Can Your Long/Short Fund Do This? 3 Ways CPLIX Can Make a Difference in a Portfolio

If you’d like a long, involved explanation of how Calamos Phineus Long/Short Fund (CPLIX) contributes to a portfolio, we’re happy to oblige. But if it’s the short and simple version you prefer, see our three ways below, as provided by Elise Pondel, Calamos Director of Product Analytics.

These three crystallize the benefits of using a long/short fund—or if you’re using a long/short fund and not experiencing the intended benefits, the reason to make a switch.

-

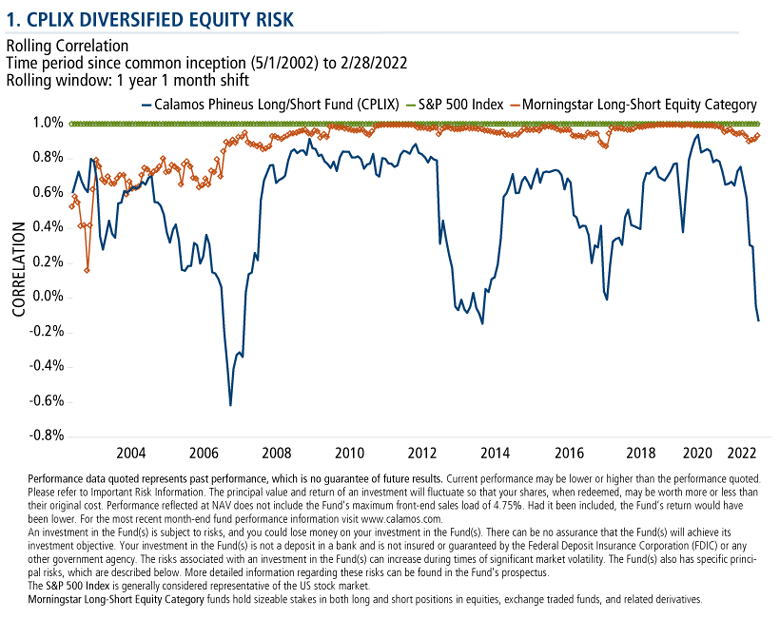

CPLIX has diversified equity risk. The fund’s role as a diversifier is especially valued in today’s environment as equity risk is increasingly dominating portfolios due to a)recent gains from the bull market and b)investment professionals transitioning from traditional fixed income into high yield or other equity-sensitive strategies. As shown below, CPLIX marches to a different drummer than the S&P or its peers in the Morningstar Long-Short Equity category.

-

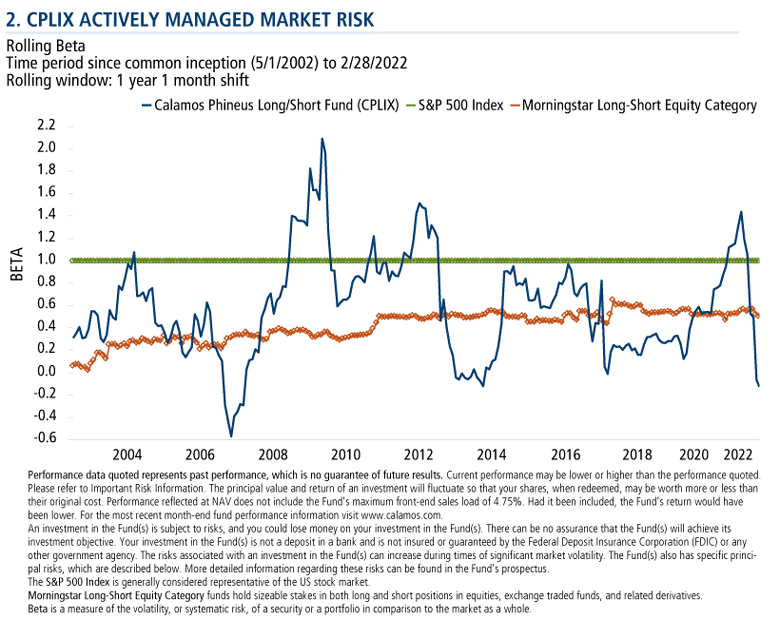

CPLIX has actively managed market risk. “There are times when it is desirable to be risk-on, and there are times when it pays to be risk-off,” says Pondel. CPLIX has the flexibility to do either—and the chart below shows the variability, as tracked by the rolling beta of the fund.

