Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Investment Team Outlooks, April 2022

Outlooks from our Investment Team

- Calamos Global Convertible Fund (CXGCX): Global Convertibles: Market Drawdown Provides Longer-Term Opportunities

- Calamos Market Neutral Income Fund (CMNIX), Calamos Hedged Equity Fund (CIHEX): Alternatives Update: Capitalizing on Market Volatility to Enhance Risk/Reward

- Calamos Convertible Fund (CICVX): US Convertible Update: Short-Term Volatility Can Create Long-Term Opportunity

- Calamos Timpani Small Cap Growth Fund (CTSIX), Calamos Timpani SMID Growth Fund (CTIGX): Small Cap Stocks: Poised to Lead Once Again

- Calamos Fixed Income Funds: Fixed Income Update: Migrating Toward Higher Quality to Counter Uncertainty

- Calamos Global Sustainable Equities Fund (CGSIX): Capitalizing on Volatility to Build Long-Term Value

Introduction from John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

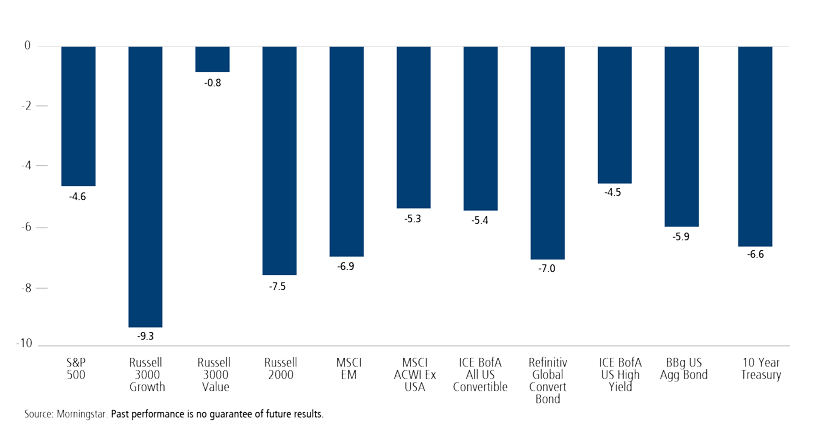

During the first quarter, markets were battered by surging volatility and vicious rotations. Russia’s invasion of Ukraine, the start of a tightening cycle by a notably more hawkish Fed, and new Covid lockdowns in China exacerbated investors’ longer-running anxiety about inflation, supply chains, commodity shortages, and interest rates. Oil prices soared and the yield of the 10-year US Treasury spiked upward. Against this backdrop, few areas of the global capital markets were unscathed, and both stocks and bonds retreated. As emotions ran high, even fundamentally strong companies experienced sharp selloffs.

Total Return %

These next months will continue to test the resolve of investors. The war in Ukraine, Fed policy, Covid-19, inflation, and an uncertain US fiscal policy backdrop each create formidable crosscurrents, and the markets must wrestle with all of them at once. The Fed has a big lift to manage, and we expect markets to reflect an ongoing debate over whether policy makers will be able to engineer the soft landing they seek. We are prepared for choppy, sideways-moving markets where sentiment at times overtakes fundamentals. Selectivity and individual security selection will be key, as we are likely to see diverging fortunes, even among companies in the same sector or even the same industry.

Although selloffs can be difficult to stomach, they are a normal part of the market cycle. The best strategy is to not get caught up in market headlines or give into the temptation to try to time the market. We’ve also seen some stabilization in the equity markets over recent weeks, as well.

Indeed, I’d encourage every investor to remember that the markets and the global economy are resilient. Through 50-plus years, I’ve seen that there are long-term investment opportunities in all environments. As you will read in the commentaries that follow, our teams share this view. In these fast-moving markets, they are relying on discipline and long-term perspective to manage downside risks and pursue opportunities across asset classes.

With so many variables right now, it’s important to not get distracted by a single economic data release, earnings announcement or news headline. What matters is how all the pieces fit together—and that’s where we believe our decades of experience in the markets will allow us to position our portfolios advantageously. Below, they share their perspectives on the economy and markets, and how they are positioning the Calamos funds. We will be adding commentaries over coming days, as well.

