No Recession, and the Low Is In for the Year: CPLIX’s Michael Grant

Calamos Co-CIO, Head of Long/Short Strategies and Senior Co-Portfolio Manager Michael Grant’s perspective on the next several months is decidedly different from many. Then again, so has been the performance this year of his Calamos Phineus Long/Short Fund (CPLIX).

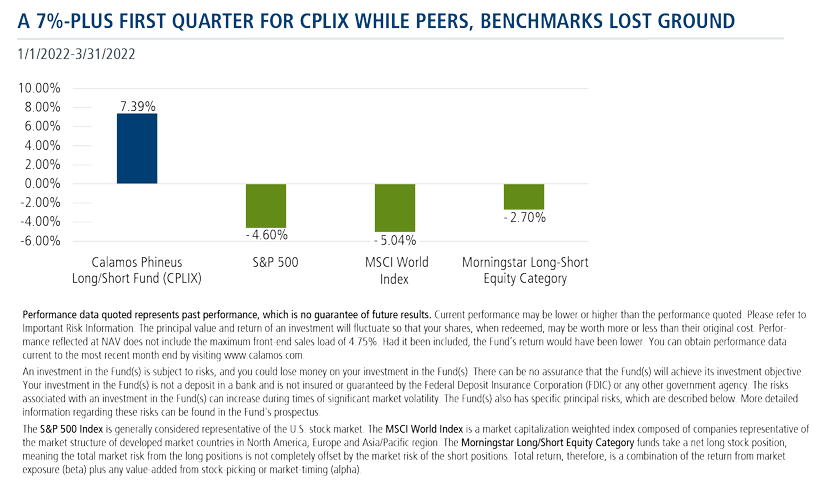

In a quarter when the S&P 500 lost 4.60%, most funds—and the Morningstar Long-Short Equity Category funds, in particular— took a few steps back, CPLIX gained more than 7%.

CPLIX: A Stand-out in a Quarter When Most Struggled

- Just 600—or 8.9%—of actively managed funds generated a positive return in the first quarter.

- Of those funds with positive quarters, just 25% of them produced 7% or better returns.

- Within Morningstar’s Long-Short Equity category, only 21 funds enjoyed a positive first quarter.

The quarter was distinguished, Grant this week told a group of investment professionals, both by what he calls “the Putin shock” and also the “dramatic repricing of duration, i.e., interest rate risk across the developed world.”

As described earlier in the year (see post), the decision by the CPLIX team to step away from duration combined with additional hedges enabled both the long and short book to contribute to performance.

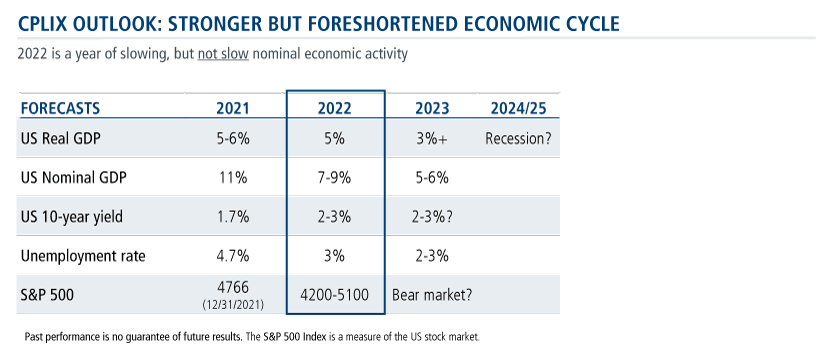

As the second quarter starts, Grant’s outlook is little changed. “The good news,” he said, “is that the bear which emerged in force in Q1 really began 12 months ago with the high duration speculative parts of the market. We think that market is now ending.

“We do not believe the S&P 500 will pierce its lows of late March. We think we are entering a period of consolidation and recovery through the course of the rest of the year. Recovery will be catalyzed by evidence of sustained earnings growth combined with the fact that inflation is probably peaking right now.”

While many investors are concluding that recession is the likely result of the current global uncertainty, “we think that conclusion is wrong,” said Grant. “There is a lot of wood to chop” between now and 2024 or 2025, the soonest he expects a recession.

He offers two reasons to believe in a robust economy in coming years:

- “The economic momentum heading into the Putin shock was truly extraordinary. That was true in US, equally true in Europe and increasingly true through the course of this year in much of the emerging world including Asia outside of China,” said Grant.

- The start of the first major capital spending cycle in the post-2008 era. “One of the direct implications of the Putin shock is to reinforce the reversal of globalization and the reexamination of supply chains everywhere…This began with certain industries like technology under [former President Donald] Trump, it continued with industries like pharmaceuticals and healthcare under COVID, and now it is extending to a whole range of industries including the energy and carbon industry.”