-

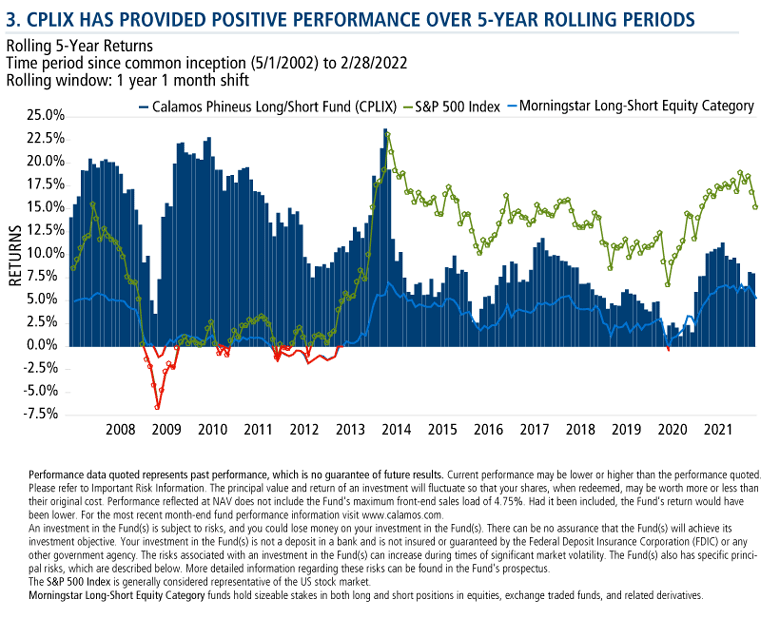

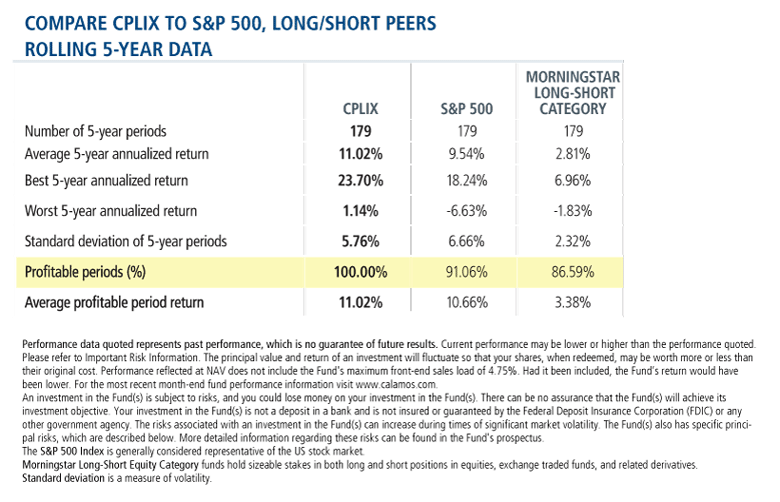

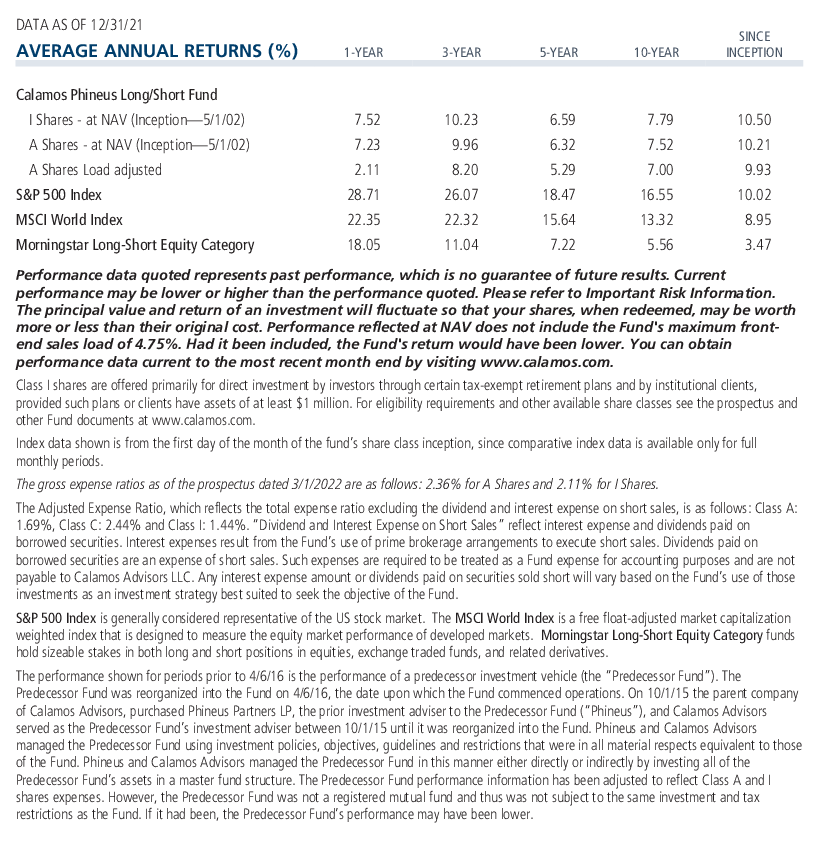

CPLIX has provided positive performance over five-year rolling periods. Those who have been able to give CPLIX five years have never experienced a negative five-year rolling period. This is since the fund’s inception on 5/1/2002 and using a monthly return series as of 2/28/2022. The same cannot be said for the S&P 500—which has had 16 negative periods. Both the S&P and other long/short funds have spent time in negative territory, including as most recently as March 2020.

Here’s another look at the data.

Investment professionals, for more information on how CPLIX has provided equity-like returns by diversifying and actively managing equity market risk, reach out to your Calamos Investment Consultant. You can reach him or her at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Morningstar Long-Short Equity Category funds hold sizeable stakes in both long and short positions in equities, exchange traded funds, and related derivatives.

S&P 500 Index is generally considered representative of the US stock market.

809970 322

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on March 21, 2023Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.