Global Convertibles: Market Drawdown Provides Longer-Term Opportunities

Eli Pars, CFA

War in Europe and perceptions that the Federal Reserve was behind the curve combined for a difficult quarter. We expect markets to remain choppy as the war wears on. Determining what will happen with the Fed will also take more time than market participants would like. That said, we do not expect the Fed to overcorrect and trigger a recession in the United States We remain vigilant for signs of a policy error, but we are still skeptical that the Fed will need to raise rates past 1.0‒1.5% to slow an economy that appears to be slowing on its own. And that is even before a spike in energy costs slows the economy further.

Given the uncertainty about the Fed’s success in engineering a soft landing and the outcome of the war in Ukraine, we remain focused on maintaining a neutral risk/reward profile in Calamos Global Convertible Fund (CXGCX). We have added back some equity sensitivity in the wake of the drawdown of recent months, but we remain slightly underweight the market on a delta basis.

The fund’s biggest underweight is to Europe. In the past, this positioning was mainly driven by our bottom-up view of convertible opportunity, but the war in Ukraine, subsequent inflation and possible recession in Europe have added a macro component. Technology continues to be the fund’s largest sector allocation and overweight.

Global convertible issuance is off to a slow start in 2022, with $8 billion coming to market in the first quarter. Slowdowns tend to happen in times of market dislocation. The combination of confusion about the Fed’s moves and the war in Europe makes for a difficult environment for companies to raise equity and equity-linked capital. But we have seen this movie before. The primary market will reopen, and once it does, we frequently see a burst of new paper.

We believe the strategic case for global convertibles remains strong in volatile equity markets, and we also see tactical opportunities as interest rates increase. Because of their hybrid characteristics, convertibles can offer an attractive risk/reward tradeoff—think “heads, you win; tails, you lose less.” The embedded option gives the convertible holder the opportunity to participate in equity upside, and the convertible’s bond attributes—coupon income and the bond floor—can potentially mitigate exposure to equity market downside. In rising rate environments, convertibles have performed well relative to longer-duration traditional fixed income investments.

Alternatives Update: Capitalizing on Market Volatility to Enhance Risk/Reward

Eli Pars, CFA

As we have discussed in our past commentaries, Calamos Market Neutral Income Fund (CMNIX) is designed to enhance a traditional fixed income allocation. Combining two complementary strategies—arbitrage and hedged equity—the fund pursues absolute returns and income that is not dependent on interest rates. We actively manage the allocations based on our view of market conditions and relative opportunities. The fund ended the first quarter with a 52% allocation to hedged equity and a 48% allocation in arbitrage, which represented an increase of three percentage points to hedged equity versus the start of the quarter. Within the arbitrage allocation, convertible arbitrage represented the lion’s share, closing the quarter at 38% of the fund. We maintained allocations of 9% in special purpose acquisition company (SPAC) arbitrage and 1% in merger arbitrage.

Because of market volatility, equity-related issuance was slow in the first quarter, including in both the convertible and SPAC new issue markets. We expect convertible issuance to bounce back when markets settle down—SPAC issuance is more of an open question. Proposed regulatory changes will have an undetermined impact on new SPAC creation. We will know more in the coming quarters.

Over the course of the quarter, the weighted average delta hedge of the convertible arbitrage strategy decreased, consistent with the drawdown in the underlying equities of the convertibles we saw in the first quarter.

Calamos Market Neutral Income Fund’s hedged equity strategy is positioned with a typical hedge ratio versus a higher-than-typical hedge ratio at the start of the quarter. The higher the hedge ratio, the less exposure the fund has to equity market downside. We continue to see cheapness in put spreads and are using them in the fund’s hedged equity book in addition to the outright long put allocation we always maintain in the fund.

Calamos Hedged Equity Fund (CIHEX) is an equity alternative designed to help investors dampen the impact of equity market volatility and drawdowns. The fund’s hedge is at the lower end of its targeted range versus starting the quarter right in the middle. We would welcome opportunities to add some more skew to the fund, but volatility is still a touch elevated in the wake of the recent equity market drawdown.

