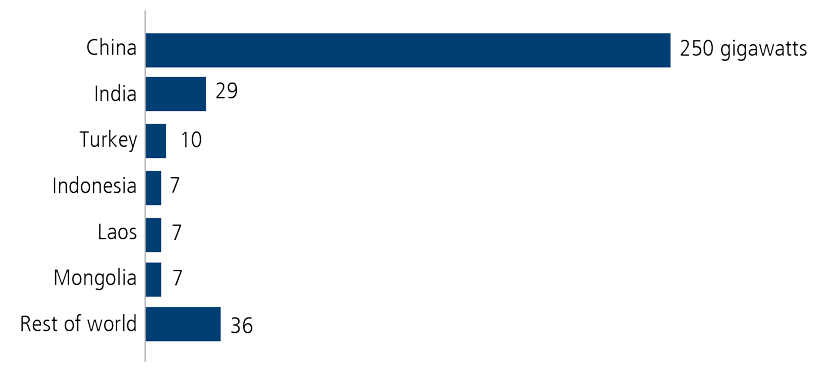

On the other hand, China accounts for almost 75% of the world’s planned coal plants (Figure 2).

Figure 2. China has almost all of the world’s planned coal power plants

Source: Bloomberg, E3G.

Case Study: Sungrow Power

Communism versus free markets, clean power versus fossil fuels, large domestic market versus limited regulation‒the investing landscape in China is one that demands analysis to separate the risks from the opportunities.

About the authors

Jim Madden, CFA; Tony Tursich, CFA; and Beth Williamson manage the Calamos sustainable equity suite, including Calamos Antetokounmpo Global Sustainable Equities ETF (SROI) and Calamos Antetokounmpo Sustainable Equities Fund (SROIX), as well as separately managed portfolios. Our team has been at the forefront of sustainable investing since 1997 and launched one of the first fossil-fuel-free-funds in the United States.

More Perspectives on Innovation

- Sustainable Building Trends Drive Investment Opportunity

- Biodiversity is Abuzz

- Stock Exchanges, A Catalyst for Improved Transparency

- Sustainable Commodities

- We are Bullish on Energy

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

19071 0423

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.