How About a Bond Alternative for Your Cash Balance Plan Clients?

First published: November 20, 2020

About Cash Balance Plans

Most popular with small and medium-size businesses, the majority of cash balance plans are funded by companies with 100 employees or fewer. They’re ideally suited for businesses that have consistent cash flow and are highly profitable—doctors/dentists and lawyers, accountants and financial services firms.

They enable high income business owners and partners in professional services firms to make significant tax deductions while setting aside much more for retirement than a 401(k).

For more, download this whitepaper.

Low yields have everyone on the hunt for new ideas. One group we’re hearing from, in particular, are the investment professionals specializing in cash balance plans. Now representing more than 42% of defined benefit business—up from 3% 20 years ago—cash balance plans tend to be invested conservatively and are heavy in fixed income.

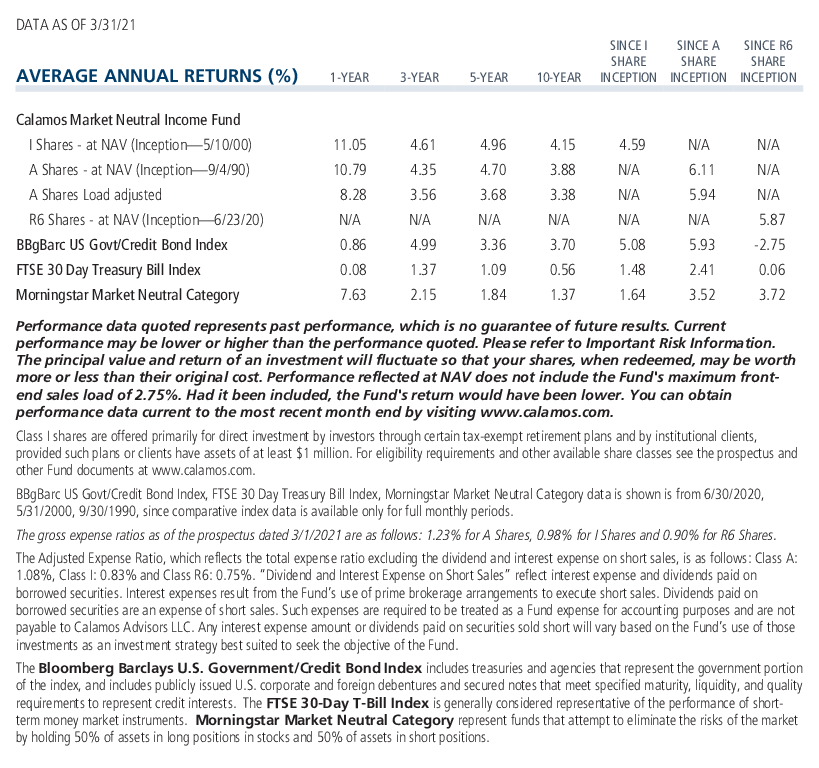

Lately, to reduce vulnerability to rising rates but also to build in some equity upside and as a hedge against inflation, retirement benefits consultants are gravitating toward Calamos Market Neutral Income Fund (R6 ticker symbol: CVSOX). The fund has a 30-year record that delivered bond-like returns with bond-like standard deviation—but without the interest rate sensitivity.

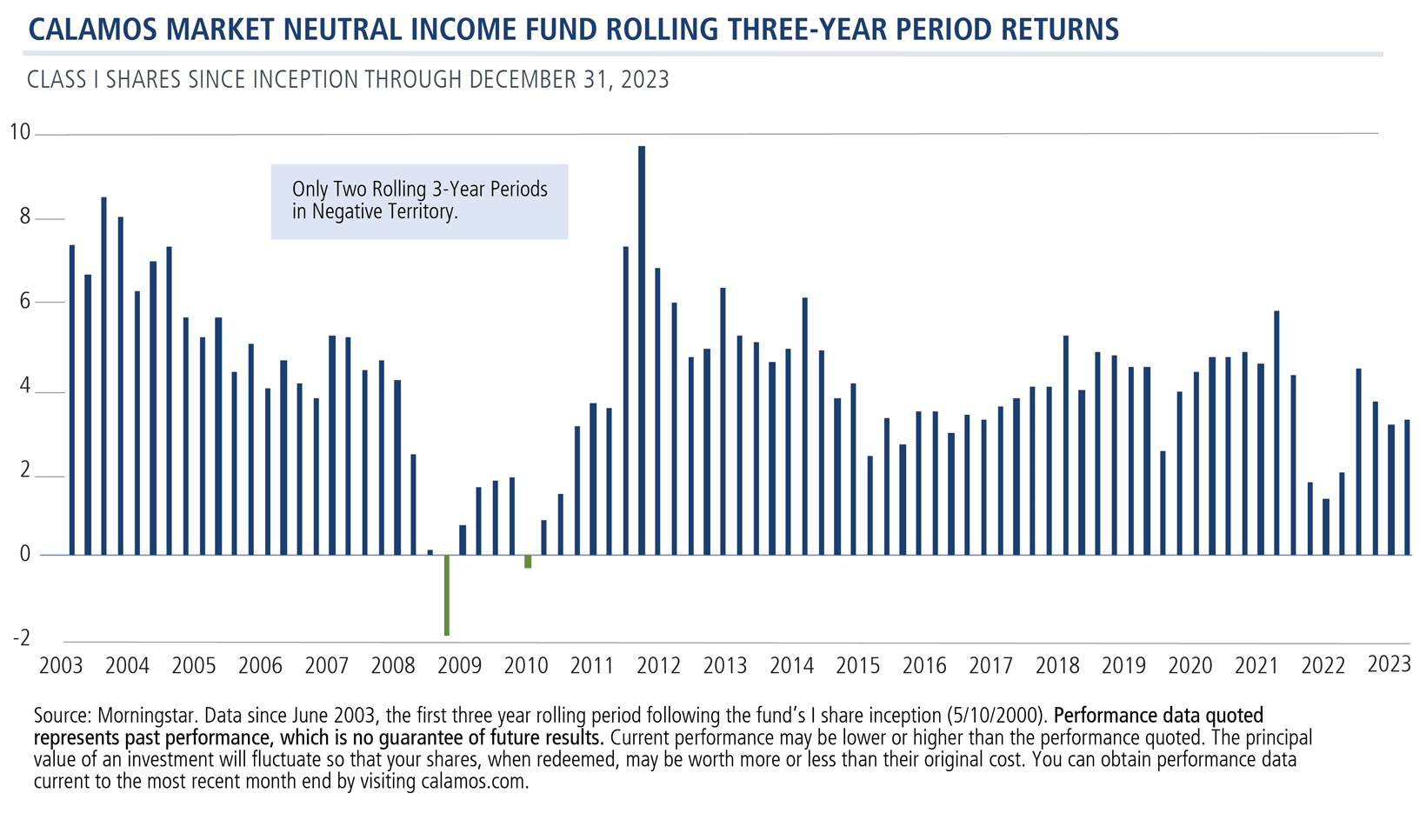

And here’s what retirement specialists especially like about the fund: its consistency in producing positive returns. Since its I Share inception (see below) the fund has produced just two negative rolling three-year periods, data through March 31.

For more about cash balance plans, see our June 2021 whitepaper.

To discuss with your Calamos Investment Consultant, please call 888-571-2567 or caminfo@calamos.com.

Click here to view CVSOX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

802229 621

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on June 15, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.