This Is Far from Over, Don’t Miss the Rest of What Could Be a ‘Remarkable’ Period for Equities: CPLIX’s Grant

“Make hay while the sun shines.” That’s how Michael Grant summarized his message at the end of last week’s CIO call. (To listen to the August 12 call, go to www.calamos.com/CIOlongshort-8-12.)

Contending that “the vast majority of the market” is making one set of assumptions about the economy based primarily on past experiences, the Co-CIO, Senior Co-Portfolio Manager and Head of Long/Short Strategies explained that he strongly disagreed with the “fear of peaking economic momentum.”

“The combination of stunning policy support and the fact that the private sector is in such robust health makes it very hard to think that this is not an economic cycle that has at least a couple of years in it. Just the restocking cycle alone should last through 2022 and possibly into 2023,” he said.

Further, Grant said, “It is too early to call the top in S&P 500 earnings. I think earnings are going to continue to trend higher at an almost historic pace between now and the middle of next year…this is a remarkably favorable fundamental setting.

“S&P estimates are between $210 and $220," noted Grant. In a year’s time, investors will be looking at forward earnings of $230 to $240. If the expansion can continue, peak earnings should be above $250 a share. That puts the S&P today at just over a 16 times EPS handle.

“There are parts of the market, which are bubbles and are valued egregiously,” he acknowledged. “But you can’t look at that number of just over 16 times peak earnings and say the world’s gone crazy.”

Grant organized his remarks around three points:

- Where he believes we are in the economic cycle

- His assumptions about the Delta coronavirus

- What this transition to a new economic cycle means for the positioning of Calamos Phineus Long/Short Fund (CPLIX)

The Economic Cycle

Investors are unsettled, Grant said, in part because of the historic nature of the COVID-19 pandemic and likely also due to uncertainty about where the market is headed.

Deceleration in many leading indicators should not be mistaken for late cycle dynamics, according to Grant.

“It is absolutely true that many measures of activity are peaking in terms of momentum and rate of growth. That’s simply because those rates of growth are historic...But it’s equally important to understand that rates of growth always peak in the 12 to 18 months following the recession. And yet the economic cycle and the equity cycle can go on for years, and has historically done so,” said Grant.

What to Watch

To track progress, pay attention to these two indicators.

-

Earnings. Many economic indicators, particularly those associated with the bond market, are distorted by the extreme nature of the COVID shutdown a year ago, as well as by unprecedented Fed intervention and government stimulus. Don’t be misguided by them, Grant said. A better measure is the trend in S&P 500 earnings. A year ago, S&P earnings troughed at $160 a share. The run rate now is close to $220 a share.

In other words, he said, “at the depth of the COVID crisis in markets, the S&P was trading not much more than 10 times forward earnings of the highest quality risk asset in the world with a free cash flow yield, therefore, of more than 10%. The point is: Everything that’s happened in equity risk assets has fundamentally followed what’s happened in earnings estimates. And the trend in S&P earnings has been decisive for the past year.” -

Bitcoin as a barometer. The amount of liquidity in the system is “stunning.” Former Federal Reserve Chairman Ben Bernanke grew the Fed’s balance sheet from 5% to 10% of the U.S. economy after 2008. Now it’s at 35%. The Fed balance sheet prior to the pandemic was about $4 trillion, it’s since doubled and the Fed’s tapering plans call for it to rise another $9 trillion by this time next year.

“Despite all these concerns about slowing liquidity, I think what that argument misses is just how massive the liquidity backdrop is today,” said Grant. Keep your eye on bitcoin—the “tulip mania of our generation,” he said. “Until bitcoin more severely rolls over and stays low, I think we have to go with the positive liquidity thesis.”

Yet to be determined, he said, is the “degree of deceleration we’ll see between now and the second half of next year and whether the economic cycle stagnates much like it did after 2009. Or, does activity settle down at a normalized rate that’s fundamentally higher than the pre-pandemic period?”

Grant and team expect a “more typical and sustained cycle underpinned by three factors. One is still very easy central bank policies. Two is labor market recovery. And three is a remarkable private economy, and very healthy consumer and corporate sectors.”

Grant asked, “After all the disruption that we’ve seen, is four quarters enough to address supply chain disruption or normalization or back to work?

“What’s going on in the economy is much more substantial than simply refilling the supply chains. We think supply chains are disrupted because they have to be rebuilt for a fundamentally higher level of nominal demand. If that conclusion is correct, then we’re heading into a real investment cycle. And it is not something that can simply unfold or be resolved in just four quarters.”

The consumer, Grant said, may be on the brink of finally achieving the liftoff that they failed to achieve since the Great Financial Crisis.

The Pandemic

Grant believes that the U.S. is “very close if not at a climax of the current wave of the Delta virus.” Elsewhere, he said, much of the reopening is still ahead. But by this time next year, he expects the world to be over the pandemic. A two-year duration is consistent with previous pandemics.

“Ironically,” he said, “the pandemic fears are the wall of worry that the market is climbing. And it is unexpectedly the support for risk assets because it ensures that policy support remains fully behind the economy.”

