Off to a Strong Start to 2022, Grant’s CPLIX Positions for a Return to a World Where Profits Matter

One of the most anticipated calls of our CIO Call series wrapping up this week (see schedule) was with Calamos Co-CIO, Head of Long/Short Strategies and Senior Co-Portfolio Manager Michael Grant. Contrary to most equity investments, Grant’s Calamos Phineus Long/Short Fund (CPLIX) has gotten off to a strong start this year (see this post for January’s performance)—demonstrating the contribution the equity alternative can make as a 5%-15% sleeve in a portfolio.

Grant started the call with a shift in his perspective about leaning into equity risk post-pandemic. Since the health care crisis began in March 2020 and through the end of last year, he had been bullish about the market’s extraordinary fundamentals and historic earnings (see this post). However, he has since tempered his view, while remaining in favor of risk assets. (Listen to the call in its entirety here.)

“This is not a case where one should immediately assume we roll into a bear market,” said Grant. “The support for equities is coming from a solid earnings picture for this year. It’s coming from a healthy economy led by robust employment conditions, and it’s coming from the reality that even though liquidity is peaking, in an absolute sense liquidity is still very robust. That leads us to the conclusion that the S&P 500 will probably trade within a range of 4200 on the downside to perhaps 5000 on the up side.”

But Grant emphasized that only profitable businesses are likely to win going forward. The recent, extraordinary period of “free money” had “disfigured the investment landscape," he said. "As a consequence, we had unusual performance in many of the unprofitable, negative cash flow-generative businesses.”

Declaring unprofitable businesses “done-and-dusted for this cycle,” he continued. “Over time, profitable businesses win in equity markets. In fact, over a decade, about 40% of the S&P eventually disappears. We think this is the world we’re now returning to, and it’s the distinction that clients should very carefully make when they look at their portfolios today. Obviously, rising interest rates affect all equities, but we equally believe that the profitable, high quality, cash flow-generative businesses are within 10% to 15% of the point where valuation is no longer the primary determinant of the stock outcome.”

In 2022 Grant and team expect “solid” earnings from businesses that can generate operating leverage, which he described as a classic mid-cycle differentiation.

“The good news is that much of the excess of the free money era was concentrated in the equity derivatives of long duration, in the long-duration growth and technology stocks in particular, and we’re beginning to see that unfold before us.

“On the other hand,” he said, ”if we look at industries like Financials, like Industrials, like Energy and Commodities, there was very little valuation premium excess built up in any of those industries in the past decade. Therefore, if those companies can deliver on the operating leverage that we anticipate over the next 12 months, we think the stocks can move higher in line with that.”

Elevated But Manageable Inflation

As in December (see post), Grant commented on the importance of rising interest rates and inflation unfolding “in glacial fashion.” He now expects this is what will happen.

The Greatest Risk Over the Next 12 Months: Wages

“At some point we do have to address the question of broader wage/income risk,” according to Grant. “I don’t think we have an answer to that right now.”

“The good news is that the real pain for wage inflation is at the lower part of the income distribution. It’s an Amazon fulfillment center going into a community and setting a floor on their wages. So, you get someone who had worked in a corner shop or a small business or a restaurant going to work at an Amazon fulfillment center.

“That’s a fairly positive shift in terms of worker productivity. Higher wages are not necessarily bad if the economy can really deliver on productivity. We’ve seen some of that. We saw how, with the first 18 months of this crisis, GDP fully recovered despite five million fewer jobs.

“This is a debate that will be going on for a long time, and I think the markets’ sensitivity to these expectations is where the main source of risk will come from.”

“The Fed is stepping back and not targeting a specific level of inflation that it must meet,” said Grant. “In a sense, this is a narrative that we saw from [previous Fed Chairman] Alan Greenspan. In the 1990s, Greenspan refused to target a certain level of inflation. His view was that in a healthy economy, 3%, 4% inflation is actually a good thing. He stepped back and said, ‘Let’s let events, unexpected events come and shock the system and allow windows where inflation would ultimately prove tame.’”

Grant parts ways with some on the scope of today’s inflation. “We don’t really have broad inflation. What we have is a handful of important prices that are all going up right now at the same time,” he said.

Today’s prices are higher as a result of the non-traditional COVID recession, according to Grant. He predicted that the supply shock in the goods sector will ease in the next few months, and headline inflation with it.