Further, Grant weighed in on those who point to the inversion of the 2-year/10-year Treasury yield curve as a signal of imminent recession. “In my opinion, the right curve to look at is the 2-year/3-month or 10-year/3-month money. In both cases, they are steepening and consistent with strong economic growth.”

According to Grant, “One of the conundrums that investors must get over is the normalization of economic growth—in other words, the shift from durable spending back to service spending as the world recovers from COVID. This will give the appearance of disruption in a range of durable industries. But that is fundamentally different from a weak economy or earnings outcome.”

In the meeting, Grant described “a real dichotomy between parts of the market that are long duration and still reflect the bubble in long duration and those that never benefited. Those that never benefited include financials, a range of industrials, commodities, and energy. These industries all trade with a standard deviation and kind of valuation that they’ve traded throughout the past decade.

“To the degree that these stocks and industries can show operating leverage in a robust economy,” he said, “I think stock prices will follow on the upside.”

Grant expanded on his views and commented on a few specific holdings in this interview last week with TD Ameritrade.

Investment professionals, for more information about Grant’s perspective or CPLIX, reach out to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The S&P 500 Index is generally considered representative of the US stock market.

The MSCI World Index is a market capitalization weighted index composed of companies representative of the market structure of developed market countries in North America, Europe and Asia/Pacific region.

The Morningstar Long/Short Equity Category funds take a net long stock position, meaning the total market risk from the long positions is not completely offset by the market risk of the short positions. Total return, therefore, is a combination of the return from market exposure (beta) plus any value-added from stock-picking or market-timing (alpha).

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

Largest Holdings

As of 3/31/22

| Long Portfolio | Sector | Weight |

|---|---|---|

| Air Lease Corp. - Class A | Industrials | 4.3 |

| Booking Holdings, Inc. | Consumer Discretionary | 3.7 |

| Raytheon Technologies Corp. | Industrials | 3.6 |

| Morgan Stanley | Financials | 3.4 |

| Boeing Company | Industrials | 3.3 |

| Total | 18.3 |

| Short Portfolio | Sector | Weight |

|---|---|---|

| SPDR S&P 500 ETF Trust | N/A | -37.4 |

| Kroger Company | Consumer Staples | -1.6 |

| Costco Wholesale Corp. | Consumer Staples | -1.5 |

| SPDR S&P 500 ETF Trust | N/A | -0.2 |

| Booking Holdings Inc | Consumer Discretionary | -0.1 |

| Total | -40.8 |

810104 422

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

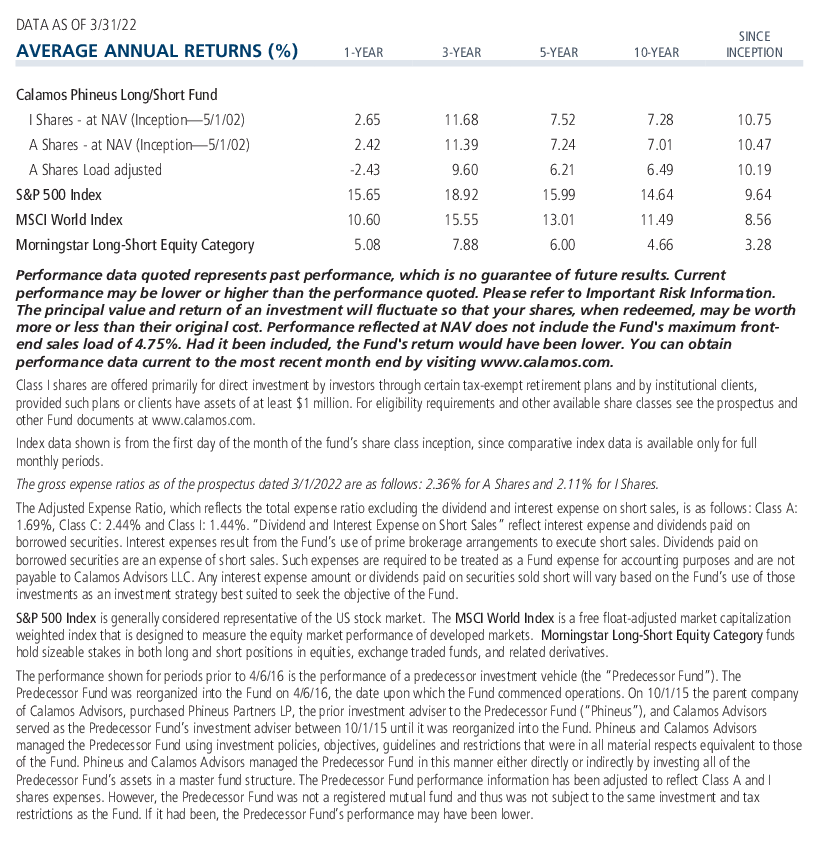

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on April 21, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.