But, Grant recognized, “the bond market is giving off a very different signal…And my simple answer for that is I think the Fed has cornered the long-term bond market. And it currently accounts for 50% to 60% of all activity in 10-year Treasuries.”

“If the deceleration in the leading indicators goes all the way back to neutral in the next few quarters and therefore leads to a reversal of the increase in earnings estimates that we’ve seen,” he said, “then the bond market is right and I am wrong.”

CPLIX Positioning

A global fund with a long-time bias toward U.S. equities, CPLIX’s positioning reflects Grant’s expectations of reflation and “a real investment cycle.”

“Whenever I see everyone standing on one side of the boat, I want to think very hard about ensuring that I have at least one foot on the other side of the boat,” said Grant. “And that alternative view to the future is a more reflationary path. At minimum, it argues for balance in your portfolio.”

As such, he said, “two-thirds of the long book is positioned to benefit from ongoing cyclical recovery, not just cyclical exposure but holdings in sectors such as industrials, financials, consumer durables—industries where operating margins and therefore earnings can move materially higher.

“We haven’t given up on quality growth stocks that outperformed in 2020 relative to the general market. About one-third of the long book is in what we would call well understood, well positioned growth, which still has favorable investor sentiment.”

“But," he said, "the important point is that that balance is very different than the benchmark composition. The [S&P 500] is more two-thirds growth and one-third cyclical recovery."

Grant concluded his comments by saying, “Now, you might say that it all comes down to the U.S. 10-year yield. I’d agree with you. What is remarkable today is that when we analyze the sensitivity of the S&P and the components of the S&P to the U.S. 10-year yield, we see a greater proportion of the S&P today is highly correlated to the daily changes in the U.S. 10-year yield than we’ve ever seen in the last two decades.

“In addition, that portion of the S&P that’s highly correlated to the U.S. 10-year yield is more highly valued relative to the rest of the market than it has ever been. When we say it all comes down to the direction of the U.S. 10-year yield, the market is confirming that,” he said.

This current opportunity to “make hay” will be finite, according to Grant. By next spring, he said, “the bulk of the risk-on story in equities will be in the price. From that point, future nominal returns in equities become much lower.” The team anticipates the possibility of “a major bear market” in 2023-2024.

Investment professionals, for more information about Grant’s perspective or CPLIX, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The S&P 500 Index is generally considered representative of the U.S. stock market.

Morningstar Long/Short Equity Category funds take a net long stock position, meaning the total market risk from the long positions is not completely offset by the market risk of the short positions. Total return, therefore, is a combination of the return from market exposure (beta) plus any value-added from stock-picking or market-timing (alpha).

Morningstar RatingsTM are based on risk-adjusted returns and are through 7/31/21 for the share class listed and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2021 Morningstar, Inc.

802473 0821

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

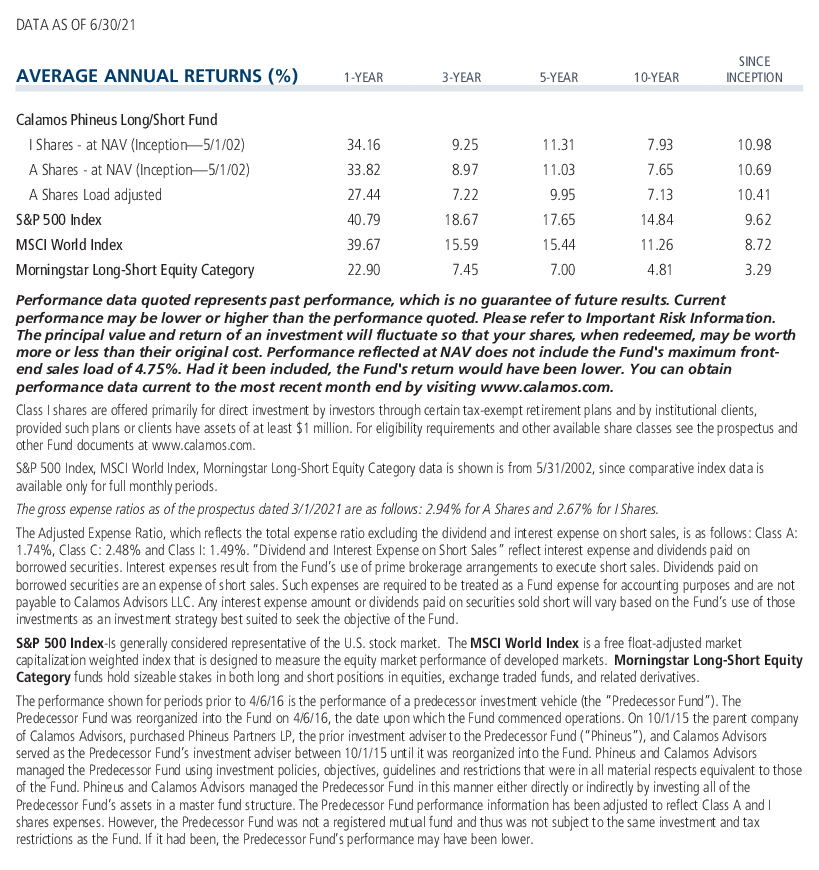

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on August 18, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.