US Convertible Update: Short-Term Volatility Can Create Long-Term Opportunity

Jon Vacko, CFA and Joe Wysocki, CFA

The equity and credit markets faced considerable pressures in the first quarter as geopolitical risks intensified and added to an already uncertain macro backdrop. Convertible securities were not immune to the increase in volatility that took hold. Against this backdrop, the pace of new issuance was also subdued, with $8 billion of new global convertibles coming to market during the quarter. This issuance activity trails the accelerated pace investors had grown accustomed to since 2020 and is also below the long-term seasonal pace we would expect during the first months of the year. Although we have anticipated deceleration in the annual volume of new convertibles after back-to-back years of near-record amounts, we believe heighted global uncertainty materially influenced first-quarter issuance. We expect that an eventual calming in global capital markets should help boost volumes back to a more traditional seasonal pace for the rest of the year.

Our focus in Calamos Convertible Fund (CICVX) continues to be on actively managing the risk/reward trade-off. Convertibles are hybrid securities that can act like equities or bonds, depending on movements in the markets. In periods of larger-than-typical moves, such as we have seen recently, these dynamics can rapidly change.

We continue to favor the balanced portion of the convertible market where structural asymmetrical profiles offer more potential upside than downside. We are underweight and highly selective within the most equity-sensitive portion of the market where convertible structures may lack material downside risk mitigation.

Although macro risks have increased and the markets continue to adjust to a tightening monetary policy, history has shown that periods of short-term volatility can lead to longer-term opportunities. For example, the recent pullback in the underlying stocks of convertible issuers has pushed the equity sensitivity of the overall convertible market toward the lower end of the range seen since the pandemic began. Among these less-equity sensitive names, we believe there are opportunities for us to invest in companies that have the potential to become future market leaders, without taking on full equity downside risk.

On a sector basis, technology is the fund’s largest overall allocation, as we continue to identify many innovative companies and convertible structures with attractive risk/reward characteristics. The consumer discretionary sector is the fund’s largest relative overweight because we expect consumer demand for services to drive returns. The fund’s largest underweight is to financials, due in part to convertible structures that are more exposed to rising interest rate risk.

As we have seen over prior market cycles, actively managing the changing dynamics of convertibles through volatile times such as these provides us with powerful tools for mitigating further equity declines while still retaining upside equity optionality.

Small Cap Stocks: Poised to Lead Once Again

Brandon Nelson, CFA

Macro concerns relating to Covid-19, rising inflation, the trajectory of the Federal Reserve interest rate tightening cycle, and geopolitical unrest dominated the first quarter. As a result, stock price valuation multiples fell, even though analyst earnings estimates for 2022 actually went higher during the quarter. The net result of this valuation-versus-earnings-revisions tug-of-war was losses across the board. Large cap stocks (as measured by the Russell 1000 Index) fell by 5.13%, and small cap stocks (as measured by the Russell 2000 Index) fell by 7.53%, lagging large caps by 240 basis points.

Interestingly, small cap underperformance was confined to January, even though macro concerns intensified after January. For the combined period of February and March, small caps had the performance edge by a magnitude of 179 basis points.

Small caps have lagged large caps for several years. Perhaps the recent performance improvement is an early sign that small cap valuations have neared a relative bottom and small caps may be poised to become a leading asset class once again. We believe this scenario is likely. Although the past cannot predict the future, it can provide investors with useful context. Based on long-term history, research suggests that over the next five years, there is an 84.2% chance that small caps outperform large caps by 8.1% per year.* Asset allocators would be wise to be aware of these remarkable odds.

We believe the aforementioned setup is especially favorable for Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX), given their disproportionate exposures to small caps and average market caps that are smaller than their benchmarks and peer groups. We believe our fundamental security selection positions us advantageously to add further value beyond the stand-alone asset class performance.

Both funds continue to have exposure to long-term secular growers and certain cyclical growth stocks that we believe should benefit meaningfully from a continued economic uptick. A noteworthy portfolio change we made early in the first quarter was to increase the funds’ weightings in energy stocks, an area that could continue to see high growth and underestimated growth trends in the coming months. We also increased exposure to certain health care stocks that should benefit from pent-up demand for elective medical procedures.

