Investment Team Voices Home Page

Investment Team Voices Home Page

Perspectives on Innovation: Stock Exchanges, A Catalyst for Improved Transparency

We all appreciate knowing what the companies we may invest in are doing across the board, from financial to nonfinancial operational activities.

Standardized disclosures about company activities are an essential tool for making good investment decisions. For financial issues, accounting disclosures are fairly uniform across the developed world. However, standardization is still in a nascent stage for nonfinancial issues, including ESG.

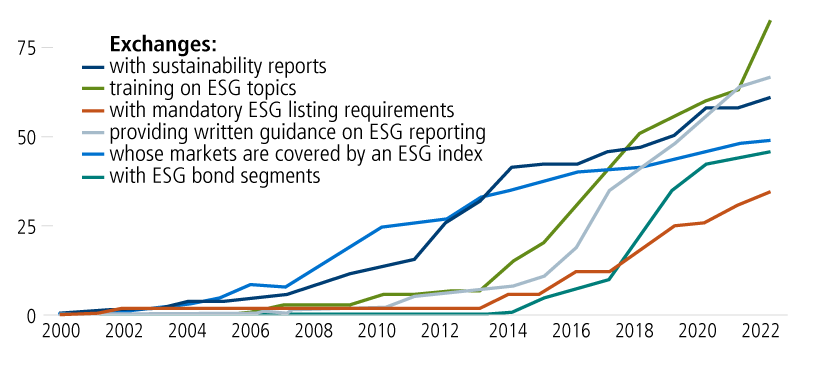

Stock exchanges are working to improve and increase nonfinancial data. Exchanges have multiple ways of interacting with ESG data and have been doing so for some time (see the graph below).

Stock exchanges: Encouraging companies to provide greater access to nonfinancial information

Source: Sustainable Stock Exchanges Initiative, Results and Impact Annual Report 2022 and UNCTAD, Annual Report 2021, “Bridging the Sustainable Development Goals’ financing gap.”

For example, the Hong Kong Stock Exchange recently announced plans to make its listed companies disclose more about climate-related risks. The disclosures would include such measures as Scope 3 emissions* and would be aligned with rules being developed by the International Sustainability Standards Board (ISSB).

Case Study: Hong Kong Exchanges and Clearing, Ltd. (HKEX)

The Sustainable Stock Exchange Initiative (SSE) was launched in 2009 to provide a global platform for exploring how exchanges—in collaboration with investors, companies (issuers), regulators, policymakers and relevant international organizations—can enhance performance on ESG issues. Since its inception, more than 130 exchanges worldwide have become SSE members.

Organizations like SSE bring investors closer to a world where nonfinancial data becomes as readily available and useful as financial data.

About the authors

Jim Madden, CFA; Tony Tursich, CFA; and Beth Williamson manage the Calamos sustainable equities suite, including Calamos Antetokounmpo Global Sustainable Equities ETF (SROI) and Calamos Antetokounmpo Sustainable Equities Fund (SROIX), as well as separately managed portfolios. Our team has been at the forefront of sustainable investing since 1997 and launched one of the first fossil-fuel-free funds in the United States.

More Perspectives on Innovation

- Sustainable Building Trends Drive Investment Opportunity

- Biodiversity is Abuzz

- Sustainable Commodities

- The China Conundrum

- We are Bullish on Energy

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

* Scope 3 emissions are the result of activities from assets not owned or controlled by the reporting organization, but that the organization indirectly affects in its value chain. Source: United States Environmental Protection Agency.

19079 0523

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.