Headlines or No, International Growth Is an Opportunity Advisors Don’t Want Clients to Miss

June 5, 2018

Investors and opportunities too often go their separate ways.

Many (including us—see this post) have bemoaned the investors’ tendency to enter markets late and leave too early. This can be why investors don’t realize the full potential of their invested dollars. Fortunately, keeping clients invested despite their better instincts is what a financial advisor does.

Of course, today’s headlines would give a client pause about investing in non-U.S. markets. Crises are bubbling in foreign debt, trade and currencies. But none of that—or what breaks tomorrow, for that matter—can reverse the underlying, multi-year secular trends widely expected to drive growth in international equities. We believe the future promises non-U.S. opportunities that advisors don’t want their clients to miss.

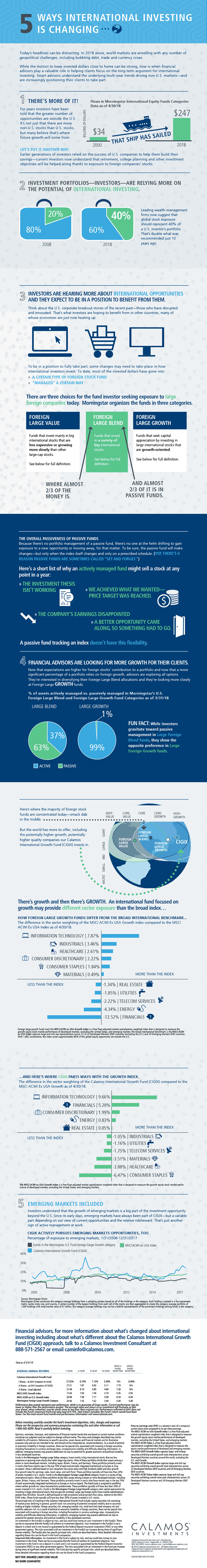

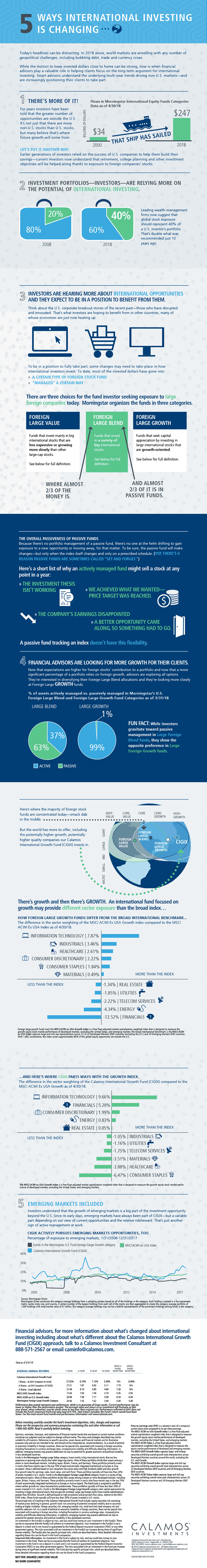

In fact, there have been several changes to the role that international assets are playing in U.S.-based clients’ portfolios. They haven’t dominated headlines but they’re real and meaningful—as illustrated in our new 5 Ways International Investing Is Changing infographic.

Download the infographic.

Here’s the condensed version:

- As suggested by the more than $200 billion increase in international equity funds in the last two decades, current investors are understanding that retirement, college planning and other investment objectives will be helped along thanks to exposure to foreign companies’ stocks.

- Leading wealth management firms are recommending that investment portfolios double their exposure—from 20% to 40%—to international stocks. This greater embrace has happened in just the last 10 years.

- Calamos predicts there will be a pivoting from Foreign Large Blend Equity funds—where almost two-thirds of the international equity assets are today—to Foreign Large Growth funds. There’s a big difference in the sectors (and expected growth potential) invested in by growth versus blend funds.

- Fun fact: While investors gravitate toward passive management in Foreign Large Blend funds, they show the opposite preference in Foreign Large Growth funds.

- Does non-U.S. investing encompass emerging markets? Yes, when the growth opportunities are compelling, our Calamos International Growth Fund (CIGIX) does.