*Source, Steven Desancitis, Jefferies, using CRSP, the University of Chicago Booth School of Business and Jefferies.

Fixed Income Update: Migrating Toward Higher Quality to Counter Uncertainty

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

To paraphrase Donald Rumsfeld, there are knowns, known unknowns, and unknown unknowns. According to history, it’s the unknown unknowns that can really get you, but we are living in a time with an extraordinary number of known unknowns, and they currently dominate the headlines and the markets. Whether it’s Covid-19, the European war, supply chain disruptions, midterm elections or energy, the situation teems with uncertainty.

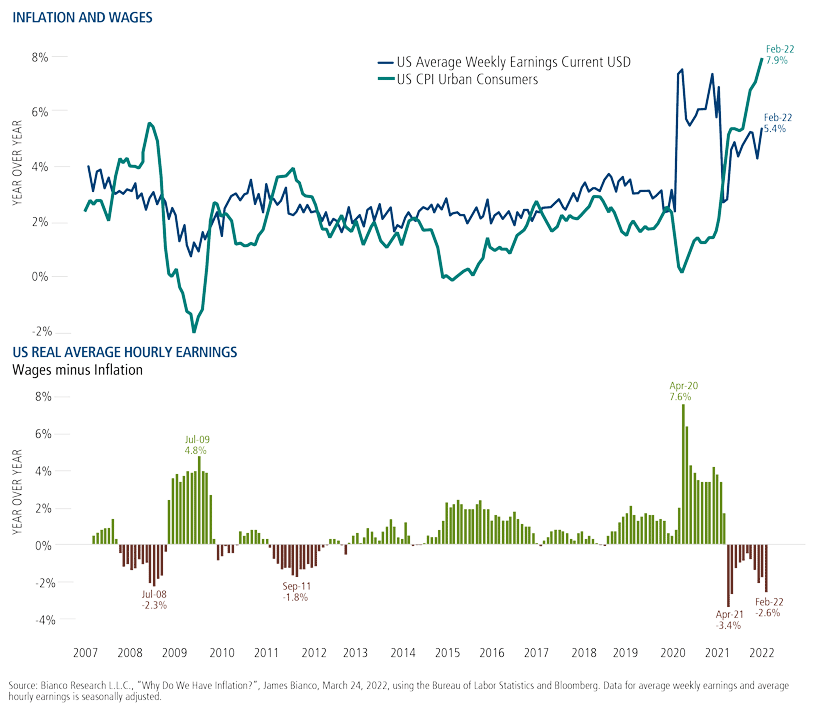

Inflation: Multiple forces are driving prices higher, including continued supply chain challenges, commodity price pressures and housing. It’s challenging to know how much is structural and how much is temporary. We are hopeful that price spikes in conflict-area sourced items (e.g., neon gas, titanium, wheat, fertilizer) will prove more temporary. At a minimum, there’s been a large one-time upward revision to prices, but the likelihood of a long-term wage-price reaction has increased. If higher inflation expectations become entrenched in consumer behavior decisions (i.e., buying now because items will cost more in the future), the problem will be exacerbated.

Fed policy: What can the Fed do about this situation? The Fed is in a bad spot—there are no two ways about it. The Fed’s goal is to slow aggregate demand without hindering labor conditions. It’s worth pointing out that only once since WWII (in the mid-1990s) has the Fed navigated a soft landing by threading that needle. Six weeks ago, it was clear that the Fed was still focused on balancing to its dual mandate, but recently its focus has shifted abrasively to halting price pressure. We expect the Fed to be very aggressive early in this tightening cycle. This aggressiveness is likely to fade by the second half of the year because the Fed will have to evaluate the impact of reducing its balance sheet in real-time as it navigates these uncharted waters.