“Ultimately,” he said, “the real problem for inflation is going to be in employment markets because we are transitioning to a much tighter era of employment conditions. In that sense, I think inflation will plateau at a much higher level than at any time in the post-2008 period. The key is what that level is. More importantly, if you look at expectations of inflation, they are still anchored in the 3%-4% range.

“As long as that holds true, I think the Fed can gradually raise interest rates over the next 12 months without it turning into a bear market for financial assets,” he concluded.

Even if the Fed raises rates multiple times this year—Grant predicted there would be at least five hikes—"liquidity is too robust for that to materially create an economic downturn.”

He said, “Up until December of last year, the Fed’s balance sheet was still growing at a 20% rate year over year. Most money supply aggregates have grown 40%-plus over the last two years. If we think of monetary policy and if we think about liquidity as a leading ingredient for the economic cycle, it’s very hard to anticipate economic weakness for the next 18 months.”

The team forecasts the economy will grow 4% real, 7%-8% nominal with the 10-year Treasury yield between 2%-2.5%.

CPLIX Performance

When the discussion turned to CPLIX’s performance, Grant was asked what he expected to be different about the next two years.

“What’s going to be different for all of us on this call is the possibility that the dominance of mega caps is over,” Grant replied. “Over the last five years, those mega caps have delivered uniformly amongst them extraordinary fundamentals. In the next couple of years, I don’t believe that’s going to be the case. In fact, it’s possible that one or two of those mega caps goes into structural decline as the market will be more discriminating concerning corporate profitability.”.

“…We’re not going to get the extraordinary, absolute returns in the benchmarks or at least the S&P. An actively managed portfolio, both long and short, in my opinion has a much greater chance of now beating those benchmarks,” he said.

The mega cap dominance over the last five years was challenging for CPLIX, Grant acknowledged. “When you have such a small, concentrated part of the market driving the benchmark returns, that makes it very challenging for a portfolio that’s diversified and active, non-benchmark in its intent to keep up with that.

“…The fund is a global product,” he said, “and it still managed to beat most other global equity markets with the exception of the S&P, again because of this concentrated performance in the mega caps.”

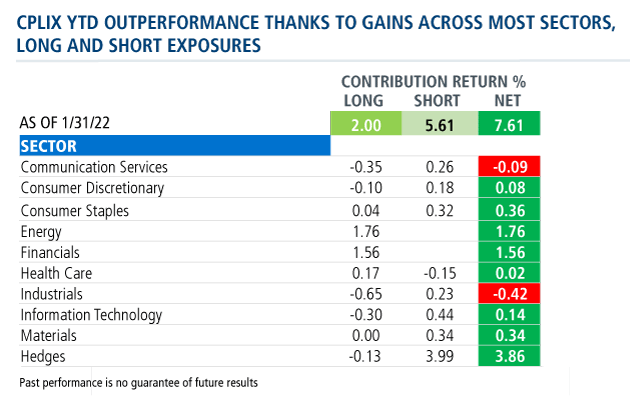

CPLIX’s performance year to date—what call moderator and Calamos Senior Vice President Robert Bush described as "firing on all cylinders," as shown in the chart on the right—demonstrates the diversification benefits of using an equity sleeve with a low correlation to equities.

Bush described the fund as “very high conviction, where Grant and team have a lot of flexibility as to how much of the market they want to embrace, where they want to go, what types of sectors they want to be in and the reasons they have for being in them.”

The fund enjoys more latitude than its peers in the Morningstar Long/Short Category, added Grant.

“We do not have limits in terms of how quickly we can move. We do have strategic ranges, which is from minus 20 to plus 80. Now, that’s a very wide range, and it makes us almost unique within the long/short category. Since inception, the average net exposure for the fund is slightly below 30%. That’s since inception in 2002.

“Now, we do tend to move those net exposures relatively slowly because the driver of those exposures is our view of where we are in the business cycle. Those fundamentals rarely change with much rapidity,” he said.

Investment professionals, for more on Grant’s outlook or CPLIX, please reach out to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Click here to view CPLIX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

The Morningstar Long/Short Equity Category funds take a net long stock position, meaning the total market risk from the long positions is not completely offset by the market risk of the short positions. Total return, therefore, is a combination of the return from market exposure (beta) plus any value-added from stock-picking or market-timing (alpha).

808667 222

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on February 22, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.