Investment Team Voices Home Page

Investment Team Voices Home Page

Perspectives on Innovation: Sustainable Building Trends Drive Investment Opportunity

- Our approach focuses on identifying high-quality companies positioned to benefit as the transition to a sustainable global economy builds momentum.

- Buildings are a major source of energy consumption and greenhouse gas emissions worldwide.

- We’ve identified companies across industries that are capitalizing on an increased focus on reducing the energy expended to produce and operate buildings.

In 2021, the operations of buildings accounted for 30% of global final energy consumption. This share is expected to increase in the coming decades as the global population grows and becomes more urbanized. Given the global focus on reducing energy use, there are tremendous opportunities for companies that can provide solutions—and by extension realize above-average growth.

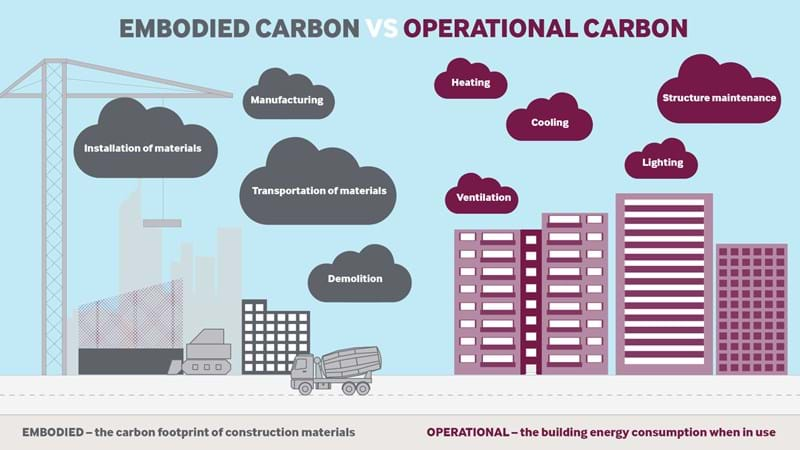

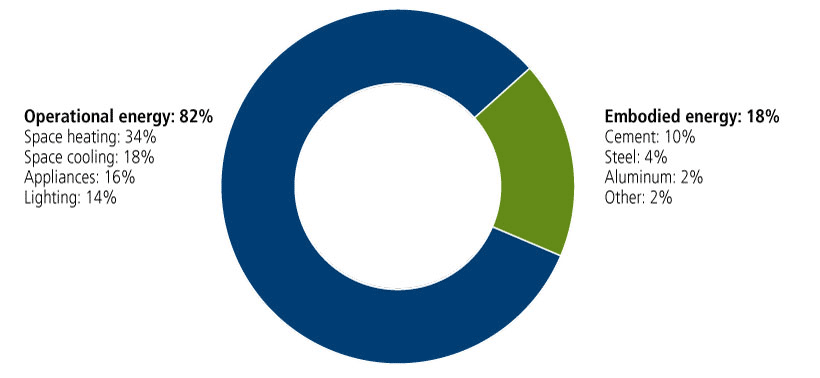

The energy used in buildings can be divided into two main categories: operational energy and embodied energy. Operational energy is the energy used to heat, cool, light, and power buildings. Embodied energy is the energy used to produce the materials and construct the buildings themselves. Both produce large amounts of carbon.

Source: RPS, www.rpsgroup.com, “Embodied carbon: What it is and how to tackle.”

Buildings Account for 30%+ of Global Energy Consumption

Source: IEA, www.iea.org, “Buildings-Energy Systems.”

We believe companies offering products and services that reduce embodied and operational carbon should see increasing demand as buildings become more efficient. Here are some examples of companies with quality fundamentals that our team believes are leading the way to more sustainable buildings:

Innovators in Reducing Embodied Carbon

- Saint-Gobain provides construction solutions such as window glazing to enhance heating and cooling controls, insulation for water pipes, and energy-efficient ventilation ducts.

- Kingspan specializes in insulated boards and panels that provide superior thermal efficiency compared to competitors’ offerings.

- Sika’s concrete additives help reduce resource use and cut CO2 Concrete is the second-most used substance on earth and its production is resource intensive.

Innovators in Reducing Operational Carbon

- Siemens provides building automation systems that enable users to monitor and improve areas of building performance such as heating, cooling and ventilation.

- Trane is a global leader in efficient HVAC equipment. Trane’s equipment uses digital controls, providing data to systems that optimize energy use.

- Prologis, a global leader in logistics real estate, helps its customers reduce energy use by providing onsite energy generation, energy storage and mobility solutions. Prologis is currently ranked second in US corporate onsite solar capacity.

Conclusion

We see a long runway for companies at the forefront of reducing operational and embodied carbon. Sustainable building innovations don’t just benefit the environment—they can also help the businesses and organizations in those buildings operate more cost-effectively. Indeed, leaders in sustainable building provide exciting opportunities for investors to benefit from the transition to a more sustainable economy.

About the authors

Jim Madden, CFA; Tony Tursich, CFA; and Beth Williamson manage the Calamos sustainable equities suite, including Calamos Antetokounmpo Global Sustainable Equities ETF (SROI) and Calamos Antetokounmpo Sustainable Equities Fund (SROIX), as well as separately managed portfolios. Our team has been at the forefront of sustainable investing since 1997 and launched one of the first fossil-fuel-free funds in the United States. Prior to Calamos Investments, Jim, Tony, and Beth were portfolio managers for the Trillium ESG Global Equity Fund Retail (PORTX).

More Perspectives on Innovation

- Biodiversity is Abuzz

- Stock Exchanges, A Catalyst for Improved Transparency

- Sustainable Commodities

- The China Conundrum

- We are Bullish on Energy

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

19115 0723

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.