For more information, download the infographic or talk to your Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Data as of 3/31/18

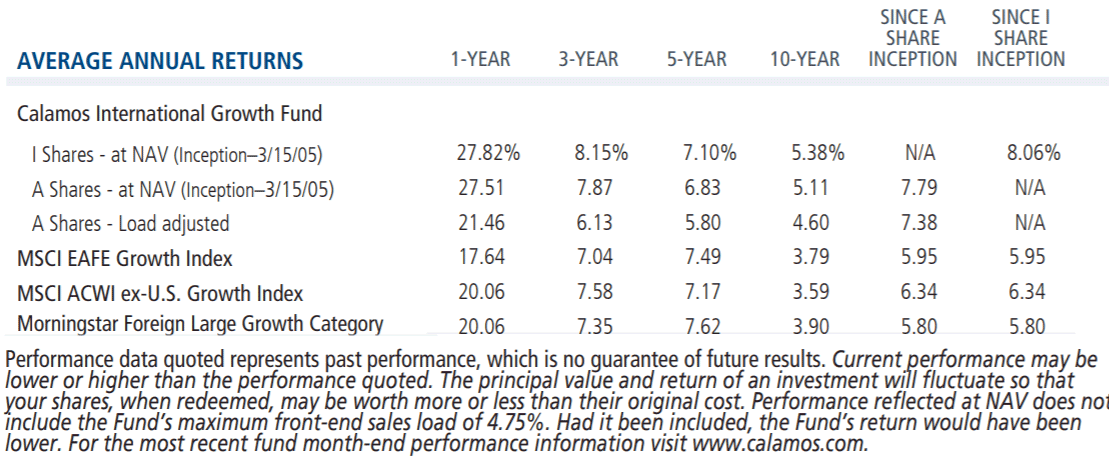

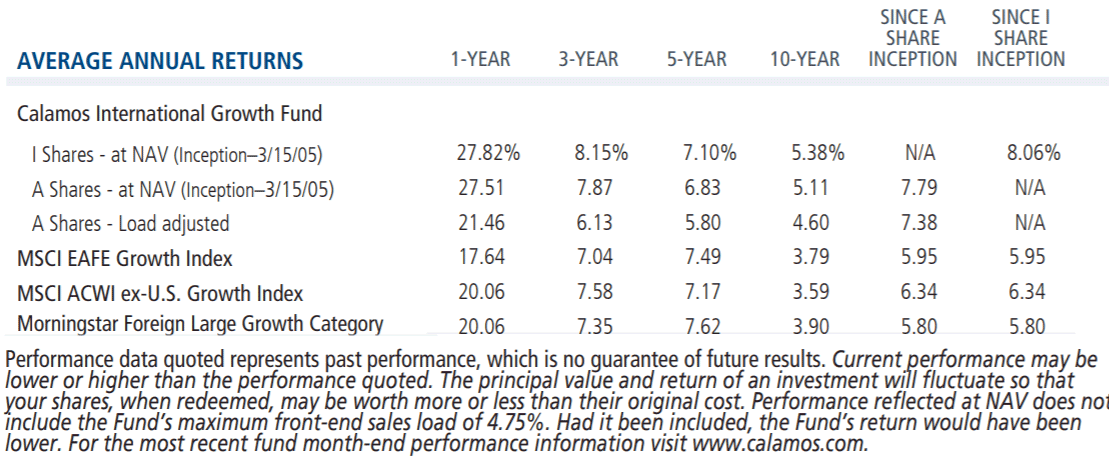

The MSCI EAFE Growth Index captures large- and midcap securities exhibiting overall growth style characteristics across Developed Markets countries around the world, excluding the U.S. and Canada.

The MSCI ACWI ex USA Growth Index is a free float-adjusted market capitalization weighted index that is designed to measure the growth equity stock market performance of developed markets, excluding the United States, and emerging markets.

Funds in the Morningstar Foreign Large Growth category seek capital appreciation by investing in large international stocks that are growth-oriented. Large cap foreign stocks have market capitalizations greater than $5 billion. Growth is defined based on high price/book and price/cash-flow ratios, relative to the MSCI EAFE Index. These funds typically will have less than 20% of assets invested in U.S. stocks.

Funds in the Morningstar Foreign Large Blend category invest in a variety of big international stocks. Most of these portfolios divide their assets among a dozen or more developed markets, including Japan, Britain, France, and Germany. These portfolios primarily invest in stocks that have market caps in the top 70% of each economically integrated market (such as Europe or Asia ex-Japan). The blend style is assigned to portfolios where neither growth nor value characteristics predominate. These portfolios typically will have less than 20% of assets invested in U.S. stocks.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

801154 618