Fiscal policy: Political gridlock gripped Washington much quicker than anticipated, starting with last year’s failure to pass “Build Back Better.” Stimulus is on track to decline dramatically over the course of 2022, which will be a de facto economic decelerator. In a midterm election year, we expect there will be plenty of support to pass legislation that puts money in the hands of consumers, but given the inflationary backdrop, the opposition will be staunch. The likelihood of a Republican majority in the Senate or both houses of Congress is growing. This would stall most, if not all, progress on the Biden administration’s domestic agenda. That said, if Biden finds an administrative action to forgive $1.6 trillion in outstanding federal student loan debt, this would equal the economic value of the reduced Build Back Better proposal that failed in December.

Economic and credit conditions: Despite the current challenges and a clearly decelerating set of data, most economic data measures indicate underlying strength. Measures of labor market health, aggregate demand and consumption, and management surveys are robust. One area of weakness is in measures of consumer confidence, which are falling because of reduced expectations for the future, which we primarily attribute to current inflation levels. Put it all together, and the picture remains relatively sanguine in comparison to the past decade—if inflation can be put in check.

In the meantime, borrowing costs for companies and households have increased, but credit is still readily available. Our assessment of corporate fundamentals suggests steady improvement of leverage and interest coverage on the back of record revenue and EBITDA growth, even in non-energy-related sectors.

Positioning implications: Our base case anticipates a more volatile spread environment with moderately higher interest rates over the balance of 2022. Rapid changes in communication from Fed have led to market rates already pricing in an aggressive path of tightening. In our view, the Treasury curve inversions we have seen to this point simply reflect that aggressiveness. (For more on Treasury curve inversions, see our post from 2018, “The Underappreciated Swap Curve.”) But the risk of a Fed policy error has increased, given the high level of volatility, and the possibility of a substantive exogenous shock feels more pronounced than in previous quarters. As a result, we have migrated the positions for our fixed income strategies (Calamos High Income Opportunities Fund, Calamos Total Return Bond Fund, and Calamos Short-Term Bond Fund) toward higher-quality credits. We are also emphasizing our focus on being well compensated for the idiosyncratic risks in our portfolios. Although we continue to doubt that the above-trend inflation environment will lead to drastically higher interest rates in long-dated maturities, we are maintaining cautious duration implementation across strategies.

Capitalizing on Volatility to Build Long-Term Value

Jim Madden, CFA, Tony Tursich, CFA, and Beth Williamson

With the daily horrors in Ukraine providing a somber backdrop, global equities endured a volatile start to 2022, with most markets finishing the first quarter well into the red. The combination of supply chain issues, inflation and rising interest rates unnerved investors who found safe havens hard to come by. Some of the worst performing stocks for the quarter included former pandemic superstars, reminding investors that indiscriminately loading up on what’s in favor under certain market conditions can result in painful losses down the road.

Looking forward, central banks have a delicate balance to maintain. Inflation continues at high levels while growth has shown signs of slowing. How much and how fast they should raise rates becomes the key questions given that monetary policy cannot support growth and fight inflation at the same time. US Fed Chairman Powell hinted at a more hawkish attitude in late March; and this time, markets seemed to take him seriously, spiking yields up and bond prices down as investors started adjusting to a new era.

Higher rates mean higher mortgage costs, which will affect the red-hot housing market. Higher rates mean it is more expensive for companies to repay or refinance their debt. Rapid increases in the price of money have many known economic effects, but perhaps more concerning is what unintended consequences will result as the world moves away from easy money.

Nothing illustrated the volatility of the quarter like Chinese stocks. A yearlong downturn was punctuated by a precipitous fall in mid-March followed by a massive upturn as the Chinese government signaled support for its markets. Rally notwithstanding, there remain questions regarding the investability of numerous Chinese stocks.

