7 Out of 7 Times, Emerging Market Equities Roared Back

March 23, 2017

This post was written by Calamos Senior Vice President and Portfolio Specialist Todd Speed.

Amid the many doubts and skepticism surrounding emerging markets in 2016, the asset class managed to stabilize and generate double-digit gains. Emerging markets were driven to a large extent by macro factors including the path of interest rates, the U.S. dollar, elections and policy risk.

Thus far in 2017, we are seeing an important pivot wherein markets are rewarding superior company fundamentals and experiencing more differentiation within country and currency returns.

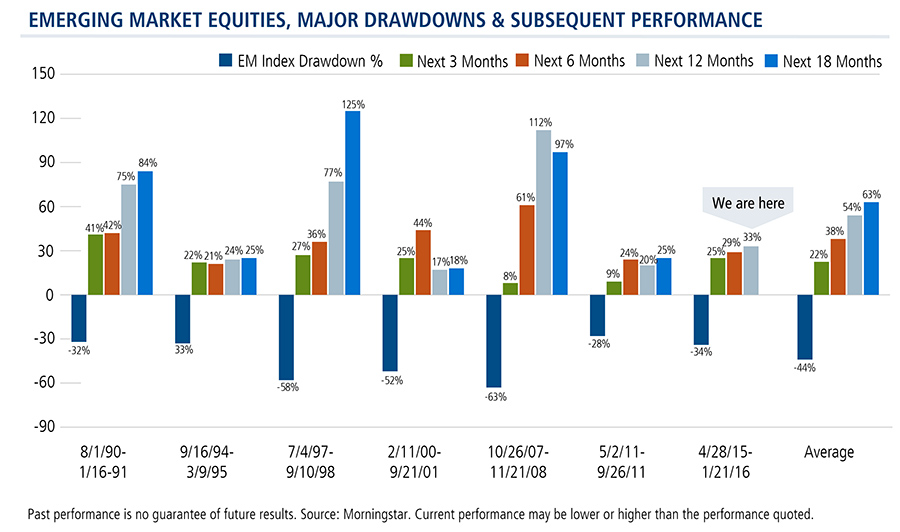

For investors who may have returned to the asset class following an extended leave we would again note the return dynamic we first introduced last July: Since the 1988 inception of the MSCI Emerging Markets Index, there have been seven major (25% or more) drawdowns in emerging markets. In each instance—seven out of seven times—the major drawdown was followed by a significant rally. (click image to enlarge)

Notably, the average returns for the 12- and 18-month periods following a major EM drawdown illustrate the potential for further gains. January 21 marked the one-year anniversary of the January 2016 low in emerging market equities.

As the chart above shows, the experience of the past year has been fairly similar to the average of the past six market rebounds.

Financial advisors, for more information about investing in emerging markets our way, see our microsite or talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com. For weekly emerging markets intel, subscribe to our EM Snapshot.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Foreign Securities Risk: Risks associated with investing in foreign securities include fluctuations in the exchange rates of foreign currencies that may affect the U.S. dollar value of a security, the possibility of substantial price volatility as a result of political and economic instability in the foreign country, less public information about issuers of securities, different securities regulation, different accounting, auditing and financial reporting standards and less liquidity than in U.S. markets.

Emerging Markets Risk: Emerging market countries may have relatively unstable governments and economies based on only a few industries, which may cause greater instability. The value of emerging market securities will likely be particularly sensitive to changes in the economies of such countries. These countries are also more likely to experience higher levels of inflation, deflation or currency devaluations, which could hurt their economies and securities markets.

The MSCI Emerging Markets Index represents large and mid-cap companies in emerging markets countries. Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

800088 0317