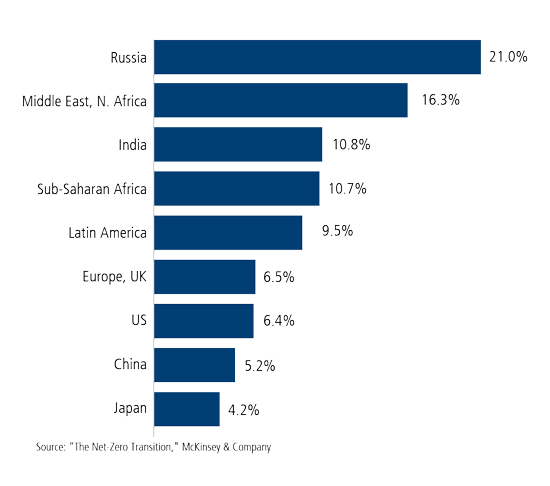

A recent study from McKinsey & Co. estimates that the investment needed to reduce the impact of greenhouse gas pollution to zero by 2050, in alignment with the Paris Agreement, could be $9 trillion annually. Scientists agree that the cost of not meaningfully advancing toward the global climate goal will be much greater. Cooperation by everyone from national leaders to individual citizens is essential. Corporations will need to adjust business models, develop new products, retool supply chains, and make prudent long-term capital decisions to gain efficiencies and remain competitive. Investors who can navigate this transition successfully will be rewarded. The Calamos Sustainable Equities team is focused on doing just that.

Developing and fossil-fuel-heavy regions face the greatest burden to reach net-zero emissions

Net-zero investment as a fraction of 2021‒2050 GDP

Times of volatility can be unnerving for investors but are also times when shares of quality companies can be bought at discounted prices. We view volatility as opportunity and a time to build long-term value.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Duration is a measure of interest rate risk. Delta is a gauge of a convertible security’s sensitivity to changes in the price of its underlying stock. It expresses the change in the convertible price per unit of change in the underlying stock price.

Option implied volatility is the expected volatility of a stock over the life of the option.

Source for issuance and market size data (high yield and convertible): Bank of America.

Environmental, Social and Governance (ESG) represent the three pillars of sustainability. In a business context, sustainability refers to how well a company’s business model contributes to enduring development.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk (all funds excluding Calamos Hedged Equity Fund, Calamos Total Return Bond Fund, and Calamos Growth and Income Fund): As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk—the Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment advisor to predict pertinent market movements, which cannot be assured.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

The principal risks of investing in the Calamos Convertible Fund include a potential decline in the value of convertible securities during periods of rising interest rates and the possibility of the borrower missing payments. The credit standing of the issuer and other factors may also affect a convertible security’s investment value. Synthetic convertible instruments may fluctuate and perform inconsistently with an actual convertible security, and components of a synthetic convertible can expire worthless. The Fund may also be subject to foreign securities risk, equity securities risk, credit risk, high yield risk, portfolio selection risk and liquidity risk.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small and mid capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, mid-sized company risk, foreign securities risk and portfolio selection risk.

The principal risks of investing in the Calamos Growth and Income Fund include the potential for convertible securities to decline in value during periods of rising interest rates and the possibility of the borrower missing payments; synthetic convertible instruments risks include fluctuations inconsistent with a convertible security and components expiring worthless. Others include equity securities risk, growth stock risk, small and midsize company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk, and portfolio selection risk.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, US Government security risk, foreign securities risk, non-US Government obligation risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Sustainable Equities Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The US Dollar Index measures the value of the US dollar relative to a basket of foreign currencies, including Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden. The S&P 500 Index is considered generally representative of the US equity market and is market cap weighted. The MSCI All Country World Index represents the performance of global equities. The MSCI All Country World ex US Index represents the performance of global equities, excluding the US. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA U.S. High Yield Index is an unmanaged index of US high yield debt securities. The ICE BofA All US Convertible Index (VXA0) is a measure of the US convertible market. The Refinitiv Global Convertible Bond Index measures the performance of the global convertible market. Oil is represented by current pipeline export quality Brent blend. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based benchmarks of the U.S. investment grade and global investment grade bond market, respectively. They include Treasury, government related, corporate and securitized fixed-rate bonds. The Russell 2000 Index is a measure of US small cap performance. The Russell 1000 Index is a measure of US large cap performance. The Russell 3000 Index measures the performance of 3,000 publicly held US companies based on total market capitalization, which represents approximately 98% of the investable US equity market. The Russell 3000 Growth Index is representative of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Value Index is representative of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. The MSCI Japan Index is designed to measure the performance of the large and mid cap segments of the Japanese market.

ICE Data: Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an `as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

18951 0422O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.